Summary:

- The dividend payout ratio is only 3%, which leaves huge upside potential for dividend growth.

- Meta has high profitability and cash cushions to support further investments within the AI product portfolios.

- Q4 financials showed strong performance, with revenue growth across all regions of the world.

nespix/iStock via Getty Images

Thesis

For a long time I held Meta Platforms (NASDAQ:META) in a separate growth account. After their recent initiation of a quarterly dividend, I’ve now initiated a position within my dividend focused portfolio as I believe META has the fundamentals to become a solid dividend growth stock over time.

Even though the starting dividend yield of 0.10% is almost immaterial, the goal here is to start a position early enough in the cycle before all of the raises take place. META has high levels of profitability so it’s reasonable to believe that raises can take place. Although it’s too early to tell, I am hoping that the raises are sizeable in nature.

Dividend aside though, META remains a solid tech holding in my portfolio. I believe that there are several catalysts that will continue to propel the tech sector higher. Some of these catalysts are the inclusion of AI (Artificial Intelligence), interest rate drops, and expanding product portfolios.

Overview

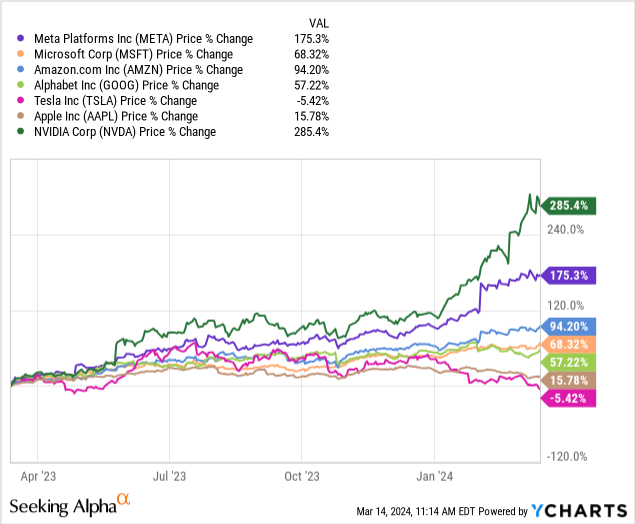

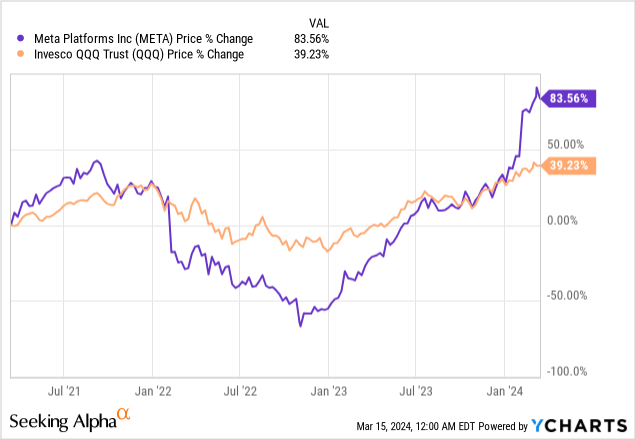

META had a really impressive run and currently outperforms most of the magnificent seven, with the exception of Nvidia (NVDA) which is up an incredible 285%. Over a 1 year time frame, META’s price has appreciated more than 175%. Despite the run up, I believe the bull movement isn’t done here yet.

Meta develops products for global connectivity and sharing through various devices. Their most popular and globally known platform is Facebook but they also operate in two other segments: Family of Apps and Reality Labs. The Family of Apps consists of platforms like Instagram, FB Messenger, and WhatsApp. Reality Labs focuses on augmented and virtual reality platforms such as their Meta Quest headset for immersive experiences.

I believe we will continue to a few catalysts contribute to the growth of META as well. For example, the US House passed a bill that can lead to the sale or ban of competitor platform TikTok. This may lead to traffic flowing into Facebook and Instagram instead. In addition, I believe AI and the growth of the virtual reality market will continue growing. VR headsets continue to become more mainstream and the technology is becoming more enticing than ever for the average retail consumer.

