Summary:

- Last year, I sold my shares of Meta Platforms due to concerns about its metaverse spending and management’s decision-making.

- However, I now realize I was wrong as META has shown strong financial performance and reduced spending throughout the “year of efficiency”.

- Now, I believe that META has the potential to become a strong dividend compounder and has bought back shares, with expectations of ongoing double digit total return potential.

LIONEL BONAVENTURE/AFP via Getty Images

I was wrong about Meta Platforms (NASDAQ:META).

I sold my shares of the stock for $186/share in March of last year, locking in small profits.

At the time I was pleased to take advantage of what I thought might be a short-term rally.

I wanted to get out of a company that I no longer trusted because of its massive metaverse spending. I viewed management as irresponsible and borderline crazy. And therefore, I was happy to exit my position since I was no longer in the red and had the opportunity to make some money while moving onto what I thought were better alternatives.

Well, with the benefit of hindsight, I couldn’t have been more wrong and my timing here couldn’t have been worse.

Shortly after I made that trade, Mark Zuckerberg announced his plans of a “year of efficiency” which sent shares soaring.

This announcement caused META shares to spike by 20%.

At the time, I didn’t buy back into the stock because of trust issues.

Talk is cheap, I told myself.

It’s easy to talk about reducing capex; however, it seemed unlikely that we’d see a total pivot after the company’s name change and overt focus on moonshot ideas surrounding the metaverse.

I wasn’t sure that Zuckerberg had it in him to swallow his pride, backtrack, and focus on what the company does best (digital advertising with its social media platforms).

But, he didn’t just talk the talk here, he walked the walk.

Kudos to him…and everyone who believed in his messaging.

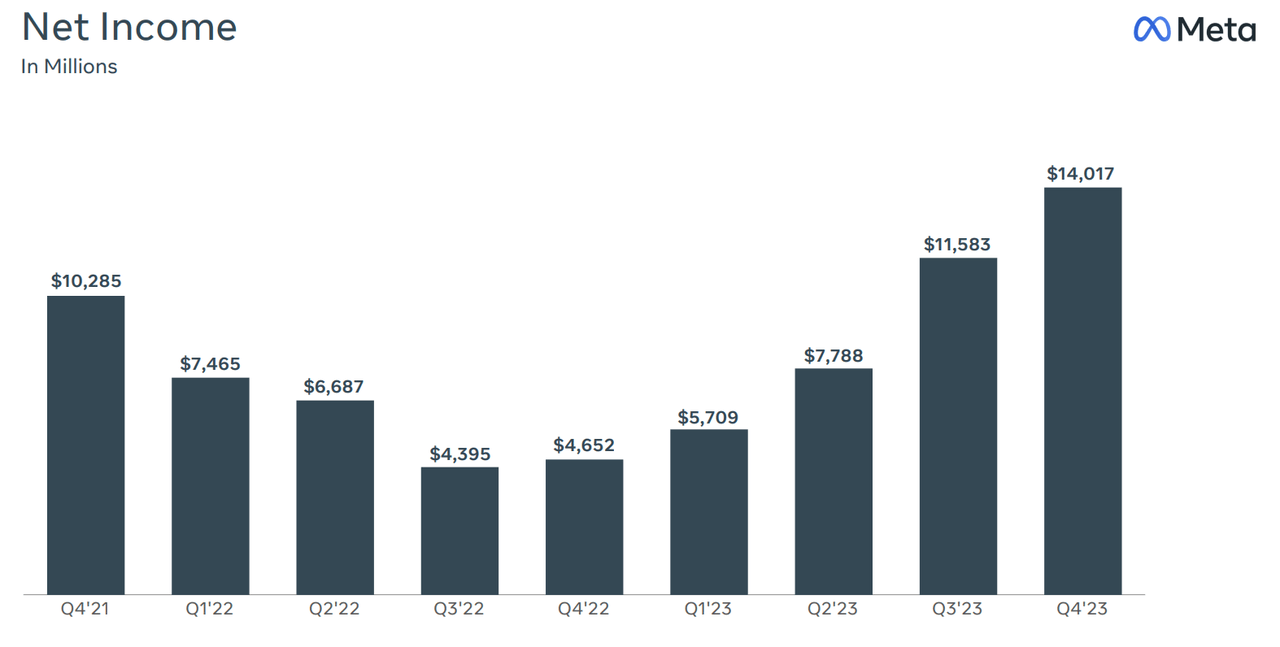

Meta has an amazing year in 2023 and I largely missed out.

