Summary:

- Many tech companies have seen fast growth lately, and Meta is no different.

- This resulted in a lot of these companies trading at high multiples with little room for expansion.

- However, I believe that Meta is better valued, less risky and there is more room for upside than with its peers.

- I present my analysis which leads me to a buy rating.

Vertigo3d

Recently I wrote an article on Tesla (TSLA) highlighting the fact that even though the company is likely to grow significantly, there isn’t much upside from the already elevated multiple the company trades at today. Today I want to start coverage on another tech giant – Meta (NASDAQ:META), formerly known as Facebook, which at first glance shares a lot of the same characteristics with Tesla, yet I think it may be worth buying.

The market overall

Before diving directly into Meta, I want to highlight some relevant market-wide trends. You see, we currently find ourselves in a situation, where despite high interest rates and a deeply inverted yield curve, the S&P 500 is almost at its all-time high. And it’s only as high as it is, because of a recent tech rally, fuelled mainly by AI speculation, which led to sharp multiple expansion.

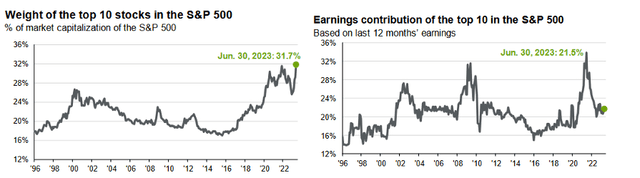

The market has essentially been driven by only a handful of companies. In particular, the largest ones, as the top 10 companies in the S&P 500 now account for a record 31.7% of the index, based on market cap.

To make things worse, the proportion of earnings that the top 10 companies contribute has dropped drastically from around 30% last year to just about 20%. This is hardly surprising, since once again, the price increase can be entirely attributed to multiple expansion, as opposed to earnings growth.

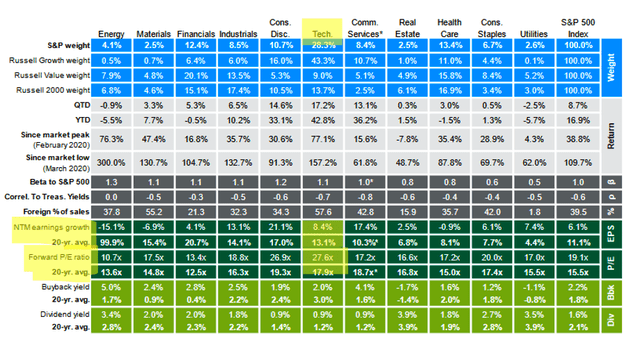

Looking at the table below, it’s evident, that the technology sector, which has the highest weighting in the S&P 500, is currently expensive (likely because it has rallied so much not based on fundamentals, but speculation).

The tech sector currently trades at a forward P/E of 27.6x, compared to a 20-year average of 17.9x. A sharp difference, which is only magnified by the fact that forward expected growth of 8.4% is significantly below historical average growth of 13.1%.

If you look at the rest of the sectors, things are not nearly as bad there so one can conclude that the reason the index as a whole is currently quite expensive, given the limited growth prospects, is primarily attributable to tech being overvalued.

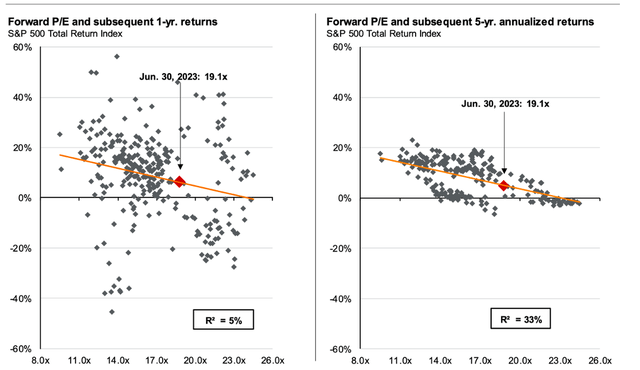

There is a fairly strong relationship between the P/E multiple of the S&P 500 and future earnings. In particular, according to J. P. Morgan, the current multiple of 19.1x earnings is likely to result in sub-par results, with total index returns of under 5% per year. That’s why I don’t advocate investing in the index at this time. The same logic can be applied to individual companies, which is why I rarely advocate buying companies at a high P/E, regardless of how bright the future might seem.

