Summary:

- Meta Platforms, Inc. presents a new buying opportunity after better-than-anticipated earnings for 2Q24.

- Operating income and margins for Meta Platforms increased due to growing demand for digital ad placements on Instagram and Facebook.

- Despite AI and capex spending, Meta Platforms remains ultra-profitable and undervalued, making it a good investment opportunity.

Kira-Yan

The carnage in the tech sector opens up a new buying opportunity for Meta Platforms, Inc. (NASDAQ:META) which presented better-than-anticipated earnings for 2Q24 last week.

Meta Platforms enjoyed a substantial increase in its operating income as well as margins due to growing demand for digital ad placements on Instagram and Facebook.

The big sell-off that the technology sector suffered last week might be a good opportunity, in my view, to deploy some cash to companies like Meta Platforms which are ultra-profitable and at the same time still sell for a rather moderate earnings multiples.

My Rating History

My last stock classification on Meta Platforms was Hold due to growing spending on AI, which I figured would depress margins. The ad market, however, performed rather well in the second quarter, with marketers continuing to spend big bucks on large-scale social media platforms.

As a consequence, Meta Platforms’ operating income and profits per share surged in the second quarter and the user count as well as sales per user continue to trend up.

Meta Platforms’ Operating Income Is Skyrocketing On Strength In Ad Growth

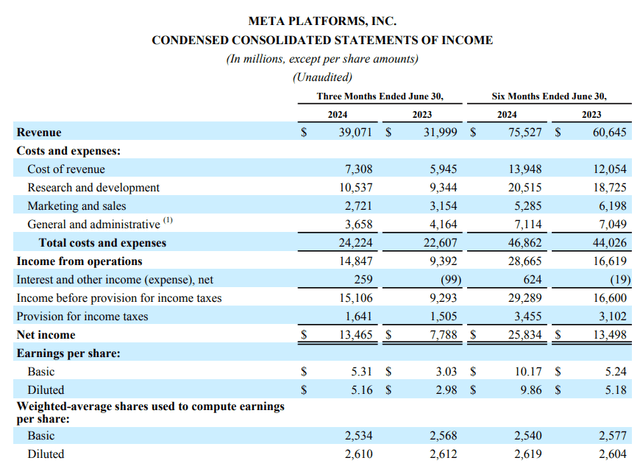

Meta Platforms’ 2Q24 sales rose 22% YoY to $39.1 billion, almost three times faster than its operating costs. Consequently, the social-media company enjoyed a substantial operating income uplift in the second quarter.

Meta Platform’s operating income in 2Q24 was 58% higher than in the year ago period and totaled $14.8 billion. In the first half of the year, Meta Platforms earned $47.9 billion in operating income and the dynamics in the ad market as well as user growth trends are bullish heading into the latter half of the year.

The company’s profits per share, for instance, skyrocketed 73% to $5.16 on a diluted basis and the results underpinned Meta Platforms’ unrivaled platform profitability.

Condensed Consolidated Statements Of Income (Meta Platforms Inc.)

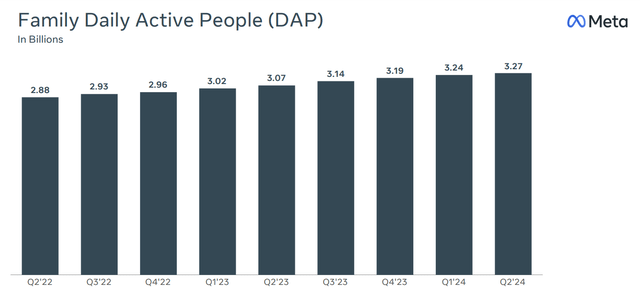

Meta Platforms’ continues to pull new users to its apps, which is something that deserves respect, given the surging popularity of other short-form video competitors, like TikTok. Meta Platforms had 3.27 billion daily active people (the company’s equivalent of users) in the second quarter, up 7% YoY, which made Meta Platforms the world’s largest social-media platform. The average amount of sales per user produced on the company’s various apps amounted to $11.89 in the second quarter, reflecting 14% YoY growth.

Family Daily Active People (Meta Platforms Inc.)

