Summary:

- Meta Platforms shares are recovering from a market selloff and have the potential for further appreciation.

- Despite facing challenges, Meta is expected to continue growing at a double-digit rate and creating shareholder value.

- Meta’s successful performance, adaptability, and growth catalysts make it an attractive investment with room for growth.

hapabapa

Meta Platforms (NASDAQ:META) shares are gradually recovering from the depreciation that happened at the beginning of August as a result of the overall market selloff, and they have all the chances to continue to appreciate in the following weeks. Thanks to the business’s successful performance in recent quarters, Meta itself is able to strengthen its position in the digital advertising market and ensure continuous growth for years to come.

Even though the company will continue to face various macro and other challenges that could affect its performance in the future, it seems that right now nothing is going to stop Meta from growing at a double-digit rate and creating an additional shareholder value along the way. That’s why as short sellers are capitulating, now might be a good time to double down on Meta as its shares are not yet overvalued and have more room for growth.

Meta’s Growth Story Is Far From Over

Back in April, I wrote an article titled Meta Platforms: Why The Selloff Is Unjustified, where I explained why the depreciation of the company’s shares at that time was unreasonable. Since that time, Meta’s stock has appreciated by over 20%, outperformed the broader market, and could continue to create additional shareholder value in the following quarters.

I’m optimistic about Meta’s future performance, primarily due to the fact that its growth story appears to be far from over. If we go through the recent earnings report for Q2, which came out a few weeks ago, we’ll see that the company’s revenues increased by 22.1% Y/Y to $39.07 billion and were above the expectations by $760 million. At the same time, Meta’s GAAP EPS of $5.16 was above expectations by $0.40, which indicates that the business remains robust and is able to perform well in the current environment.

Going forward, it’s likely that Meta will continue to surprise investors in a positive way in the following quarters, as it has more than enough catalysts that should help it scale its operations and continue to grow at a double-digit rate at the same time.

One of the biggest advantages of Meta is that it’s able to quickly adapt to the changing environment and minimize its losses. Even though the company suffered from Apple’s (AAPL) decision to change its privacy policy a couple of years ago, which affected the way advertising algorithms work, Meta was able to quickly find new solutions to remain relevant. Thanks to this, Meta’s business was booming in the last year and recently achieved a new milestone as the company was able to increase the daily active people metric across its family of apps by 7% Y/Y by the end of Q2 to 3.27 billion. At the same time, the ad impressions and average price per ad in Q2 both have increased by 10% Y/Y.

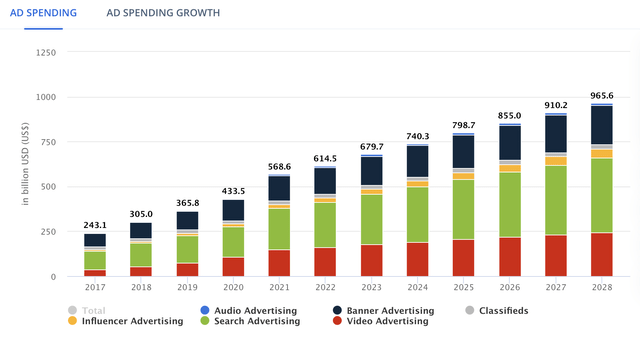

Considering that the spending in the digital advertising market is forecasted to reach $740.3 billion this year and close to $1 trillion in annual spending by the end of the decade, it makes sense to assume that Meta would be able to benefit from such an increase due to its dominant position in the market.

Ad Spending Forecast (Statista)

At the same time, Meta appears to be on track to greatly expand its presence in the video segment. During the recent conference call, the company’s management noted that Reels engagement is on the rise, while the recent rollout of the unified video player for Facebook gave encouraging results. This is important considering that the company’s short-form video competitor TikTok is about to increase its revenues by ~30% Y/Y this year thanks to the growth in usage of the short-form content that attracts users and advertisers in droves at the same time. Given that TikTok could be banned in the United States at the beginning of next year, Meta has a chance to capture a significant portion of the growing market with the help of its own short-form video products, which it continues to improve each quarter.

In addition to all of that, Meta’s scaling of its text-based platforms could also make it possible for the company to continue to expand the user base across its family of apps and grow its sales at the same time. Right now, Meta’s WhatsApp is the most popular messenger app in the world, with over 2 billion total users. During the recent earnings call, the management noted that the app has over 100 million monthly active users in the United States, which translates to roughly 30% of the country’s population that use it on a monthly basis. If Meta manages to continue to improve the app’s retention and expand it in other markets, then WhatsApp has a chance of helping the company drive overall sales higher. The same thing is true for Threads, which is about to have 200 million monthly active users and could become another major social app with a steady income stream once Meta starts to monetize it in the future.

All of those growth catalysts make me optimistic about Meta’s ability to create additional shareholder value in the long run. At the same time, there’s also a case to be made that Meta remains a solid growth and value pick at the same time.

