Summary:

- Meta Platforms is a highly profitable business that has a large share of a growing digital marketing industry.

- It is a market leader in VR headsets and could potentially make it a profitable contribution to future returns.

- Through its open-source LLM plans, Meta could become a leader in AI development, as well as harness its own to offer further value to its advertising customers.

- We expect it to outperform the market over the next 10 years, and see its current valuation as a buying opportunity.

AerialPerspective Works

Moats and Monopolies

Welcome to Moats and Monopolies! We share our portfolio every quarter here on Seeking Alpha, and since starting just over a year ago, we have comfortably beaten the S&P 500. This has been in no small part due to our investments in 4 of the so-called ‘Magnificent Seven‘ stocks, which comprise Microsoft (MSFT), Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), Amazon (AMZN), Meta Platforms (NASDAQ:META) and Google Parent, Alphabet (GOOG). (We own Meta, Microsoft, Alphabet and Amazon).

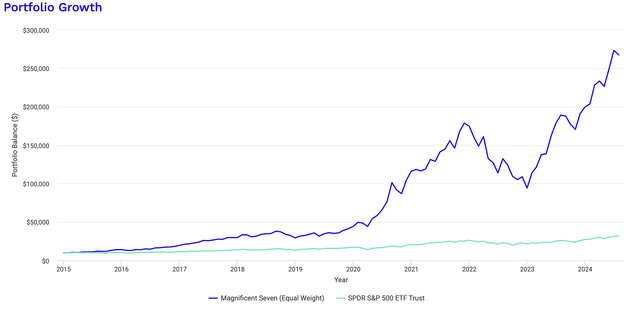

Over the past decade, this group of mega cap, US-based technology companies, have comfortably beaten the market, and they collectively make up around a third of the current S&P 500 index. Below, we can see how an equal weighted portfolio of the 7 companies would have performed over the past decade against SPDR S&P 500 (SPY). It’s not even close – turning an initial $10,000 investment into over a quarter of a million with a 40.9% compound annual growth rate.

An Equal Weighted Magnificent Seven Portfolio vs SPY Over the Past Decade (Author’s Work using Portfolio Visualizer)

However, the past few days have seen a narrative change with these mega caps, they’re: ‘overvalued’, ‘too large’, ‘in an AI bubble’, ‘being rotated’. As we are concerned with the future performance of our investments, not the past, our plan over the next few weeks is to look at each of these big tech companies and determine whether they have the growth opportunities and current stock price to continue to provide alpha against the market over the next 10 years. In this article, we start with Mark Zuckerberg’s Meta Platforms.

Meta Platforms in Exactly 100 words

Meta Platforms has grown from a way of connecting students on US campuses through ‘The Facebook’ to a trillion dollar tech company. Through its acquisitions of WhatsApp, a major messaging platform and Instagram, a photo sharing app as well as Oculus, a VR hardware platform, it has created arguably the world’s largest network effect of over 3 billion daily users of its products. Meta leverages the data gleaned from their social media products to sell advertising and, along with Google, has around a 50% market share in a fast-growing digital marketing industry that has plenty of room to grow.

Areas of Potential Growth

Harnessing the ‘Family of Apps’

WhatsApp, Facebook, Facebook Messenger and Instagram make up Meta’s ‘Family of Apps’, and together make up arguably the greatest network effect ever created. The sheer volume of personal data accumulated by these communication and social media applications, and the regular and often extended periods of their use, gives Meta a unique insight into its consumers, which it leverages to offer value to its customers – advertisers. This individualization of adverts from this data leads to high returns on investments.

Further, the average click-through rate of an advert presented on Facebook to a user scrolling on the platform is just under 1%, i.e. they see the advert and choose to click on it. This number is lower than the average of Google Search (around 3%), which is not surprising as the user is literally typing in what they are interested in as opposed to it popping up whilst scrolling. Whilst this may sound low, if you consider its billions of daily users, one can quickly see the benefit of advertising on the platforms that Meta own.

