Summary:

- Meta has a leading position in social media and its core business is a cash machine.

- However, its costly investments in Reality Labs are putting a lot of pressure on the company’s financial performance and cash flow.

- While its valuation is cheap compared to its history, its risky business strategy is likely to pressure its share price in the coming quarters.

Justin Sullivan

Meta Platforms (NASDAQ:META) continues to invest big on the metaverse, which is costing billions with no clear path to monetization in the near future. This is putting a lot of pressure on the company’s profitability and valuation, a situation that is not likely to reverse in the coming quarters.

Company Overview

Meta Platforms was formed at the end of 2021, to aggregate Facebook’s platforms under a single holding company, namely Facebook, Instagram, and Reality Labs. The company was founded in 2004 (as Facebook) and has been listed since 2012 on the NASDAQ stock exchange. Its current market value is about $350 billion, much lower than at its share price peak reached in September 2021. Since then, its share price has declined by more than 65%, similar to what happened for many growth stocks during this period.

Meta’s core business is social media, namely through its family of apps Facebook, Messenger, Instagram, and WhatsApp. Beyond these established platforms, Meta also has a business segment called Reality Labs, which accounts for augmented and virtual reality products, as part of the company’s strong bet on its potential next growth area of the metaverse.

Meta generates most of its revenue from selling advertising placements for marketers, through its self-service ad platform, where marketers can launch and manage their advertising campaigns. Meta has been a clear leader in this industry over the past decade, both through organic initiatives and new developments, and acquisitions as well.

While this industry has relatively low barriers to entry, the network effect is a strong competitive advantage, and it is not easy to challenge Meta’s dominant position in social media. Nevertheless, competition is strong and TikTok has been able to challenge, to some extent, Meta’s leadership position in social media in recent years, while other social media companies have failed to be a major threat to Meta, such as Snapchat (SNAP) or Twitter.

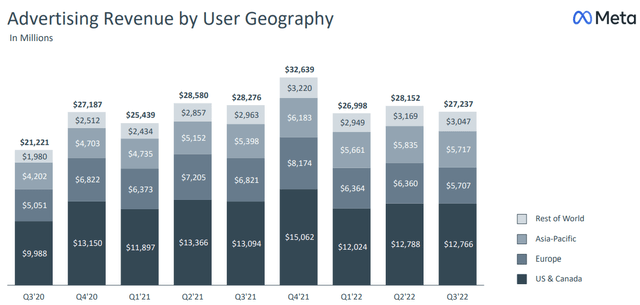

Meta’s business is well spread across the globe, even though North America is still the largest region, accounting for some 46% of total revenue, followed by Europe with a weight of about 20%, and Asia-Pacific also with a weight slightly below 20% of total revenue.

Growth Prospects

Meta operates in an industry where it has a leading position, but this is constantly being challenged by rapid change, innovation, and disruptive technologies. While other competitors have largely failed to put Meta’s leadership into question, TikTok has been able to rapidly expand its user base and is presently Meta’s major competitor.

While Meta’s strategy in the past of buying new entrants or copying new features, such as Snapchat’s stories for instance, was quite successful in the past, it had more difficulty in recent years to challenge TikTok’s rapid growth. As TikTok is owned by a Chinese company, Meta cannot acquire it and its strategy to push for Instagram’s Reels was not enough to make its platforms more attractive to consumers than TikTok.

Its Chinese competitor had more than one billion users at the end of 2022, being therefore one of the largest social media apps, and a major threat for Meta’s growth in its core businesses. TikTok’s rising popularity has been driven by its easier way for users to make videos, showing how technological development can easily make a new entrant become a major threat for large, established companies in the industry.

Beyond its core businesses of social media, Meta is investing significantly on its most recent segment called Reality Labs, as part of the company’s metaverse vision. This shows that Meta is not the typical leading company of the past, that could easily be disrupted by start-ups and new technologies by being comfortable in its position, and is still investing heavily on new technologies.

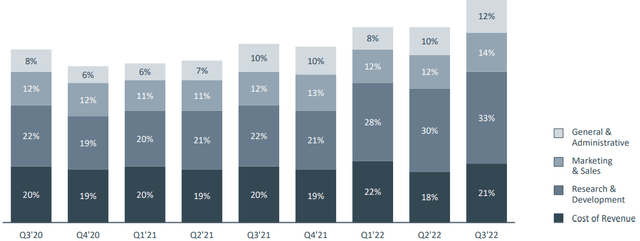

Indeed, research and development (R&D) expenses are the most significant part of Meta’s operating costs, which have represented about 30% of its revenues over the past few quarters, showing that Meta is investing big on new features, artificial intelligence, and new technologies, to remain a leading company in its industry over the long term.

While the metaverse is Meta’s major bet in the near future, its success is highly uncertain and can lead to significant costs with no certainty of monetization over the coming years. On the other hand, if the company’s vision comes to life, it will certainly have a competitive advantage over peers, which can lead to an undisputed leading position in the industry for many years to come.

