Summary:

- Meta is a buy after earnings, driven by the company’s tremendous margin and EPS growth.

- The company continues to grow its user base in all regions, alongside improved monetization.

- The combination of Facebook and Instagram’s dominance, the metaverse opportunity, and room for growth in users and engagement make Meta a compelling investment.

- Its PEG ratio is below 1x, indicating a reasonable buy for its growth potential.

Urupong

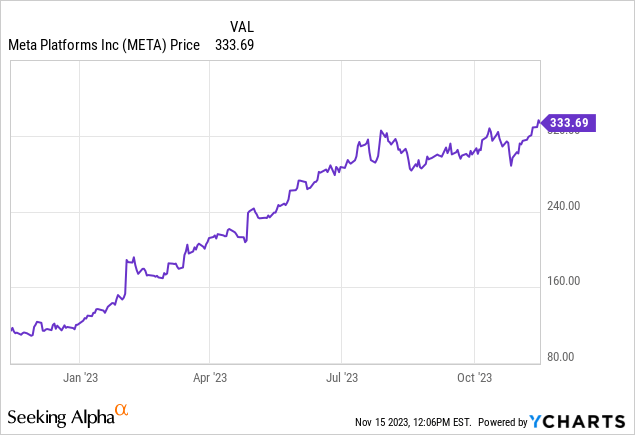

This year, it’s a winner-take-all market as investors have flocked to the safety of large, profitable names in the tech sector. Few stocks have benefited more from this than Meta Platforms (NASDAQ:META), the parent of Instagram and Facebook, which has seen its share price nearly triple year to date.

Yet underneath this large appreciation in share price, Meta has made bona fide progress in its fundamentals and cleared up a lot of investor concerns. The company has succeeded in growing its user base, better monetizing its platform outside of the U.S., and drawing on economies of scale to generate tremendous profitability growth.

I last wrote on Meta in September, when the stock was trading closer to $300. I recommended at the time that investors add Meta to their watch lists, citing a relatively balanced bull and bear thesis for the company. Since then, the company has released incredibly strong Q3 results, nudging Wall Street’s estimates for FY24 upward. In spite of the ~10% boost to share prices since, I am now far more confident in Meta’s profit generation capacity for next year and beyond, and am upgrading the stock to bullish.

Here is my full long-term bull case on Meta:

- The combination of Facebook and Instagram’s dominance is unparalleled- Facebook has the leading market share of any social media platform on the planet and has dominated the space for nearly two decades. New introductions like Threads and Reels showcase Instagram’s ability to jump on newer trends and compete directly with hot startups.

- Metaverse opportunity- Among all of the large tech companies, Meta’s Mark Zuckerberg has been the most outspoken about the opportunity that the company has for a metaverse economy, which is reflected in the company’s new name. If and when this takes off, Meta will have the first mover advantage.

- Room to grow in absolute users, including and especially in lucrative developed markets- Meta continues to grow daily active users and engagement even in the U.S., which has been a problem spot for many fellow smaller social media companies like Snap and Pinterest.

- Room to grow in engagement- Whether we like it or not, we’re glued to our phones now, and the emerging Gen Z has never experienced life before the smartphone. Meta is delivering double-digit y/y growth in ad impressions, which will continue to trend upward the more time we spend on social media.

- Immensely profitable- Especially now as Meta turns its focus to the bottom line, rich 20%+ GAAP net margins are coming to the forefront and delivering healthy EPS growth in a company once thought to be growing at all costs.

From a valuation perspective, for next year FY24, Wall Street analysts are expecting Meta to generate $17.62 in pro forma EPS, representing 22% y/y earnings growth, on top of $151.2 billion in revenue, up 13% y/y. At current share prices near $334, Meta trades at a P/E ratio of 18.9x, slightly richer than the ~18x multiple of the S&P 500. We shouldn’t ignore Meta’s premium earnings growth, however; and so I continue to believe that Meta’s PEG ratio of 0.86x (its P/E ratio divided by expected earnings growth of 22%) remains the best way to appropriately value the stock for its earnings expansion.

It’s a great time to go long on Meta – there is further upside to go.

User growth stacked on top of ARPU expansion

Strong user metrics underpinned the company’s latest Q3 earnings print, which helped fuel a renewed rally in Meta’s shares beyond the macro rally driven by interest rates and lower inflation readings.

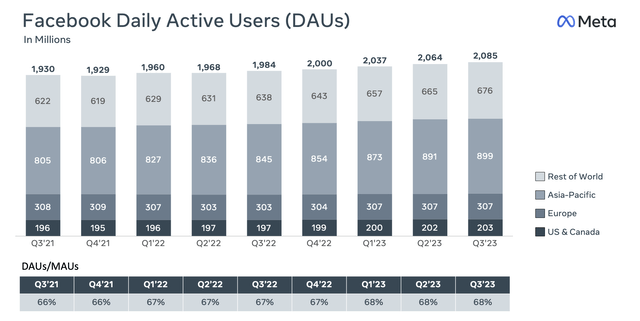

Meta DAU trends (Meta Q3 earnings deck)

As shown in the chart above, DAUs grew by 21 million users sequentially and up to a total of 2.09 billion, up 5% y/y. The “Rest of World” segment, as usual, was the fastest growing at 6% y/y, but it’s also encouraging to note that the company added one million net-new users sequentially in the U.S., which is the most lucrative ad market for Meta.

Global ARPU, meanwhile, rose to $11.23, up 19% y/y – driven by both higher user engagement plus stronger advertising demand.