That brings me to Meta.

Meta’s recent results

At the beginning of 2022, Meta implemented several actions to increase efficiency and realign its business and strategic aims. As of June 30, 2023, the business had completed a large part of anticipated staff layoffs while continuing to evaluate facility consolidation and data center restructuring activities. Headcount was 71,469 in the second quarter, a decrease of 14% year-over-year. This resulted from Zuckerberg’s planned “year of efficiency, “which led to laying off more than 21,000 employees, tightening spending in some divisions, and flattening the company’s hierarchy. On the other hand, total costs and expenses were $22.61 billion, which is an increase of 10% YoY. This includes legal fees and restructuring charges (over $2.5 billion). The growth in spending is expected to continue by top management – you can guess the cause – the capital expenditures on AI systems (servers and “powerful “computers) and higher hiring costs and salaries for AI experts.

Meta also disclosed an increase in active users on their apps. The number of daily active individuals increased by 7% yearly to 3.07 billion, while the number of monthly busy people increased by 6% YoY to 3.88 billion. Additionally, while impressions delivered across Meta Platform climbed by 34% YoY, the average price per ad was reduced by 16%. The most intriguing statement for some investors was also not so awful, with an 11% CAGR and revenue of $32.0 billion. Figures that must have pleased investors. However, it must also be said that Meta’s current net profit margins lowered significantly from 28.2% last year to 18.7% this year. This indicates a low competitive advantage since the company cannot raise its prices.

The company expects its operating losses to rise YoY in building Reality Labs, Zuckerberg’s preferred project, which has failed to provide anything promising and does not appear promising in the future. In a quarterly report, Meta also stated that the most wanted thing these days is investing in artificial intelligence, one of the most compelling opportunities for the company. Zuckerberg also said that the company is currently working on several exciting projects, such as Llama 2, Threads, Reels, and the launch of Quest 3. Llama 2 is set to compete with chatbots like OpenAI or Google’s Bard. Meta enhances Threads (competition of “X” formerly known as Twitter) as it faces user exodus. The most significant changes are the closer connection to Instagram and the desktop version, which are supposed to regain users.

Last but not least, Meta repurchased $793 million of its Class A common stock in the second quarter of 2023. As of June 30, 2023, the company had $40.91 billion available and authorized for repurchases, which means it is ready to buy back many of its shares when the market goes down.

Valuation

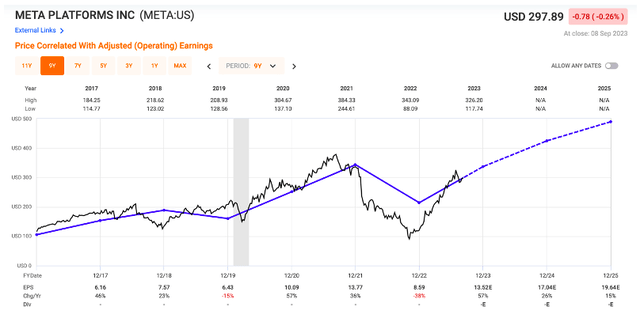

Let’s keep things simple. Meta is expected to reach an EPS of $13.52 this year, which would represent annual growth of over 50%. Beyond this year, the consensus is for about a 25% increase in 2024 and a 17% increase in 2025. So clearly, a lot of growth is expected for the company.

In the meantime, shares trade at just under $300 per share, which corresponds to a forward P/E of 22x. That’s very reasonable, given that earnings are expected to grow by about 20%. And in fact, it’s in line with the company’s historical average P/E.

What this means is that the risk of a severe price drop, if for example Meta underdelivers, is significantly lower than that of Tesla. It also means that we can comfortably expect the company to generate total returns in line with its EPS growth, with no need to rely on an elevated P/E multiple to deliver upside.

All things considered, I’m quite comfortable buying Meta (which is AA- rated, quality company) at 22x earnings, with expected 2024-2025 EPS growth of 20%, especially when the tech sector as a whole trades at 27x earnings with only 8% expected growth. I think Meta will outperform the S&P 500, which as discussed is likely to deliver returns of around 5%, therefore generating solid alpha for investors. I rate META as a BUY, here at $297 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.