Summary:

- Meta Platforms announced new jobs cuts last week that are meant to improve profitability metrics.

- I believe the advertising slump may not be as severe as expected as Meta Platforms’ revenue impact has remained quite limited.

- Meta Platforms’ operating expenses are set to get revised to the downside in Q1’23. EPS estimates have already started to rise.

- Meta Platforms’ valuation is still very attractive and has revaluation potential.

Justin Sullivan

Meta Platforms (NASDAQ:META) announced a second round of layoffs this month that is meant to improve the social media company’s productivity and boost its profitability. The new round of layoffs comes after Meta Platforms cut approximately 11 thousand jobs from its pay-rolls in Q4’22 as a persistent slowdown in the advertising market and early bets on the metaverse have eaten into the company’s profits. Considering that the social media company’s stock is still relatively cheap, based off of earnings, I believe a combination of a rebound in the ad market, aggressive stock buybacks and a restructuring of Meta Platforms’ cost structure could be powerful catalysts to drive META into a new up-leg in FY 2023!

Meta Platforms announces a new round of job cuts in order to boost profitability

In its latest round of job cuts, Meta Platforms said that it will lay off an additional 10 thousand employees, cut back on filling positions that have already been advertised and cancel lower priority projects. The job cuts come just shortly after the company axed 11 thousand employees from its pay-rolls in the fourth-quarter.

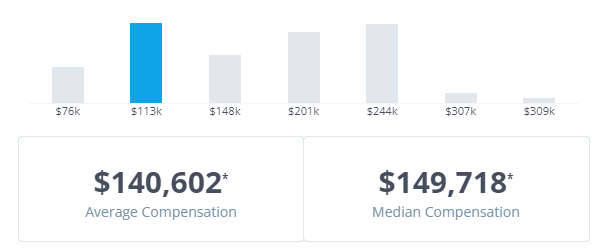

Considering that the median salary of a Meta Platforms’ employee is about ~$150 thousand, according to Comparably, the annual cost savings potential related to the total number of pay-roll reductions announced since November could be around $3.0-3.1B, not including any short-term severance payments. By cutting its operating costs aggressively, Meta Platforms signals that it understands it needs to boost profitability in a difficult ad market.

Source: Comparably, Meta Platforms’ Average/Median Salary

The job cuts are set to result in lower operating expenditures and improve Meta Platforms’ profitability going forward. In FY 2022, Meta Platforms reported $87.7B in operating expenses, most of which related to Research and Development. The social media company guided for full-year operating expenses of $89-95B in its last quarterly report, showing a down-grade from an original FY 2023 cost forecast of $94-100B largely because of lower expected pay-roll expenses. With the new around of lay-offs announced last week, I believe we are going to see yet another revision of operating costs in Q1’23 and a new forecast around $90-92B might be possible, implying a $2B profit boost. A better than expected OpEx forecast could be a catalyst to push Meta Platforms’ shares into a new up-leg.

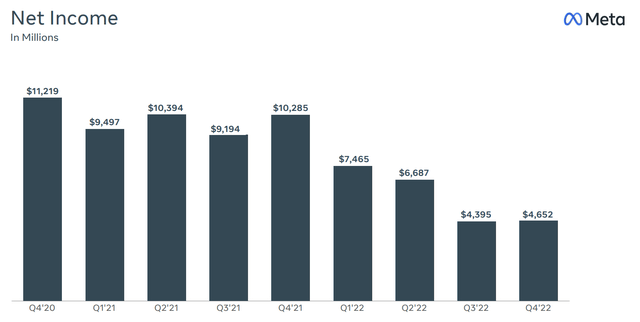

Due to a slowing ad market and a ramp up of investments in the metaverse, Meta Platforms has seen a decline in its net income and free cash flow that investors have started to worry about. Meta Platforms generated $23.2B in net income in FY 2022, which was 41% less than in the year-earlier period. As we will see below, however, Meta Platforms’ top line impact has been rather limited, indicating that the generation of net income is the main problem for the social media company. The social media company accelerated its metaverse investments in the last two years, especially in FY 2022. I have discussed the metaverse opportunity, which is valued at between $800B and $1T, here.