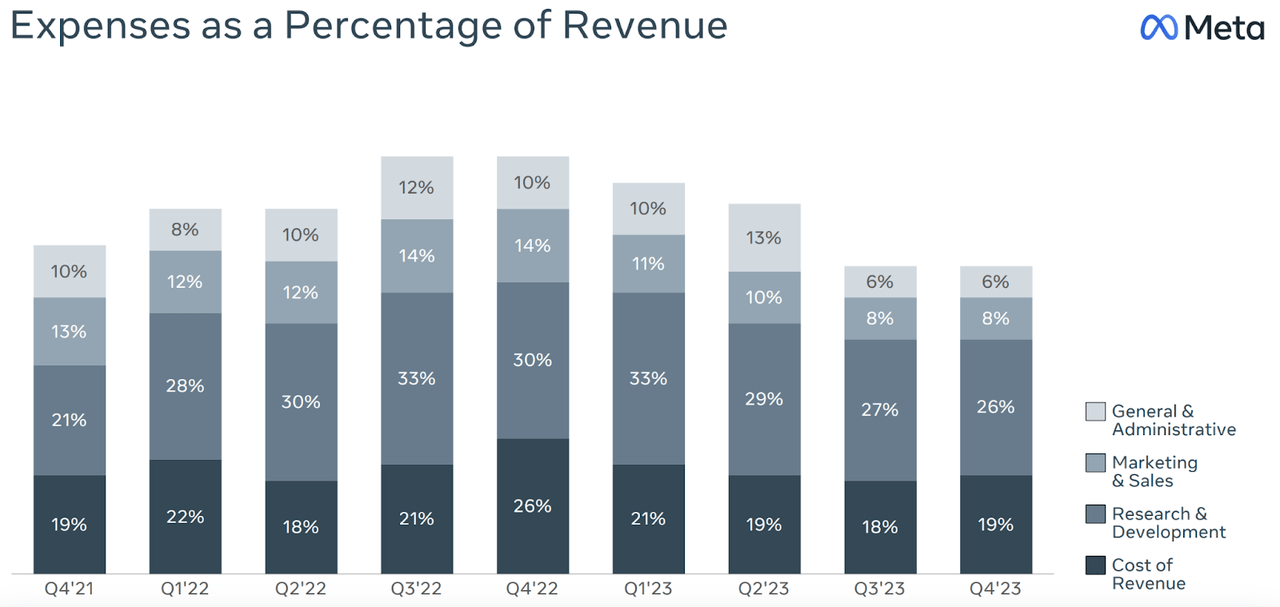

Over the last year, META reduced its headcount by more than 22%.

The company’s capex continues to fall each quarter.

And yet, Meta’s fundamentals continue to rise.

It’s rare to see a company can slash spending while still growing revenue.

But, META has done just that. This resulted in strong margin expansion and ultimately, huge profits.

Those profits caused META’s share price to soar.

In 2023, META generated triple digit total returns looking ahead, I think META shares will continue to outperform.

What’s more, META announced a new dividend during its most recent quarter, which meant that these shares are now included on my dividend growth compounder screens.

Now, when stacked up against my other favorite dividend growth stocks, META’s fundamentals shine.

I think this company has the chance to become one of the strongest dividend compounders on planet Earth and therefore, last week I ate a little crow, swallowed my pride, and rebought those shares that I sold last year (and a few more as well) at a price that was more than 2x the size.

I initiated a sizable META position at $476.04 after its Q4 earnings and now this company sits at the top of my personal watch list, in terms of companies I want to add more of when cash becomes available to invest.