Financial Overview

Regarding its financial performance, while Meta has a very good growth history, this has clearly changed over the past couple of years, as the company’s growth decelerated strongly. Indeed, while its revenue and earnings increased at more than 30% per year from 2016 to 2020, its user base and revenue reached a top during 2021 and have been somewhat flat since then.

In 2021, the company maintained a positive operating momentum, even though its growth was much more muted compared to its history. While its annual revenues amounted to some $117.9 billion, an increase of 37% from the previous year, its quarterly trend was clearly softer, which raised some concerns about the company’s growth ahead. Its total costs increased by 34% YoY, and its net income was $46.7 billion (up by 43% YoY).

As the company continued to invest significantly in capacity, especially in data centers, its capital expenditures increased to more than $19 billion (+22% YoY). Despite that, its free cash flow was above $39 billion, showing that Meta’s business has a strong cash generation capacity.

During the first nine months of 2022, Meta’s operating performance was much weaker than in the recent past, as growth stalled due to challenging macroeconomic conditions that led to lower spending on digital marketing, and strong competition from other platforms.

In Q3 2022, its revenue was $27.7 billion, representing a decline of 4.5% from the previous year, while advertising revenue declined by 3.7% YoY and Reality Labs revenue collapsed by 48% YoY, to just $285 million in the past quarter. More worrisome than declining revenue was Meta’s operating loss in Reality Labs, which increased to close to $3.7 billion, compared to an operating loss of $2.6 billion in Q3 2021. In its family of apps, operating income was $9.3 billion (-28% YoY), which led to an overall operating margin of 20%, the lowest level over the past eight quarters.

Due to lower revenue and higher costs (+19% YoY), Meta’s net income was only $4.4 billion in Q3, a decline of 52% YoY, and its EPS was $1.64 (-49% YoY). Regarding its balance sheet, Meta had more than $30 billion in net cash at the end of Q3, thus it has a solid balance sheet even though its net cash position has declined significantly over the past few quarters as the company continues to increase its capex ($9.52 billion in Q3).

Going forward, despite its relatively weak performance over the past few quarters, to a large extent driven by higher expenses, Meta is taking some steps to operate more efficiently, such as reducing its staff numbers and office space, but it expects total operating expenses to be in the range of $96-$101 billion (vs. about $86 billion in 2022). This is explained by Meta’s investments in Reality Labs, which are likely to report an even higher operating loss in 2023, compared to last year.

Moreover, the company also expects capex to increase to a level of $34-$39 billion due to its investment in data centers, which means that the vast majority of its free cash flow generation is expected to finance capex. As the company still has a large net cash position, even if its free cash flow turns negative in 2023, its balance sheet will remain quite strong and Meta can maintain its strong investments over the next few years and not materially change its financial position.

Beyond 2023, according to analysts’ estimates, Meta is expected to return to a stronger growth phase, and reach revenue of about $152 billion by 2025. Its net income is expected to be above $31 billion by 2025, which represents some recovery compared to its bottom in 2023 (about $21 billion), but is still a lower level than compared to 2021.

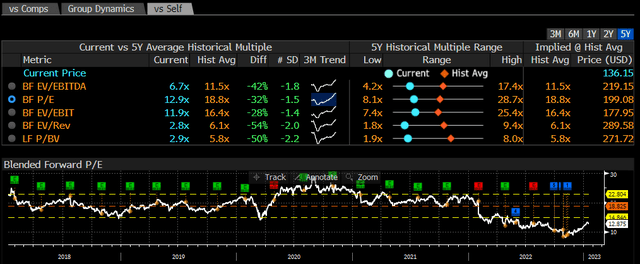

Regarding its valuation, Meta has significantly de-rated over the past eighteen months, due to its own fundamental woes and lower multiples for growth stocks. As can be seen in the next graph, Meta’s historical forward earnings ratio over the past five years is close to 19x, but at the top of its valuation in 2022 it traded at close to 30x earnings, while nowadays is trading at only 12.9x forward earnings.

Its current valuation is closer to its bottom during this period, which was reached last October at just 8x forward earnings, rather than its historical average, showing that despite its share price recovery over the past three months its shares are still undervalued.

Conclusion

Meta has a leading position in social media and its core business is a cash machine, even though growth has clearly decelerated over the past few months, and it can be argued that Meta’s family of apps has reached a mature phase.

While the company is pursuing other growth sources in its Reality Labs segment, it is costing billions and revenue is practically non-existent, which makes its investments highly risky and monetization may take many years to be reached.

Therefore, even though Meta’s stock is currently undervalued compared to its historical pattern, I see Meta as not compelling enough because the company’s strategy is leading to much lower earnings and cash flows, which can go on for some years as Meta is not likely to give up on the metaverse easily. This means that financial figures are likely to remain under pressure for a few more quarters, as economic conditions are challenging in the coming months, which is likely to put pressure on the company’s share price over the short to medium term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments/FinTech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.