Summary:

- I view Meta Platforms, Inc.’s performance since Q2 earnings as an illustrative demonstration of its resilience.

- I am not alarmed by its investment in AI and/or other new products either, judging by the financials released.

- Meta Platforms continues to demonstrate excellent returns on its investments, as measured by Buffett’s $1 test.

LumerB/iStock via Getty Images

META stock Q2: AI investment in focus

I last analyzed Meta Platforms, Inc. (NASDAQ:META) back in July 2024 before the release of its 2024 Q2 earnings report (“ER”). As illustrated by the chart below, the article was titled “Meta Platforms: Don’t Bet Against Double-Compounding” on July 14, 2024. The article focused on the long-term resilience of the stock and its capital allocation advantage. More specifically, I argued that:

Despite some near-term uncertainties, I see double-compounding as the dominating force for META in the years to come. The combination of profit growth and large-scale share buybacks is simply overpowering. The ability (or privilege) to leverage with cheap and extended maturity adds further potency to the compounding forces.

Since then, there have been several new developments surrounding the stock. First and foremost, the stock released its 2024 Q2 ER last week. And second, the overall stock market has experienced extreme volatility since my last writing. As seen in the chart above, SP500 lost more than 8% since my last writing. And as an example of META’s resilience, this individual stock actually demonstrated lower volatility (losing only 4.6%) than the broader market. A key driver for such correction is investors’ concerns about tech giants’ investments in AI technologies and the uncertainties of the return.

These developments have motivated this follow-up coverage. Given the market’s AI-related concern, I will focus on META’s AI investments reported in Q2. More specifically, I will apply the so-called Buffett’s $1 test for a more objective assessment of the return of its AI investments. Given the timeframe and limited data, the results cannot be entirely conclusive. However, based on the results, I do not see clear signs that can support the market’s fear on this front – that is, in the case of META. Whether the fear is better grounded for other AI players is a different issue and deserves separate analyses.

By this time, the most common aspects of META’s Q2 results have been dissected by other review articles already. Therefore, I will just very briefly recap the results and move directly into the aspects central to this review. Overall, the company delivered a strong quarter and beat market expectations on both lines. To wit, its GAAP EPS dialed in at $5.16 in Q2, beating market consensus by $0.40. Revenue totaled $39.07B in Q2, also beating expectations by $760M.

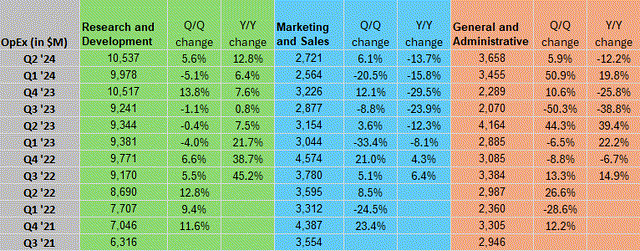

What concerns the market is the rapid increase in R&D expenses and capital expenditures, widely believed to be the results of an arm’s race in the AI arena. For example, as shown in the next chart below, the company has been doing a good job controlling its marketing/sales and G&A (general and administrative) costs despite the overall inflationary pressure. However, R&D costs kept rising at a rapid pace, increasing another 12.8% YOY in the past quarter. Capital expenditures paint an equally concerning picture. Capital expenditure for the second quarter amounted to $8.17 billion, an increase of nearly one-third compared to the same period last year. The company also raised its minimum capital expenditure guidance for the full year 2024 from the earlier $35 billion to at least $37 billion (while maintaining its upper end of the guidance of $40 billion unchanged).

Besides AI, META also invests heavily in other emerging technologies. These investments could pay off handsomely in the future, but have a high-risk flavor. Therefore, it is totally natural for the capital market to have divided feelings. On one side, there is a strong vision of artificial intelligence (and other new technologies such as its Metaverse) transforming the world and creating unprecedented profit growth along the way. On the other side, there is a deep skepticism about the return on such large investments.

Next, I will examine the issue using an objective approach – the so-called $1 test.

META stock: Buffett’s $1 test

The so-called $1 test was first promoted by Warren Buffett to my knowledge – like many other good ideas. For example, his 1984 BRK shareholder letter below sums up it quite well:

“Unrestricted earnings should be retained only when there is a reasonable prospect – backed preferably by historical evidence or, when appropriate, by a thoughtful analysis of the future – that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This would happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors.”

The gist is very simple – if a company (say META) decides to retain $1 of earnings (and to invest in AI as an example), then it should at least generate $1 of return for shareholders in terms of market cap gain. Otherwise, shareholders are better served if the company does not retain earnings at all (and use them, for example, to pay dividends, reduce debt, and/or repurchase shares).

