Summary:

- Meta Platforms has transformed from the world’s largest social network to an AI-powered tech giant with a market cap nearing $1.5T.

- Llama 4 is expected to drive the Reality Labs segment to cash flow generation soon.

- Increasing CAPEX does not harm the current key metrics of the business.

- The current price is trading above the historical fair value, but does not fully reflect future earnings from AI and AR.

Kira-Yan

This is my first public coverage of Meta Platforms (NASDAQ:META) despite being a shareholder since 2020. I, as well as the entire investment community related to the Meta business, have experienced the transformation from simply the world’s largest social network to a true AI-powered Tech Giant, whose market cap is almost $1.5T. By this metric, the ex-Facebook is second only to the ex-Google (Alphabet) in the Communication Services sector.

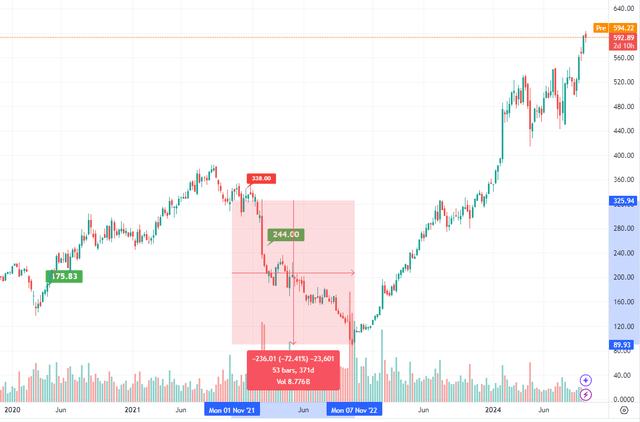

When Mark Zuckerberg announced plans to rename the company and change its business paradigm at the end of 2021, its capitalization fell by almost 70%.

Corporate events coincided with the general market’s negative sentiment. Uncertainty about the metaverse and the expected rise in capital expenditures scared the market. I got scared too, having exited the long position. But I returned to the investment quite quickly. At that time it even seemed to me that it was not entirely successful. 3 years ago CAPEX was the main fear, today it drives the investors’ expectations and share price growth.

Advertising Is Still The Main Fuel

Even though Meta is no longer Facebook, the financial report claims otherwise. Advertising, as before, brings in 98% of revenue, and the Family of Apps segment is the only one that brings profit. A record 3.27 billion people who use one of the company’s many apps at least once a day allowed the Apps segment to earn a record (for the second quarter) operating profit of $19.33b. Year-over-year growth is a significant +47%.

Instagram and Facebook are not the only ones. The company has reached a milestone of 100 million monthly active WhatsApp users in the US, and Threads (a new microblogging app from Instagram), which is already used by 200 million people monthly, has also contributed.

At The Forefront Of The AI Evolution

Mark Zuckerberg devoted half of his speech at the Q2 2024 earnings presentation to AI. Behind the curtain of AI, it is not always clear what impact it can have on business. Sometimes the explanation sounds too technical. But in the case of Meta, I think it is very clear. And I will lay out the integration of AI and the impact on core business point by point:

1. Llama 3 is an open-source AI model that developers around the world can freely use to help themselves and train the model. According to Zuckerberg, it is already at the level of leading intelligence models, and next year version 4 will already become an industry benchmark.

2. What does AI mean for a family of apps and core business? With its help, the company expects to improve user engagement metrics (through recommendations). This will allow it to expect growth in advertising revenue through monetization.

3. Advertising itself should also be fully powered by AI soon. Starting with the fact that intelligence will select a target audience for the advertiser better than oneself and ending with the formation of any kind of creatives and their support. Turnkey advertising from artificial intelligence. The company’s management does not give forecasts for 2025 and beyond until the end of the 4th quarter of 2024, so it is difficult to estimate the growth of advertising revenue in money, but in words, it looks inspiring.

4. Of course, Zuckerberg’s favorite brainchild – Metaverse – which is a “long-term focus” also depends on the development of the company’s AI. If a few years ago it was obvious that holographic reality would appear earlier than artificial intelligence, now a breakthrough in this area is bringing the release of augmented reality products closer.

5. Finally, the Meta AI product is planned to be launched in a self-sufficient form, which the company promotes as the most used AI assistant in the world by the end of the year.

Reality Labs Investments

The company is investing heavily in the Reality Labs segment, which is only taking away profits for the current period, but shortly will allow it to reach industrial production of its flagship products. A significant part of the capital expenditures is related to AI and the metaverse segment. However, according to the CEO’s plan, they should become the key to the formation of a completely new line of products that generate profit.

The Quest 3 headset is positioned by Meta Platforms not only as the most affordable device available but also as the best on the market today.

Ray-Ban Meta Glasses, which in the foreseeable future may become a replacement for modern smartphones, cannot be produced today on the scale required by the consumer market, but remain an important milestone for the company’s business in 2025.

What does Reality Labs mean for Meta’s business in the long term? The company is very cautious in its statements and forecasts. But reading the transcripts of the presentation, I understand that Zuckerberg is betting on this segment. Today, it is difficult to predict the revenue of this area in a few years. The products that the company is developing today can technologically determine the development vector for decades to come. However, I would guess, given the capital expenditure figures, the usual return on investment for the company, and the size of the market (graph below), that Meta is aiming for tens of billions of dollars in revenue in the long term, which is comparable to the results of Family of Apps in the current period.

The Fundamental Idea Of Investing In META

After a detailed review of the latest presentation, report and earnings call transcript, I have come up with the following fundamental analysis of the investment opportunity in META shares.