Limited top line effect from advertising slump

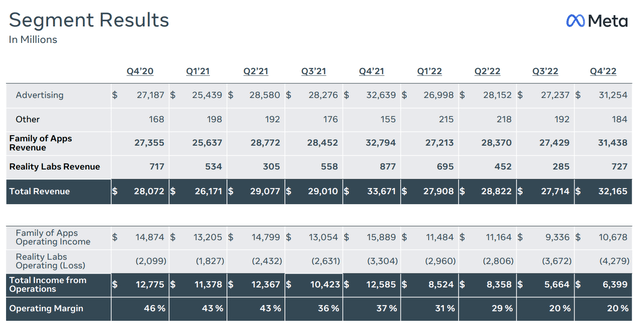

Despite worries about the state of the advertising market, Meta Platforms saw a relatively moderate 1% year over year decline in revenues in FY 2022. The social media company generated $116.6B in revenues, showing only a 1% decline on a year over year basis. The drop-off in revenues, or better: the lack of growth, resulted from headwinds including Apple’s iOS update in FY 2021, which limited advertisers’ ability to track consumer online purchases, but also high inflation and the rising threat of TikTok which has steadily been grabbing market share in the attention economy. In total, the top line impact from a slowing ad market has been limited for Meta Platforms in FY 2022.

Despite concerns over an ad market slowdown in FY 2022, the impact on Meta Platforms’ advertising revenues has been rather limited so far, I would say. Meta Platforms recognized an average of $28.4B in advertising revenues each quarter in FY 2022 while the average quarterly revenue amount recognized in FY 2021 was only slightly higher: $28.7B.

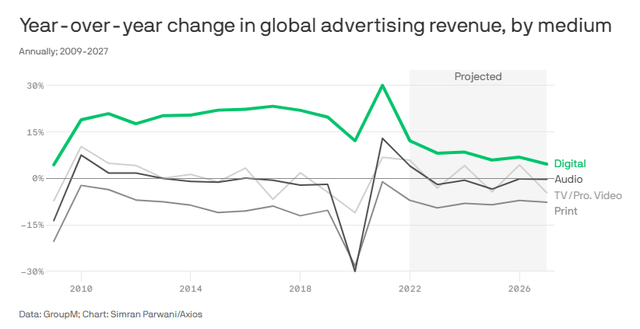

The near term outlook for the ad market is not positive as multiple factors weigh on spending (such as inflation, rising rates and slowing economic growth), meaning Meta Platforms is likely going to see continual challenges regarding revenue growth in the near future. The down-turn in the digital advertising market has hit many technology companies, including Google and Snap (SNAP), resulting in a wave of lay-offs across the sector. However, I believe the weaker prospects for growth have already been fully priced into Meta Platforms’ valuation.

