Summary:

- Meta Platforms could report solid growth rates again in the second quarter of fiscal 2023.

- Aside from improving monetization of its Family of Apps, Reality Labs and Threads could be two further revenue generators for Meta Platforms.

- Although the stock is moving closer to its intrinsic value, I still see some upside potential – and Meta Platforms remains and good long-term investment.

Leon Neal

I have been writing about Meta Platforms (NASDAQ:META) on a regular basis, and I have been publishing an article about Meta Platforms more or less every quarter in the previous two years. And I have covered Meta Platforms on its way down and on its way up again. In my last article I still called Meta Platforms a “Buy” when the stock was already trading for $239 again. And while the S&P 500 (SPY) could gain 10% in value (which is a strong performance) since my last article, Meta Platforms increased about 30% in value.

Year-to-date, Meta Platforms gained about 170% – and aside from NVIDIA (NVDA), which gained even 220% year-to-date – it is the best performing stock in the S&P 500. And after such a strong rally, we must ask if Meta Platforms is still a buy at this point.

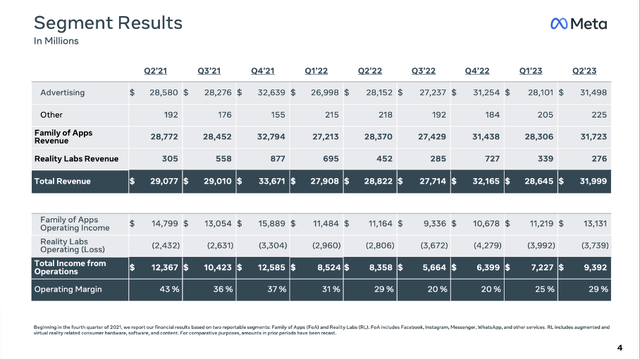

Quarterly Results

When looking at the quarterly results, Meta Platforms is still not able to report similar results as in previous years, but Meta Platforms could report the highest revenue growth since Q4/21, and it was the first quarter since Q3/21 in which Meta Platforms could report growing earnings per share again.

Revenue increased 11.0% year-over-year from $28,822 million in Q2/22 to $31,999 million in Q2/23. Income from operations increased from $8,358 million in the same quarter last year to $9,392 million this quarter – resulting in 12.4% year-over-year growth. Total costs and expenses also increased, but less than revenue and especially marketing and sales expenses declined. Diluted earnings per share increased 21.1% year-over-year from $2.46 in Q2/22 to $2.98 in Q2/23.

Meta Platforms Q2/23 Earnings Release

And especially, free cash flow increased from $4,450 million in Q2/22 to $10,955 million in Q2/23. Free cash flow was mostly higher due to net cash provided by operating activities – Meta Platforms is benefiting from a deferral of income taxes, of which management is expecting it will be paid in the fourth quarter.

Meta Platforms Q2/23 Presentation

When looking at the segment results, the biggest part of revenue stems from “Family of Apps”. And out of $31,723 million in revenue from this segment, $31,498 million stemmed from advertising. $225 million in revenue stemmed from “Other revenue” – an increase of 3.2% YoY from $218 million in the same quarter last year. About 1% of revenue stemmed from “Reality Labs” – but revenue declined from $452 million in the same quarter last year to $276 million this quarter, which is not a good sign for the segment Meta Platforms has high hopes for (we will get to this).

Meta Platforms Q2/23 Presentation

Monetization of Meta’s Family of Apps

Aside from growth strategies like Reality Labs or Threads (we will also get to this), Meta Platforms can especially grow by a better monetization of its “Family of Apps”. And one way to grow is by increasing the number of daily (or monthly) active users. While the number of monthly active users increased 3% to 3.03 billion, the number of daily active users increased 5% to 2.06 billion for Facebook. And the DAUs for the Family of Apps increased 7% to 3.07 billion and the MAUs increased 6% to 3.88 billion.

Meta Platforms Q2/23 Presentation

And although Meta Platforms might be able to grow MAUs and DAUs in the single digits in the years to come, the growth potential is limited. Nevertheless, Meta Platforms can also grow by increasing the average ad price, increasing the number of ads shown or increasing the time spent on the platforms and so on.

While looking at impressions and pricing, we can see that the average price per ad decreased 16% year-over-year and Meta Platforms are still struggling here. However, the total number of ad impressions across the different services increased 34% year-over-year. CFO Susan Li commented during the earnings call:

Moving to the other driver of revenue, improving monetization. Here, we’re focused on improving monetization efficiency of products that monetize at lower rates today like Reels and our messaging services and more broadly, driving measurable performance and returns for our advertisers. On Reels, we are making good progress on monetization with more than three quarters of our advertisers now using Reels ads. We remain focused on further reducing the Reels revenue headwind and narrowing the monetization efficiency gap with our more mature surfaces. However, we continue to expect time on Reels will monetize at a lower rate than Stories and Feed for the foreseeable future since people scroll more slowly through video content.

