Summary:

- Meta Platforms stock is up nearly 200% over the past year.

- The company is finally seeing the fruits of its investment in artificial intelligence, helping it to overcome data privacy challenges.

- The company maintains a net cash balance sheet and is flowing cash flow even after accounting for Reality Labs losses.

- The valuation remains more than reasonable even after the huge run-up – I reiterate my strong buy rating.

Drew Angerer/Getty Images News

Meta Platforms (NASDAQ:META) has been one of the biggest winners in the tech sector. Its most recent quarter has made me of the view that these winning times may not end soon. META initially won over Wall Street through its aggressive cost cutting initiatives, but is seeing additional gains from its artificial intelligence focus. While many may be wondering if META is a real AI-play due to not having a cloud offering of its own, the company has ironically seen the greatest direct AI-boost as it has been able to use artificial intelligence to overcome the iOS data privacy issues and TikTok competition. Management is projecting stunning growth rates moving forward as the company begins to lap easy comparables. The stock has run up greatly, but the forward valuation is much cheaper than it appears. I reiterate my strong buy rating.

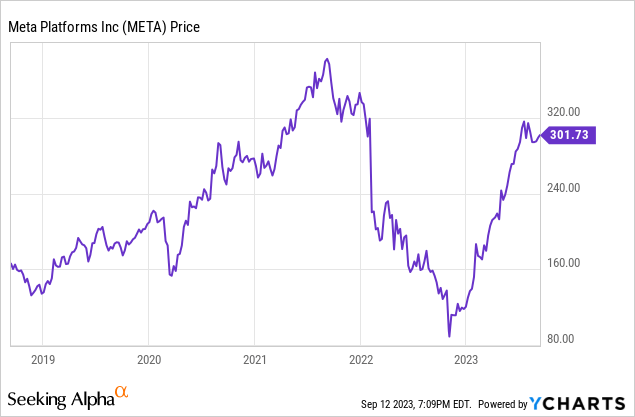

META Stock Price

META’s recent price action may look hyperbolic and it is indeed stunning, with the stock up well over 200% from 2022 lows. Many investors might look at such price action and instantly think “danger,” but META should never have traded so low in the first place.

I last covered META in June where I rated the stock a strong buy due to the changing investment narrative. The stock is up another 14% since then, but the stock arguably has quite a bit of ground still left to cover after underperforming over the past several years.

META Stock Key Metrics

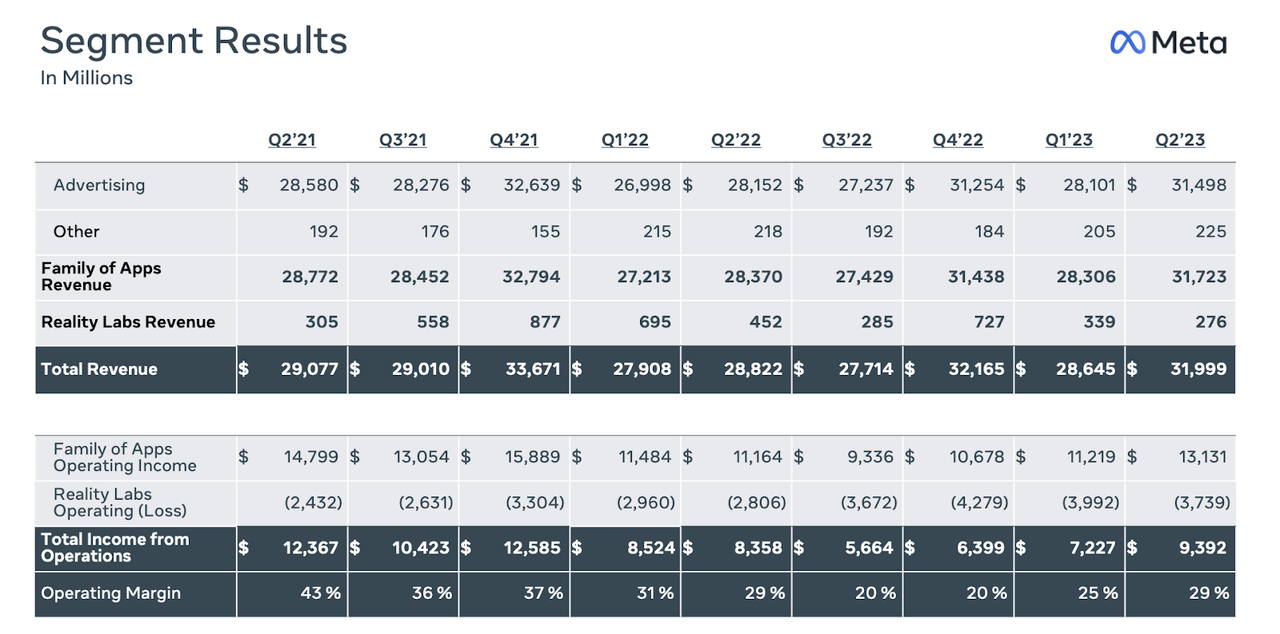

In its most recent quarter, META delivered $31.999 billion in revenue, coming in at the high end of guidance for revenue between $29.5 and $32 billion. Operating margins increased 400 bps sequentially to 29% in spite of Reality Labs continuing to be a loss business.