Meta Platforms’ valuation

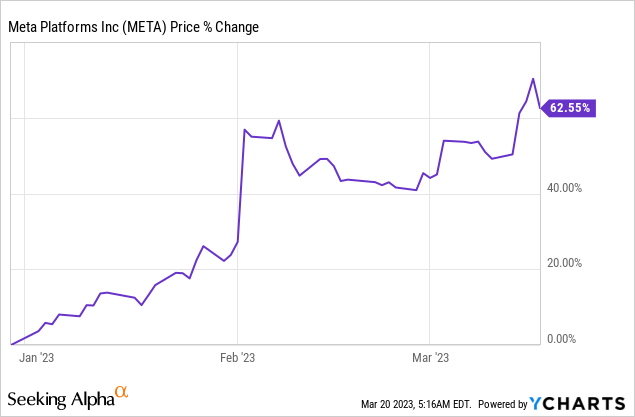

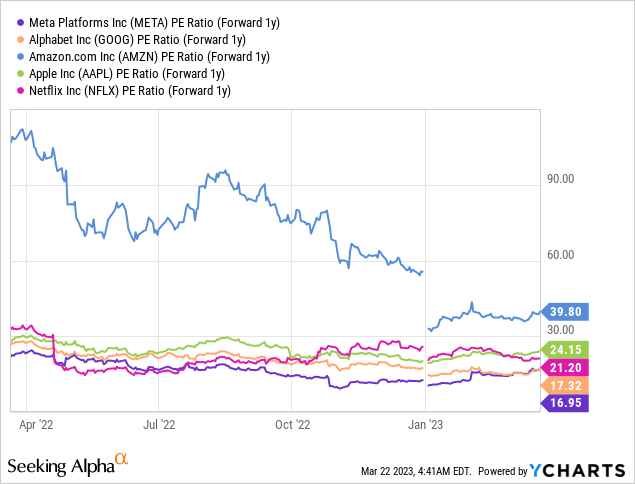

Meta Platforms has seen a notable upside movement in the stock after the company presented results for the fourth-quarter which included the announcement of an aggressive $40B stock buyback. Despite a 63% price return year-to-date, shares of META are still cheap, trading at a price-to earnings-ratio (forward) of 17.0 X. Meta Platforms is still the cheapest FAANG stock in the market and even cheaper than Alphabet (GOOG)… which is also irrationally undervalued and offers investors deep free cash flow and buyback value.

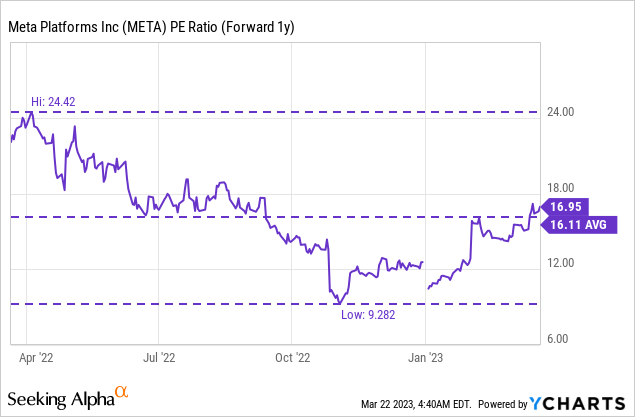

Meta Platforms’ shares are now trading slightly above its 1-year average P/E ratio… but I believe the stock is still a bargain.

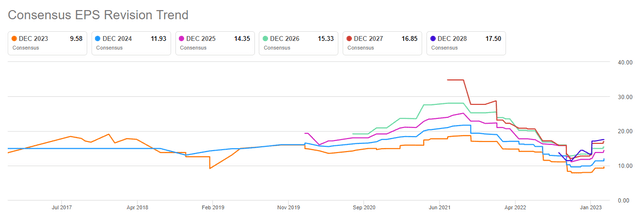

The estimate trend is also increasingly looking better as EPS estimates have started to trend up. The expectation is for Meta Platforms to see 11.5% EPS growth in FY 2023 and 24.5% growth in FY 2024, so the market is pricing in a rebound in the advertising market in FY 2023/2024. The currently available estimates also have upside since most of them have not been updated yet for the recent round of lay-offs and improved OpEx picture.

Risks with Meta

The biggest commercial risk for Meta Platforms is that the social media company could see a more severe slowdown in its advertising top line growth. Meta Platforms’ estimates imply that the market expects a recovery in its earnings picture, but a prolonged ad market down-turn would be a major negative for the stock. What would change my mind about Meta Platforms is if the company saw a steep decline in its key operating metrics such as daily active users and free cash flow. Meta Platforms achieved a free cash flow margin of 16% in Q4’22 and a major drop-off, potentially related to accelerating metaverse investments, would be a negative for Meta Platforms and the company’s stock prospects.

Final thoughts

A new round of lay-offs has the potential to boost Meta Platforms’ profitability in FY 2023 which has been negatively affected by a broad-based advertising slump, driven by high inflation and growing competition, especially in the rapidly growing market of short-term video apps. Given Meta Platforms’ new focus on drastically cutting operating costs, I expect Meta Platforms to revise its operating expenditure forecast down to a range of $90-92B when it reports Q1’23 earnings. EPS estimates have started to trend up and also represent surprise potential. Since Meta Platforms is still the cheapest FAANG stock and $40B in buybacks are about to be executed, I believe Meta continues to remain one of the most promising big tech stocks, besides Google!

Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.