Summary:

- Meta Platforms has experienced significant gains during 2023, but may face a number of headwinds during 2024.

- The stock valuation has become expensive again, with high interest rates and a recession not factored into the bullish price today.

- Upside technical momentum is fading, while long-term concerns are growing on Wall Street about government intervention in the company’s operations.

martin-dm

I have wavered between Buy and Sell ratings on Meta Platforms (NASDAQ:META) over the years. I will admit to being overly bearish on the name since last spring around $200 per share. My last effort here suggested selling into good news earnings beats from the company and strength in the stock. So, the quote of $332 a share today means I have missed out on sizable gains. My job is to weigh the risks and rewards of owning a stock using my 37 years of trading experience. I then give readers an honest opinion on what I believe will happen in the future. I am not right 100% of the time; 60% accuracy for profits/losses is actually the statistical number that helps you earn trading income over time.

My negative long-term view for Meta really hasn’t changed much, meaning I have not felt a need to update it on Seeking Alpha. Meta’s strong performance has been a function of three variables. #1) Cost-cutting at the business (which I suggested loudly in late 2022 would be the correct course of action) has been critical to offset its slowing advertisement sales/pricing and the crazy overspend on Reality Labs buildout (the metaverse thing). #2) An expected recession has been slow to materialize over the last 12 months. Such would/will definitely hurt online ad pricing and spending levels at Meta, when it appears. 2023’s economic outperformance vs. my forecast has kept sales dollars rolling in the door. #3) Investors in America have gone bonkers again for Big Tech names (akin to 2020-21). The newly nicknamed Magnificent 7, including Meta, have experienced a swoosh of buying interest all year long, from admittedly undervalued levels to start.

My worries going forward are all three positives holding up price could reverse quickly with little notice during 2024. #1) There’s not much left to cut for expenses outside of Reality Labs, CEO and founder Mark Zuckerberg‘s pet project. #2) A recession should eventually begin from the tightest Federal Reserve banking/credit policy since the early 1980s, on the largest debt totals in American history today. #3) The Big Tech boom is overdue to flip upside down, and move into a bust cycle pattern again, as the extra AI enthusiasm this spring/summer fades over time.

For my money, I am still avoiding Meta Platforms. Its valuation has become quite rich in late 2023, especially vs. high short-term interest rates as investment competition. In addition, new regulatory pressures/lawsuits by Uncle Sam to curb Meta’s business success (growth and profitability metrics in the future) cannot be ruled out next year.

Let me explain why a bearish stance and Sell rating still make sense to me.

Stretched Valuation

Without doubt, investor pessimism on Meta’s operating future in late 2022 has reversed into an unusual level of confidence into December 2023. Price has jumped by almost +200% over the trailing 12 months, a blistering pace not remotely sustainable for a business with a market capitalization of $850 billion.

Sure, operating results have beaten lowered analyst expectations, but at far weaker growth rates than stock price gains. In fact, analysts are projecting sales and income advances to decline toward 10% annualized levels by late 2025. What if a recession is next, and sales/earnings stagnate?

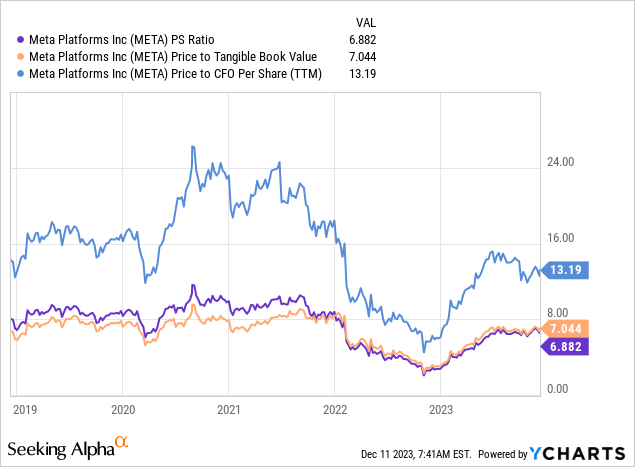

The end result of the moving parts is Meta is again valued at slightly above-average levels vs. the past 5 years of trading on fundamentals like price to trailing sales, tangible book value, and cash flow. We are a distance from the low valuation setup of late 2022.

