Summary:

- Meta Platforms initiated a $0.50 dividend, sparking interest in their future dividend growth potential.

- Q1 earnings beat expectations, with upcoming Q2 earnings expected to show continued growth in revenue, but EPS is anticipated to decline.

- Despite potential risks, Meta’s strong cash flow growth, balance sheet, and upside potential make it a buy.

- Free cash flow is expected to grow by double-digits in 2025 & 2026, likely supporting strong dividend growth for the foreseeable future.

- CAPEX and expenses are anticipated to be much higher in 2024 as a result of their aggressive investments in artificial intelligence.

Kira-Yan

Introduction

Meta Platforms (NASDAQ:META) is one of the most popular and largest companies in the world with a market cap over $1 trillion. They are also a member of the infamous Magnificent Seven.

The company initiated a dividend of $0.50 this past February, a move that piqued my interest. I’m a huge fan of collecting dividends as you can tell by my SA handle, but I typically only follow or buy companies that I consider to be high-quality with sustainable dividends for the long-term.

META is a quality cash cow, but how likely is the company to continue growing the recently initiated dividend in the future? In this article I discuss the company’s Q1 and upcoming earnings, fundamentals, and why I think they are likely to become a strong dividend grower in the future.

Brief Overview

Meta Platforms operates in mainly two segments: Family Apps and Reality Labs. Most of us use their products on a daily basis. Whether it be Facebook, Instagram, or even WhatsApp. The company has been the dominant social media platform amongst users and was founded roughly 20 years ago. They went public 8 years later in 2012, and have been a force in the market, growing to a trillion-dollar company in a short time span.

Q1 Earnings

META reported their Q1 earnings back in April and is scheduled to report their upcoming quarter on July 31st, in roughly 2 weeks. Before I touch on the upcoming quarter, I’ll discuss the company’s most recent one. META reported a strong quarter with EPS of $4.71, beating analysts’ estimates by a sizable margin of $0.39. Revenue came in at $36.5 billion, also beating estimates by $240 million.

So, a great start to the year with a beat on both its top and bottom lines. This is impressive, considering the current economic backdrop, which has plagued so many businesses. Higher for longer interest rates have increased operating costs. Moreover, it has caused many to implement cost-savings initiatives to continue running their businesses efficiently.

Despite the impressive start to the fiscal year, both net income and revenue declined from the prior quarter. EPS declined by nearly 12% from $5.33 while revenue also declined from $40.11 billion. META’s top & bottom lines declined as a result of higher expenses during the quarter. These were 9% higher while research & development expenses climbed 6%.

Despite the decline however, the company’s platforms continued to perform well with revenue up 27% and 30% respectively year-over-year. META has been spending a lot of capital on artificial intelligence, which is likely to continue for the next few years as they optimize and implement AI into their platforms.

Upcoming Earnings

META reports their Q2 on July 31st and is expected to continue with growth in their top line. Revenue is expected to be $38.23 billion, a near 5% growth rate from Q1. EPS however, is expected to decline slightly to $4.69. This is likely due to expected higher expenses for the entire year.

However, I expect them to continue to deliver with a beat on earnings. I anticipate this to come in between $4.69 – $4.75 due to steady growth in their segments. Additionally, I anticipate another beat on revenue and this to come in at a range of $38 billion to $41 billion.

Dividend

And for the most exciting part of the company in my opinion, the dividend. I know many investors may not care about the company initiating a dividend. Especially considering the yield is less than 1%. But companies paying dividends do matter. This is likely why their share price shot up 15% shortly after the announcement.

They also announced a $50 billion dollar buyback program and they have been buying shares aggressively, which will also likely drive earnings per share growth going forward. META has paid a dividend of $0.50 twice since the initiation and should be announcing the third payment next month if you go off their history.

But just because a company like META announces a dividend, that doesn’t mean it will continue growing or is sustainable. Companies like META are CAPEX intensive and with them investing aggressively in AI, this could eat into their cash flows.

I will say I do anticipate dividend growth, albeit slowly in the coming years as the company focuses on AI. During Q1 free cash flow was $12.5 billion, a near 8.7% increase from the prior quarter. Year-over-year this nearly doubled from $6.9 billion. Additionally, they repurchased $14.6 billion worth of shares while paying $1.3 billion in dividends.

