Summary:

- Meta’s 2Q FY2023 earnings led to an 8% rally, reaching a new YTD high, driven by a soft-landing narrative and early-than-expected recovery in the online advertising industry.

- The company’s strategic focus on prioritizing user base growth and AI investments over monetization initiatives has strengthened its market leadership, poised for long-term gains.

- Meta’s “year of efficiency” has demonstrated early success, with cost reduction resulting in a positive trend of margin expansion.

- With a current P/E fwd of 25x, only 10% above the 5-year average, META stock still appears to be undervalued amid the recent AI revolution.

Galeanu Mihai

Investment Thesis

Meta Platforms (NASDAQ:META) experienced an impressive 7% rally, reaching a new YTD high, driven by its impressive 2Q FY2023 earnings results. Without a severe economic downturn in the near term, I anticipate a modest rebound in U.S GDP growth during 2H 2023. This, in turn, is likely to boost online media spendings, leading to revenue acceleration for META.

However, considering the recent price action, investors seem to be expecting a substantial improvement in operating margin in 2H FY2023, potentially resulting in further EPS growth. Despite the stock’s current valuation being stretched over a 5-year horizon, it still remains cheaper than most mega-cap stocks, trading at 25x P/E fwd.

Therefore, I reiterate buy rating on META because the full monetization potential of its AI and MI investments has not been realized yet. As META’s capex/revenue decreases, the FCF profile is expected to improve. These investments could serve as future catalysts, significantly expanding its valuation in the years to come.

2Q23 Takeaway

The fact that META has recently topped both revenue and GAAP EPS expectations may not lead to an immediate 8% rally during aftermarket trading. This is mainly because the stock has already experienced a remarkable 140% YTD. I believe the rally was driven by two factors.

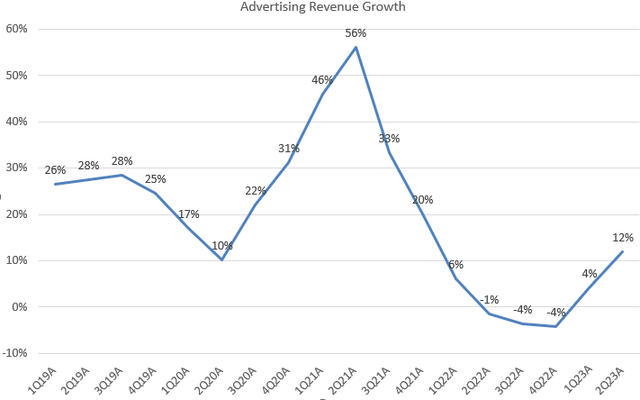

Firstly, META’s advertising revenue growth continues to accelerate, with an impressive 12% YoY growth in 2Q FY2023. We also saw its competitor Google (GOOGL) has also achieved a growth acceleration in its advertising business, indicating a potential early recovery in online advertising spendings.

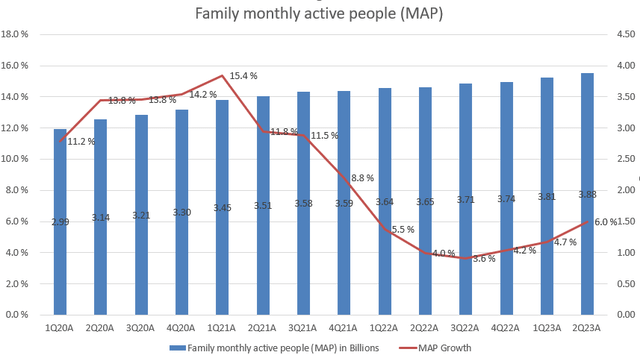

Secondly, the company’s user base has started to show signs of acceleration as well, after a sluggish growth in FY2022. Particularly, META’s Family MAP grew by 6% YoY in 2Q FY2023, marking the highest growth rate since 4Q FY2021. Additionally, FB’s monthly active users (MAUs) is also showing a growth rebound, increasing by 3% YoY, the highest since 4Q FY2021.

Furthermore, investors are enthusiastic about META’s Threads monetization prospects. I admit that Thread’s revenue contribution is yet to be determined, but the initial response has been positive, with 100 million users joining in the first three days of the announcement. I believe any monetization plan on Thread could act as a near-term catalyst to further push the stock higher.

Despite the recent constructive outlook, we still need to be cautious about the potential risk of a recession, which could disrupt META’s ongoing recovery. The market has mostly priced in a soft-landing scenario, but an unforeseen economic downturn could leave the cyclical advertising industry vulnerable, adding downside pressure to the stock.

Focus on User Base Growth

As I mentioned in my previous article, META has been heavily investing in AI, but its ultimate goal is to create a seamless social network ecosystem where all its apps can work together cohesively. Similar to Google, META’s top-line growth is primarily driven by the expansion of advertising revenue.

