Summary:

- Meta Platforms has performed incredibly well recently, financially, however, the company hasn’t solved some fundamental problems.

- We expect slow user growth around its assets, however, that ultimately won’t be enough to justify the company’s valuation.

- The company still has fundamental issues around its metaverse strategy etc., that make its recent recovery look more like a dead-cat bounce.

Justin Sullivan

Meta Platforms (NASDAQ:META) has rocketed up from its 52-week highs and is currently at more than double its lows. The company is now at an almost $500 billion market capitalization. However, it still has structural issues through its focus on the metaverse and increased competition with privacy changes. As a result, we expect the company will underperform.

Meta Platforms Revenue

Meta Platforms has continued to generate substantial revenue alleviating some fears about the business.

Meta Platforms Investor Presentation

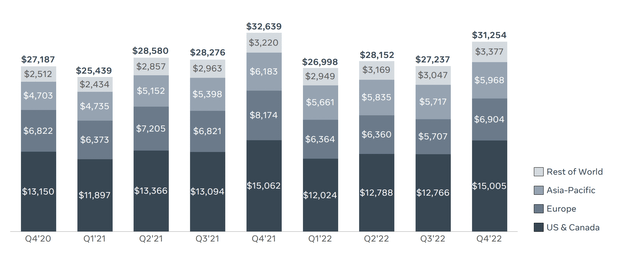

Meta Platforms Revenue – Meta Platforms Investor Presentation

The company achieved strong revenue in 4Q 2022, despite a YoY decline, with the company’s Rest of World segment showing respectable growth and its US & Canada core segment maintaining substantial resiliency. However, it was the third quarter in a row without the company managing to achieve YoY growth, which is in of itself a major statement.

This could be a sign of a slow move away of customers. Similar to server processors as Intel slowly bled dry to AMD, advertising customers are reluctant to switch-up until the alternatives have been thoroughly proven.

Meta Platforms Expenses

At the same time, the company’s expenses have skyrocketed and show no sign of abating.

Meta Platforms Investor Presentation

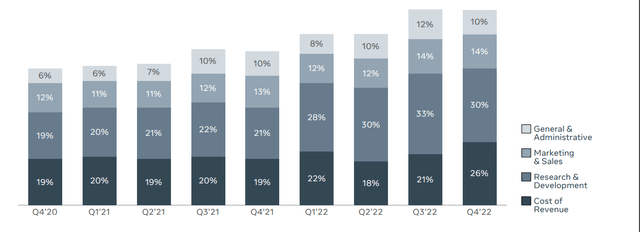

Meta Platforms Expenses – Meta Platforms Investor Presentation

The company’s expenses have grown from 56% of revenue in 4Q 2020 to 80% in 4Q 2022. That’s a substantial increase, primarily from the company’s marketing & sales which skyrocketed in early 2022 along with a rise in expenses across the board. With the company’s revenue growth stagnating (1Q 2023 forecasts are in line with 1Q 2022) we don’t see this going down.

The company’s total 2022 expenses were just under $88 billion. The company’s anticipated 2023 expenses are expected to be $92 billion, representing roughly 5% YoY growth in expenses. A substantial portion of the company’s expense growth is continued massive R&D expenditures on the metaverse. The company is continuing to spend massively on capex as well.

Meta Platforms Active Users

META stock has continued to maintain a bright spot in its portfolio with growth in its family of apps.

Meta Platforms Investor Presentation

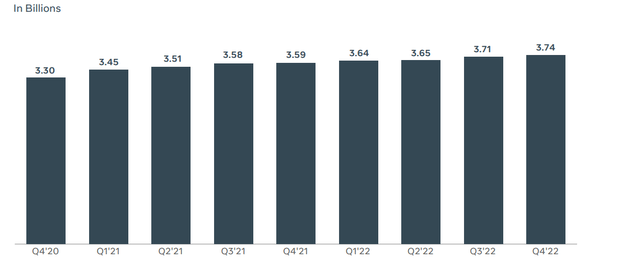

Meta Platforms Active Users – Meta Platforms Investor Presentation

The company’s 4Q 2022 active users increased by 0.1% QoQ in line with the company’s prior quarterly increases. The company hasn’t seen true substantial growth since YE 2020, at the start of the pandemic. Still in a saturated market with numerous competing platforms, the ability for the company to maintain minimal growth is impressive to see.

Meta Platforms FCF

Unfortunately for the company, it’s a massive company, and simply earning revenue isn’t worth it anymore. It needs tens of billions in annual cash flow to justify its valuation.

Meta Platforms Investor Presentation

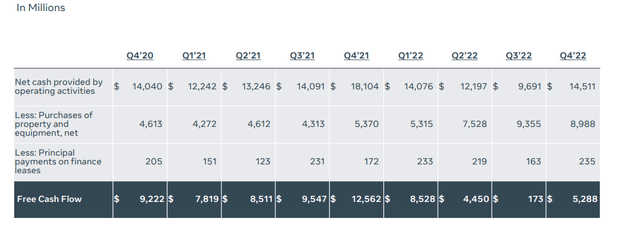

Meta Platforms FCF – Meta Platforms Investor Presentation

In our view, the company needs ~$35 billion in annual FCF to justify its present valuation. In 2022, the company earned $18.5 billion in FCF or roughly half this number. In 2021, the company earned $35 billion in FCF. That was sufficient cash flow, but clearly the company’s 50% YoY decline in FCF doesn’t justify its valuation.

The question for the company remains whether it can earn enough cash from its core business to generate the cash flow to justify its valuation. At the current time, with its massive spending on projects that might not pan out, whether the company can do that remains to be seen.

Meta Platforms Problem

Meta Platforms has several core problems that it needs to work on solving to justify its valuation.

The first is advertising directness. The company already lost substantial advertising strength with customers with Apple’s privacy updates. Amazon, with its ability to show you directly what a customer is looking to buy, has been taking both Facebook and Google’s lunch money. We expect that those problems will continue leading to a more fragmented advertising market.

As a part of this is the privacy changes for the company. The strength of an advertiser and the returns that they earn (and thereby how much they’re willing to pay) is based on their ability to hit the customers interested in buying their products. As Apple, one of Facebook’s largest sources of users, continues its privacy focus that could get harder and harder.

Apple, has no incentive and only cost in helping Facebook achieve its goals.

Last is “metaverse flopverse”. Meta Platforms has decided the metaverse is the next big thing and then it has decided it needs to spend tens of billions proving it’s the next big thing. It made both of those decisions without actually having the evidence (which it still doesn’t) that the metaverse will ever earn enough to justify its valuation.

That’s dramatically hurt the company’s FCF and it has yet to show an inclination to fix that.

Thesis Risk

The largest risk to our thesis is that Facebook’s core business generates massive cash flow. The company’s 2021 FCF based on its current market capitalization was in the double-digits. If the company scales back its metaverse losses and focus on its core business it could quickly generate substantial shareholder returns.

Conclusion

Meta Platforms has had an incredibly strong recovery since the financial lows that the company hit. That recovery has pushed its market cap back up towards $500 billion, although it’s still nowhere near the company’s peak of a market capitalization of just over $1 trillion. Unfortunately for the company, we see the recovery as more of a dead-cat bounce.

The company’s FCF is still nowhere near high enough to justify its valuation. It continues to have substantial problems with Apple’s privacy changes along with its continued substantial metaverse expenses. That put pressures on both the company’s earnings and expenses, a double whammy that hurts its FCF. Overall, we recommend against investing in Meta Platforms at this time.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.