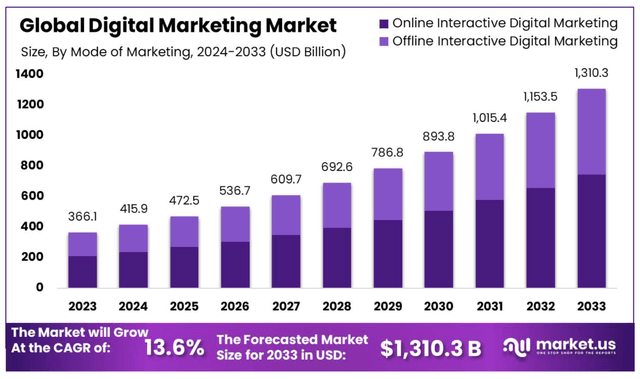

Despite the success of advertising on Facebook and Instagram, it is fair to say that growth of users is reaching saturation, despite there still being some areas of the world where adoption of smartphone use or access to the internet is increasing. Fortunately for Meta, the total pie of Global Digital Marketing spend is expected to triple from here out a decade.

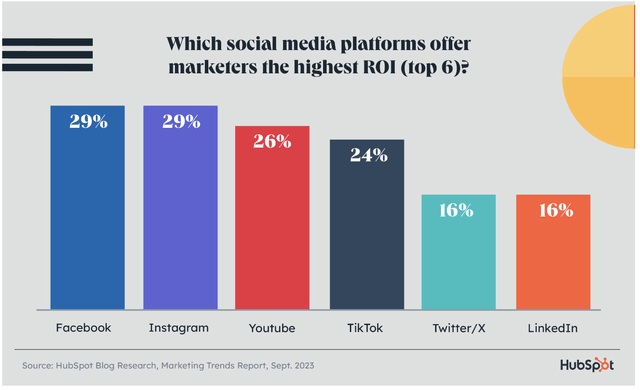

If Meta’s applications can continue to hold their market position, and for a frame of reference it is approximately 20% of US digital advertising spending, against other popular apps and platforms such as YouTube and TikTok, then it will naturally grow its earnings quite consistently over the next 10 years.

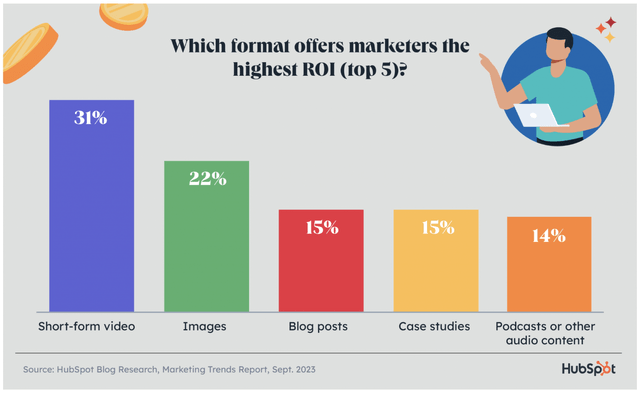

Reels

In 2020, with the pressure of the rapidly growing short form video platform TikTok, which had come from almost nowhere to overtake Instagram and place itself as number 2 most used social media platform after Facebook, Meta started to enter the same market by developing Reels and introducing it first to Instagram users and then to Facebook users. As seen below, the more highly engaging nature of short videos means that advertisers can get better returns on their investment than images alone. Anyone here who uses Reels or TikTok or knows/has teenagers or young adults in their lives will probably attest to the addictive nature of scrolling thorough their homescreen watching them. Meta knows this, of course, as they can track exactly what parts of their apps are getting the most attention, and is harnessing Reels to become a potentially large advertising opportunity in the future.

Virtual Reality – AKA ‘The Metaverse’

In 2021, there was some excitement in finally bringing together Meta’s social media nous and combining it with the $2 billion acquisition of Oculus back in 2014. The idea was to harness improving VR hardware to create a virtual world AKA the metaverse in which users could socialise, play games, and of course, be advertised to – Horizon Worlds. Such was the internal enthusiasm and perhaps the need to move away focus from being known predominantly as Facebook, the company announced its plans to change its name to Meta Platforms. Certainly, the capital expenditure increases since then in order to build out the infrastructure for the metaverse as well as the subjectively awful demonstrations of the product caused shareholders to dump the stock. Looking simply at the raw numbers, its VR/AR Reality Labs division is only bringing in around $2 billion of revenue on a TTM basis and still operating at a heavy loss. It could, could still be a success. With rival Roblox (RBLX) still growing its user base, it’s entirely possible that Meta could create a platform that is used by millions of people on a daily basis, and they have a strong history of scaling applications. Headset sales are forecast to grow quickly, and with the company having a dominant share of the market, it could leverage its own applications or platform to become profitable over the next 10 years.

