Summary:

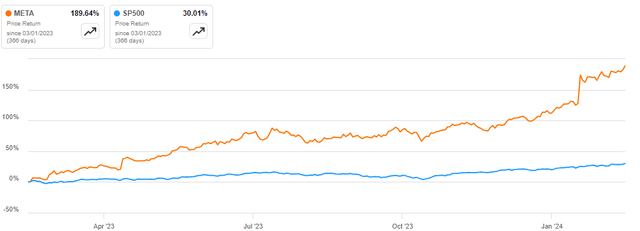

- Meta Platforms, formerly known as Facebook, has seen its stock soar by 189.64% over the past year, outperforming the S&P 500 by 160%.

- The company’s strong financial performance, dominant market position, and strategic monetization initiatives make it a compelling investment opportunity.

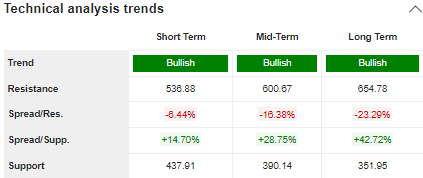

- Technical analysis indicates that the stock is still on an upward trajectory, with bullish indicators and strong momentum. Price targets for 2024 and 2025 are projected to be $597 and $786, respectively.

Justin Sullivan

Investment Thesis

Meta Platforms, Inc. (NASDAQ:META) was formerly known as Facebook. Its stock has soared about 189.64% over the last year, outperforming the S&P 500 by a margin of about 160%.

With such an outstanding performance, this company presents itself as a compelling investment opportunity. Despite the three-digit share price gains over the last year, I am bullish on this stock due to its strong financial performance, dominant market position, and strategic monetization initiatives. From a technical analysis standpoint, the company’s upward trajectory is still strong, which further lends credence to my bullish stance. My price target for 2024 and 2025 are about $597 and $786 respectively. For these reasons, I recommend this stock to potential investors.

Price Chart First

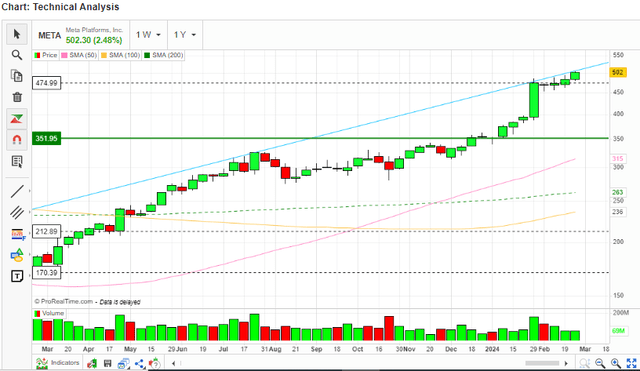

As mentioned in the preceding section, META’s share prices are currently on an upward momentum. To understand it better, I will first look at the technical indicators and then relate the price movement to its fundamentals, particularly EPS, to project my price targets. To begin with, according to TradingView, META has a technical rating of 10 out of 10, which is a reflection of steady performance both in the short, medium, and long term, to confirm this assertion, all three time horizons are bullish according to TradingView.

Market Screener

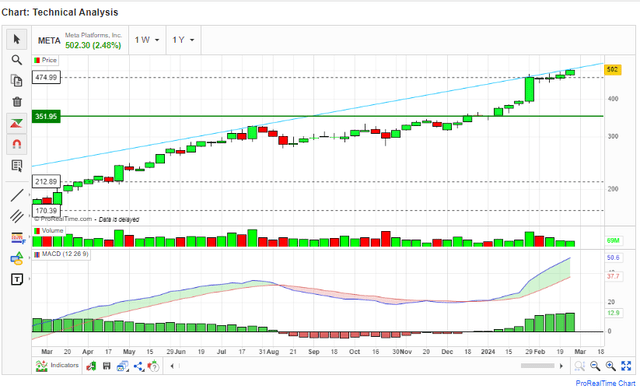

Let’s dive deeper and evaluate what the indicators tell us about the share price movement. To begin with, the share price is above the 50-day, 100-day, and 200-day moving averages, an indication that this stock is bullish in the short-term, medium and long-term. Most importantly, a bullish crossover has occurred between the 100-day MA with both the 50-day and 200-day MAs, an indication that the upward trajectory is very strong.

Secondly, the MACD is above the signal line and diverging with the signal line, a sign that the bullish momentum is getting stronger. This can be confirmed by the MACD histogram being above the zero mark and growing higher with each new bar.