Q4/Full-Year Results

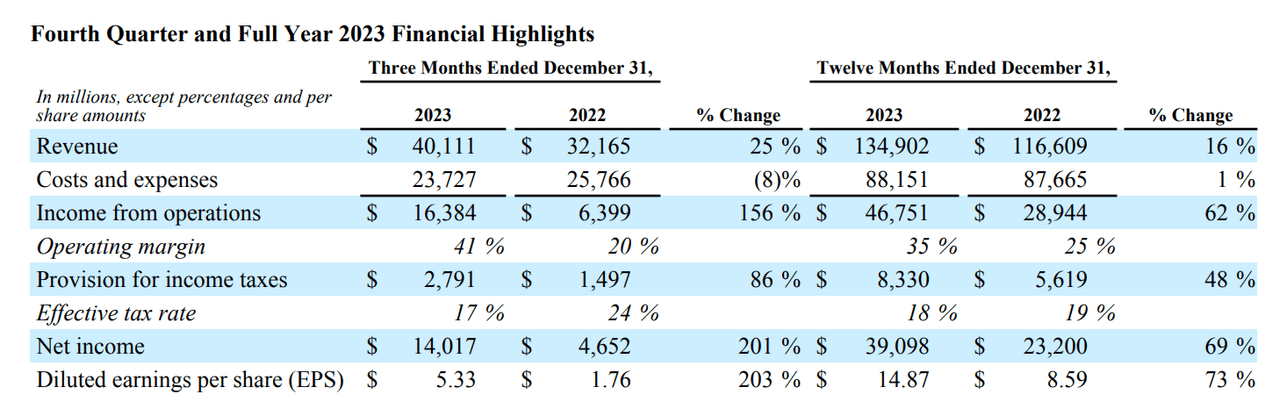

During the fourth quarter, META’s revenues came in at $40.1b, up by 25% on a y/y basis.

For the full-year, META produced $134.9b in sales, up 16%.

As you can see below, META’s bottom-line results accelerated at a pace far beyond those revenue growth rates, due to the company’s focus on cost cutting and margin expansion.

META Q4 ER

This chart clearly shows the success of the “Year of Efficiency” that Zuckerberg highlighted last year.

META Q4 ER Presentation

As you can see, capex is falling and that’s leading to enormous cash flows.

META Q4 ER Presentation

META reduced its annual capex by roughly $4b during 2023, or roughly 12%.

And yet, this doesn’t appear to have hurt the company’s products.

META’s family of app’s daily average user growth remained in place during Q4 and 2023 overall.

During the fourth quarter, more than 3.1 billion people estimated to visit its ecosystem.

On a monthly basis, nearly 4b people are estimated to have visited this company’s ecosystem.

Think about that. There’s an estimated 7.89b people on Earth right now. That means that Meta’s platforms are used by more than half of the human population on a monthly basis.

This demand results in strong pricing power for the company when selling ads.

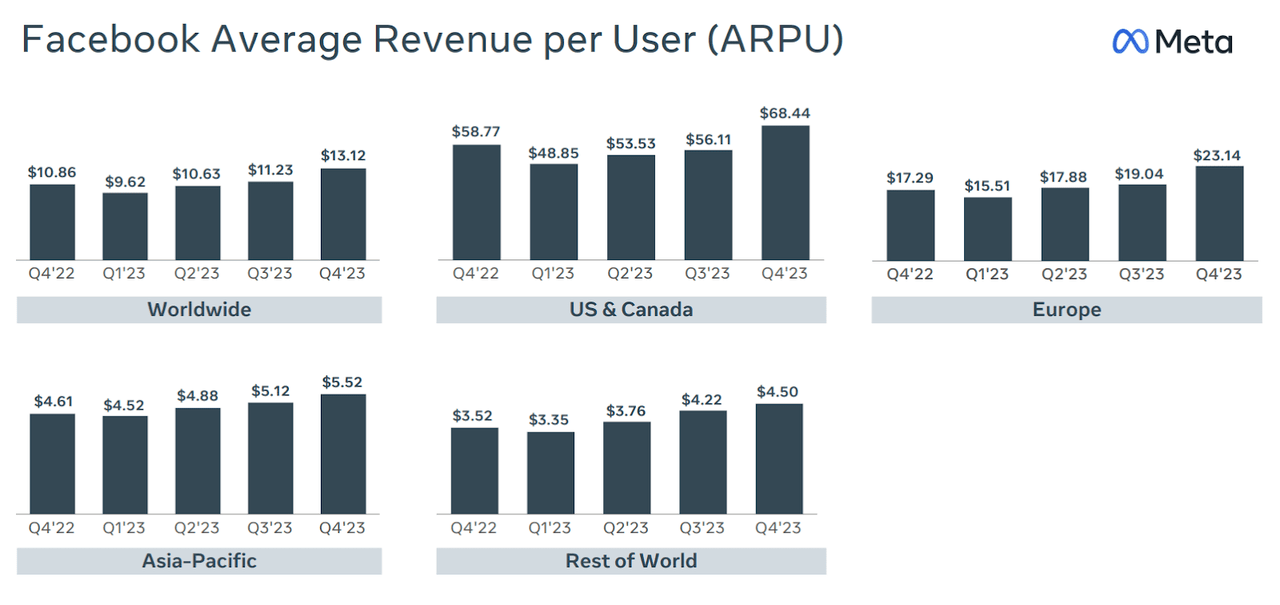

Meta’s average revenue per user (ARPU) posted positive growth in every geographic region in every quarter during 2023.