Impressive Financial Growth

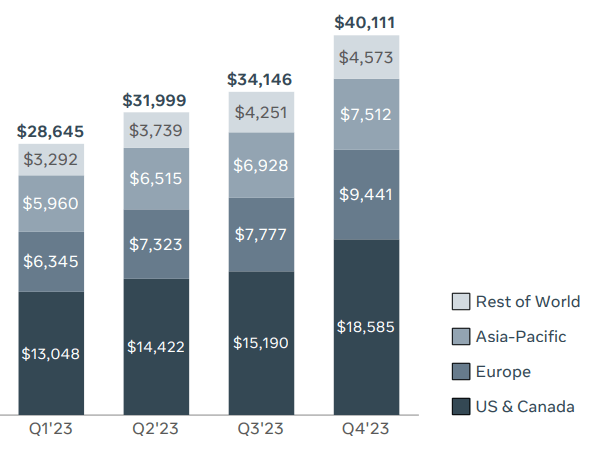

META reported their Q4 earnings last month and the results were excellent. They reported EPS of $5.33, outperforming expected EPS by about 8%. META’s reported revenue for the quarter reached $40.11B which represents a 24.7% increase YoY. Not to mention they beat analyst expectations here as well by about $1B.

To break it down, META receives its revenue from Advertising, The Family of Apps, and Reality Labs. Here were the breakdown of each of those segments:

- Advertising: $32,639M

- Family of Apps: $32,794M

- Reality Labs: $877M

- Other: $155M

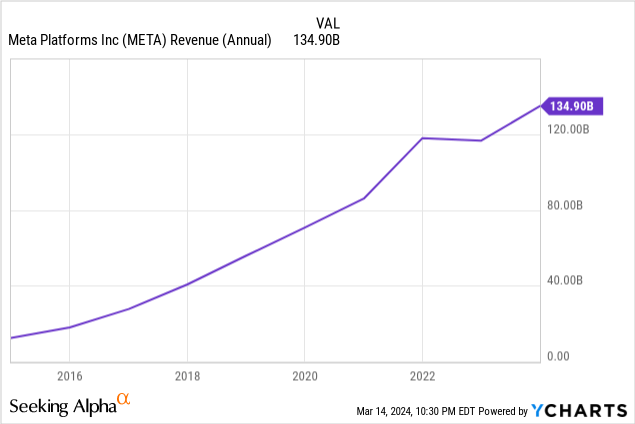

Even when zooming out and looking at the numbers for the full fiscal year of 2023, performance was strong. Revenue totaled $134.9B and key engagement metrics for their platforms grew across the board. The outlook that was presented over the last earnings call was that revenue for Q1 2024 is expected to fall within the range of $34.5B – $37B. I think that this is extremely likely considering that the data also tells us META’s engagement numbers across all of their social platforms have grown.

META Q4 Presentation

Something I’d like to point out is that the revenue from every region has grown consistently quarter after quarter. The entire fiscal year of 2023 was a strong one and it’ll be interest to see if this growth continues throughout all regions. Even comparing these revenue numbers from Q4 of 2022, there is growth in every region. META experience the perfect combo here because as revenue from each sector rose, expenses stated relatively flat, and even slightly decreased within the marketing and sales channel. This growth in revenue isn’t much of a surprise though since there were more daily users online over 2023.

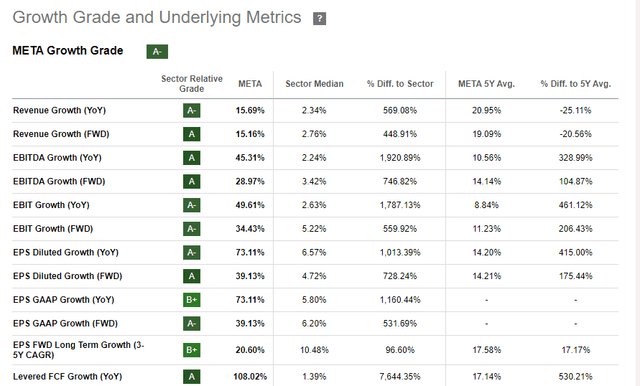

For example, daily active users throughout the Family of Apps (Instagram, Facebook, etc.) reached 3.19B users. This is up 8% from the prior year Q4. More specifically, Facebook daily users were 2.11B which represents an increase of 6% YoY. Lastly, I feel it’s worth mentioning that Seeking Alpha gives META an A- rating in growth with great metrics across the board. EBITA growth averaged 10.56% over a 5-year period which significantly outperforms the sector median of 3.42%.