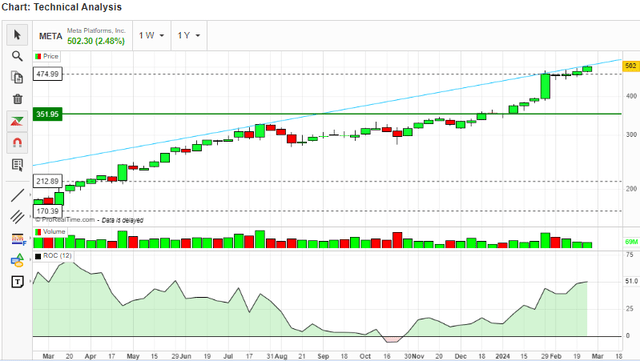

While the above indicators make it apparent that the upward trend is dominant and that the bulls are in control, the most important indicator now is the price rate of change, which gives a signal of how strong the momentum is. Interestingly, the ROC is currently at 51 and is growing steadily, indicating that the bullish momentum is very strong and is even getting stronger.

In summary, from a technical point of view, this stock is currently in a strong bullish momentum with no signs of a reversal.

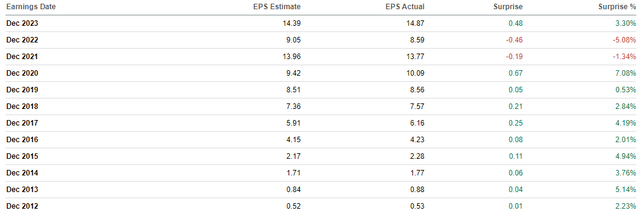

While the charts are bullish, I believe it’s important to relate the price movement fundamentally. In doing that, I will evaluate the price changes in relation to the EPS because the two mostly have a strong positive correlation. From my assessment, META’s price movements have been a reflection of its fundamentals and have shown consistency. To support this, I will pick two scenarios. One of which is bearish and the other one is bullish. For the bearish case, I will refer to the share’s dipping movement between 2021 and 2022 where the price declined from its high of about $384 in September 2021 to its low of about $88 in October 2022, marking a share decline of about 77%. Interestingly, between the 2021 and 2022 FYs, the EPS declined by about 37.62% from $13.77 in 2021 to $8.59 in 2022. This implies that the price change was about 2.04x the EPS change.

Let’s now consider the upward price movement over the last year, where the stock has gained about 189.64%. Over the last year, the EPS has gained about 72.11% growing from $8.59 in 2022 to $14.87 in 2023. This implies that the price has changed about 2.59x its EPS change.

From these two case scenarios, it is evident that this stock is responsive to its fundamentals, and the share price moves about 2x its EPS change. Using this background, I will project my price targets for the 2024 and 2025 FYs. To do this, I will assume the company will hit its estimated EPS for the two years. Further, I will assume an average 2x EPS change to estimate the price changes for the two financial years. With these assumptions, for the 2024 FY, according to Seeking Alpha, the projected EPS would translate to a growth of about 34.36%. Applying the 2x factor would imply that the price will change by about 68.75%, which will translate to a target price of about $597 by the end of this year. In 2025, the estimated EPS would translate to a 15.82% growth from the 2024 EPS (estimated). Therefore, applying a 2x factor would imply that the price would change by about 31.64% from the 2024 target price, translating to a target price of about $786 by the end of 2025.

While these projections are based on an assumption that the company will hit its estimated EPS, it is important to evaluate how likely this assumption is. To do this, I will draw your attention to the company’s respectable history of beating its estimated EPS. Since 2012, the company has failed to beat its estimated EPS for only two years, 2021 and 2022, and this was majorly due to the impacts of the COVID-19 pandemic and the inflationary economic conditions which the company appears to have overcome given its solid financial performance recently.

Given this background, it appears that it is very likely that this company will meet and even exceed its estimated EPS targets and therefore the price targets could likely be higher than estimated, something which would serve as a buffer to my error approximation, especially in my assumptions.

