Summary:

- Meta Platforms has delivered a price return of over 149% in the past year, pushing its market cap beyond $1.3 trillion.

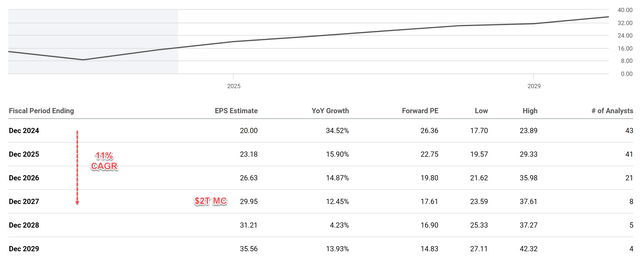

- Analysts predict Meta’s EPS to grow from $20 to about $29.95 by 2027, translating into an annual growth rate of about 11%.

- Assuming today’s P/E, its market cap would reach $2T by then.

- I see this as a very likely scenario given its strong profitability, many catalysts, and aggressive growth CAPEX investments.

Robert Way

META is worth $1.34 trillion now

Meta Platforms (NASDAQ:META) have delivered outstanding returns for its shareholders in the past ~2 years or so. As seen in the chart below, in the past year alone, META has delivered a price return of more than 149% and has reached a current market cap of $1.34T. Despite the record high prices, its current P/E ratio is still very reasonable in my view, only about 26.4x on an FWD basis.

Against this background, the thesis of this article argues that the stock still has more upside potential. In the remainder of this article, I will elaborate on my thesis from the perspective of valuation and also growth potential. The next chart below summarizes consensus estimates of META’s future earnings growth. As you can see, between 2024 FY and 2027 FY, analysts predict its EPS to grow from $20 to about $29.95, translating into an annual growth rate of about 11%. At an EPS of $29.95, and assuming its current P/E multiple and share counts, the company would be worth about $2T by then.

Of course, you already see the two key assumptions here: A) its P/E can sustain at the current level of 26.4x and B) its growth rate can sustain at a CAGR of at least 11% for the next 3~4 years. And next I will argue why I think both assumptions are likely to materialize.

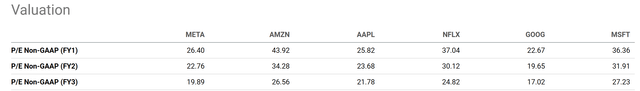

26.4x P/E is very reasonable

The chart below shows the P/E ratio of META in comparison with the rest of the FAANMG group. As seen, META’s P/E ratio of 26.4x is toward the lower end of the group, substantially below Amazon’s (AMZN) 43.92x, Microsoft’s (MSFT) 26.36x, and Netflix’s (NFLX) 37.04x. Compared to the broader market, META’s P/E is also at a sizable relative discount. The Nasdaq 100 index is currently trading at a P/E of 29.54x. Yet, next, you will see why I think META’s profitability and growth potential are at least as good as the FAANMG average and far better than the Nasdaq 100 index.

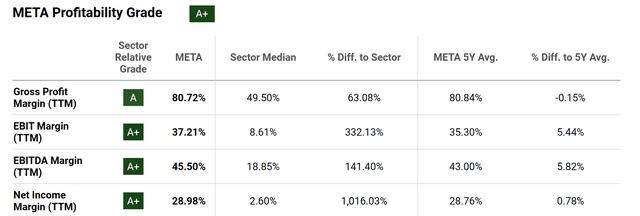

Profitability comparison

The chart below paints a pretty clear picture of META’s profitability compared with the tech sector median. As seen, META’s profitability is simply superb across the board compared to the sector median. Its Gross Profit Margin of 80.72% is almost 2x higher than the median. And its Net Income Margin of 28.98% is more than 10x better than the median.

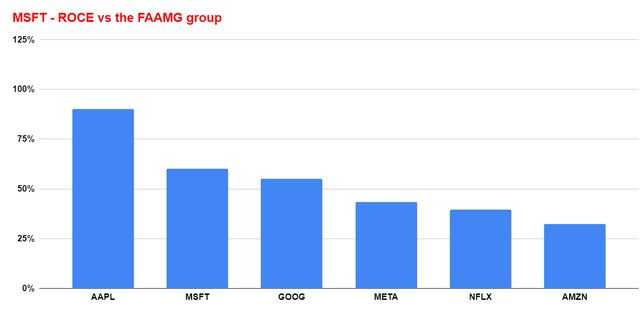

When compared to the other overachievers in the FANNMG group, META’s profitability is also very competitive as seen in the chart below. Readers following my writings know that the profitability metric I prefer is the return on capital employed (“ROCE”). And in terms of ROCE, META’s ROCE in recent years sits at an average of around 48%, in line with the average ROCE of this group.