Capex Spending, AI Spending To Be A Headwind

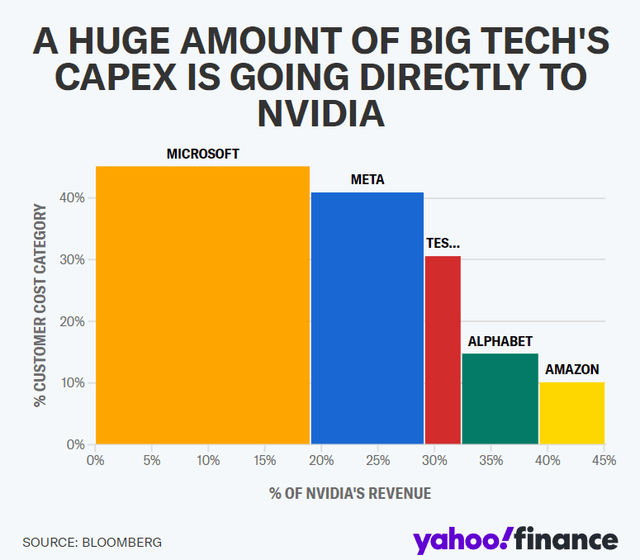

Meta Platforms is spending a boatload of cash on acquiring graphics processing units from Nvidia to train its own large-language models and AI assistants. Meta Platforms spent $8.5 billion on product development in the second quarter, up 33% YoY.

According to the company’s capital expenditure forecast, which Meta Platforms updated last week, it now anticipates to spend at least $37 billion and up to $40 billion on capital projects this year. Previously, Meta Platforms anticipated to see $35-40 billion in capital spending.

Ray-Ban Meta smart glasses are seeing good traction across the app universe, said the company in its 2Q24 earnings release.

The important point here, in my view, is that Meta has a strong case to justify continued spending on its various AI projects, including the development of a more intelligent digital assistant.

Since the company spent $15.2 billion on capital expenditures in the first half of the year, Meta Platforms is poised to ramp up its spending by 150% in the latter half of 2024. This capital spending will go primarily to the development of artificial intelligence capabilities and the purchase of Nvidia’s high-performance H100 graphics processing units.

While Meta is spending billions of dollars this year to gain a leading position in the market for AI technology and assistants, the company is poised to accelerate its spending next year. The same is true for other companies like Microsoft, Tesla and Google, which are all investing billions of dollars to grow their respective markets by leveraging AI technology.

Percentage Of Nvidia Revenue (Bloomberg)

Meta Platforms Is Still Extraordinarily Cheap

Taking into account Meta Platforms’ operating income upsurge in the second quarter as well as considerable profit per share growth, I think investors may want to at least consider taking advantage of last week’s tech carnage.

The market presently models 14% profit growth per share for Meta Platforms in 2025 which may turn out to be a bit conservative given the substantial momentum that we are seeing play out in the advertising segment (user and sales per user growth)/ I think we could see a 20-25% profit uplift next year if Meta Platforms’ family of apps continues to attract new users and if sales per users keep rising as well.

Presently, the stock of Meta Platforms’ is selling for 20.3x next year’s sales, which makes the social-media company about as cheap as Alphabet Inc. (GOOG). Google is selling for 20.0x next year’s sales and is anticipated to grow its profits 14% YoY also.

Google is a bargain that I rarely miss buying on drops, and I explained in my piece Google: The More It Drops, The More I’ll Buy why. Both Meta Platforms and Google are silly bargains at 20.0x profit multiples given their strengths in their respective industries (ads, search and cloud) and have been buying both company’s stocks on Friday.

Earnings Estimate (Yahoo Finance)

Why An Investment In Meta Platforms Might Go Wrong

The social-media platform made a big strategic blunder with its investments in its Reality Labs business, which essentially consolidated the company’s metaverse plans.

The metaverse was a giant failure, and Meta Platforms wasted billions of capital spending on this business. Until this day, Meta Platforms has very little to show for its past investments in the metaverse, as the Reality Labs segment accounted for less than 1% of sales in 2Q24.

As far as AI spending is concerned, Meta Platforms is poised to accelerate its spending, particularly if it is seeing a pay-off, for instance, with its Ray-Ban Meta smart glasses.

My Conclusion

Meta Platforms’ operating income and profit per share explosion in the second quarter is undervalued and underappreciated by investors, in my view.

Meta Platforms profits clearly from growing advertising spending on its platforms, across multiple products such as Instagram and Facebook. As a consequence, I think that Meta Platforms’ is well-positioned to grow its ad business and produce double-digit profit per share growth moving forwards.

Its users and sales per user are growing. The most compelling reason to buy Meta Platforms is the low profit multiple of 20.0x.

Taking into account last week’s tech carnage, I think this may be an opportune time to deploy some cash to the technology sector. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.