Summary:

- We remain buy-rated on Meta Platforms, Inc.

- We think Meta’s FoA customer base and A.I.-enabled interactive services position it for better ad revenue growth in 2024.

- The company is anticipated to launch its own A.I. chatbot across its social media apps, targeting younger users, later this week at the Meta Connect conference.

- We see more momentum for the stock as Meta takes steps to position itself as a one-stop A.I. shop and continues to reduce capital expenditure this year.

- We expect Meta will be one of the more resilient names in 2H23 and see the stock outperforming the peer group into 2024.

piranka/E+ via Getty Images

We maintain our buy-rating on Meta Platforms, Inc. (NASDAQ:META); the stock is up 209% since our buy-rating in early November, outperforming the S&P 500 by 197%, and we see more upside into 2024. Our bullish sentiment is based on our belief that management reeling in spending coupled with A.I.-enabled FoAs will drive outperformance.

Management noted last quarter that FY capex would be in the $27B to $30B range, revised down from previous estimates of $30 to $33B – we see the year of efficiency playing out this year. Simultaneously, we’re seeing Meta take strategic steps to edge itself ahead in the race to leverage A.I. against Microsoft (MSFT), Alphabet (GOOG), and Amazon (AMZN), to name a few. This week, we’re expecting to see Meta launch its own gen A.I. chatbot called “Gen AI Personas” targeted at younger users; reports from The Wall Street Journal confirmed that Meta’s set to announce its chatbot at the company’s Meta Connect event that starts today. While we’ve been less than optimistic about near-term A.I. revenue growth in the software/hardware space, specifically A.I. monetization, we don’t think this concern extends to Meta. We think Meta using A.I.-enable interactive services throughout its FoA will position it for more visibility and traction in ad spending. Meta makes most of its money on advertising, accounting for 98% of revenue.

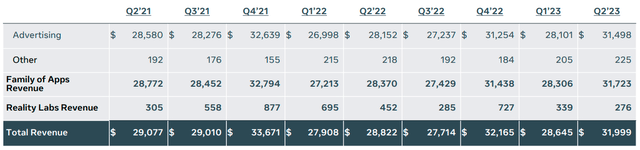

The following table outlines Meta’s segment results up to 2Q23.

We expect Meta’s customer base across Instagram, WhatsApp, Facebook, and now Threads to position it as an attractive spending platform for advertisers. Meta’s been XXX on revenue. Now, we expect to see ad revenue growth reaccelerating into 2024 due to two tailwinds. The first: Meta integrating A.I.-enabled interactive services into its social media apps, explicitly emphasizing the success of Reels and A.I.-enabled algorithms. The second: a rebound in ad spending in 2024 compared to this year.

We expect macro headwinds tightening ad firm budgets in the current macro backdrop. Considering Meta derives the majority of its revenue, $14,131M out of total ad revenues of $31,498M, from the U.S. and Canada, we think the company will see an upside correlation with the easing macro pressures in North America towards 2H24. We think Meta is among the best positioned to leverage the intersection of A.I. and advertising, and believe we have yet to see the financial outperformance this drives.

A new chatbot joins the game

Meta is set to launch its version of OpenAI’s ChatGPT later this week; the chatbot focuses on increasing engagement and interaction with younger users. The “Gen AI Personas” chatbot is supposedly able to interact and portray different ranges of emotions – Meta’s goal of the chatbot is to keep them engaged for longer periods and, by extension, “increase the opportunity to serve them ads.” According to the Journal, Meta intends to create “dozens” of bots, from chatbot creation tools that allow celebrities to make their personalized chatbots for fans to productivity-focused tools for coding and other tasks.

The company is following in the footsteps of Alphabet’s Bard and rival Snapchat’s (SNAP) own A.I. chatbot launched earlier this year. Testing for the chatbot has already begun on Instagram, with a leaked screenshot showing the intro screen for the new feature, which answers questions, offers advice, and helps generate texts across a selection of 30 A.I. personalities. The chatbot is not entirely surprising as CEO Mark Zuckerberg said the company was “developing A.I. personas that can help people in a variety of ways” back in February; we think management is now fine-tunning how to ease the A.I.-enabled interactive services into the social media apps and see this being a growth driver for ad revenue.