Meta Stock Outlook – Catalysts

Alongside the impressive financials and growth in daily active users throughout META’s platforms, I also think we have some catalysts to propel even more growth. As ridiculous as it might sound, I think that if the recently passed bill that could lead to the ban of TikTok, serves as a catalyst within the US market. Facebook and Instagram have the same mechanisms and almost the same monetary systems in place to replace TikTok already. It isn’t too farfetched to believe lots of content creators will flock to META’s platforms as a replacement if the ban progresses this far.

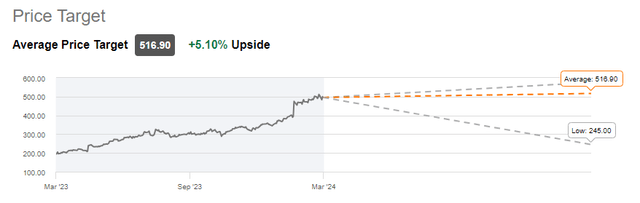

For reference, the average Wall St. price target sits at $516./90/share which only represents a slight 5.10% upside. The highest price target sits at $575/share and I lean more towards this higher end of the spectrum due to the strong growth and these catalysts. The price target of $575/share would represent a potential upside of +17%.

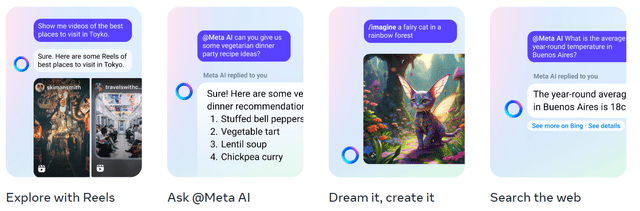

The next contributor to future growth is the use of AI (artificial intelligence). META is already implementing Generative AI in a few different ways. The most familiar would be the AI chatbot features that you can use to refine searches for specific content, use as a CHATGPT alternative, create art with, or get web results with. While these are not inherently new features anymore, these still serve as a stepping stone to the next phase of AI.

In addition, the power of AI is being used to build on bettering our communication channels. We are one step closer to seamless and speedy language translation as we know it. This huge as it can eliminate the barriers between languages and accents. The current translation models are slow and delayed but the model that META is working on is much faster to the point where it’s almost instantaneous. This makes it possible for two people speaking completely different languages to communicate in real time as the AI translates your voice and text so that both parties understand each other.

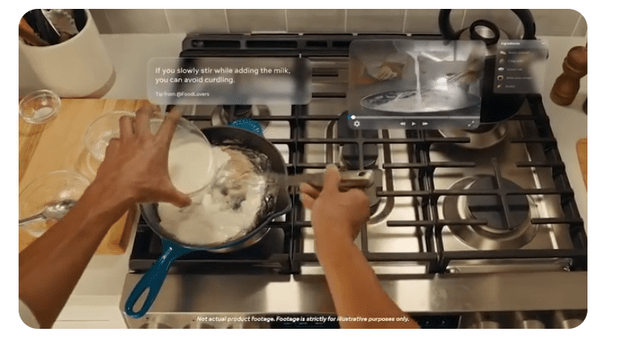

Last but not least, I want to mention the most exciting segment of future growth: Augmented reality. We saw the success and hype around Apple’s (AAPL) Vision Pro headset. There are tons of videos of people using these in public and strapping the headset to their face for prolonged periods of time.

Imagine the excitement to learn this style of augmented reality will eventually become so advanced that you are no longer required to wear a full headset. Instead, a pair of normal looking glasses will have the tech to incorporate this tech into all aspects of your life. Get real live cooking lessons while you are at the stove. Maybe learn how to play the piano with real live prompts for keys through your glasses. META has already made huge strides in their META Quest department with the virtual reality and augmented reality.

We already see a basic pair of smart glasses on the market from META: the META & Ray-Ban collab, but these take the game to the next level. While there is no release date for this kind of tech, META has been very vocal about how they are working to develop and research this AI. Personalized guides or coaching will become extremely accessible due to the help of AI and I think we are still early. There is a pretty cool video on META’s site that can show you a lot better than I may be explaining.

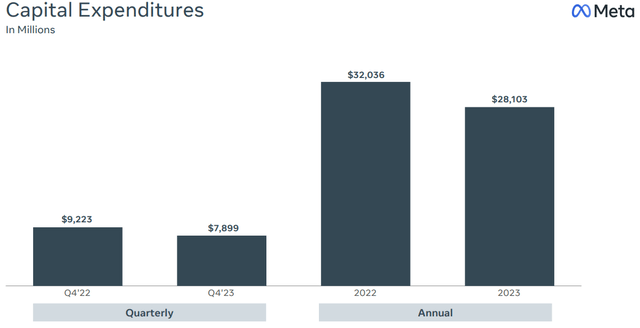

Lastly, META continues to invest back into their business aggressively. They have capital expenditures totaling $28,103M which went towards servers, data centers, and network infrastructure. This amount also included principal payments on finance leases totaling $7.9B. During their earnings call, managed confirmed that they plan to spend even more in this category over fiscal year 2024.