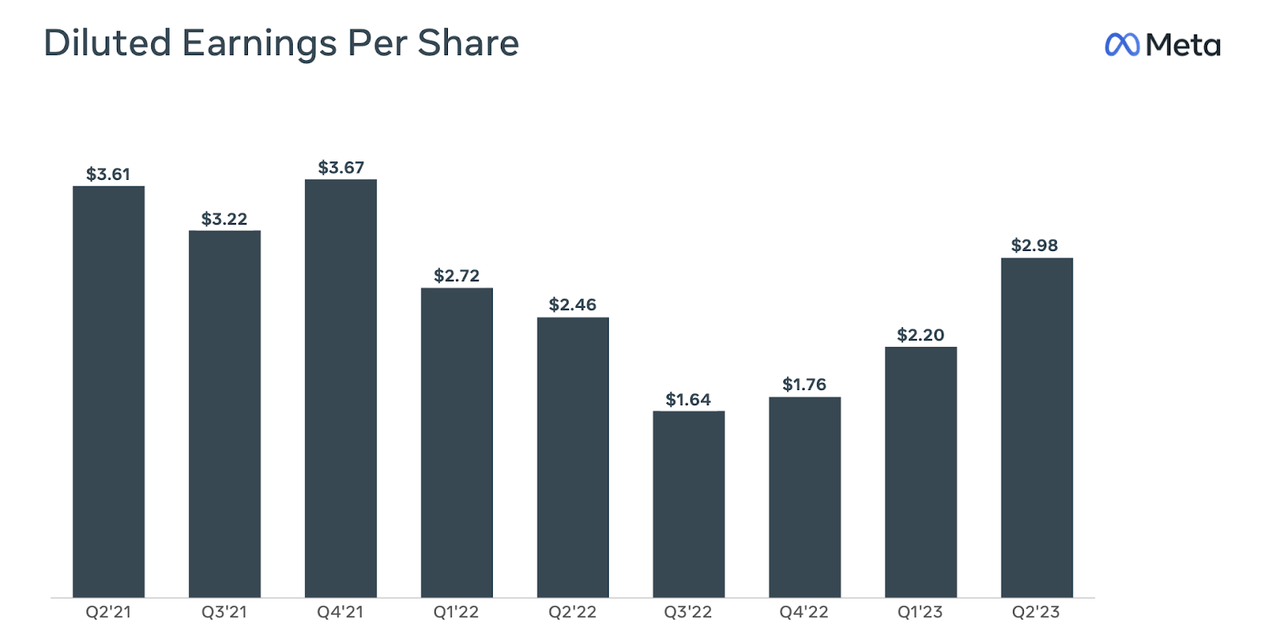

Diluted EPS grew significantly faster than operating income at 21% YOY growth due in large part to the company’s aggressive share repurchase program.

I expect OpEx to continue to improve moving forward, as the company notes that their second quarter headcount still “included roughly half of the approximately 10,000 employees impacted by the 2023 layoffs.”

