Summary:

- Our expectations of Meta Platforms’ free cash flow declined in 2022 due to its aggressive spending on the metaverse and a slowdown in advertising revenue.

- We had previously defended Meta Platforms but ultimately removed it from our Best Ideas Newsletter portfolio due to a change in our assessment of the company.

- Today, Meta Platforms has become more efficient while experiencing a nice recovery in advertising spending, but we remain cautious on the stock.

- What happened in 2022 could happen again, and we don’t want to be involved with the stock if or when it does.

- Nonetheless, Meta Platforms has returned to a net-cash-rich, free-cash-flow generating powerhouse, and its share price surge reflects that.

Justin Sullivan

By Brian Nelson, CFA

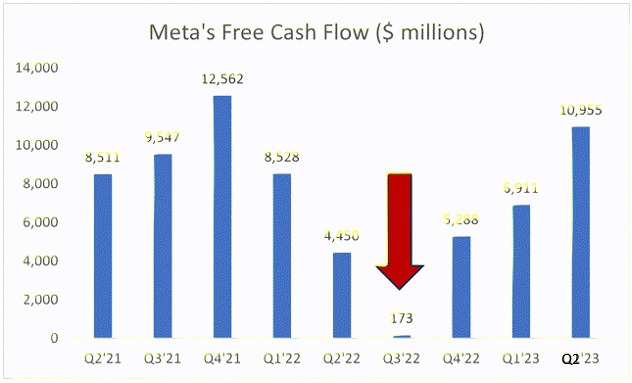

Meta Platforms (NASDAQ:META) used to be a no-brainer stock. Years ago, the company fit right in with that of Apple (AAPL), Alphabet (GOOG) (GOOGL) and Microsoft (MSFT) as net cash rich, free-cash-flow generating powerhouse. But things took a tumble for the worse through the back half of 2022, as free cash flow expectations at Meta Platforms shrank considerably with the social media giant continuing to spend aggressively on the metaverse while advertising spending (revenue) growth slowed. Free cash flow expectations (and changes in them) are a key component to equity returns, so it’s understandable why shares of Meta collapsed through the course of 2022 as future expectations of free cash flow were ratcheted down.

Meta’s free cash flow generation fell significantly during 2022 and is now on the mend. (Source: Meta Platforms)

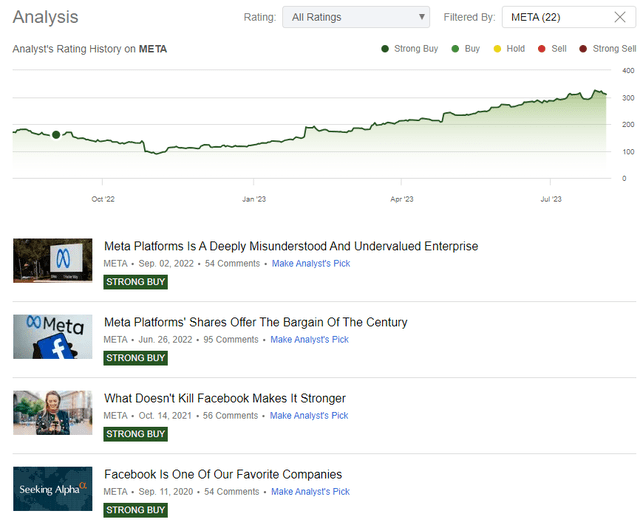

A look at our rating history on Seeking Alpha for Meta Platforms (see image below) might suggest that we did well with the stock, but unfortunately, that wasn’t the case. We absolutely loved Meta Platforms for years, and we defended it almost all the way through its fall in 2022, but we ended up throwing in the towel before the bottom in the Best Ideas Newsletter portfolio, but still much lower than where shares are today. We have a data-driven, forward-looking process at Valuentum, and when the story changes, as in free cash flow expectations, we just don’t sit back idly, we make changes, too. It was a big move because Meta Platforms in the past had registered high on the Valuentum Buying Index, our rating system, but we just couldn’t continue to defend a stock that was spending so aggressively in the midst of a cyclical downturn in advertising coupled with new competition from Tiktok.

Our rating history on Meta Platforms is good, but we threw in the towel once free cash flow soured considerably last year. (Seeking Alpha)

We bring this up because we think it’s important that readers know that we don’t get everything right, and we tend to encounter some difficulty on ideas when management makes a huge strategic shift, or rather an about face on strategic initiatives. For example, we were blindsided by AT&T’s (T) decision (as was most of the market) when the company wrote that it would support its dividend in the firm’s Annual Report (see page 6 of the report, page 7 of the pdf), released on February 8, 2021, but then ended up cutting its dividend just a couple months later. We were aware of the risks of AT&T at that time, including its massive net debt position and capital-intensive nature, but the risk-reward still seemed to favor income investors at that time. To a large degree, AT&T just pulled a 180 and burned its income-oriented shareholder base.