Additionally, Meta has more in its A.I. shop – the company’s now in partnership with Microsoft to democratize access to the next version of Llama 2 offering after seeing huge demand for Llama 1. The company is also rumored to work on an LLM to rival OpenAI’s latest GPT-4 that underpins ChatGPT and Bing.

Valuation

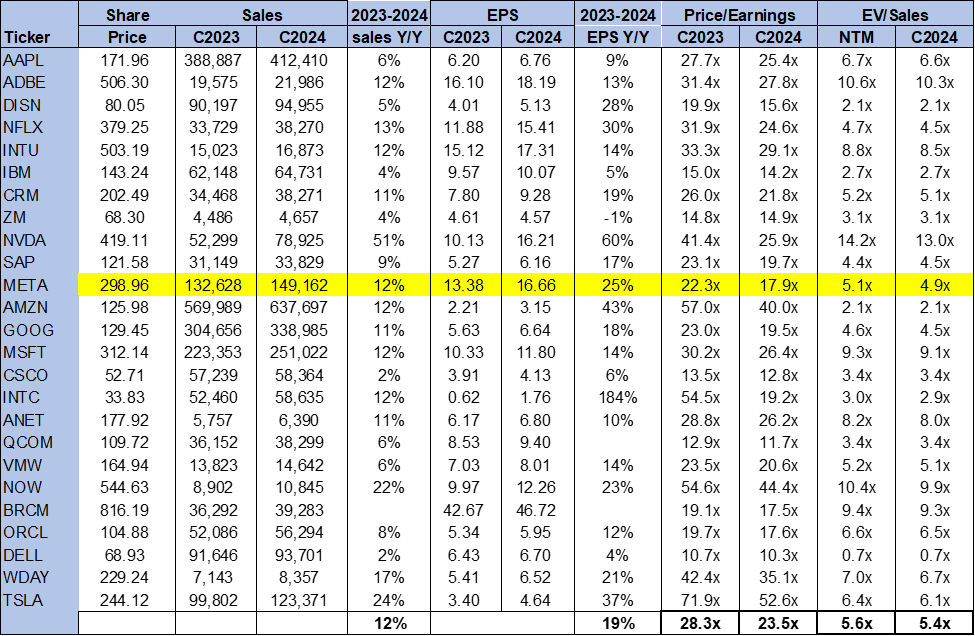

Meta is extremely undervalued, in our opinion. On a P/E basis, the stock is trading at 17.9x C2024 EPS $16.66 compared to the peer group average of 23.5x. The stock is trading at 4.9x EV/C2024 Sales versus the peer group average of 5.4x. Meta is trading well below the peer group on most metrics. We think Meta is a value stock with high growth rate prospects. We see attractive entry points at current levels.

The following chart outlines Meta’s valuation against the peer group.

TSP

Word on Wall Street

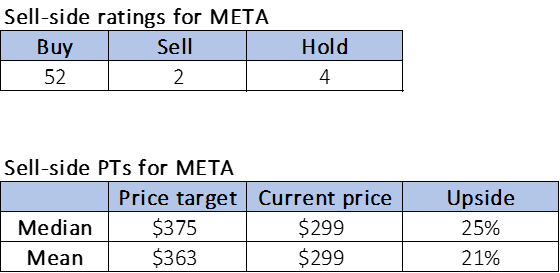

Wall Street shares our bullish sentiment on the stock. Of the 58 analysts covering the stock, 52 are buy-rated, four are hold-rated, and the remaining are sell-rated. While we understand investor concerns over Meta’s high spending and unprofitable Reality Labs segment and what this means for the company’s identity, we think the company is restructuring and shifting investments to leverage the A.I. growth opportunity. We believe Meta will be among the benefactors of the A.I. boom in the mid-to-long run.

The stock is currently priced at $299 per share. The median sell-side price target is $375, while the mean is $363, with a potential 21-25% upside.

The following charts outline Meta’s sell-side ratings and price targets.

TSP

What to do with the stock

We see more upside ahead for Meta Platforms, Inc. We expect the company’s A.I. investments and integration across the FoA will enable Meta to monetize A.I. for ad revenue growth. We’re also constructive on management discipline in spending, with capex lowered for FY23. We think Meta will be resilient in the 2H23 and expect the stock to continue outperforming the FAANG peer group into 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This idea was discussed in more depth in our investing group, Tech Contrarians. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.