Summary:

- Meta Platforms stock pared its metaverse-related losses as CEO Mark Zuckerberg is once again focused on utilizing the company’s core strengths to create additional shareholder value.

- Further monetization of Reels and WhatsApp have all the chances to help Meta’s business to continue to exceed expectations and outpace its competitors in the long term.

- However, there’s a risk that Meta’s shares could depreciate in the short term due to them being in the overbought territory after the recent rally.

- That’s the main reason why I’ve recently closed my long position in Meta Platforms, Inc.

Justin Sullivan

After failing to convince the Street to back up his metaverse vision last year, Meta Platforms, Inc. (NASDAQ:META) CEO Mark Zuckerberg pivoted on his plans and began to talk more in recent conference calls about how the company is aiming to utilize the advantages of its core business to create additional shareholder value. The introduction of Reels within Facebook and Instagram along with the ongoing monetization of WhatsApp have already helped Meta increase its user count and improve its overall performance. This has led to the appreciation of the company’s shares as the market approved Zuckerberg’s pivot and helped Meta’s stock regain its momentum.

However, as Meta now trades close to its 52-week highs, questions are being raised about whether META stock is now overbought after the latest rally in the current uncertain macroeconomic environment. Therefore, as investors are rebalancing their portfolios, this article aims at highlighting all the upsides and downsides of owning Meta at this stage and explains why I’ve recently closed my long position in the company.

Mark Zuckerberg Continues To Deliver

In late April, Meta kicked off its year of efficiency by reporting stellar earnings results for Q1. During the quarter, the company managed to increase its revenues by 2.7% Y/Y to $28.65 billion, while its GAAP EPS was $2.20. At the same time, the amount of daily active people and monthly active people across its family of apps was up 5% Y/Y and 5% Y/Y to 3.02 billion and 3.81 billion, respectively. Thanks to such a performance and the increase in engagement and user count, Meta now expects to generate revenues in the range of $29.5 billion to $32 billion in Q2 against the consensus of $29.74 billion.

Considering the resilience of the digital advertising market in recent months, there are reasons to believe that Meta would be able to achieve its performance targets in the foreseeable future. The latest data suggests that ad spending is expected to increase at an annual rate of 13.1% by 2026 and surpass $700 billion in annual spending in 2025. Therefore, if we don’t experience a major recession, then Meta’s growth story would remain intact.

At the same time, several growth catalysts should help Meta achieve its targets and exceed expectations. One such catalyst is the explosive growth of its short-form video product Reels, which has been integrated into Facebook and Instagram. Last summer, I’ve been saying that Reels is far more important to Meta’s growth story than the company’s metaverse projects due to its greater potential to drive engagement and retain users. Since that time, Reels have been greatly contributing to Meta’s recent successes.

During the latest conference call, Meta’s management noted that Reels helped the company to increase the overall time spent on Instagram by 24%, while Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook. Considering those numbers, it’s safe to say that Reels would be able to continue to help the company to improve its overall performance in the following months, especially if TikTok is banned in the United States since it would help Meta gain a greater foothold in the short-form video segment.

On top of all of that, the ongoing monetization of Meta’s messaging apps such as WhatsApp, which started last year, also has an opportunity to help the company reach its performance targets in the following months. During the same conference call, Meta’s management stated that the number of businesses that use paid messaging ads on WhatsApp has increased by 40% Q/Q as messaging ad tools start to gain greater popularity among advertisers.

Considering all of this, there are reasons to believe that a further monetization of messaging opportunities along with the growth in popularity of Reels would likely help Meta to continue to meet its targets and create additional value along the way.

Is There More Upside To Meta’s Stock?

While Meta without a doubt has all the chances to continue to exceed expectations as long as it continues to utilize its core advantages to expand its market share and increase its user count, there are nevertheless questions about whether the company’s stock has become overbought after the latest rally.

Back in February, my discounted cash flow (“DCF”) model was showing Meta’s fair value to be $159.31 per share. Even back then, Meta was overvalued based solely on the fundamentals. However, since my average purchase price was below that level, I decided to retain my long position in the company at that time as there was an indication that Meta’s stock has more room for growth thanks to the improvement of the business’s fundamentals. That’s exactly what has happened in recent months.