YCharts – Meta Platforms, Basic Fundamental Valuation Metrics, 5 Years

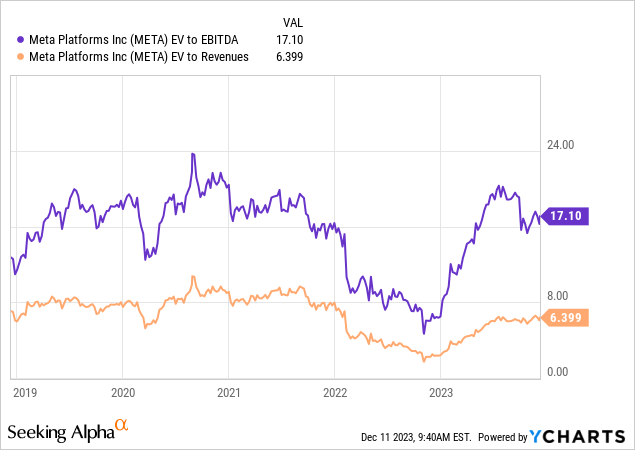

Enterprise valuations (adding total debt to equity worth, while subtracting cash holdings) look about the same. On EV to trailing cash EBITDA or net sales, Meta is no longer the buy proposition of late 2022 and early 2023.

YCharts – Meta Platforms, Enterprise Valuations, 5 Years

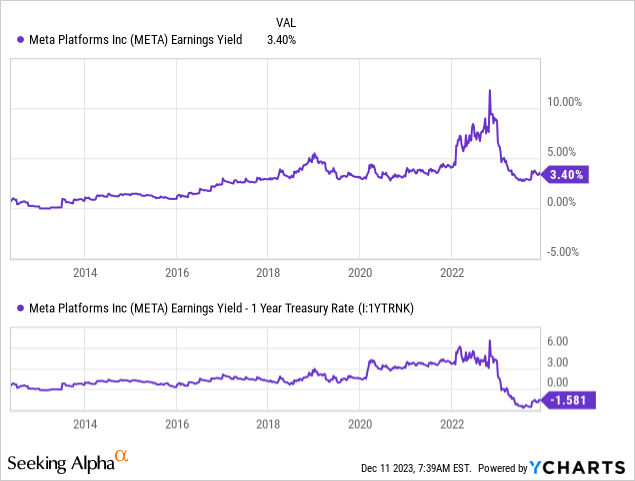

Even worse news for shareholders at $332 in December, the Meta earnings yield is hovering near all-time “lows” vs. 1-year risk-free cash investment rates on instruments like Treasury bills (sitting at a negative -1.58% relative yield). If I can capture a guaranteed 5% profit on top of the guaranteed return of 100% of my upfront capital invested in 12 months, why bother owning a business with all types of operating risk, earning less return that I can put in my pocket? Using this guide, if 2022’s all-time high nominal and relative earnings yield to existing savings rates was a raging buy, the current setup is a screaming sell.

YCharts – Meta Platforms, Trailing Annual Earnings Yield vs. 1-Year Treasury Rate, Since 2012

