Summary:

- Meta reported solid result for Q1 2023 as it beat both its revenue and earnings growth estimates.

- The company has faced challenges monetising its Reels video format, but its efficiency metric has improved by 30% and 40% for Instagram and Facebook sequentially.

- Meta has continued to grow its user base by ~5% year over year to 3.81 billion people, for its Family of Apps.

- Meta bought back $9.22 billion of stock in Q1,23 which is a positive for existing shareholders. The company has a further $41.73 billion authorized for share buybacks.

- The company plans to roll out “AI Agents” for business messaging and introduced its 65 billion parameter AI model LLaMa to researchers in Q1,23.

Kira-Yan

Just last year Meta (NASDAQ:META) was written off by investors as a legacy technology company that was splurging cash on the “Metaverse”, with declining revenue, earnings, and slowing user growth. However, now the tide looks to be turning as Meta reported solid financial results for Q1,23 with a beat for both top and bottom-line growth estimates, as growth returned for both revenue and users.

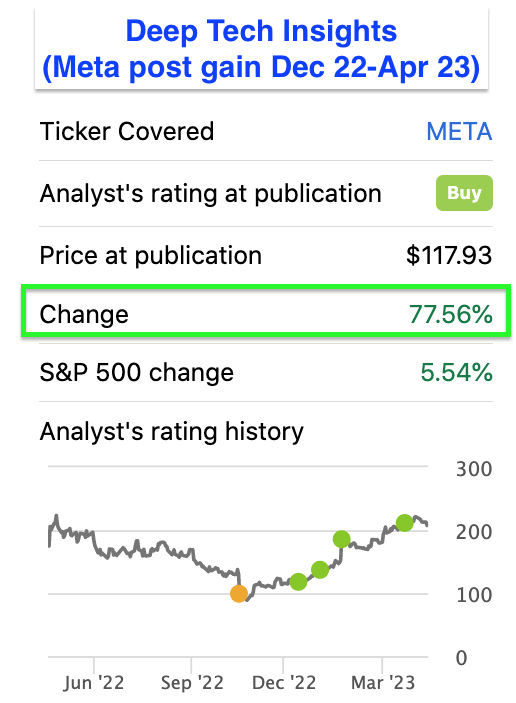

The company still has a long way to go but since my original post on Meta in October 2022, titled “Disaster Quarter but Deeply Undervalued” its stock price has rallied by over 113% and over 77%.

Meta Post Gain (Deep Tech Insights post)

Meta is still grappling with challenges related to the monetization of its Reels, but its metric trends have been positive. In addition, Meta is a leader in Artificial Intelligence (AI) with over 20% of its Instagram and Facebook content feeds, recommended by AI, according to its earnings call. Thus in this post, I’m going to break down Meta’s Q1 results in granular detail before revealing my valuation model and forecasts for the stock let’s dive in.

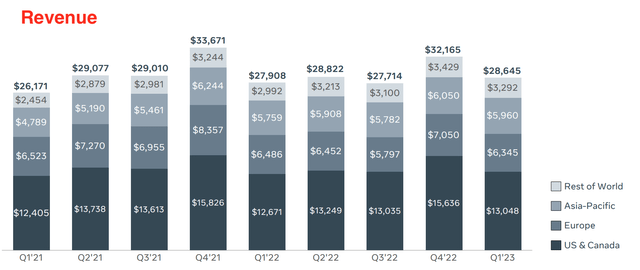

Solid First Quarter Results

Meta Platforms reported solid financial results for the first quarter of 2023. Its revenue was $28.6 billion which beat analyst forecasts by $1.04 billion, despite increasing by just 3% year over year. This is not a “fast” growth rate relative to the 6.67% YoY increase reported in Q1, FY23 and the rapid 19.95% reported in Q4,21. However, this was better than the negative 4.47% growth rate reported in Q4,22. Also on a constant currency basis, revenue actually increased by 6% year over year. Therefore, as the U.S. dollar has started to adjust down relative to most other currencies, I believe Meta will see a tailwind from its international revenue.

Advertising Progress but Headwinds Remain

Meta Platforms generated 98% or $28.1 billion of its total revenue from advertising and thus is prone to cyclical declines as industry advertising spend fluctuates. The good news is year over year its advertising revenue has increased by 4.46%. Advertising rival Alphabet or Google (GOOGL) also makes the majority (78%) of its revenue from advertising but has not rebounded as strong in Q1,23, as I alluded to in my recent coverage. Therefore I don’t believe advertising spend has fully returned yet, given the forecasted recession.

Meta confirmed my thesis during its earnings call and announced e-commerce and healthcare-related advertising revenue performed strongly but financial services and the technology sector remains “challenged”.