Growth prospects

Besides being a more fundamental metric, another key reason I like ROCE is that it is directly related to the growth potential. In the long term, the growth rate is governed by ROCE and the reinvestment rate (“RR”) as detailed in my other articles.

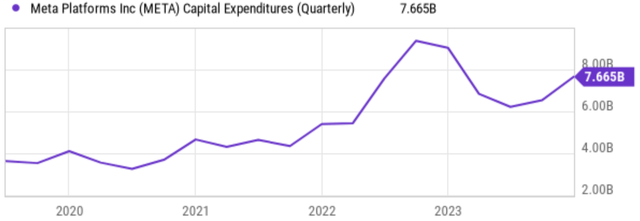

We’ve already analyzed its ROCE above, so here I will focus on its RR. META’s reinvestment rate is about 10% on average in the past, in line with the average of growth companies. However, in recent years since 2022, it has cranked up its growth CAPEX investment substantially. The chart below shows META’s capital expenditures on a quarterly basis starting in 2020. As seen, META’s capital expenditures have been relatively stable before 2022 around the $4B level. Then it increased sharply to a peak of ~$8.6 billion in 2022 and persisted at such an elevated level since. According to its most recent quarter’s report, its capital expenditure is about $7.6 billion.

I certainly see good areas for META to crank up its growth CAPEX, and the top 3 areas in my view are its metaverse investment, monetization of WhatsApp, and the development of AI.

Metaverse is a high-risk and high-reward opportunity. I agree with META’s strategy of building its own virtual reality (“VR”) and augmented reality (“AR”) technology. This requires significant spending on data centers, servers, and research and development to create this new virtual world. However, the upside is boundless in my view. If the Metaverse gains widespread adoption, it could open up new revenue streams through virtual advertising, in-app purchases, and e-commerce within the virtual world.

WhatsApp is a hugely popular messaging platform (speaking from firsthand experience as the parent of a teenager) acquired by META recently. It currently generates minimal revenue. Meta is exploring ways to monetize WhatsApp while maintaining user privacy. And I see many possibilities here, such as in-app purchases or subscriptions for premium features.

Finally, there is the AI potential that has been discussed so much already, and I won’t add too much to it. I will just say that AI technologies are highly synergistic with META’s core social media platforms like Facebook and Instagram. And it requires substantial CAPEX investments in the years to come, both in terms of AI infrastructure and also recruiting/retaining talent.

Due to these nonlinear growth areas and its current, my estimate of its RR going forward is about 20%, essentially doubling its historical average before 2022. With a ROCE of 48% and RR of 20%, my projection for META’s growth rate would be ~10% (48% ROCE x 20% RR = 9.6% growth rate). Note this is the real and organic growth rate. The actual or notional rate would likely be higher once the inflation escalator is added and close to the 11% CAGR consensus projected.

Other risks and final thoughts

There are two more upside risks worth mentioning. First, in my above analysis, I’ve only considered the organic growth rate. I think there are good odds that META can achieve higher growth rates from acquisitions, considering that it has more than $65B of cash sitting on its ledger currently.

Second, there is a possibility that TikTok could be banned in the United States. As detailed in this news below:

Biden raised U.S. concerns about the app’s ownership, the report added. Chinese company ByteDance (BDNCE) – the owner of TikTok – is facing a crisis in the world’s largest economy as the U.S. House of Representatives passed a bill in March directing the company to either sell the U.S. operations of the app or face a ban in the country. Senators are yet to decide on how to tackle the issue. Biden had said earlier that he would sign such a bill if it came to his office.

A ban on TikTok in the US could potentially benefit META. TikTok, especially popular with younger demographics, occupies a significant space in the social media landscape. With its absence, users might migrate to other platforms, and Meta’s offerings like Instagram Reels, which feature similar short-form video content, could be a prime destination. This potentially increased user base could translate to more engagement and ad revenue for Meta.

In terms of downward risks, META is exposed to all the risks common to other tech stocks, such as regulation, competition, etc. There are a few challenges that are more specific to META compared to its peers in my view. First, I am seeing signs that Facebook, META’s core platform, may be reaching saturation in developed markets. Attracting new users, especially younger demographics, might be more difficult going forward. Second, its investment in VR has a high-risk flavor, as aforementioned. META is heavily invested in VR technology through its Oculus division. This is a nascent market with uncertain future potential.

All told, my overall conclusion is that META presents a compelling GARP opportunity (growth at a reasonable price). While many of its peers are trading at a premium (and so is the overall market in my view), META’s P/E ratio is very reasonable despite its strong profitability and growth potential. In particular, I expect its increased CAPEX investment in key growth areas to drive double-digit growth in the next few years and propel its market cap toward $2T in tandem.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat the S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.