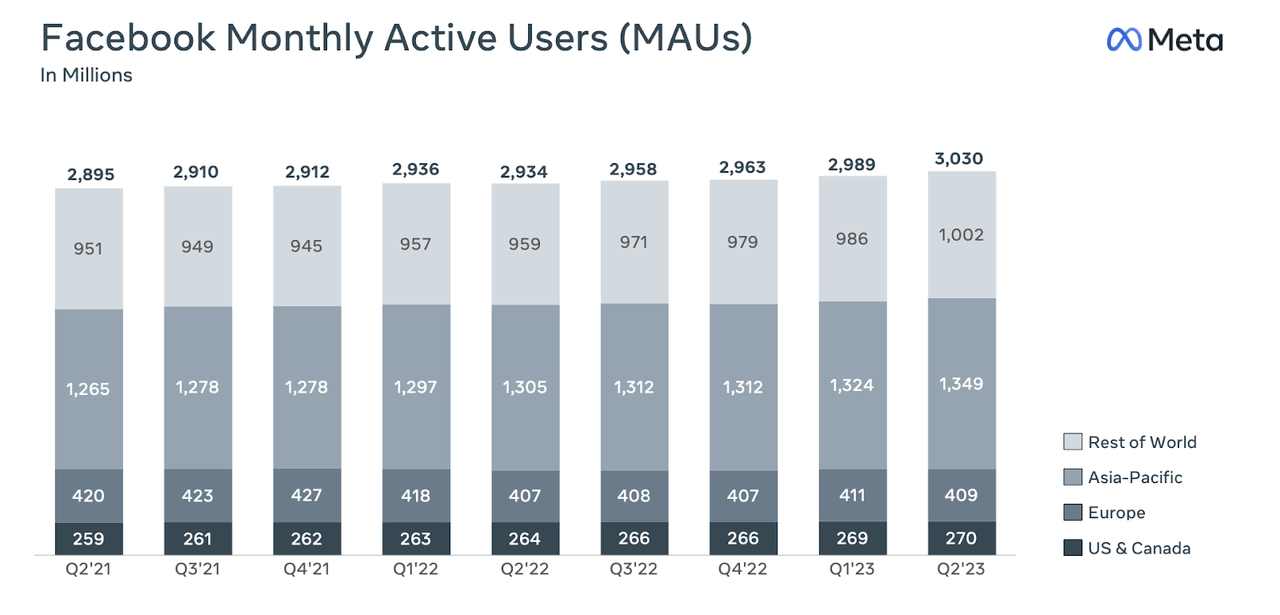

META saw its Facebook monthly active users (‘MAUs’) grow at a healthy 1.4% sequential pace (apparently many people still use Facebook).

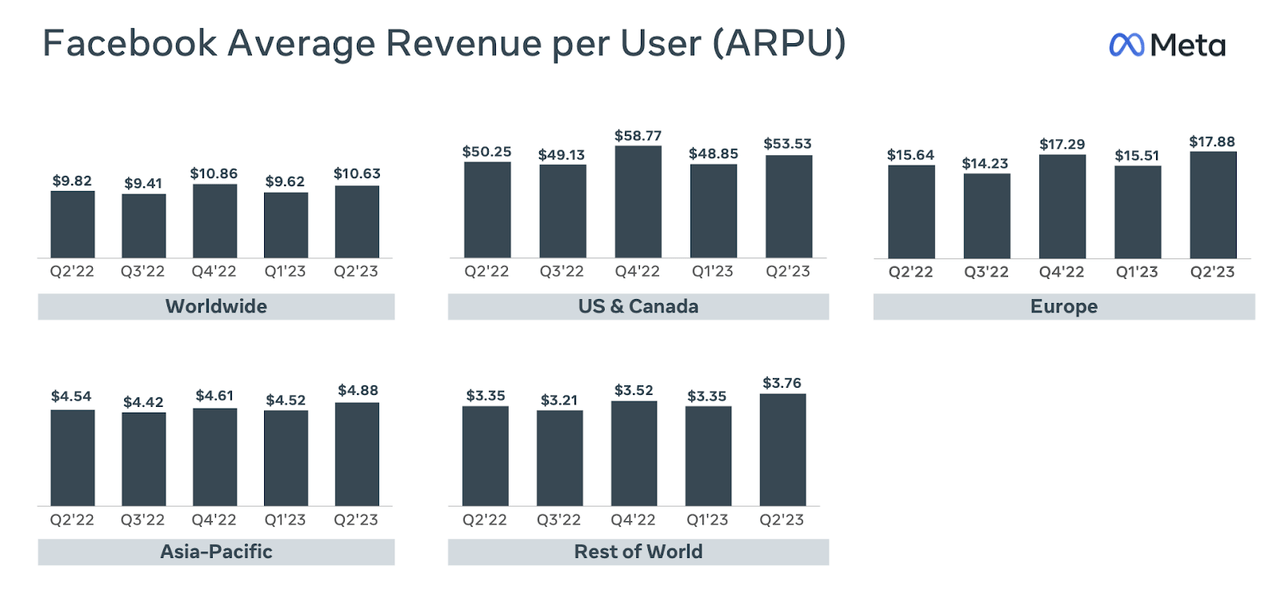

META was also able to deliver solid YOY growth in average revenue per user (‘ARPU’).

The company had previously seen weakness in ARPU due to both the iOS data privacy changes as well as the tough macro environment. As expected, those headwinds have now become tailwinds as the company is beginning to lap easy comparables.