I believe Meta received a boost in its revenue this quarter, from not just direct advertising spend but an increased number of advertising placements. The company has previously experienced challenges monetizing its “Reels” short-form video format, which is the equivalent of a TikTok video. In my previous post on Meta, I alluded to the fact that Google and YouTube had also experienced similar issues monetizing its “Shorts” video format, but has gradually started to resolve this. Meta has announced plans to continue to “narrow the gap” related to its monetization efficiency, which has proven to be a greater challenge than monetizing its “Story” format. Given the sheer technical power of Meta and metric-driven culture, I have no doubt they will solve this issue, and drive up its average “monetization Per Reel” metric. So far the trend has been positive with its “Reels monetization efficiency” rising by 30% on Instagram and greater 40% on Facebook quarter over quarter, according to CEO Mark Zuckerberg on Meta’s Q1,23 earnings call.

Another positive is the company has expanded its advertising formats by making its “Click to Messenger Ads” available for Facebook Reels. More advertising placements generally helps to boost advertising revenue as previously the popularity of Reels was ironically negatively impacting “normal” advertising placement revenue, due to the engagement shift and cannibalization. A nice analogy for this is an e-commerce store that is selling a low-margin “new product”, but it is taking away sales from its “high-margin”, old products (or advertising formats). Keeping with the same analogy, the “new product”, will generally have its manufacturing efficiency improved over time, which will then result in higher margins, but in the short term pain will be felt. Overall, I believe this is an issue Meta will eventually solve and the metrics are pointing in the right direction so far.

Overall Reels have continued to grow in popularity with 2 billion views per day, which has doubled over the last six months. With “AI recommendations” boosting time spent on “Instagram by 24%”, (I believe year over year), according to the earnings call.

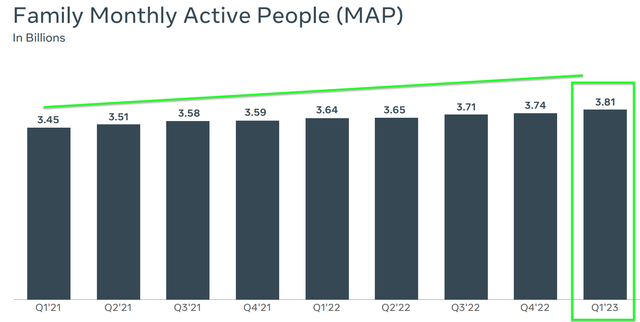

Solid User Growth but Watch User Value

Meta reported a staggering 3.81 billion monthly active people (MAP) across its family apps (Facebook, Instagram, Messenger, and WhatsApp), up 4.67% year over year, which is positive.

Family Monthly Active People (Q1,23 results with author annotations)

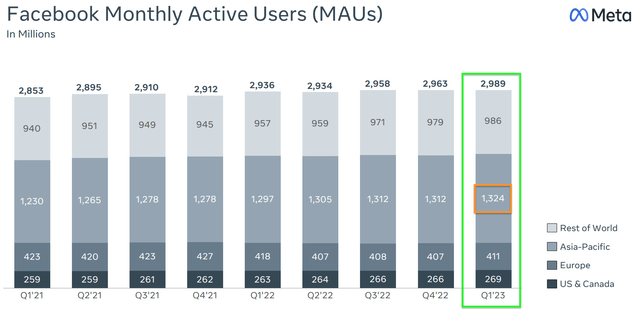

Its Facebook platform reported 2.989 billion monthly active users (MAUs) up 1.8% year over year. Given Facebook is a legacy platform, this fairly slow growth rate is expected. However, I have discovered an insight that nobody seems to be talking about, especially in the mainstream media. If we “pop the hood” and look at which regions this user growth is actually coming from, you will see the majority is from the Asia Pacific region. This region reported 1.324 billion users or 44% of the total, up 2% year over year. Whereas its U.S and Canada users increased by just 1.1% YoY to 269 million people.