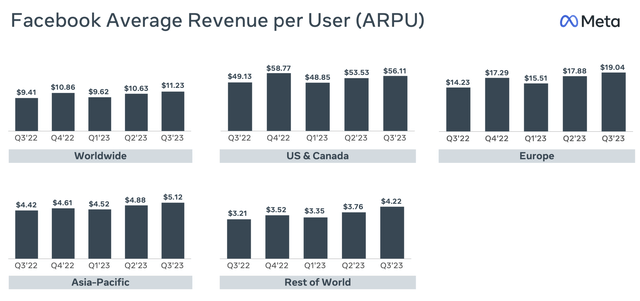

Meta ARPU trends (Meta Q3 earnings deck)

In particular, note that ARPU in Europe grew 34% y/y to $19.04, while the “Rest of World” segment – which lags behind other markets in terms of monetization – also grew 31% y/y to $4.22.

Product rollouts have been a core driver behind heightened user engagement; in particular, the company notes that Reels, which is Instagram’s answer to TikTok, has driven a 40% increase in time spent on Instagram. It’s worth noting that Reels and all other video services make up more than half of time spent across Facebook and Instagram, and is a giant source of ad dollars.

The company notes as well that improvements to AI recommendations behind the scenes have driven increased usage of Meta’s apps. Per Zuckerberg’s remarks on the Q3 earnings call:

Generative AI will increasingly be important going forward. I outlined our product roadmap earlier. And on top of that, we’re also building foundation models like Llama 2, which we believe is now the leading open source model with more than 30 million Llama downloads last month. Beyond that, there was also a different set of sophisticated recommendation AI systems that powers our feeds, Reels, ads, and integrity systems. And this technology has less hype right now than generative AI, but it is also very important in improving very quickly.

AI-driven feed recommendations continue to grow their impact on incremental engagement. This year alone, we’ve seen a 7% increase in time spent on Facebook and a 6% increase on Instagram as a result of recommendation improvements. Our AI tools for advertisers are also driving results with Advantage+ shopping campaigns, reaching a $10 billion run rate and more than half of our advertisers using our Advantage+ creative tools to optimize images and text in their ads creative.”

Cost discipline works well with ARPU growth to drive substantial margin gains

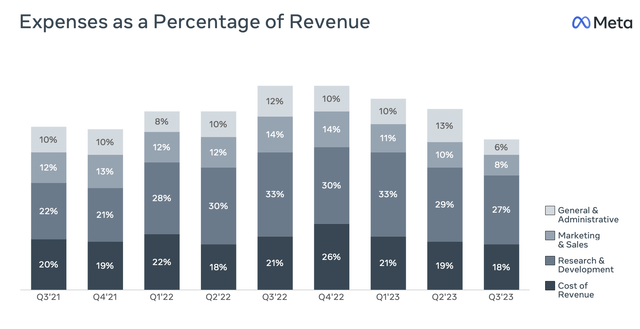

Meta’s top-line strength was also complemented by enormous leverage on operating costs. As shown in the chart below, the company sliced down every component of its operating costs both sequentially and year over year.

Meta expense trends (Meta Q3 earnings deck)

G&A expenses, in particular – which I view to be the “least productive” component of corporate overhead – trimmed down to just 6% of revenue, versus 12% in the year-ago quarter. The company has been judicious at continuing to trim headcount, while still investing in continued innovation in core areas. Total headcount of 66.1k was down 7% sequentially from Q2.

Here’s helpful commentary from CFO Susan Li’s remarks on the Q3 earnings call regarding the company’s headcount and hiring plan going forward:

One important point to note is that we are currently operating with a significant underrun against our 2023 budgeted headcount. For much of late 2022 and early 2023, we had instituted a broad-based hiring freeze as we undertook our restructuring efforts. In addition, as part of those restructuring efforts, many teams elected to make deeper headcount reductions in order to hire different skill sets that they need. We have since resumed hiring but expect that much of our hiring that was originally planned for and budgeted in 2023 will occur in 2024.

As part of our 2024 budget, we plan to selectively allocate incremental headcount toward four key company priorities, AI, infrastructure, Reality Labs, and monetization as well as toward our regulatory and compliance needs. Of those areas, we expect AI to be the largest area of increased investment as we further invest in Generative AI across our core products, internal tooling, and research efforts. We aim to offset some of this growth by continuing our efficiency focus and reducing planned hiring in other areas across the company in 2024.”

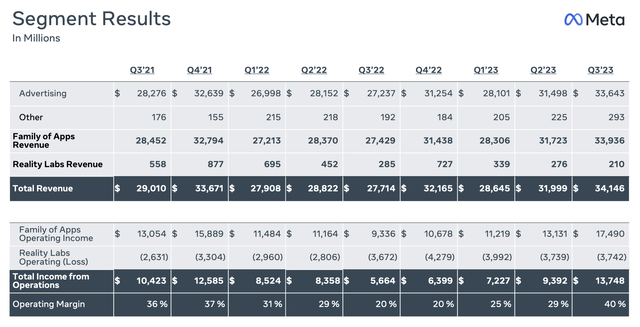

Meta hit a multi-year operating margin high of 40% this quarter, while operating income itself grew more than 2x y/y to $13.7 billion:

Meta trended financials (Meta Q3 earnings deck)

Pro forma EPS of $4.39, meanwhile, beat Wall Street’s consensus of $3.60 with 22% upside.

Key takeaways

With expanding ARPU, continued user base growth, and boosted operating efficiency from reductions in workforce, the stage is set for Meta to deliver tremendous profit growth in FY24 and beyond. Longer term, the company’s investments in the metaverse and other initiatives will continue to solidify its relevance. Buy this name.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.