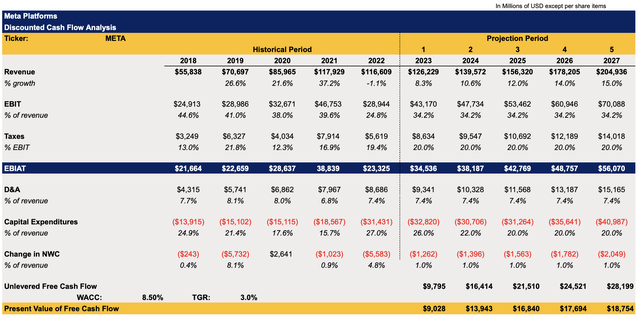

The updated model below now includes the improvement of guidance that was revealed after the latest earnings results and forecasts a better top-line performance of the business in the following years. Most of the other metrics in the model remain the same as before and are mostly in line with the management’s outlook.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

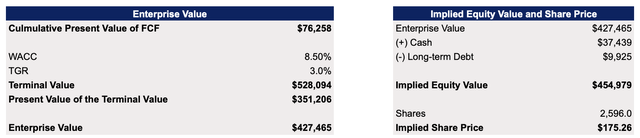

The updated model shows that Meta’s enterprise value is $427 billion while its fair value is $175.26 per share, above the previous valuation but significantly below the current market price.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

While this valuation doesn’t mean that Meta’s shares can’t appreciate further, there’s nevertheless a risk that Meta is now in the overbought territory after the recent rally and the fact that the fair value doesn’t closely align with the market price gives reasons to be cautious about holding the company at the current levels. Even though Meta would likely be able to create additional shareholder value in the long run, there’s a possibility that we’ll witness a major depreciation of its share price in the short term due to macroeconomic uncertainty that could kill the stock’s momentum and limit the upside. That’s the main reason why I’ve recently closed my long position in the company at a major profit and would likely reopen it if we get close to the fair value levels in the following quarters.

Additional Risks To Consider

As noted earlier, the potential recession could negatively affect Meta’s performance in the short term as it would have a direct impact on the digital advertising market and would likely kill the momentum of the company’s stock. While Meta was able to improve its overall business performance in Q1, its average price per ad nevertheless decreased by 17% Y/Y. While this decrease was mitigated by the increase in ad impressions by 26% Y/Y, there’s nevertheless a risk that if advertisers cut their ad spending in the worst-case macro scenario, then ad impression growth would likely subside and make it harder for Meta to achieve its performance targets in the second half of the year with price per ad already down.

At the same time, the potential worsening of the macroeconomic environment could also make it harder to justify Meta’s obsession with its metaverse projects that continue to lose money to this day while the management doesn’t fully understand how to monetize them. In Q1 alone, revenues of Meta’s Reality Labs segment were down 51% Y/Y to $339 million while its expenses were up 18% Y/Y to $4.3 billion, which resulted in an overall operating loss of $4 billion. At this stage, it seems that Meta’s metaverse projects would continue to drag the whole business down and hurt the company’s total bottom-line performance, which would continue to negatively affect the overall valuation of the business. That’s something that investors need to take into account when deciding whether to hold Meta’s shares in their portfolios.

The Bottom Line

After the metaverse-related debacle of last year that brought Meta Platforms, Inc.’s shares below $100 per share, Mark Zuckerberg’s pivot was the only thing that could’ve improved the overall situation, and that’s exactly what’s happened. By shifting the focus back to the development of core products that resulted in the better monetization of messaging apps along with an expansion of Reels, Meta was able to increase its user base and improve its overall business performance. At the same time, as long as Meta continues to utilize its core advantages, it’ll likely be able to continue to create additional shareholder value in the following years.

However, there’s also a possibility that in the short to near-term Meta Platforms, Inc.’s shares might depreciate after the recent rally due to its stock being in the overbought territory at a time when the stock market momentum could be coming to an end due to macroeconomic challenges. As such, I’ve decided to recently exit my long position in Meta Platforms, Inc. at a profit and plan to potentially reenter it later at a lower price when the overall environment improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!