Family Monthly Active Users (Q1,FY23 with author annotations)

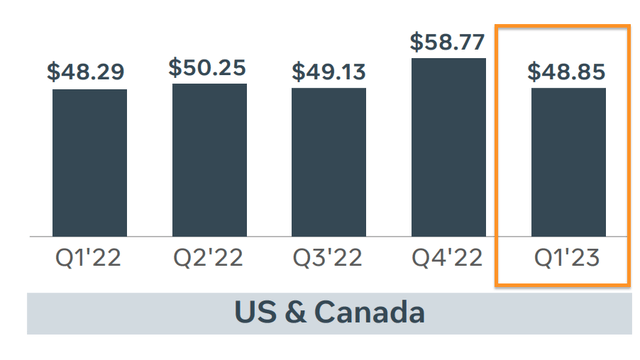

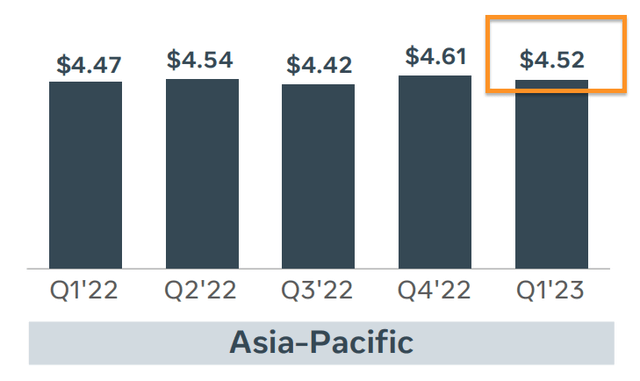

Now you may think, “who cares, a user is a user isn’t it?”. While not exactly, in the world of advertising users from the U.S, Canada are the most highly valued, with an Average Revenue Per User (ARPU) of $48.85. If we compare this to the Asia-Pacific, Meta’s largest and fastest-growing cohort its ARPU was just $4.52, as of Q1,23.

US and Canada ARPU Facebook (Q1,23 data with author annotations)

Therefore it is reasonable to say that a U.S and Canadian user is over 10 times more valuable to Facebook (and Meta), than an Asia Pacific User. This isn’t about race or location but more about excess income and average salaries. In this case, the U.S. alone has an average salary of $70,000 per year and if we use Thailand as an Asia-Pacific example, that country has an average salary of just $7,000 per year. Keep in mind, Meta doesn’t operate in China and thus can’t take advantage of the huge middle-class growth in that country.

Asia-Pacific ARPU (Q1,23 data with author annotations)

There is also a user’s age range which changes the advertising rates. From my experience in the digital advertising industry (consultancy Director), I have a few insights into this space. Generally, younger demographics (but not too young) are seen as valuable by the advertisers of many products, as they are more open to trends, trying new things and products can “grow with the customer”. I believe Facebook has gradually become more adopted by the “boomer” generation and Instagram by “millennials”. Whereas, the younger Gen-Z demographic is gravitating more toward carefree platforms such as TikTok. This is partially why I previously made the case that Meta should “Spin off” Instagram, despite not being an activist investor in general. I also discuss the user demographic data which backs up these points in more detail in the aforementioned post.

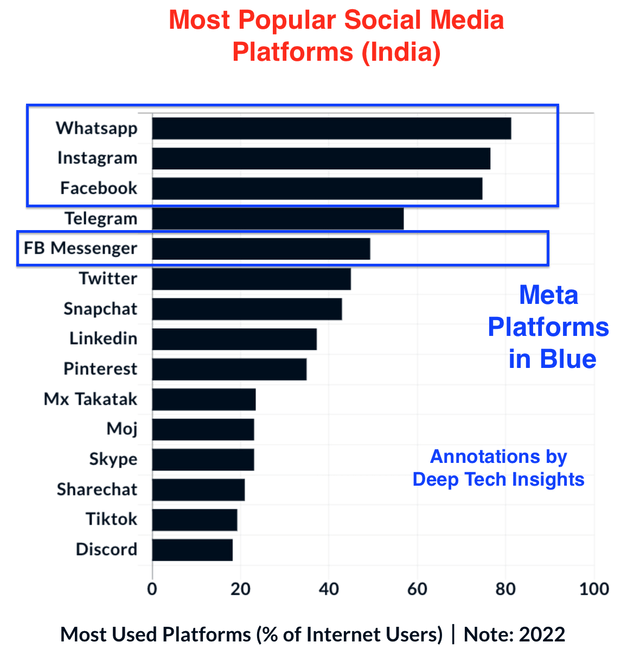

Moving forward, I would like to see Meta publicly disclose its Instagram Monthly Active User (MAU) numbers to help investors make better decisions. Failing this, I would like to see either its Asia-Pacific and Rest of the World ARPU grow or its U.S & Canada user growth improve. A positive for the Asia-Pacific region is India has a huge population of ~1.4 billion people and Meta’s platforms are ranked as the top three social media networks. Facebook is used by ~75% of all internet users. Given many analysts have forecast India will have a growing middle class, ARPU expansion is likely.