When looking at monetization, the focus should be especially on Reels as it is becoming more and more important for Meta Platforms, but monetization cannot keep up with the monetization Meta Platforms could achieve in previous years. During the last earnings call, Zuckerberg commented on Reels monetization:

Reels is a key part of this discovery engine and Reels plays exceed 200 billion per day across Facebook and Instagram. We’re seeing good progress on Reels monetization as well with the annual revenue run-rate across our apps now exceeding $10 billion, up from $3 billion last fall.

And of course, Meta Platforms is focusing on artificial intelligence. And Meta Platforms is one of the companies that is not just jumping on the “AI hype train” but is focusing on that topic for several years now. During the earnings call, Zuckerberg told investors:

Beyond Reels, AI is driving results across our monetization tools, through our automated ads products, which we call Meta Advantage. Almost all our advertisers are using at least one of our AI driven products. We’ve also deployed Meta Lattice, a new model architecture that learns to predict an ads performance across a variety of datasets and optimization goals. And we introduced AI Sandbox, a testing playground for generative AI powered tools like automatic text variation, background generation and image outcropping.

And these short-term AI investments also seem to pay off as the overall time spent on the platform continues to grow:

Investments that we’ve made over the years in AI, including the billions of dollars we’ve spent on AI infrastructure are clearly paying-off across our ranking and recommendation systems and improving engagement and monetization. AI recommended content from accounts you don’t follow is now the fastest-growing category of content on Facebook’s feed. Now, since introducing these recommendations, they’ve driven a 7% increase in overall time spent on the platform.

Business Messaging

One of the pillars of growth – aside from improving monetization – is business messaging. Of course, business messaging is using an already existing app – WhatsApp – and can therefore also be seen as a way to improve monetization of WhatsApp. Other revenue – the segment which consists mostly of “Business Messaging” – increased slightly from $218 million in Q2/22 to $225 million in Q2/23. During the earnings call, Mark Zuckerberg commented:

Business messaging is another key piece of our monetization strategy and we recently announced that the 200 million users of our WhatsApp Business app will now be able to create Click-to-WhatsApp ads for Facebook and Instagram without needing a Facebook account. This is a pretty big unlock, particularly in countries where WhatsApp is often the first step to bring their business online. Paid messaging is a bit earlier, but it’s also showing good adoption. The number of businesses using our paid messaging products has doubled year-over-year.

Reality Labs

While business messaging could be one pillar of growth, the big long-term vision of Mark Zuckerberg is the Metaverse – and this vision is still alive, and the company is still spending billions. And in the second quarter of fiscal 2023, Reality Labs still generated an operating loss of $3,739 million. But the company is having high hopes for the launch of the Quest 3 and is hoping that revenue for Reality Labs will increase again. During the earnings call, Zuckerberg stated:

The next big thing on the Reality Labs side is the launch of our Quest 3 mixed reality headset at Connect. It’s our most powerful headset yet with better displays and resolution and next-gen Qualcomm chipset with twice the graphics performance. It will also have the best immersive content library out there and it’s 40% thinner than Quest 2. Its mixed reality seamlessly blends your physical world and the virtual one by intelligently understanding the physical space around you. We pioneered mixed reality with our Quest Pro headset and Quest 3 takes that to the next level. Now others in the industry are, of course, working on bringing mixed reality to the market too, but Quest 3 is going to be the first mainstream accessible device that we expect many millions of people will get to experience this technology with.

And in a previous article called “Meta Platforms: Once In A Lifetime Buying Opportunity?”, which was published when Meta Platforms was trading for $90, I wrote:

In my opinion, investors are mostly scared by Mark Zuckerberg’s plans for the Metaverse and the huge expenses necessary. By focusing on the Metaverse (and seeing it as a huge cash-burning fantasy of a billionaire), they are overlooking that Meta Platforms is still a solid, highly profitable cash cow (yes it is, even when it will struggle for a few quarters). And the vision of the Metaverse is generating uncertainty, and investors don’t like uncertainty.

And there are reasons to be cautious (or even pessimistic). In the last few weeks, disappointing data about the Metaverse has been reported – about users not returning and fewer than 200k users signing up for the Horizon World.