META ended the quarter with $53.5 billion of cash versus $18.4 billion of debt, but repurchased only $898 million in stock in the quarter (the company generated $11 billion in free cash flow). I am not too concerned about the dropoff in share repurchases given that the company was very aggressive in repurchasing stock amidst the tech crash. Based on management’s commentary on the call and Wall Street’s apparent reaction to the fundamentals, I would not be surprised if META begins to aggressively invest in its growth ambitions moving forward, after many quarters of aggressive share repurchases.

Looking forward, management has guided for third quarter revenues in the range of $32 to $34.5 billion. The high end of that range implies 24.5% YOY growth. Can someone remind META that this is a tough macro environment? Like other tech names, META expects currency exchange to now offer a 3% tailwind in the quarter. Management guided for costs to grow in 2024 due to investment in AI and Reality Labs. With META stock soaring and enjoying investor love once again, management appears to have been given the green light to continue plowing cash into Reality Labs. That is a surprising development given the intense focus on profitability seen broadly in the tech sector.

On the conference call, management expressed optimism regarding their release of Threads, a Twitter look-a-like. Management noted a warm reception, but more importantly, stated that the product “was built by a relatively small team on a tight timeline.” I have seen some articles stating that Threads might be a distraction with poor ROI, but to me the effort appears to be one with “low risk, high reward” as the company likely has been able to reuse much of its existing infrastructure to support the new site.

Regarding their strong financial results overall, it is clear though that there is something more at play here besides just easy comparables. Management noted that their AI recommendations have driven a 7% increase in engagement. Those who thought that META could not survive with intimate access to personal data now have their answer. Management noted that nearly all of their advertisers use at least one of their AI driven products. META stock has soared alongside the generative AI rally and it is arguably a legitimate generative AI stock.

Management appears to be saying all the right things, showing significant growth in maturity since the tech crash. Management emphasized their intentions to “run the company as lean as possible” even as the fundamentals improve into 2024. Management confirmed analysts’ thoughts that their strong top-line strength may continue into the fourth quarter due to the easy comparables, but understandably noted the inherent macro uncertainty. I again reiterate the curious observation that Wall Street now believes in management’s ability to both commit to profitability even as they continue to invest heavily in metaverse ambitions. This has been a win-win result for management and shareholders.

Is META Stock A Buy, Sell, or Hold?

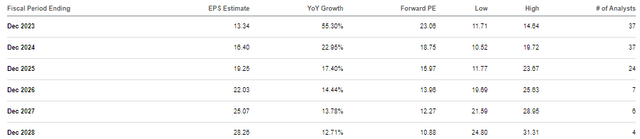

It may surprise some investors to know that in spite of the vicious rally in the stock price, META recently traded hands at just 23x this year’s earnings estimates. Earnings are expected to grow rapidly over the coming years as the company allows operating leverage to take hold.

What is a fair value for the stock? Given that the company is seeing rapidly improving fundamentals in its advertising business, it may finally be time to begin valuing META on a sum of the parts basis, similar to how Alphabet (GOOGL) is often valued with its “Other Bets” business. META’s metaverse business unit is losing money and thus has an implied negative value when valuing the stock on a PE ratio basis. If we instead value the metaverse business as a zero and assign a 25x PE ratio to the advertising business, then we arrive at a stock price of around $465 per share. If the macro environment can improve and lead to accelerating growth, then I could see the advertising business being worth 30x earnings, implying a stock price of $558 per share.

But there may be even more upside to that target, as one can argue that the metaverse business is worth more than zero. Yes, the current state of VR and the metaverse leaves a lot to be desired in my opinion, and I’m a META shareholder. But the long-term vision looks appealing. CEO Zuckerberg stated on the call his vision for traditional glasses to all be smart glasses in the future, with TVs and computers having a similar immersive transformation as well. I have not assumed any value for the metaverse business and the stock looks attractively valued even with the metaverse segment having what looks to be “moonshot” upside.

What are the key risks? The tough macro environment may get worse. Online advertising has historically benefited from the secular tailwinds of advertising moving digital, but that transformation is much more underway than a decade ago – I expect META to see much more cyclical results than it did in the past. There remains the risk of regulation and potential future data privacy fines, as META’s large profits at the very least make it an easy target. META has shown solid user growth but it is unclear if the TikTok threat will go away – I am not personally of the view that the United States will ban the app. Management has a short history of focusing on profits, and it is possible that they eventually slip back to their old ways, allowing more and more resources to go towards the Reality Labs initiative. It is also possible that the stock experiences a re-rating downward if the online advertising business is viewed to be more cyclical and not deserving of a growth multiple.

In spite of the strong price action over the past year, I reiterate my strong buy rating for the stock as I see further execution on operating leverage leading to further multiple expansion ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best investment reports.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!