The main and traditional revenue and profit generation platforms are in the growth phase. And while cash flows are growing well, the company is increasing capital expenditures on AI and meta-universe areas. I provided a chart from the presentation above. Capital expenditures are growing. Over the year, based on the results of two quarters, capex increased from $13.4b to $15.2b. However, as a percentage of net profit, it is 58%, while a year ago and earlier it was close to 100%.

It is difficult to say when investments in Reality Labs will start to pay off and at what pace. We are dealing not just with the expansion of the existing market, but with the creation of a new one. Therefore, the company does not give clear financial forecasts. However, do not forget that, being Facebook, Zuckerberg and the company already once created a new market of social networks and messengers, taking a dominant position in it. Why shouldn’t history repeat itself?

Metaverse market size (Statista)

There are different forecasts on the metaverse market, and I took as a reference one of the most conservative from Statista. If relying on a market size of over $500b by 2030, that means a CAGR of ~38%. Impressive.

The increase in CAPEX does not lead to a decrease in the company’s profitability. According to the 6 months 2024 results, the operating margin is 38%, while a year earlier it was 29%. The net margin is a significant 34%. In other words, investing in Meta today is buying future profits from new products and markets without damaging current financial performance. I am very excited about this opportunity.

Quantitative Side of Analysis

In terms of numbers, the company does not face any significant difficulties in its development. The highest levels of Gross Margin (81%) and Net Profit Margin (34%) confirm the dominance and competitive advantages of Meta, and a solid ROE of over 30% confirms the management’s ability to manage capital.

At the Q2 2024 presentation, Susan Li, CFO, gave a little more guidance on future performance. Third quarter of 2024 total revenue is expected to be in the range of $38.5-41 billion. Considering that over the last 4 quarters, we have seen repeated revenue growth of 20-22%, then for the full year 2024 we can expect total revenue of approx $160b. 2024 total expenses are projected to reach a range of $96-99b and CAPEX will be in the range of $37-40b. This means that even with record investments in development, the net income margin can be seen at 38%, and capex will not exceed 65% of the net profit level (by the way, please leave your opinion or quotes in the comments, why Buffett does not invest in Meta with such metrics). Let’s add 2 more here: R&D expenses do not exceed 30% of Gross Profit, and SGA is even lower than 20%. Isn’t this the puzzle for an outstanding company to invest in, which was described in books (for me, this is a rhetorical question)?

What is no less important is the fact that the company remains fully solvent. At the end of the first half of the year, total debt is $38b, but most of it is operating lease liabilities.

Seeking Alpha

I exclude this portion of liabilities for the solvency metrics calculation. And then in terms of the debt burden for Meta, there is not a cloud in the sky, since net debt is negative. The debt-to-equity ratio is 0.12, the current ratio is 2.7 and the cash flow-to-debt ratio is a significant 4.2 – the company has no difficulty servicing its debt while increasing investments for the future.

Current Valuation Is A Bit High

Meta shares are valued significantly higher than the sector as a whole. Using the historical multiples method, the median P/E value over the 5 years is 25. As of 09 Oct, META stock is trading at $590.5 near its 52-week-high, which corresponds to a price-to-earnings ratio above 30. This is although the consensus of analysts from Wall Street for earnings growth rates over the next three years promises a more modest rate than we have seen before.

Meta Comprehensive Analysis (Own calculations)

In this scenario, the company’s current valuation looks like the only downside to medium-term investments (I have no doubts about the returns of long-term ones). I hold the shares and do not plan to reduce my positions, and I am not here to give any recommendations, but if I did not have shares in my portfolio, I would wait for a correction to the $500 per share area to buy at a historically fair price.

Meta Valuation by Historical Multiplies Method (eyestock.io)

However, such statistical valuation analysis is based on historical dynamics and the current market valuation of the business. It does not attempt to take into account future cash flows, particularly when Reality Labs reaches the breakeven point.

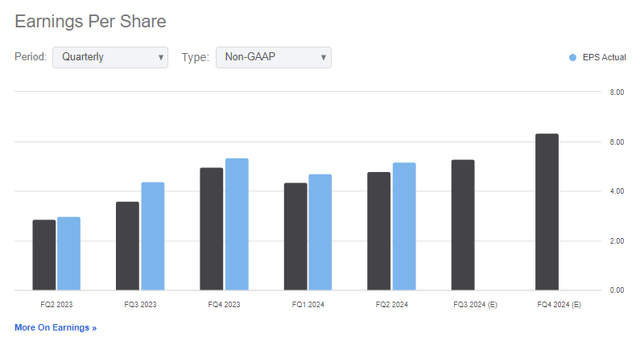

Since I’m talking about statistics and numbers. The new earnings report is expected on Oct 30, and the EPS consensus is at $5.29. A fairly bold and positive forecast, meaning year-over-year growth of 20.5%.

However, I note that a year ago, the report for the third quarter of 2023 exceeded analysts’ expectations by 22%, and the average estimate beating for the last 3 reports was 8%. From a statistical perspective, I have the right to look positively at the stock prices.

Conclusion

Meta is one of the clear and promising investment ideas from the “must-have” category. Excellent financial indicators of the current period and the continuing growth of the core of the business allow the company to lay the foundation for the profitability of new divisions. They are designed to generate cash flows from artificial intelligence and augmented reality, where Meta is at the forefront of technological progress. And for now, investors have the opportunity to buy not just Facebook at the price of still just Facebook.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.