Summary:

- The management team at Meta Platforms announced robust financial results covering the first quarter of the company’s 2023 fiscal year.

- In addition to beating expectations on its top and bottom lines, the company announced significantly better guidance on the expense side of the equation.

- All around, the business is showing signs of stability and even growth, completely dismantling the bearish argument levied against the firm.

- Given how cheap shares are, the additional upside is very likely warranted.

Kelly Sullivan

April 26th proved to be a remarkable day for shareholders of Facebook parent Meta Platforms (NASDAQ:META). After the market closed, the management team at the firm announced financial results covering the first quarter of the company’s 2023 fiscal year. Leading up to the earnings release, shares were experiencing something of a pullback. However, after the company reported some rather impressive results across the board, shares spiked, trading around 12% higher after the market closed. Although the headline results provided by management are important, the real meat is when you dig deeper. Significant improvements in the company’s planned cost structure, combined with robust performance in advertising, were incredibly helpful in dismantling the pessimism that was surrounding the company. Although I no longer own shares of the business and have since downgraded it from a ‘strong buy’ to a ‘buy’, I am encouraged by this development and I believe that the company still offers investors attractive prospects moving forward.

Great headline results

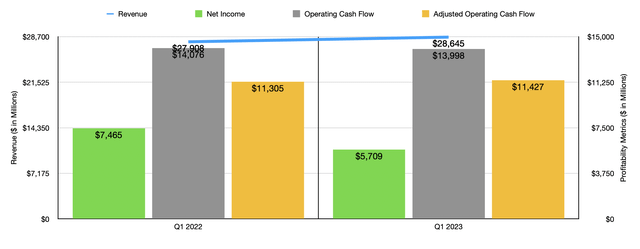

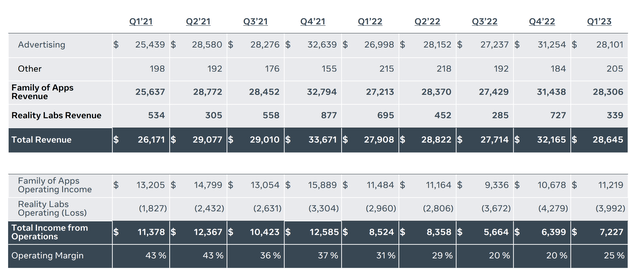

Starting with the headline figures, it’s worth mentioning that the company reported revenue of $28.65 billion for the first quarter of its 2023 fiscal year. Those who are bearish about the business may point out that this is only a 2.6% increase over the $27.91 billion that the company reported one year earlier. It is noteworthy that the revenue reported by the company exceeded analysts’ expectations by $990 million. It is also true that the company experienced a great deal of pain associated with foreign currency fluctuations. On an organic basis, actual revenue would have been about 6% higher. This increase was driven by a couple of important factors.

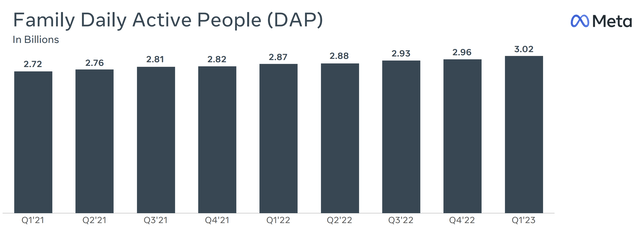

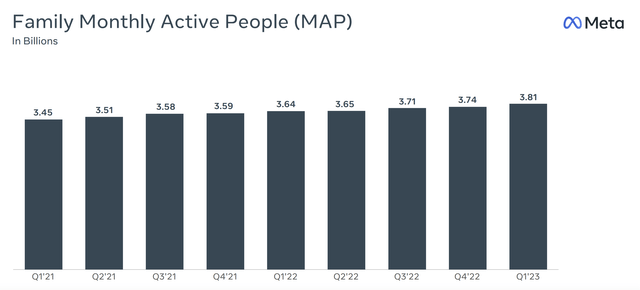

First and foremost, the number of users across the family of apps that the company has never been higher. Daily active users across the platforms totaled 3.02 billion at the end of the quarter. That’s about 5% higher than the 2.87 billion reported one year earlier and it compares favorably to the 2.96 billion that the company had as of the end of the final quarter of last year. Similar growth was seen when looking at monthly active users. This number totaled 3.81 billion, which was up 5% from the 3.64 billion one year earlier and compared nicely to the 3.74 billion reported just one quarter ago.