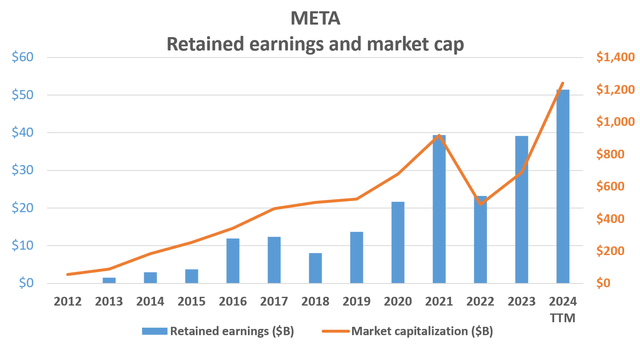

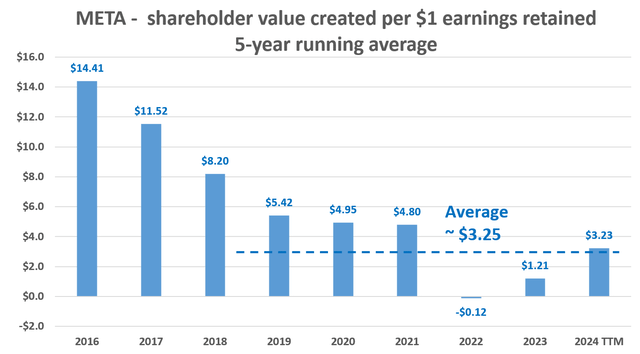

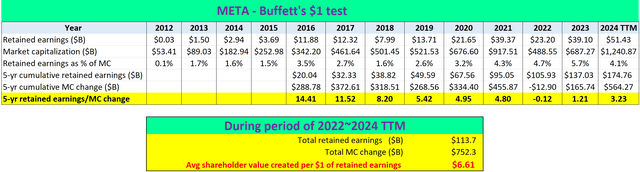

META has been doing a terrific job, as measured by this test, historically. As an example, the next chart below shows the annual market cap (“MC”) of META and the amount of retained earnings since 2012. And the second chart below shows the market cap gain divided by the amount of retained earnings. Note that a 5-year running average was applied here to even out the stock price fluctuations and annual earnings fluctuations. As seen, META has passed the test with flying colors every year, with the only exception of 2012. Since 2019 – after its explosive growth phase has ended – META has rewarded shareholders with an average of $3.25 of MC gain for every $1 of earnings retained.

Of course, the concern is more with what has happened in the recent 1~2 years, since the AI arms race began. And I will examine this immediately below.

META stock: AI investment’s $1 test scorecard

The following Excel spreadsheet shows more details of the $1 test applied to META, and we will examine the scores in the past 1~2 years closely.

The first row shows the annual retained earnings. Indeed, the company has been retaining drastically more earnings recently to fund its rapidly growing R&D and CAPEX projects. To wit, retained earnings reached a record of $51.3 billion as of 2024 TTM based on the financials just released in Q2, more than doubling the figure in 2022. As the third row shows, measured as a percentage of the average market capitalization, the retained earnings have also increased substantially. In the recent 1~2 years, the amount of retained earnings translated into about 4~5% of its market cap, the figure has been generally below 3% in the past.

The statistics at the bottom highlight the scorecard between 2022 and 2024 when AI investments began to intensify. As seen, META has retained a total of $113.7B of earnings during this period and has created a total MC gain of more than $752B. Thus, the average MC gain created by $1 or retained earnings is $6.61, actually far better than the 5-year average shown above.

Of course, this cannot directly dispel the market’s concern (more on this later). But it at least does not contradict its historical record and does not support the market’s concern, in my view.

Other risks and final thoughts

In terms of downside risks, META entails all the risks generic to its other tech peers. Besides heavy R&D and CAPEX, it also faces regulatory risks (especially on the privacy front), competition intensification, etc. Here, I will focus more on the risks specific to my approach here. As just mentioned, META’s scorecard on the $1 test cannot directly dispel the market’s concern over its AI investment (or overinvestment) for at least two reasons. First, the time frame (2022~2024 TTM) used above is quite short. Second, due to the short timeframe, market sentiment can play a large role (e.g., inflating the company stock prices and MC temporarily). A better way to measure the effectiveness of its CAPEX investment is probably a variation of Buffett’s $1 test. Instead of measuring the MC gain created by $1 of retained earnings, we could measure the organic earnings by $1 of CAPEX invested. And this test does not show any alarming signs in my view either.

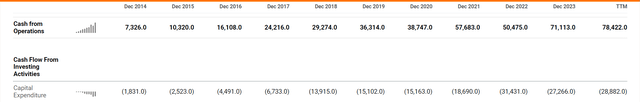

As seen in the chart below, in 2023, META invested $27B in CAPEX and its operating cash increased by about $21B between 2023 and 2022. So the ratio is close to 1. Again, this does not directly dispel the market’s concern either, mostly because of the short time frame and limited data. But it again, at least, does not support the market fear of AI overinvestment.

To conclude, I think META delivered a strong Q2 and view its stock price performance since then as an illustrative example of its resilience. In particular, I am not too concerned about the overinvestment in AI or other new products, judging by the financials release. META has demonstrated an excellent return on its CAPEX measured by the $1 test, and I am not seeing contradictory signs in the recent 1~2 years since the AI race began to heat up.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.