Most Popular Social Media Platforms in India (oosga, author Deep Tech Insights annotations)

Margins and Balance Sheet

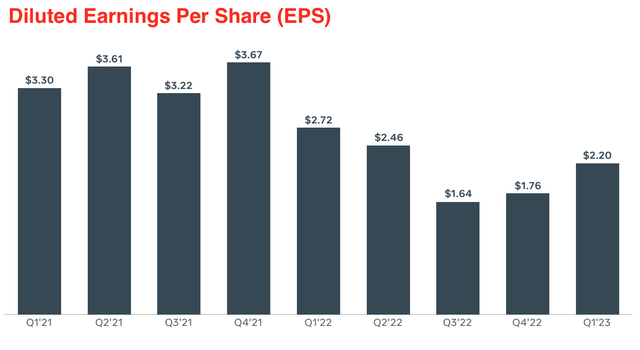

Moving onto profitability, Meta reported earnings per share (EPS) of $2.20, which beat analyst forecasts by $0.25. A negative was this was down from the $2.72 reported in Q1,22. Although Q1,23 EPS was up relative to the Q4,22 level of $1.76, which could indicate a turnaround, especially given the seasonality bias usually prevalent in Q4, due to the holiday spending season.

Diluted EPS (Q1,23 data with author annotations)

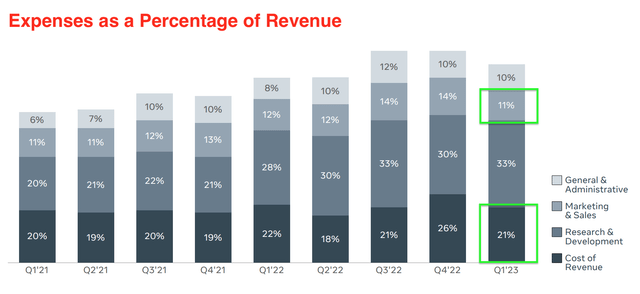

The year-over-year decline in operating income, was impacted by a 10% increase in expenses to $21.4 billion. A positive is its cost of revenue has declined as a percentage of revenue from 26% in Q4,22 to 21% by Q1,23. Its General & Administrative (G&A) expenses also reduced by 3% sequentially to 11% of revenue for Q1,23 and was down 1% year over year, (as a percentage of revenue). These metrics could indicate Meta is getting a control on its expenses as Zuckerberg previously announced a “year of efficiency”, which included workforce restructuring. Interestingly its headcount is only down 1% year over year to 77,114 people, but further layoffs are planned (~10,000 people) mainly via a reduction of recruiters and middle managers. I will discuss more on the cost related to these efforts and others in the next section.

Expenses as a Percentage of Revenue (Q1,23 data with author annotations)

Valuation and Forecasts

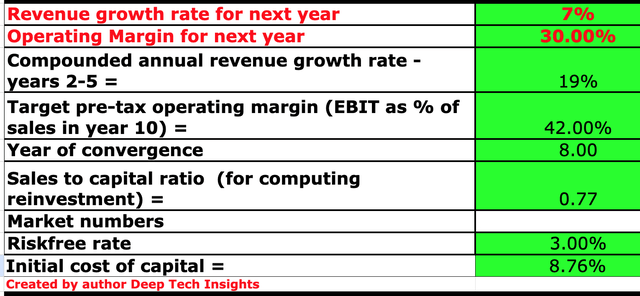

In order to value Meta I have plugged its latest financial data into my discounted cash flow model, which I have enhanced with features such as a tax rate calculator and R&D expense capitalization. In this case, when I adjust Meta’s effective tax rate down from my default 25% to 22% reported in Q1,23 I get a 1.5% boost in my intrinsic value reported in a previous post. This is only a small amount but it just adds extra accuracy. Moving onto forecasts, I have estimated a 7% revenue growth for “next year” or the next four quarters. This is up substantially from my prior conservative estimates of negative 5% growth. I have based this higher estimate on the midpoint of management guidance of between 4% and 11% growth for Q2,23 year over year, which I have then extrapolated out to the next four quarters. I forecast this to be driven by improved Reel Monetization mainly and continued growth in users as per the current trend.

In years 2 to 5, I have kept a 19% revenue growth rate the same as my previous estimate, which is based upon a rebound in the advertising market post-2023 (which I am forecasting). Keep in mind, Meta previously grew its revenue between 35% and 48% YoY in the quarters of Q1,21 and Q3,21 and thus I don’t believe this growth rate is unreasonable. I also haven’t taken into account the huge potential of monetizing WhatsApp which adds further optionality to the stock and could be a bonus, again I have discussed this in a previous post in depth.

