Summary:

- Meta puts out guidance that not only is far above the Street’s expectations. But it shows that revenue growth rates are once more reaccelerating.

- But there’s more than this too, Meta’s investments into AI are leading to expanding profit margins.

- Yes, expectations for Meta are now higher, that’s clear. But there still appears to be upside potential in META stock.

NorthernStock/iStock via Getty Images

Investment Thesis

Meta (NASDAQ:META) comes out with middle-of-the-road results. But what got investors excited about this stock, again, was its outlook pointing to accelerating revenue growth rates.

That, combined with Meta reducing its investment in the metaverse. Furthermore, despite all the discussion of users turning off their Facebook accounts, Facebook crosses more than 200 million daily actives in the US and Canada.

But the real driver of investors’ excitement is Meta seeking to embrace the AI wave. All around there are a lot of positive elements.

2023 Continues With Efficiencies

Even as our financial position improves, I continue to believe that slowing hiring, flattening our management structure increasing the percent of our company that is technical, and more rigorously prioritizing projects will improve the speed and quality of our work. (Mark Zuckerberg)

Meta continues on its path to reduce its operating costs. That’s good news. But the real carrot for investors was its AI proclamations. On the back of Microsoft’s (MSFT) stock soaring after its critical AI Speech Steels the Show, it was more than expected that Meta too would highlight all its recent advancements in AI.

Here are some examples of how AI is improving Meta’s prospects. From ensuring users spend more time viewing AI-ranked reels to better monetizing users.

Furthermore, Zuckerberg discusses how Meta isn’t playing catchup on its infrastructure spend any longer, and that Meta can be more attentive to deploying capital for its infrastructure spend that will lead to more end usage.

That being said, Zuckerberg used the earnings call to highlight to the investment community that Meta isn’t shying away from the Metaverse, but that the metaverse is an expression of AI.

Metaverse technologies will also help deliver AI as well. For example, embodying AI agents will take advantage of the deep investment that we’ve made in avatars over the last several years. Building the Metaverse is a long-term project, but the rationale for it remains the same, and we remain committed to it.

Although, to be clear, beyond a compelling AI narrative there are some aspects that are less than rosy. For instance, Meta has been working hard to drive engagement in Reels, but this leads to a more significant gap between shown adverts, as users spend time watching Reels, rather than viewing an ad.

Nonetheless, investors are unlikely to be unduly concerned for now, given Meta’s revenue guidance ahead.

Revenue Growth Rates Come Sizzling Back

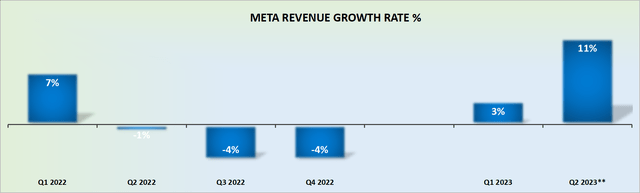

META revenue growth rates

Meta has succeeded in getting advertisers to deploy more spend on its platform. Meta’s CFO Susan Li described how Meta’s platforms are delivering better ad conversions, together with lowering its cost per ad, leading to advertisers improving their ROIs, a formula that works tremendously well, as you can see in its guidance.

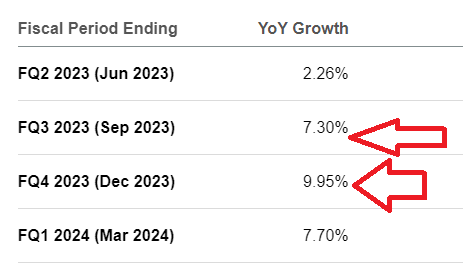

What’s more, given that H2 2023 will be up against even easier comparables than Q2 2023 is up against, there’s a high likelihood that we’ll see Meta resuming its revenue growth rates back at mid-10s%. A large increase relative to where analysts’ consensus presently finds itself at.

SA Premium

To put it more concretely, I believe that investors can now rely on Meta to grow at around 15% CAGR after Q2 2023, which is substantially higher than what analysts were expecting.

Next, let’s talk about Meta’s capital return program.

Capital Return Program That Actually Works

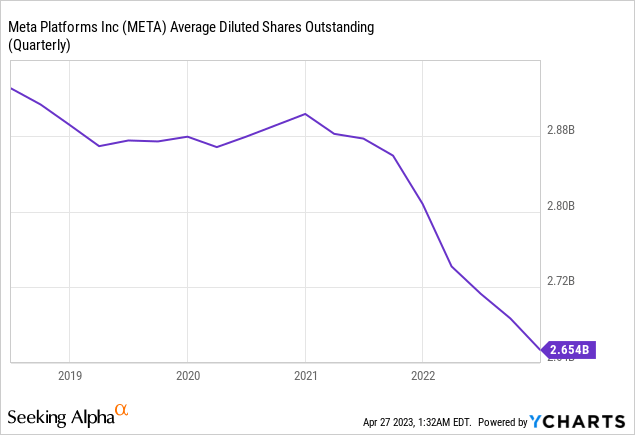

The graphic that follows hasn’t been updated for yesterday’s quarterly results.

However, the trend is pretty clear. With time, Meta is reducing its share count. Moreover, Q1 2023 saw its share count reduce further by 5% y/y from 2.7 billion in last year’s Q1 to 2.6 billion in its most recent quarter.

This is insightful and speaks about Meta’s free cash flow engine. There are many tech companies that make a lot of free cash flow, but that free cash flow ends up as SBC expenses. Not with Meta. Its free cash flow is actually large enough after SBC, that it can actually reduce its share count, despite all its investments into the metaverse and AI.

The Bottom Line

The pop post earnings weren’t as big as on the back of its Q4 results, but at the same time, investors’ expectations going into the quarter were substantially higher too. After all, Meta’s stock was already up more than 100% in 6 months.

Nevertheless, there were a lot of positive considerations to get investors interested in Meta once again. There were ample discussions surrounding the use of AI in future advertising and even in potentially new products.

But also, critically, Meta shows that it’s listening to investors and tempering its investment into the metaverse. There’s truly a lot to be exciting and hopeful about Meta, particularly that the stock hasn’t gone very far in the past 5 years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.