AI

We all knew it was coming at some point in the article; let’s talk AI. Whilst Google, Microsoft’s partner OpenAI and other private start-ups such as Anthropic are going for closed solutions for the development of their large language models, Meta is doing something potentially much more interesting – they’re going open source. Consider how Google effectively destroyed Windows phone by offering Android as open-source and free to OEMs, undercutting Microsoft’s licensing model, it is an approach that we consider potentially hugely lucrative. The company recently launched its most recent version, Llama 3.1, which appears to compare well against its immediate and aforementioned rivals.

Meta going open source could help them to become a leader in AI in the next decade. We thoroughly recommend reading Mark Zuckerberg’s open letter on the decision but in a nutshell, it means that they can easily become a standard for those not wanting to be in a walled garden/ecosystem, can grow more efficiently as developers from around the world have access to Llama LLM and then can build on top of it, and ironically considering its Meta, they can sell the idea that companies and even governments can use Llama internally and train it with their own data sets without it being shared with anyone externally, which could happen with competitors. Llama is already being used by corporations and other organisations, for example: Zoom (ZM) who are utilising it to summarise meeting notes and the Yale School of Medicine using it to co-develop Meditron, an open-source AI for medicine.

The question we have is how would Meta eventually monetise this? Zuckerberg stated in the most recent earnings call that they are doing what they have always done – build the product, develop the user base and then look to monetise, so it is unclear exactly what the plan is at the moment. They could do what Oracle did with Java – sharing it as open source for a while until it was integrated in software development and then license it for updates and key features, or license different versions to corporations and organisations that profit from the software and keep it free for non-profits for reputational enhancing reasons. It could maybe offer consultancy or tailor made solutions for clients later down the line.

What is clearer from our perspective is how it could potentially make money from Meta AI, its AI built on top of Llama. Zuckerberg said in the earnings call that Meta AI could potentially write copy for companies who are looking to advertise a product or service, and rather than them state their desired demographics based on whom they believe would be a potential customer, it could work that out for them. Charging extra money to companies to bypass copywriters and marketing agencies, and to also replace market research with data from its incredible network sounds potentially very lucrative to small and medium-sized businesses who already use Instagram and WhatsApp to run their companies, and of course, to Meta’s shareholders too.

“Over time I think that just like every business has a website, a social media presence, and an email address, in the future I think that every business is also going to have an AI agent that their customers can interact with” – Mark Zuckerberg from Q2 2004 earnings. This makes complete sense; a decade ago, companies who didn’t have a website or an email address were virtually invisible. Today, companies are doing everything they can to use social media to make you, the customer, feel like you have a personal relationship with their brand. In the future, these same companies would love to reduce their dependencies on call/service centres and use bots trained on phone calls, tweets, emails and direct messages rather than pay people.