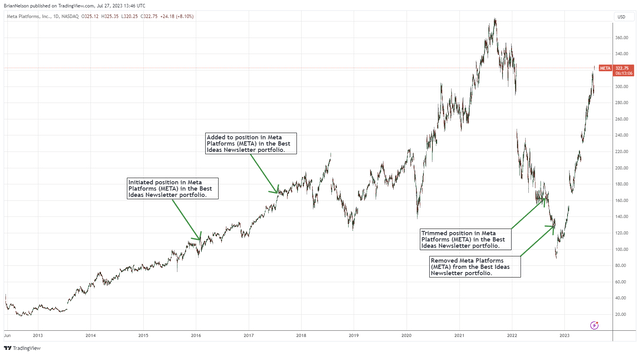

With Meta Platforms, investors in shares were on cruise control for years, but then the story began to change in 2022 as its free cash flow continued to falter. One of the primary reasons why we liked Meta Platforms was that it was a net-cash-rich, free-cash-flow generating powerhouse, but $173 million in free cash flow in the third quarter of 2022 was hardly impressive (and definitely not deserved of the “powerhouse” label). When we decided that its future outlook for free cash flow generation may not be as resilient as we once thought–even despite potential cost-cutting measures–we decided that it no longer fit the bill for the Best Ideas Newsletter portfolio. The change turned out to be a poor move.

Shares of Meta Platforms have been on a wild ride the past few years. We didn’t do well with the stock, unfortunately. (Trading View)

Meta Platforms pulled an about face. It slowed its expected pace of spendings and expense growth, pursued efficiency initiatives by slashing jobs, and its Reels started to make significant inroads into competing more effectively with TikTok, while advertising spending recovered more generally. Though, of course, the newsletter portfolios have benefited as other big cap tech and large cap growth stocks surged in 2023, but we were shaken out of one of our favorite names, and frankly it didn’t have to happen if management had played its cards right. Had Meta Platforms kept its free cash flow trajectory intact through the course of 2022, we may not have thrown in the towel on shares. We suspect many investors feel this way.

What we learned through this ordeal, however, is that Meta Platforms may not be as strong as we once thought it was–even with its fundamental, free-cash-flow, and share-price recovery. Prior to the collapse in shares, we thought Meta’s economic moat was impenetrable, but a budding rival in TikTok undoubtedly impacted its performance, and while it seems to have neutralized TikTok as a competitive threat for now, Tiktok undoubtedly made inroads into areas where Meta Platforms was once lacking (i.e. short-form video). What artificial intelligence may bring in the coming years as it relates to social media and the advertising space, more generally, is something that we just can’t predict with precision, and it represents a key threat when it comes to assessing Meta Platforms’ potential vulnerabilities, which were on full display last year.

Then, there’s the capital investment cycle. Though today it continues to pursue efficiency initiatives, Meta may once again turn on the capital spending gushers in the future, if it sees another opportunity as in the metaverse, and it may swing big and miss again. That’s not something that we’re going to fall victim, too, for a second time. We gave Meta Platforms a lot of wiggle room last year with its spending, but it took the stock to nosedive before the executive suite finally made the changes needed to get the equity moving back in the right direction. 2022 not only showed that Meta Platforms was vulnerable to competition (and the broader advertising cycle), but also that its free cash flow could face unprecedented pressure. This is not something that we were expecting heading into 2022, and we’ve learned more about the long-term risks of Meta from it.

That said, today, Meta Platforms is back. The company retains a huge net cash position, with cash and cash equivalents coming in at $53.45 billion at the end of June, with the firm only having $18.38 billion in long-term debt at that time. Free cash flow generation of ~$11 billion in the second quarter of 2023 is not too shabby either and much better than the doldrums of last year. We think it’s fair to say that Meta Platforms has returned to the category of being a net-cash-rich, free-cash-flow generating powerhouse. But as with AT&T, it’s unfortunate that it whipsawed so many shareholders that they may never return to the stock. We’re certainly liking what we see in Meta Platforms today, but we’re looking elsewhere for new ideas given the vulnerabilities uncovered during 2022. What happened last year may happen again at some time in the future, and we don’t want to be involved with the stock if or when that happens.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. AI in part wrote the summary of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.