We anticipate our full year 2024 capital expenditures will be in the range of $30 billion to $37 billion, a $2 billion increase of the high end of our prior range. We expect growth will be driven by investments in servers, including both AI and non-AI hardware, and data centers as we ramp up construction on sites with our previously announced new data center architecture. – Susan Li, CFO

META Dividend

The newly initiated dividend was declared on February 1st of 2024 for $0.50/share. While the dividend yield is relatively tiny at 0.10%, I am okay with this as the goal is to ultimately hold through future raises. You’ve already seen how strong the revenue growth has been. To no surprise, free cash flow has also been strong here. In addition to the dividend declaration, META also announced a $50B increase in the share repurchase authorization.

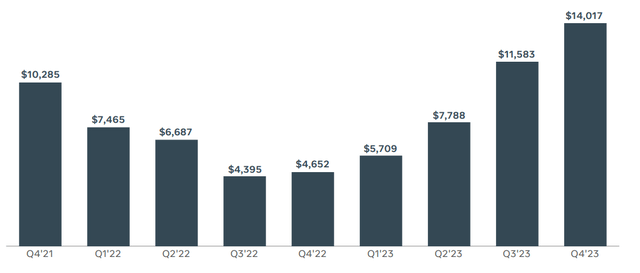

FCF (free cash flow) has grown substantially over the prior year. Total FCF over the last fiscal year ended at $18,439M. Compared to the prior year’s total, FCF grew by about 133% to $43,010M as of fiscal year 2023! Lastly, overall net income growth has been positive as well so this was one of the best times for META to announce the start of a dividend.

Net Income (In millions) (META Q4 Presentation)

META’s current dividend payout ratio sits at approximately 3.36%. This is extremely low which means that there is plenty of room to grow on the upside. At the same time, this also means that there is virtually no risk to the dividend being reduced or eliminated. META has about $71B in cash from operations and a gross profit margin at 80.72% which lies way above the sector median profit margin of 49.07%.

While I imagine the raises may start out slower at first if META chooses to take a more conservative approach, the reassurance that they are fully capable of aggressively growing the dividend is a huge plus for me. Revenue growth over the last 5 years have averaged 20.95% per year. Assuming that META is able to grow at the same pace, the dividend in theory, could be raised as high as 10% – 15% per year while still having very little impact to the financials here. Just to reiterate, it may take some time to see this kind of growth, therefore this is obviously a better play for the investor that doesn’t necessarily need the income right now. I plan to hold my shares for a very long time and watch the compounding take place.

Risk

I stay committed for the long term but I do stay weary of the prolonged amount of time it may take for the prior mentioned AI innovations to fully materialize. I think these products great a great amount of hype but it if there aren’t any tangible protype devices coming out to compete with the rest of the market, confidence levels may dwindle.

In addition, META receives a large portion of their revenue from advertising. Although it seems like there hasn’t been many other rivaling platforms to advertise on, except TikTok, META still remains vulnerable to losing market share to a competing social platform. Lastly, the whole tech sector has seen some serious upside recently.

With interest rate cuts anticipated in the later half of the year, prices may have a negative reaction to the downside. It’s too early to see how the market may react but these interest rate cuts may cause some short-term volatility that can result the price coming down from its high.

Takeaway

I rate META as a Strong Buy due to the impressive financial growth that is likely to continue due to strong innovations within the AI space as well as the future dividend growth potential. The current dividend payout ratio sits around 3% which means there is plenty of room for large increases as cash flow remains strong and net income trends upward. The dividend yield is tiny at the moment, but I plan to hold and add shares here to capitalize on the future large raises that may happen over time.

In addition, the strong financials and capital expenditure reassure me that META is here to stay. The company continues to invest in their future growth prospects within the AI space. I believe that META has all the fundamentals to be leader within the augmented reality space, especially when it comes to the size of wearables shrinking. I don’t think we are too far from a future where you no longer have to strap a headset to your face and can instead put on a sleek pair of glasses for everyday use.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.