Forecasted Returns

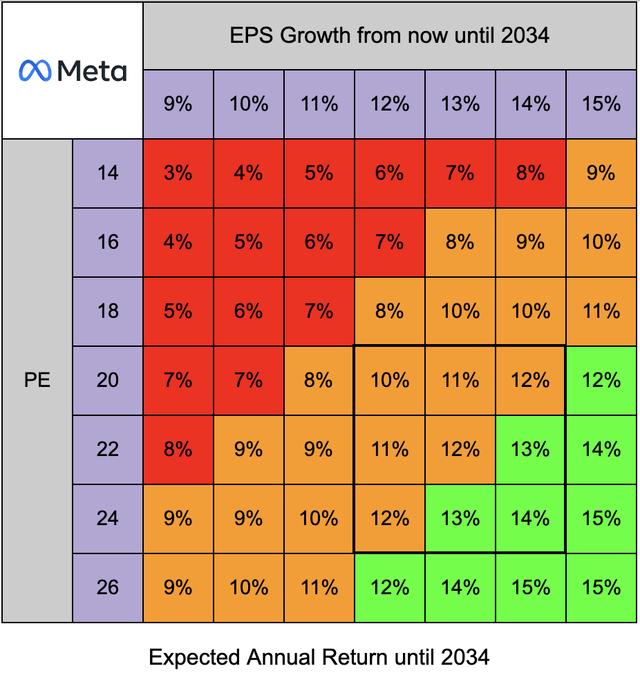

So, in addition to having a very large share of digital marketing from its social media and communications apps – Meta could be a leader in open-sourced AI provision through its Llama models, can offer advertisers tools directly via its Meta AI, and it might even persuade people to live in a headset, at least enough to make Reality Labs profitable. In the last 10 years, Meta have grown their EPS by 35% per year, and although we do not expect a repeat of that, we are forecasting in the range of 12%-14% compounded annual EPS growth until 2034, with analysts forecasting just over 12% growth over the next 5 years, but we feel this is a little on the low side with so many potential ways to increase earnings and the company starting to reduce its share count.

As the company is very profitable, with 35% net income margins, we expect it to trade with a premium to the market and long term can see it holding a multiple to its earnings around the early 20s.

With these 2 assumptions, our forecast for buyers of the stock at $488 (the price at the time of writing) would be a return of between 10% and 14% per year (the bold region below), which doesn’t include a company’s recently initiated dividend that likely would add a percentage point or two as it grows over the next few years. Of course, you can line up the axes below and make your own assumptions, should you disagree with ours.

Just to help with the colour coding: red means that there is an expected annual return less than 8%, orange around a historical market return, i.e. between 8-12%, and green is above that. Note that where 2 numbers are identical and have different colours, it is because the decimals are not shown for sake of readability and thus numbers may have been rounded up or down.

Risks

The elephant in the room is the ongoing FTC case against Meta Platforms that claims that despite passing checks and balances at the time, retroactively the acquisitions should not have gone ahead amidst a claim that the company has amassed a monopolistic position. This case was once dismissed and is now awaiting a court date that both sides agree with. It could go ahead as early as this year, but even if it does, we cannot see it having a meaningful impact on the company. The aforementioned rise of TikTok as well as other social media platforms such as Snapchat (SNAP) and a variety of messaging apps provided my Google, Apple and privately owned Telegram means it is difficult to legally prove that competition has been stifled (albeit it probably has been) nor can the state prove in our opinion that consumers have been negatively affected.

Away from concerns of enforced divestment of parts of their app ‘family’, social media as an industry has had a relatively short life and has seen various products come and go, for example Myspace, Vine and Google Plus. Although we cannot see it, 10 years is a long time, and it is possible that what is popular today may lose its status in the near future. Should Facebook or any other product lose relevance, switching costs to join new social media platforms is relatively low should they be able to create and maintain a comparable network effect, and there might be another TikTok waiting in the wings.

As the recent sell-off of AI related stocks, particularly chipmakers and the cloud providers, has shown – the market still isn’t sure whether the large capital expenditure planned is going to be accretive over the long term. Meta needs LLMs to continue to advance and be utilised on a large scale for their investments in chips and data centres to work, and as yet, there still isn’t a clear plan for future monetisation. This year’s capital expenditures are looking like hitting the $40 billion mark, and the company expects significant capital expenditures growth in 2025 to support AI efforts. With no specific numbers being shared, it is unclear what ‘significant’ means, but we wouldn’t be surprised to see upwards of $50 billion as Llama 4, which the company hopes to release next year, is expected to need 10x the amount of compute of Llama 3. 10 times sounds expensive.

Final Words

With the S&P around a PE of 27, and Meta around a 25, we have an opportunity today as investors to purchase a company with various growth verticals and high profitability that we believe can grow its EPS by at least 12% per year and is currently valued cheaper than the market. Further, it has a perfect balance sheet with a large surplus of cash and no net debt. There are risks, particularly with the FTC case hanging over them, but we do not expect the state to be able to prove their case, and the stock will likely have a little jump should the result go the way of the company. Taking everything from this article into account, we believe it is a Buy at current prices.

As always, we are looking forward to chatting below the line.

Moats and Monopolies.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.