The consistency of that growth/execution is amazing.

META Q4 ER Presentation

Yes, this 2023 success sets up tough 2024 comps for the company in the coming quarters; however, so long as Meta remains disciplined with its capital spending, I think it can continue to increase margins and generate rising profits even if we see user growth stagnate.

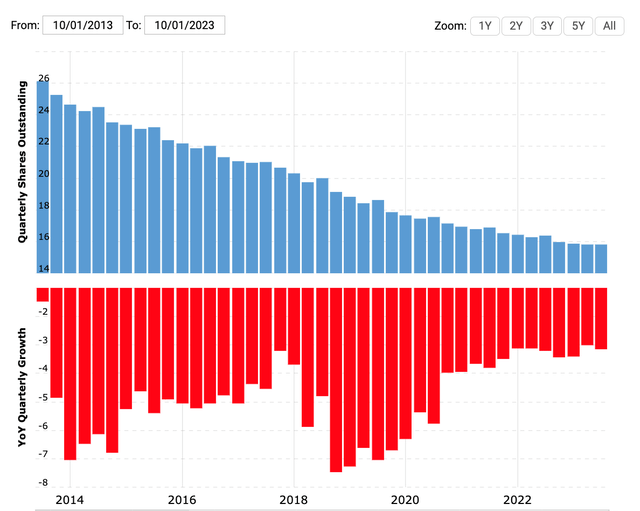

This expectation for continued margin expansion, alongside the potential benefits of financial engineering via META’s massive buyback (the company authorized an additional $50b of share repurchases during the Q4 result), results in strong bottom-line growth expectations in 2024.

And rising earnings and free cash flows should result in rising shareholder returns as well.

To me, this turned META from a somewhat speculative growth play into a sleep well at night dividend growth stock (literally, over night).

And now I’m a happy shareholder with plans to buy & hold over the long-term.

Shareholder Returns

I’d be lying if I said that META’s new dividend wasn’t the driving force behind my recent purchase.

To some, this measly dividend yield might not seem very important. But to me and my investing strategy, it’s everything.

Sure, the company’s fundamentals are fantastic, but they’ve been that way all year.

Frankly, I didn’t feel the need to own META when I already had overweight positions in high-growth, big-tech plays like Alphabet (GOOGL), Amazon (AMZN), and Nvidia (NVDA) which don’t really factor into my passive income stream (yes, NVDA pays a dividend, but even with a very large position, its 0.02% yield means that these shares don’t play a significant role in my dividend snowball).

However, the new dividend changed that calculus.

For a while now, I’ve said that companies like Meta, Alphabet, and even Amazon could become major players in the dividend growth space. However, looking at the companies’ fundamentals, thought that Alphabet would the first one to make that move. I was wrong about that too, but here’s to hoping that Alphabet’s management sees the market’s reaction to META’s earnings and adopts a year of efficiency-like mindset as well.

Sure, right now, META’s yield is also quite low (just 0.43%). But, this purchase isn’t about the yield in the present. It’s about my expectations for META to consistently grow that dividend over time – at an above average rate – putting this company into very rare air when it comes to its shareholder returns profile moving forward.

To me, META now falls into the same wonderful category as blue chip shareholder return plays such as Apple, Microsoft (MSFT), Visa (V), Mastercard (MA), and MSCI (MSCI).

Stocks like these are always high priority buys for me, anytime they’re trading at or below fair value, because of the strength of their compounding potential.

Obviously META hasn’t had time to establish a dividend growth track record, but now that management has initiated its dividend, I believe that cat is out of the bag and I have high hopes for dividend growth moving forward.

I suspect that they’ve seen the success that other very generous growth companies have had with regard to adopting disciplined capital structures, returning cash to shareholders, and still having strong enough cash flows to spend massive amounts of money on R&D and other growth-oriented capex, to keep the compounding machines running.