But with capital expenditures expected to be higher next year, how safe is META’s dividend really? During their dividend initiation, this was expected to be between $30 billion to $37 billion. Now management expects this to be in a range of $35 billion to $40 billion for the full-year.

But even if the company faced some temporary financial turbulence, their strong balance sheet puts them in a comfortable position to continue paying a dividend. At quarter’s end META had $58.1 billion in cash and $18.4 billion in debt.

This is small in comparison to the company’s market cap. So, their balance sheet puts them in a comfortable position seeing as how META currently has more cash on hand than total debt and can pay off their total debt balance without putting a dent in their balance sheet.

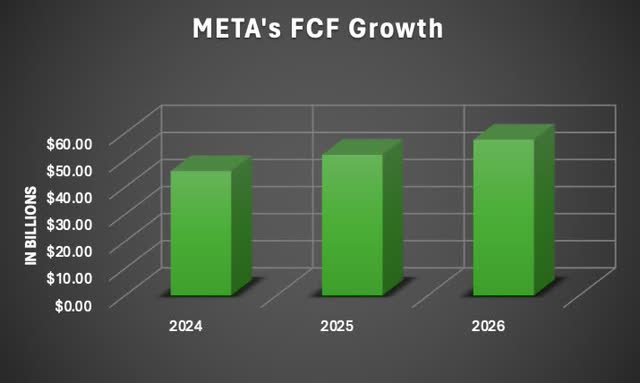

Future FCF Growth

META’s free cash flow growth is anticipated to grow steadily over the next few years. For 2024, FCF is expected to be $45.9 billion, a growth rate of more than 6.7% from 2023’s $43 billion. In 2025 & 2026 free cash flow is expected to pick up with double-digit growth of roughly 13% and 11% respectively. And as the company continues to buy back its shares over time, this will increase their dividend safety going forward.

Valuation

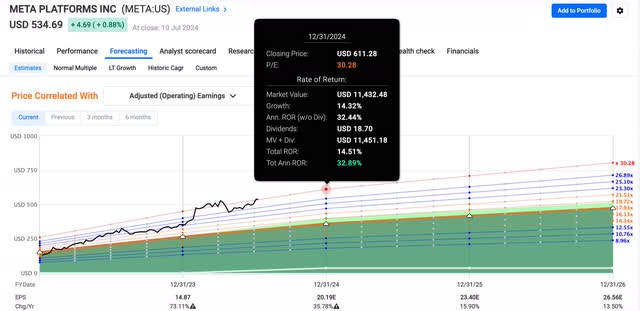

Despite headwinds the stock is up more than 40% YTD. Using their expected earnings of $20.09 for 2024, this gives META a forward P/E of 25.52x at the time of writing, slightly above their 5-year average of 23.68x. This is in comparison to peer Alphabet’s (GOOG) 24.8x.

This isn’t out of the norm for companies of this caliber to trade at 25x – 30x earnings. Moreover, with interest rates expected to decline sometime soon, this may give the company a boost as investors rotate out of fixed-rate investments back into the stock market.

However, both peers trade below Apple’s (AAPL) forward P/E of 34.4x currently. So, in my opinion the stock is still a buy. Additionally, they offer strong upside to their price target of $611 by the end of the year if the stock returns to their blended P/E of more than 30x earnings.

Risks & Conclusion

A big risk to META is new apps that could impact the company’s revenue and users. Although they are considered a cash cow and would likely buy out any company that poses a threat to their operations in my opinion, this is still a risk for the company.

Additionally, since META now pays a dividend and CAPEX & expenses are anticipated to increase, this could temporarily stall the company’s dividend growth, although I don’t anticipate this happening since FCF is expected to grow double-digits in 2025 & 2026. However, for those investing in the company for dividends, this is a risk to consider.

META Platforms is a cash cow that I expect to grow their dividend at a healthy rate going forward. Furthermore, their balance sheet supports their growth initiatives and aggressive investment in AI, which will likely positively impact their free cash flow growth as well.

Moreover, although they could see some volatility in the coming months, I expect the share price to continue to rise by the end of the year with interest rates expected to decline. As a result of their strong cash flow growth, healthy balance sheet, and upside potential, I rate META Platforms a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.