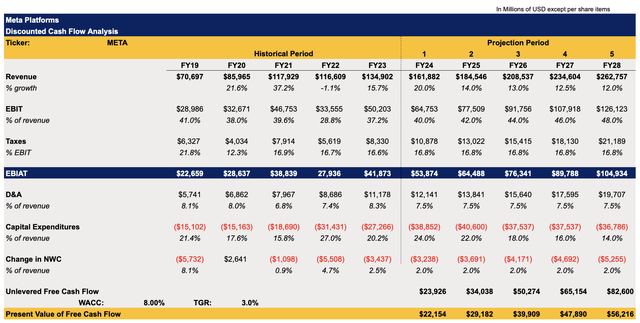

Back in April when the company was trading at ~$430 per share, I made a DCF model which showed the company’s fair value to be $499.17 per share. Given the successful performance in Q2 and countless upward revisions in recent months, I decided to update my model as well and make my own revisions that better reflect Meta’s post-Q2 state of affairs.

The updated model below assumes a higher revenue growth rate in the following years, thanks to the expected monetization of growth opportunities described earlier in this article. The highest growth rate is expected in FY24, after which the rate will start to gradually stabilize in the following years. My revenue expectations closely mirror the overall street expectations for this year and beyond.

At the same time, in the updated model below, I also assume a higher CapEx in 2024 and 2025. This is in line with the management’s forecast of having CapEx in the range of $37 to $40 billion in FY24 and a CapEx growth in 2025, which in my model is above $40 billion. The increase in spending is associated with the need to support the company’s AI infrastructure and product development efforts. In FY25, I expect the spending to peak, after which a stabilization of CapEx is expected to happen.

The assumptions for the other metrics in the new model remained the same as before, and they closely correlate with Meta’s historical performance.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

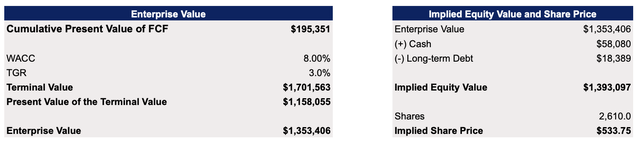

The updated model shows that Meta’s fair value is $533.75 per share, which indicates that the company’s shares represent an upside at the current price.

Meta’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

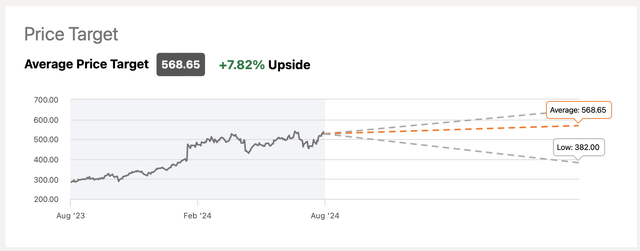

For comparison, the consensus on the street is that Meta’s fair value is $568.65 per share, which implies that some of my growth assumptions could even be conservative. The main thing to take from all of this though is that at the current price, Meta remains to be an attractive investment and that’s the main reason why I continue to hold its shares in my portfolio.

Meta’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

In addition to all the growth opportunities, there are several risks that investors need to consider. First of all, there’s a possibility that the growth of the overall digital advertising market will be weaker than expected, which could result in the inability of Meta to achieve its fiscal goals. Earlier this month, the market has already experienced a selloff after the unemployment data came out, which ignited recession fears in the United States. Even if the unemployment numbers won’t skyrocket in the foreseeable future, especially since the Federal Reserve is likely to start cutting interest rates next month, the potential escalation of the Sino-American trade war could nevertheless have a negative impact on the global economy and negatively affect Meta’s performance in the future.

On top of that, there are questions about whether it makes sense to significantly expand Meta’s CapEx on AI infrastructure, given that it seems that generative AI is slowly losing its hype. After all, Mark Zuckerberg himself earlier this year admitted that it would take years for the company to start making money from generative AI.

What’s more, is that Meta’s metaverse projects continue to be a major money pit, and it’s unlikely that they will break even and start making profits anytime soon. If we look at the latest earnings report, we’ll see that while the revenue for Meta’s Reality Labs division, which is responsible for all of the company’s metaverse projects, increased from $276 million in Q2’23 to $353 million in Q2’24, its loss from operations widened from -$3.74 billion in Q2’23 to -$4.49 billion in Q2’24. While this is not that big of a deal if we look at the bigger picture, Reality Labs still unnecessarily drags Meta’s overall bottom-line performance down. This could become an issue if the core business fails to meet its goals in a worsening market environment.

The Bottom Line

While there are certain risks related to investing in Meta, they will likely be offset in the foreseeable future as the company has more than enough growth catalysts that should help it to continue to exceed expectations and reward its investors at the same time. That’s why I continue to be optimistic about Meta’s future and believe that its stock right now is a solid buy as it could be considered a great value and growth play at the same time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.