I also wouldn’t be surprised if this move can set META apart from other growth tech plays when it comes to attractive human capital because the new dividend differentiates their share from most other silicon valley companies when it comes to share based comp.

I saw a slew of articles last week noting that Mark Zuckerberg will be making roughly $700m per year from META’s new dividend.

Obviously he owns the most shares and frankly, doesn’t need the money either way, but I have to believe that I’m not the only person who sleeps well at night while my shares provide passive income and therefore, I think the cash flows and relative stability that comes with shares that provide growing shareholder returns will help to attractive (and maintain) top talent.

META’s new dividend isn’t the only similarity that I’m seeing compared to Apple.

For years, META was known for its pristine balance sheet. This company was flush with cash and had zero long-term debt. Well, in 2022 that began to change.

The company ended 2022 with $9.92b in long-term debt.

That figure rose to $18.39b by the end of 2023.

And while I loved META’s former balance sheet, I’m actually happy to see them take advantage of leverage, alongside their increasing shareholder return programs, because even in today’s interest rate environment, META generated very strong ROIs last year with debt-fueled buybacks and over the long-term, I suspect that this will continue to be the case while its growing is EPS/FCF’s at such a strong rate.

To me, it looks like META is taking a page out of Apple’s “cash neutral” playbook. META’s cash position isn’t nearly as large as Apple’s, but right now, it’s sitting on $65b of cash/cash equivalents (and $43b of annual free cash flows), which gives it a lot of financial flexibility when it comes to increasing leverage without putting its stellar AA- credit rating at risk.

With all of that in mind, I expect to see META continue to buy back tens of billions of dollars’ worth of shares each year while also raising the dividend.

As META’s discipline, with regard to headcount and share-based comp reduction continues, these buybacks will become more and more efficient, with regard to reducing the company’s outstanding share counts.

Now that a dividend is in play, I suspect that reducing its outstanding shares will become more and more of a priority because every share retired by a buyback program reduces the burden of the overall dividend on the company’s cash flows.

In short, I believe that META has what it takes to follow in Apple’s footprints when it comes to a mature, big-tech name with massive cash flows…

Over the last 10 years, AAPL has reduced its outstanding share count by 39.4%.

During this same period of time, on a split-adjusted basis, AAPL’s dividend has increased from $0.1089/share to today’s $0.24/share level on a quarterly basis.

In other words, AAPL’s dividend has increased by more than 120%.

I could easily see META’s share count and dividend trend in a similar direction over the coming decade as well. Therefore, I felt compelled to get into this company at the ground floor (with regard to its recently initiated dividend). Obviously META and APPL aren’t a perfect apples to apples comparison here, but I see too many similarities between the two capital return stories to avoid META any longer.

Investing in AAPL shortly after it initiated its dividend was one of the best decisions I’ve ever made in the market. If I have even half that much success with these META shares, it will accelerate my journey towards financial freedom in a big way.