Strong Financial Performance

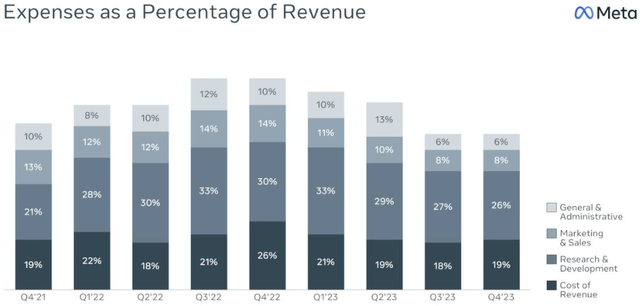

Recently, META has registered strong financial performance and health with a market cap of $1.28 trillion. In the 2023 FY, revenue increased by about 15.69% reaching $134.90 billion, up from $116.61 billion in 2022. In Q4 2023 dated Feb 1, 2024, the company reported revenue of $40.11 billion, representing a YoY growth of 24.70% and beating estimates by $940.64 million. I believe this growing revenue is because of the company’s growing customer base and family average revenue per person. In the 4th quarter of 2023, its family monthly active people grew to 3.98 billion up from 3.64 billion in Q4 2022 and its family average revenue per person grew to $10.10 up from $7.91 in Q4 2022. In terms of profitability, the company made significant strides, with its net income growing from $4.65 million in Q4 2022 to $14.02 million in Q4 2023. These significant gains in profitability were majorly fuelled by a significant reduction in expenses as a percentage of revenue, as shown below.

While this performance is very impressive, its sustainability and future growth are the most important aspects as far as our investments are concerned. For this reason, I will discuss why I believe this company will keep registering solid performance in the future and why it’s bound to grow.

Where My Future Optimism Stems

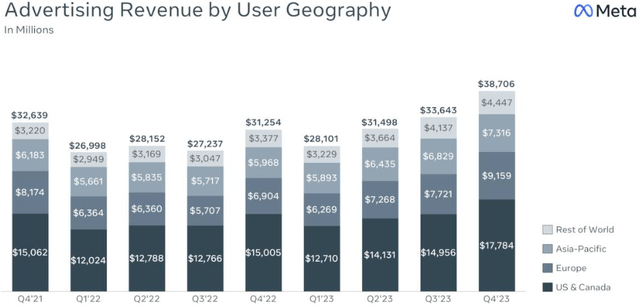

As far as future growth and sustainability is concerned, I have several reasons to be optimistic. The first one is the company’s dominant market position. The company’s ecosystem ranging from Facebook to Instagram, among other platforms, boats of about 4 billion monthly active users according to Statista. Most importantly, these users are in diverse geographical regions, which means that the company has distributed its revenue risk adequately and therefore is almost immune to revenue shocks in case one geographical economy underperforms. Most importantly, the extensive user base offers a solid foundation for sustainable advertising revenue, which accounts for more than 90% of its total revenue. It is worth noting that its monthly active users are growing and this has also been reflected in its advertising revenues.

Although this company enjoys a vast and dominant market, this hasn’t just come easy. META has proven to be resilient amid headwinds, and hence its sustainable market dominance and performance. For example, its strategic moves to explore ad-free subscriptions and its efforts to address “shadow banning” is a reflection of its ability to adapt to dynamic conditions, something which instills confidence in me regarding the company’s relevance and viability in the wake of changing consumer needs and regulatory environment.

The other factor that makes me believe that this company will keep thriving in the long run is its strategic monetization strategies. Their Reel products which are competing with TikTok have reached more than 200 billion daily views across Facebook and Instagram, while monetization is swiftly growing to more than $10 billion revenue run-rate. In my view, this growth trajectory reflects a strong potential from revenue diversity, which is crucial for the company’s long-term success. The Reels aspect also shows the company’s innovation, which in my opinion, is a competitive advantage.

Lastly, in my optimistic view, is its key innovation of metaverse, which is a blend of physical and digital realities with the potential of revolutionizing other sectors. According to Forbes, this innovation is a $1 trillion revenue opportunity. This speaks volumes about the visibility and optimism in the company’s revenue and financial health in general. In a nutshell, META’s future is bright backed by its dominant market position, strategic monetization, and innovation.

Risks

Although I am bullish on this stock, investors need to know the inherent risk of investing here. The main risk that I see here is the company’s overreliance on advertising revenue, which accounts for more than 90% of its revenue. This makes the company susceptible to fluctuations in advertising demand, which can be influenced by several factors, such as regulatory changes and changes in economic conditions. Additionally, the model dictates that the company must maintain high user engagement, which could be challenging sometimes. Also, the user base growth could reach saturation point, meaning that maintaining or sustaining its growth could be difficult at some point.

Conclusion

In conclusion, META is a good investment opportunity with tremendous growth potential given its dominant market position, solid financial performance, and strategic monetization backed by innovations. For these reasons, I recommend this stock to potential investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.