Meta stock valuation 1 (Created by author Deep Tech Insights)

Now onto margins, I have revised my margin estimate down to 30% from the 38.99%, I previously forecast for “next year” or the next four quarters. This includes an adjustment for R&D expenses which has significantly boosted its operating margin from 27.5%, in the trailing 12 months. I have discussed this trend in my previous post on Meta and how it’s investing aggressively into R&D, despite headwinds in its core business. This could pay off long term especially given the forecasted growth in the Metaverse industry, which I have also discussed in a prior post in detail.

Reality Labs reported $339 million in revenue for Q1,23 which was down from the $695 million reported in Q1,22. A positive is over 1 billion Meta Avatars have now been created, and over 50% of Quest daily active users now spend over one hour using their device.

Given this segment produced an operating loss of $3.9 billion in Q1,23, I deem it to be more of an R&D segment, than a substantial business at this time. But its potential should not be understated.

I have revised my short-term margin estimate down, due to the substantial number of costs expected in 2023. Meta was hit with $621 million in “restructuring charges” in the first quarter of 2023. In addition, the company expects to experience a further $379 million in severance-related charges by the end of 2023. Total restructuring charges including facility consolidation is expected to be between $3 billion and $5 billion. Therefore I expect 2023 margins to be squeezed in the short term, but the good news is “long term” (over the next 8 years), I forecast margins to improve to 42%, as Meta will be a more efficient and streamlined business. This may seem like an optimistic figure but it is only a return to the operating margin reported in Q2 of 2021.

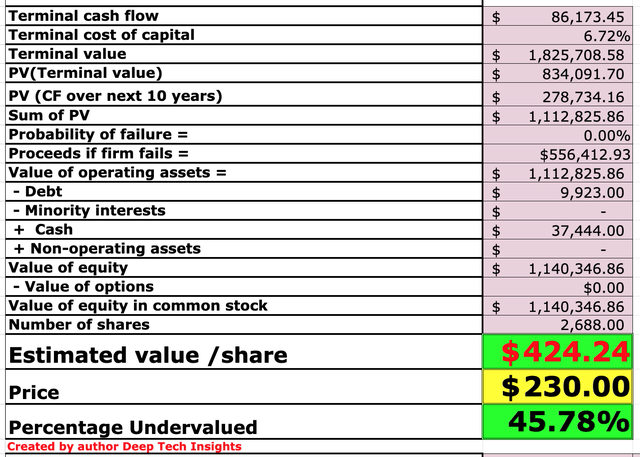

I have also taken into account Meta’s fortress balance sheet with $37.44 billion in cash, cash equivalents, and marketable securities. In addition to long-term debt of $9.92 billion.

Meta stock valuation 2 (Created by author Deep Tech Insights)

Given my forecasts and calculations, I reach a fair value of $424 per share (up from $383 previously). The stock is trading at ~$230 per share at the time of writing (including a pre-market jump) and thus is ~46% undervalued.

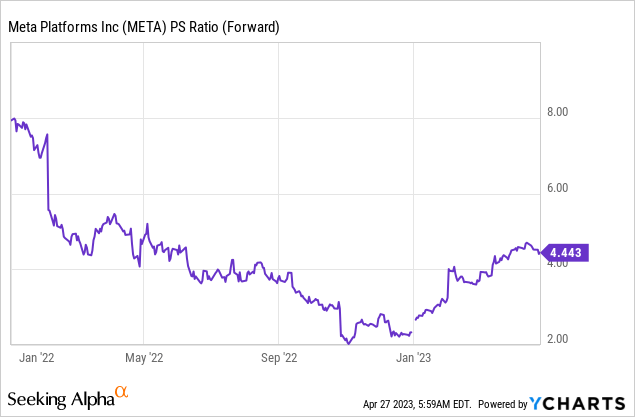

The company also trades at a price-to-sales [P/S] ratio equal to 4.4, which is ~37% cheaper than its 5-year average.

Risks

Competition

Meta is now facing more competition than ever with platforms such as TikTok gaining huge popularity, with ~2 billion monthly active users. In addition, I believe the changes Elon Musk is making at Twitter could help to increase the popularity of that platform. The good news is Meta’s products are incredibly addictive and given users upload more of their personal details (Photos etc), I believe monthly active accounts will stay “sticky” for some time, even if daily engagement drops in the short term.

Final Thoughts

Meta Platforms has faced a number of challenges over the years, but has always come out on top. I believe a key component of its success is the incredible vision and execution strategy of founder and CEO Mark Zuckerberg. He has “fast followed” new competitor platforms such as TikTok, while simultaneously investing in the future aggressively, despite upsetting Wall Street. I believe the company will continue to face short-term headwinds as the advertising market recovers, but given my valuation model and forecasts indicate the stock is undervalued, I will deem it to be a “buy” for the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.