Summary:

- Meta’s stock has been flat since April, but fundamentals remain strong with expected revenue growth and improved financial position.

- Recent earnings report showed impressive growth in revenue and EPS, with upcoming earnings expected to continue the positive trend.

- Valuation indicates that all positives are highly likely already priced in, and the fact that insiders are only selling also points that there is not much upside left.

filo

Investment thesis

Meta’s (NASDAQ:META) stock has been flat since my previous bullish thesis. This compares to a 9% growth for the broader U.S. stock market since April, but short-term price movements might be misleading.

Meta’s fundamentals are still robust and continue improving as the company delivered a staggering Q1 report and is expected to show close to 20% YoY revenue growth once again in Q2. Meta’s early 2023 transformation with massive layoffs start bringing economic benefits as the bottom line also demonstrates strong improvements. In my today’s analysis, I pay more attention to the stock’s valuation and insider selling activity because it is highly likely that all the positives are already priced in. My discounted cash flow model suggests that there is almost no upside left after the rally which started after the stock bottomed out in late 2022. All in all, I downgrade META to “Hold”.

Recent developments

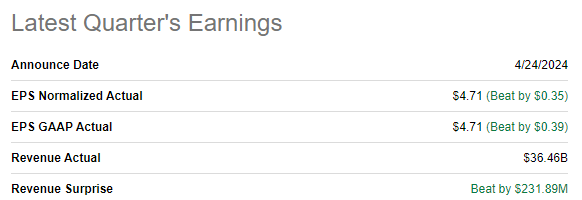

Meta released its latest quarterly earnings on April 24, surpassing revenue and EPS consensus estimates. Revenue grew by 27.3% YoY. The adjusted EPS more than doubled YoY, from $2.20 to $4.71.

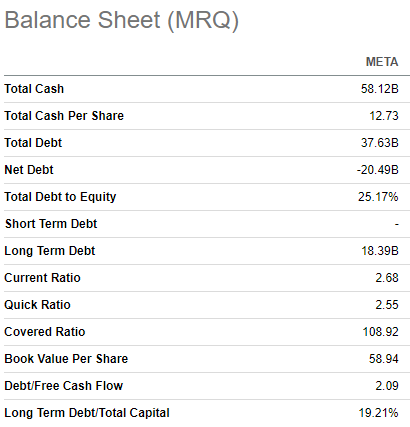

Seeking Alpha

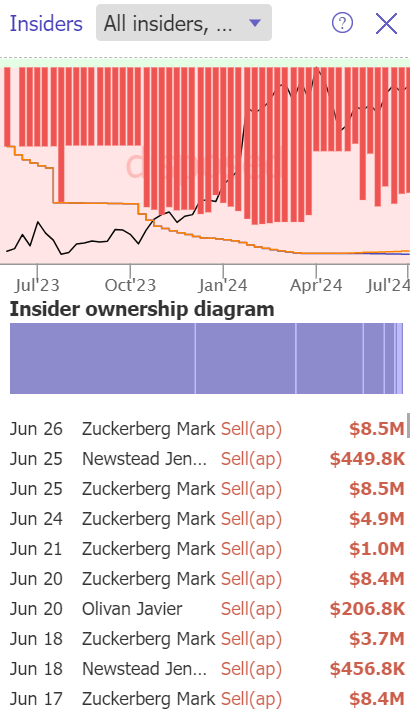

EPS expansion was achieved primarily via operating leverage. The gross margin expanded by around 350 basis points to 81.8%. The operating margin improvement was even more notable, from 27.40% to 38.6% on a YoY basis. Such a stellar performance allowed Meta to generate $8.1 billion in free cash flow [FCF] in Q1 2024 compared to $5.5 billion during the same quarter last year. Therefore, Meta’s financial position keep improving with a massive $58 billion cash pile and quite shallow leverage levels.

Seeking Alpha

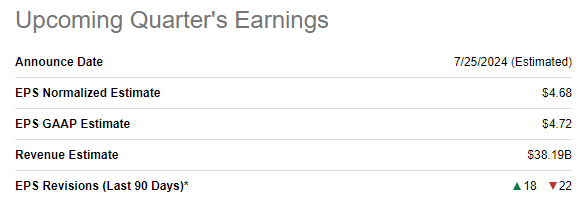

The upcoming earnings release is scheduled for July 25. Wall Street analysts expect Q2 revenue to be $38.2 billion, a 19.4% increase compared to the same quarter of 2023. The adjusted EPS is expected to expand from $2.98 to $4.68 on a YoY basis. Analysts’ sentiment around the upcoming earnings release is mostly cautious with more negative EPS revisions over the last 90 days.

Seeking Alpha

It does not necessarily mean that we should be bearish about it, but insiders were only selling in recent months. Even Mark Zuckerberg was selling notably even despite getting around $700 million in dividends from the company’s first payout in its history. Once again, the fact that insiders are selling might mean nothing because even billionaires have their bills to pay. However, the fact that insiders are not buying might indicate that they do not see much upside potential from these levels.