(…)

And the voices are getting louder that Mark Zuckerberg should let go of his vision of the Metaverse and cut spendings to an absolute minimum. But Zuckerberg seems to hold on to his vision, and although he is acknowledging it will take time (several years) and several tries before the right platforms and apps exist, he is optimistic that Meta Platforms is on the right path.“

But I can understand when people remain sceptic about this long-term vision and see Meta Platforms only burning huge amounts of cash here. But what was obviously reason enough for investors to drive the stock below $100 about a year ago, does not seem to be such an issue anymore, although this segment is still far away from being profitable.

Threads

One of the major news stories in the last few months regarding Meta Platforms was the release of “Threads” – a rival to the app that was formerly known as Twitter (and is now called X). And while Threads had an excellent start and quickly reached 100 million users, it seems like the hype is fading and Threads can be rather seen as struggling. After Threads had 44 million DAUs on July 7, 2023, the number was only 13 million two weeks later. According to other estimates, the number of DAUs was close to 50 million at its peak, and therefore almost half of Twitters daily active users. But now not only the number of daily active users was declining, daily minutes per user also declined.

Now we must try to put this into context. On the one hand, Threads would not be the first app of Zuckerberg that failed. Biggest failures in the past include Poke and Slingshot (two attempts to copy Snapchat) as well as Lasso (an app similar to TikTok). While Meta Platforms was quite successful including new features in Facebook or Instagram (Reels is a good example), stand-alone apps were often a failure (for more information and background you can listen to two Business Wars seasons – Facebook vs. Snapchat as well as TikTok vs. Instagram).

On the other hand, Zuckerberg was rather optimistic during the last earnings call:

On Threads briefly, I’m quite optimistic about our trajectory here. We saw unprecedented growth out-of-the-gate. And more importantly, we’re seeing more people coming back daily than I’d expected. And now we’re focused on retention and improving the basics. And then after that, we’ll focus on growing the community to the scale that we think is going to be possible. Only after that we are going to focus on monetization. We’ve run this playbook many times before with Facebook, Instagram, WhatsApp, Stories, Reels and more. And this is as good of a start as we could have hoped for. So I’m really happy with the path that we’re on here.

One note I want to mention about the Thread launch related to our year of efficiency is that, the product was built by a relatively small team on a tight timeline. We’ve already seen a number of examples of how our leaner organization and some of the cultural changes that we’ve made can build higher-quality products faster and this is probably the biggest example so far.

Time will tell, if Threads can be successful and actually generate billions in revenue as some optimistic estimates assume. And if it should fail there seems to be little harm as the expenses for developing the app were obviously very limited.

Fairly Valued

In my last article, I calculated an intrinsic value around $330 for Meta Platforms and as the stock is trading rather close to this amount, one can make the argument that Meta Platforms is almost fairly valued at this point. And usually in three months a business is not changing enough to justify a new calculation – or at least the result should be rather similar.

However, we can make the argument that free cash flow is improving again, and in my last article I assumed a similar free cash flow in fiscal 2023 and fiscal 2024 as in the trailing twelve months. When updating this to the current TTM number ($23,327 million) and all other assumptions are similar as in my last article, we get a slightly higher intrinsic value of $331.90 for Meta Platforms.

Meta Platforms EPS Revision Trend (Seeking Alpha)

Additionally, we can make the argument that growth estimates are improving again, and analysts are expecting double-digit growth rates in the years to come and therefore only 6% growth for the years to come might be a bit too pessimistic. Instead, we can calculate with 8% growth till fiscal 2032 followed once again by 6% growth till perpetuity. This would lead to an intrinsic value of $370.04 for Meta Platforms and still implying upside potential for the stock.

And of course, we can make the argument for even higher growth rates as analysts are expecting higher growth rates (for the next seven years, analysts are expecting EPS to grow with a CAGR of almost 20%) and even in the last few years when Meta Platforms was struggling a bit, revenue increased with a CAGR of 18.15% in the last three years and earnings per share grew with a CAGR of 10.14%).

Conclusion

Overall, I would still remain bullish about Meta Platforms – especially when seeing the stock as a long-term investment. However, in the short-term, I would be more cautious. After gaining about 250% in the less than one year, a correction seems likely at some point in the future, and we should also not be surprised if the stock is correcting more than just a few percentage points.

On the other hand, I would also not be surprised if Meta Platforms continues to climb higher without a major correction – especially if Meta Platforms can improve the underlying business further and confidence about the business returns. A likely scenario in my opinion is the stock climbing to its previous all-time high around $380 before we see a major correction. But we are always dealing with probabilities in investing, and this is just one potential scenario.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.