Valuation

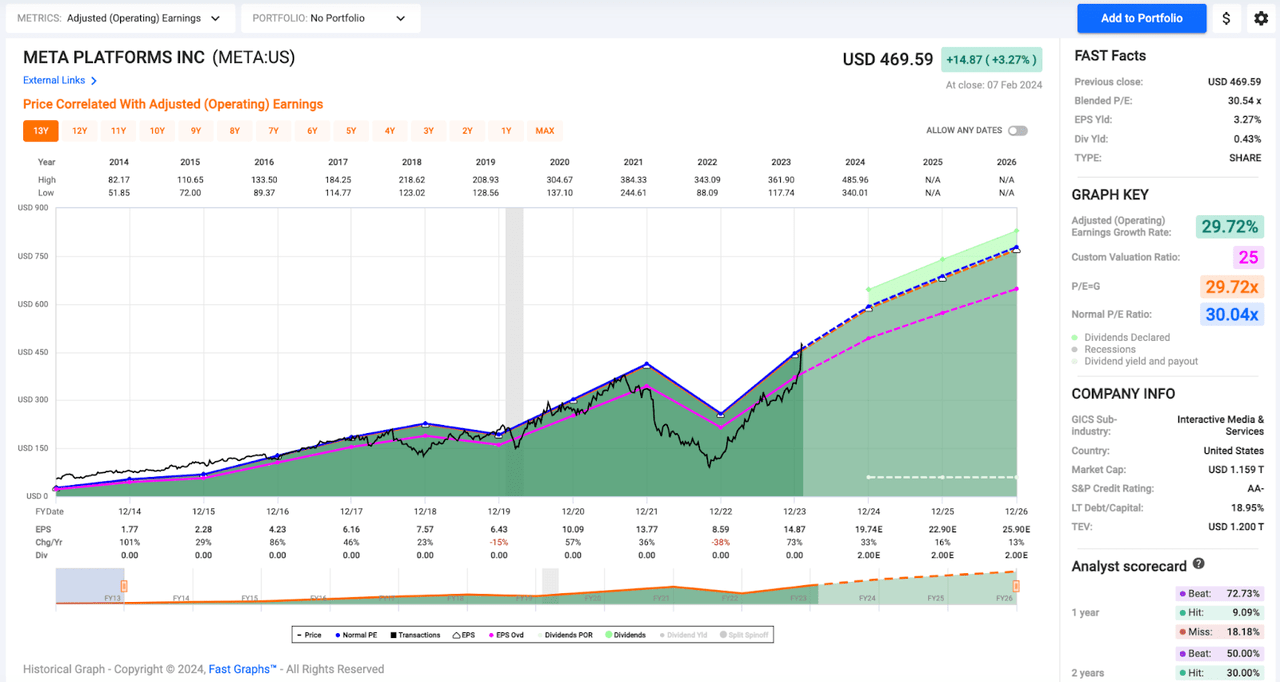

I believe that a ~25x forward P/E multiple represents a conservative fair value for META.

This level is marked on the chart below by the pink line, which, you’ll notice, represents a significant discount to META’s historical average P/E of ~30x.

FAST Graphs

At that level, META would still be cheaper than all of the companies I compared it to before…

- Apple currently trades with a forward P/E multiple of 28.8x

- Microsoft currently trades with a forward P/E multiple of 35.7x

- Visa currently trades with a forward P/E multiple of 28.1x

- Mastercard currently trades with a forward P/E multiple of 32.1x

- MSCI currently trades with a forward P/E ratio of 39.8x

Well, not only is META trading at a discount to its peers – it’s trading at a discount to that target fair value multiple.

Today, Wall Street consensus for META’s earnings in 2024 is $19.74. As I write this, META’s share price is $468.65. Therefore, we’re talking about a forward P/E multiple of just 23.7x.

25x that $19.74/share earnings estimate is $493.50.

That’s where my fair value lies (and frankly, I wouldn’t be surprised to see this figure rise as the year moves on because wouldn’t be surprised to see META continue to beat earnings).

With that in mind, META’s current share price represents a ~5% discount to fair value.

Even with my relatively conservative 25x target multiple, META still offers strong upside total return prospects.