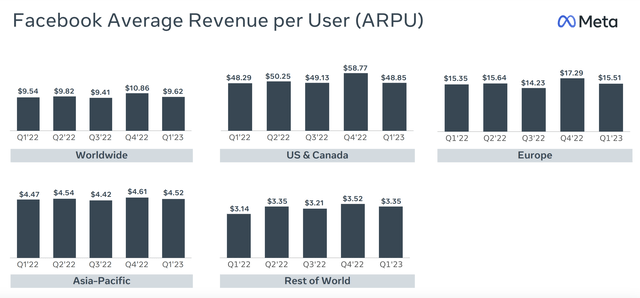

In addition to this, the company saw some improvement in ARPU. For Facebook specifically, this number was $9.62 globally. That compares to the $9.54 experienced 20 year earlier. The company saw strength across all of its regions. But the most impressive improvement came from the Rest of the World segment, with ARPU of $3.35 beating out the $3.14 reported at the same time last year. When you dig a bit deeper, you find out something interesting. And this is that actual ad pricing dropped 17% year over year. But this was more than offset by a 26% surge in ad impressions delivered across its family of apps. This implies significant additional usage from those on the network, offset some by a weakness in advertising revenue on a per impression basis. The strength in activity is a testament to the health and quality of the company’s platform, why all the drop in ad impressions is likely related to a combination of factors, such as uncertain economic conditions and the companies continue to growth on the global scale where advertising activities are less valuable than in developed, domestic markets.

On the bottom line, the company did experience a drop in profitability. Net income of $5.71 billion came in lower than the $7.47 billion the company reported one year earlier. But a good portion of this decline was driven by $1.14 billion in restructuring charges. $505 million worth of charges were associated with severance pay and other personnel related costs. $807 million, meanwhile, was associated with the company consolidating its physical footprint. Despite this drop, the firm reported earnings per share of $2.20. Although this was lower than the $2.72 reported one year earlier, it was $0.23 per share greater than what analysts anticipated. Outside of the earnings picture, we should also pay attention to operating cash flow. This decreased modestly from $14.08 billion last year to just under $14 billion this year. But if we adjust for changes in working capital, it would have risen from $11.31 billion to $11.43 billion.

I would also like to point out that the company achieved all of this while continuing to hemorrhage cash associated with its Reality Labs operations. This relates to activities involving the metaverse. Revenue for that part of the company dropped from $695 million in the first quarter of 2022 to $339 million the same time this year. At the same time, its operating loss surged from $2.96 billion to $3.99 billion. Management expects continued significant losses from this part of the enterprise throughout this year.

The picture moving forward is robust

Management has provided some interesting guidance when it comes to 2023. For the second quarter of this year, they are forecasting revenue of between $29.5 billion and $32 billion. This is after taking into consideration a 1% hit associated with foreign currency fluctuations. If this comes to fruition, it would be 6.7% above what the company reported one year earlier. The company has not provided any guidance for revenue for the 2023 fiscal year and its entirety. But they have provided cost guidance. At present, they think that expenses will come in at between $86 billion and $90 billion. This would mark a significant improvement over the $89 billion to $95 billion that the company was previously forecasting. This improvement in cost structure comes even in spite of estimated restructuring expenses of between $3 billion and $5 billion.

If we assume that revenue this year will grow by about 3%, which would reflect continued foreign currency pain, and we assume that management will hit the midpoint of guidance when it comes to costs, we would end up with a scenario where the enterprise generates profits of $25.69 billion assuming the 20% tax rate management said investors should expect. But of course, I care more about cash flow than I do earnings. Odds are, depreciation and amortization costs will be similar year over year. The tricky thing is how much of the cost structure of the company will relate to share-based compensation. For the purpose of this article, I assumed that it would match with the company reported for last year. That would be about $12 billion.

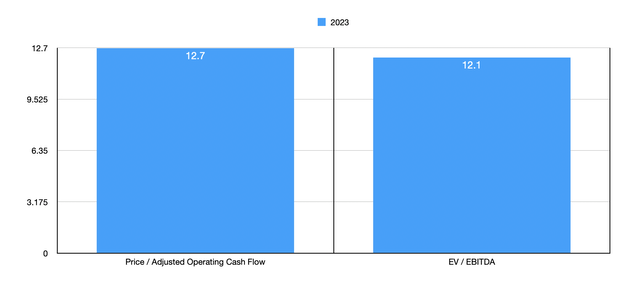

In all likelihood, this number could come in lower. This is especially true when you factor in its cost cutting initiatives. At the same time, I’m also not docking the company for the one-time restructuring costs. So we can call the uncertainty here between the restructuring initiatives and the share based compensation a wash. On top of this, I also included the implied impact on cash flow that the company should see from Meta Verified that I assimilated in a prior article. Putting all of this together, we end up with operating cash flow of $47.27 billion and EBITDA of $47.51 billion for the current fiscal year. Given where the stock is trading at now, after factoring in the after-hours share price appreciation, I calculated that the company is trading at a forward price to adjusted operating cash flow multiple of 12.7 and at a forward EV to EBITDA multiple of 12.1. These numbers are quite attractive for such a large company that generates the kind of cash flow that Meta Platforms does. When you add on top of this the fact that management is actively deploying cash to buy back stock that’s on the cheap, with $9.22 billion in purchases in the most recent quarter alone and another $41.73 billion in capacity under its share buyback program, you end up with a recipe for some really attractive upside.

Takeaway

Fundamentally speaking, the picture for shareholders of Meta Platforms just continues to improve. The company is clearly far healthier than many thought it was. Management’s efforts are truly shining through and shares are trading at levels that should be considered very appealing. Although I no longer own shares of the company, I would feel comfortable owning them again if I felt that the other opportunities I have invested my capital into were not as appealing. But since I do also recognize that the easy money has been made, I can’t in good conscience rate it any higher than a solid ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!