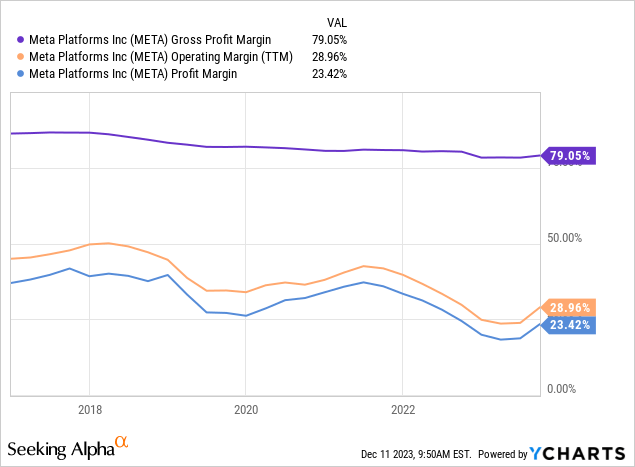

Another worry for shareholders is profit margins have already been in decline for years. The easy and massive growth span for the business is gone. Now capital spending on new products, aggressive social media competition from other Big Tech players, rising legal bills from consumer lawsuits and to fight government-mandated change requests, and perhaps soon added government regulations (with extra company expense to meet), are turning margins lower. What I am saying is the Meta of 2023 is not the same investment as the original Facebook business right after going public in 2012.

YCharts – Meta Platforms, Profit Margins, 7 Years

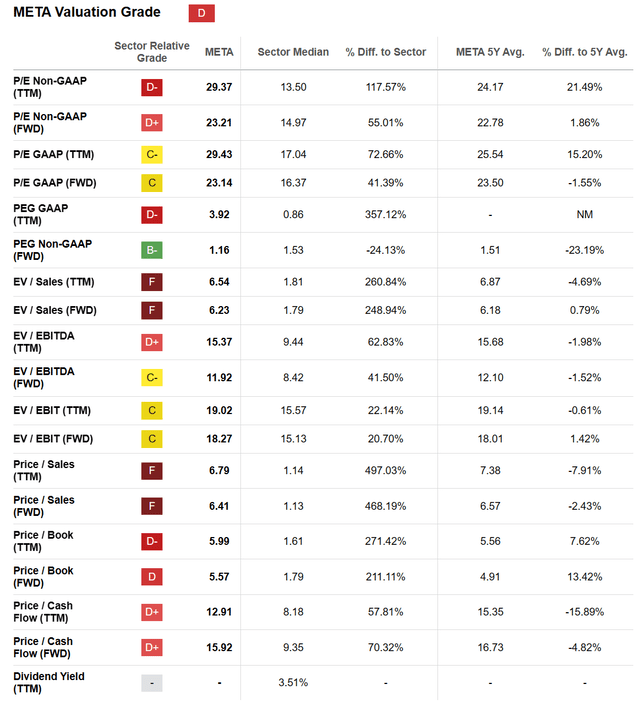

Seeking Alpha’s computer-ranking comparison formula puts a Valuation Grade of “D” on Meta. Looking at peer/competitor companies in the Communication Services and Internet Media space, plus a review vs. Meta’s 5-year history, shares are now sitting on the expensive side of the underlying fundamental valuation equation.

Seeking Alpha Table – Meta Platforms, Valuation Grade, December 10th, 2023

Fading Technical Momentum

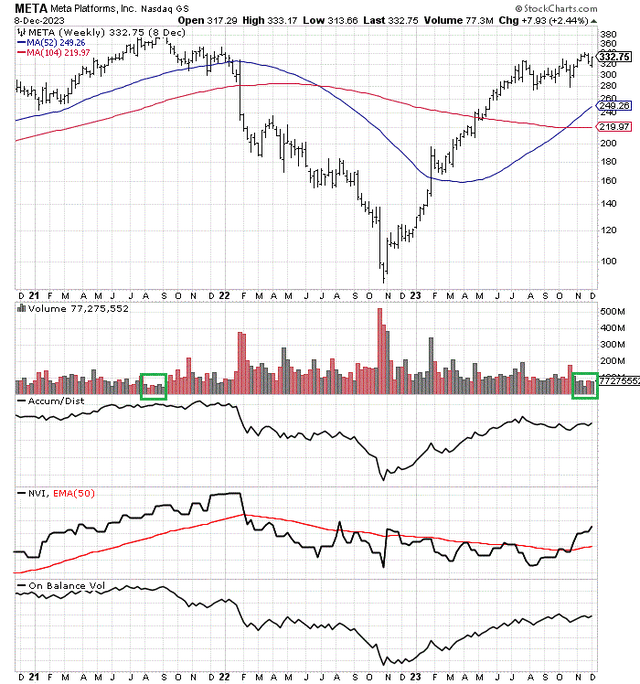

Another point of concern is upside trading momentum has been sliding in recent weeks. On the 3-year chart below of weekly price and volume changes, we can review how the 2023 upmove still remains well under the 2021 peak for scope.