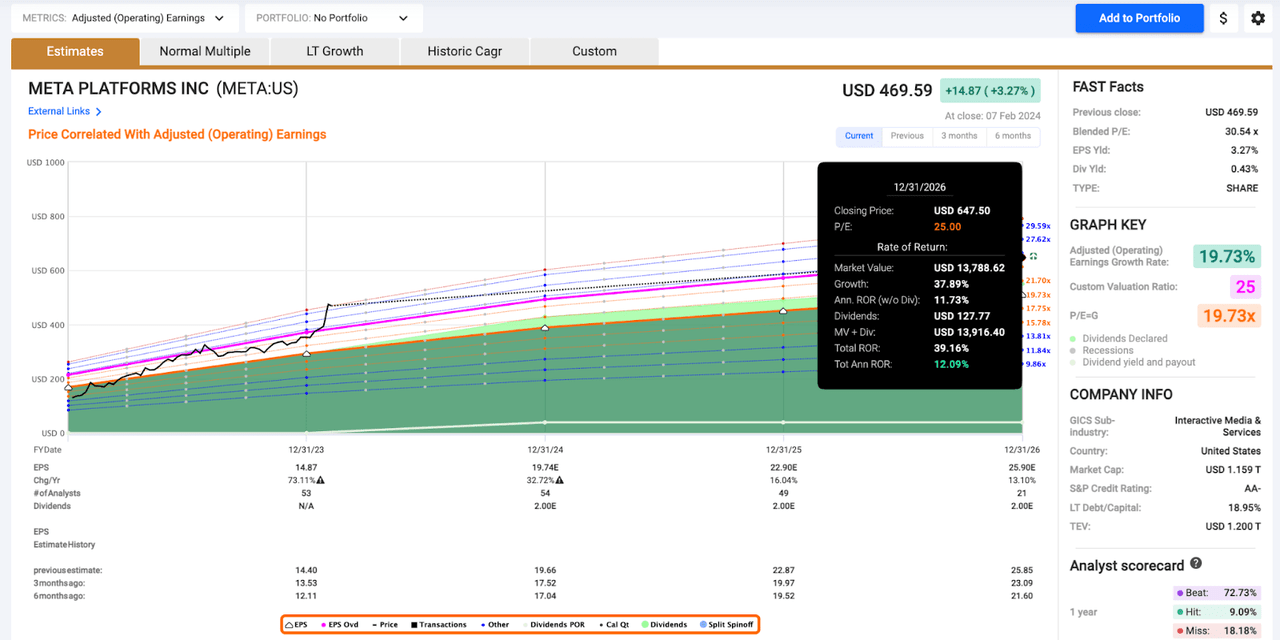

If the company meets analyst EPS growth estimates over the next 3 years, then we’re looking at a total annualized return CAGR of ~12% from here.

FAST Graphs

And, if META does see multiple expansion via mean reversion back up to that 30x level, then we’re talking about a total return CAGR north of 19% per year between now and the end of 2026.

I’m content with 12%, but I think realistic upside to the 20% range should be considered when thinking about buying shares.

Risks To Consider

The primary risk to this bullish thesis is simply management execution.

I’m basing my bullish outlook and fair value target on Meta generation nearly $20.00 in EPS during 2024 and if that doesn’t come to fruition then I will be forced to reduce my fair value estimate.

If management decides to backtrack and aggressively allocate capital toward low ROI capex then it’s like that Meta will not meet its target.

However, it seems clear that they’ve fully bought into the year of efficiency mantra and this disciplined management will continue moving forward (I will be tracking things like headcount, share based comps, and share based comp as a percentage of free cash flow, moving forward).

The advertising market is economically sensitive. Investors should understand this and accept a potential slowdown if we enter into a deep recession. However, even in this event, I still believe that the digital ad space has secular tailwinds and even in a down advertising market, leaders in the digital ad space like Meta, Amazon, and Alphabet will continue to take market share away from legacy avenues like print and cable television.

What’s more, there will be a ton of political ad spending in 2024, so that should bolster the ad environment in the short-term. This will create tough comps in 2025; however, my current fair value isn’t based upon outsized growth next year. To justify my 25x P/E target, Meta would only have to grow at a 12-15% clip in 2025 (which, as you can see on the chart above, is well below their long-term historical average), assuming that they hit consensus growth estimates of nearly 35% in 2024.

Conclusion

It wasn’t long ago that I was selling shares here because of worries around capital discipline and misguided investments.

Well, what a difference a year makes.

I’ve been amazed by management’s discipline during the last year or so.

Now, when looking at META’s valuation, growth prospects, balance sheet, and shareholder return policies this is a very easy company to buy and hold at today’s levels.

With the benefit of hindsight, I wish I hadn’t sold META a year or so ago. But, I don’t have access to a working time machine.

Living in a puddle of regret isn’t going to do anyone any good when it comes to their investment portfolios.

So, instead of looking mournfully at the past, I’m looking towards the future with excitement.

I believe that META has the potential to continue to outperform the broader market – and even many of its big-tech peers – and now that the company is paying a dividend, it’s a very easy stock for me to hold.

This dividend helps me to avoid fearful impulses with regard to selling into negative volatility, or greedy ambitions of trying to time the market and selling into strength.

That’s why I focus on dividend growers. Their passive income keeps me grounded and reduces anxiety while I hold over the long-term.

I’m very happy to have established a ~1% position at $473 and this stock remains near the top of my watch list moving forward.

I’d like to build this position up to the 2-3% range, which would make it a top 10 position within my portfolio.

It’s difficult to find dividend growers with 15-20% long-term EPS growth prospects.

It’s especially difficult to find those companies trading for below 25x earnings.

META falls into that category, making it one of the most attractive fast compounders that I track right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CME, CNI, CP, CPT, CRM, CSCO, CSL, DE, DHR, ECL, ELV, ENB, ESS, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, MA, MAIN, MCD, MCO, META, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.