TrendSpider

I consider other recent developments not very important from the fundamental perspective. The company faced some new antitrust issues in Europe, but it does not look like a big threat for me.

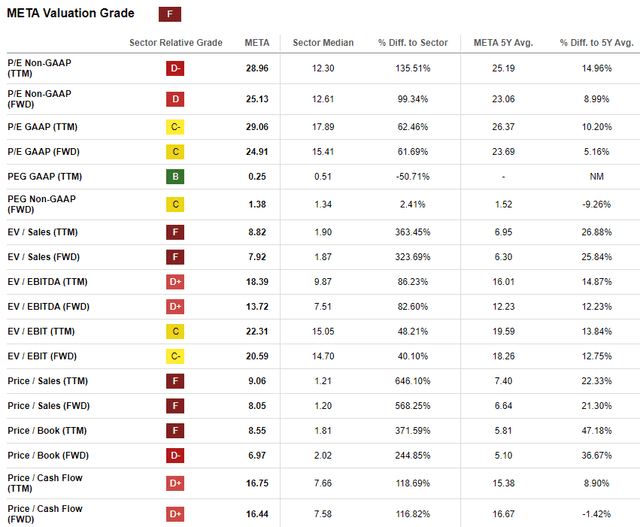

Valuation update

The stock gained 77% over the last twelve months, substantially ahead of the broader U.S. market. META’s YTD performance is also better compared to the S&P 500 with a 42% rally in 2024. Meta’s valuation ratios are inherently high compared to the sector median due to the company’s unparalleled profitability and revenue growth. However, I want to emphasize that Meta’s current valuation ratios are higher than historical averages across the board. This indicates slight overvaluation, in my opinion.

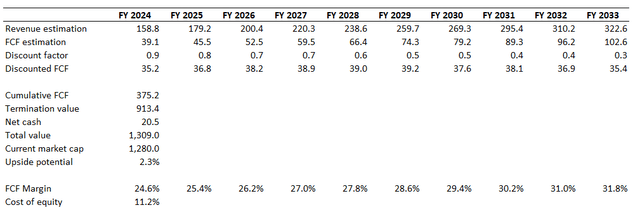

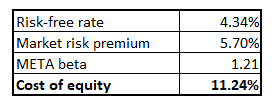

The discounted cash flow [DCF] approach will help in figuring out the business’s fair value, which will be then compared to the current market cap. The below 9% WACC I used last time appears to be too soft, as the stock did not realize a solid 17% upside potential suggested by my previous analysis despite its stellar Q1 performance. Therefore, this time, I recalculate the discount rate in the below table.

Author’s calculations

I ignore debt because Meta’s reliance on it is immaterial. Therefore, an 11.24% cost of equity will be used to discount Meta’s future cash flows. An 8% revenue CAGR for the next decade projected by consensus is a conservative assumption for a company like Meta, and I am using it for my DCF. The TTM FCF margin is 24.6%, and I incorporate an 80 basis points yearly expansion. The FCF margin expansion by 0.8 percentage points correlates with an 8% revenue CAGR.

Meta’s current market cap is very close to the business’s fair value. This indicates that not much upside potential left and the DCF’s outcome aligns with current valuation ratios compared to historical averages. Therefore, I can conclude that META is currently approximately fairly valued.

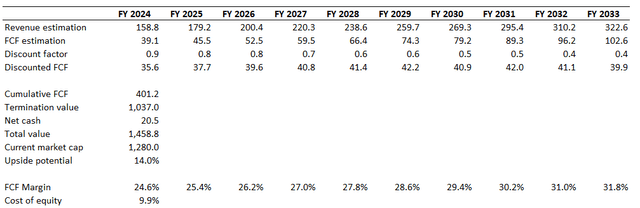

Risks to my rating upgrade

Any DCF model is full of variables, and they are quite dynamic. I update my coverage one time per quarter, meaning that the next time I will do Meta will be in October. A lot can happen to DCF assumptions over the next three months. For example, Meta might significantly boost its revenue guidance during the upcoming earnings call. Boosting revenue growth expectations will also lead to EPS growth assumptions upgrades. The Fed might start cutting rates faster than expected. For example, revising the risk-free rate in my CAPM formula to 3% decreases cost of equity to 9.9%. With this discount rate the present value of Meta’s future FCF becomes notably higher, and the business’s fair value moves closer to $1.5 trillion.

Meta’s stellar rebound started in early 2023 when Mark Zuckerberg announced that the company starts pursuing more efficiency and there was a big transformation with laying off thousands of employees. The stock soared since then and the experience was obviously positive for the management. Recent news suggest that the transformation is still not over and that investors can expect more layoffs. In case Meta continues its transformation with more layoffs it can boost profitability even further and this can also positively affect the market cap.

Bottom line

To conclude, I think that Meta is now a “Hold”. Fundamentals are still robust and keep improving, but I think that all the positives are already priced in, and it will be difficult to expect more upside from the current share price level.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.