Whether talking about price or movements in the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume, this year’s sharp rebound only looks to be a retracement of 2022’s major losses.

Of particular note, buying volumes have all but disappeared over the last 5 weeks vs. the robust and outsized bullish interest during the year. I have boxed in green the low volume situation may be mirroring the all-time price peak for Meta in August 2021.

StockCharts.com – Meta Platforms, 3 Years of Weekly Price & Volume Changes, Author Reference Points

Final Thoughts

Lower interest rates and a soft landing are now the “requirements” to hold Meta’s share quote above $300 during 2024, in my view. If we get a recession, while interest rates remaining elevated, a correction of its large 2023 gain is all but guaranteed.

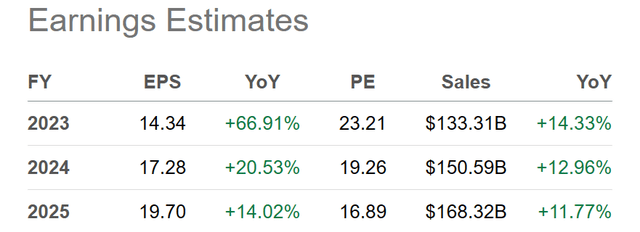

I am modeling a fair value number of $275 for the company in 12 months, to better match expanding earnings and cash flows with interest rates remaining stubbornly higher. A 5% earnings yield in the future would bring the relative yield closer to risk-free cash returns. The optimistic Wall Street analyst view is company growth rates will stay in the 10% to 20% range during 2024-25, assuming we avoid a serious recession.

Seeking Alpha Table – Meta Platforms, Analyst Estimates for 2023-25, Made December 10th, 2023

However, if we do experience a recession or interest rates surprise and rise further (for example, on Middle East turmoil spiking crude oil, or trouble with China causing imported-goods pricing to rise at abnormal rates soon), Meta shares could trade back into the $225 to $250 area (using a P/E projection of 16x EPS of $15). Granted this would not be the end of the world for shareholders, but an extended correction in Meta remains my baseline forecast.

In a worst-case scenario, U.S. antitrust actions could be announced that require either a breakup of the company or the imposition of new regulations that hurt income generation (through greater mandated expenses). Given high interest rates, a recession, and major government attacks on the business model, targeting a $200 quote is not out of the realm of possibilities. If long-term operating growth rates turn negative, a P/E of 14x on EPS of $13 is completely justifiable with interest rates between 5% and 7%.

If you want to be the optimist in the room, the absence of any economic downturn, with a moderation in interest rates, after assuming no new government proposals to divide Facebook and Instagram (as one possibility of many) by the Biden administration in an election year, could support price in the $325 to $350 range during 2024. But, such would mean Meta Platforms remains on the high side of what I would consider a fair long-term valuation, for a business this large undergoing a material deceleration in compound growth rates (a real math issue for long-term ownership). A P/E projection around 20x EPS of $17+ would be targeted a year from now.

Pulling all the ideas together, I come up with upside potential of +5% vs. downside of -40%, with a midpoint total return forecast over the next 12 months of -15% as my current projection. Remember, Meta pays no dividend, which is typically a huge investor turnoff/negative during periods of high interest rates.

Mr. Zuckerberg decided to liquidate almost $190 million in stock during November, his first sell decision in 2 years. The stock plan has included almost daily selling since November 16th. If he is willing to lock in gains over $300 per share, perhaps now isn’t the smartest time to consider a purchase.

I continue to rate shares a Sell and Avoid for traders and short-term investors. In addition, the long-term investment story becomes far more problematic if government intervention in business operations eventually shows up (which I believe is inevitable).

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.