However, we know that META’s advertising revenue growth has shown signs of weakening since 2Q FY2021. This decline had a significant impact on the stock, leading to a 73% drop last year. I think the primary concern among investors was the fear of reaching peak growth in advertising revenue, as the company experienced multiple consecutive quarters of negative growth in FY2022.

In response to these challenges, I believe META is currently focusing on strengthening its user base before fully implementing monetization plans. This approach may be influenced by the increasing competition from other platforms like TikTok, which had a substantial impact on META’s user growth in FY2022.

Massive Return on AI Investments

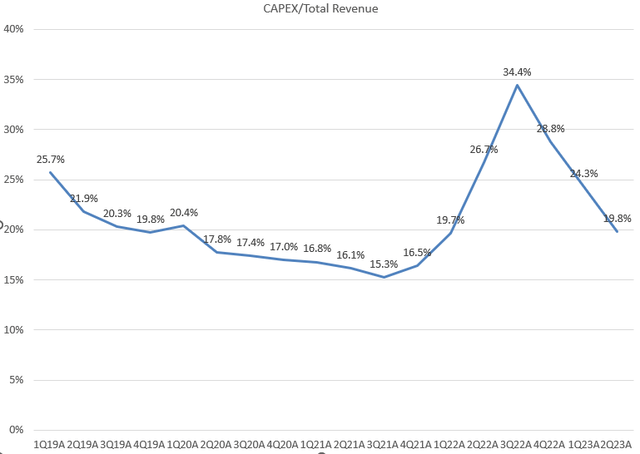

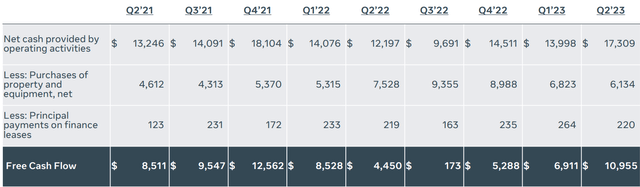

As I previously mentioned, we saw a sharp decline in advertising growth during FY2022, which coincided with an increase in META’s capex for the same year, as shown in the chart. This led to a significant contraction in the FCF margin. However, since 3Q FY2022, there has been a gradual decline in capex relative to revenue, which implies a potential rebound in FCF growth. In 2Q FY2023, META’s FCF has more than doubled on a year-over-year basis, showing a remarkable comeback in its FCF profile.

Therefore, while META’s AI monetization thesis, which has the potential to significantly expand its valuation multiple, has not yet fully materialized, this stage could present a compelling long-term buying opportunity for investors, especially considering the stock’s attractive valuation.

For example, Microsoft (MSFT) recently announced a monetization plan for their M365 Copilot at a premium price of $30 per user per month. This news immediately resulted in a 4% intraday surge in the stock price.

Year of Efficiency

We know that a significant decline in top-line growth coupled with large capex could negatively impact META’s FCF profile, putting pressure on the stock’s valuation. To address this near-term headwind, the CEO Mark Zuckerberg has taken measures to improve the company’s margins. At the start of this year, he referred to FY2023 as the ” Year of Efficiency” and implemented a plan to reduce the company’s team size by around 10,000 employees and close approximately 5,000 open roles that were yet to be filled. This strategic move aims to alleviate operating expenses and boost its operating margin as we saw in the recent quarter.

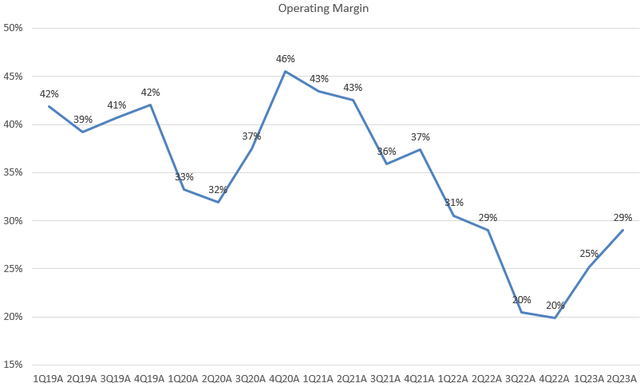

Looking at the chart, META’s operating margin experienced a sharp contraction, declining to 20% in 2Q FY2022. However, in 1Q FY2023, investors saw the first margin expansion since 4Q FY2021. The 2Q operating margin of 29% has reached the same level on a year-over-year basis, indicating a positive trend of margin expansion that is expected to continue in the upcoming quarters.

Valuation

META’s current P/E TTM stands at 36.5x, which is 50% above its 5-year average. According to Bloomberg, the Nasdaq 100 stock index’s P/E is 34.6x, indicating that META’s P/E is relatively in-line with the broader index. However, META’s P/E fwd is currently trading at 25x, which is only 10% above its 5-year average. This suggests that analysts expect a significant EPS growth.

Considering META’s increasing capex on AI technologies, including the Metaverse, which has the potential to structurally drive secular growth under the current AI revolution, I believe a 10% expansion in its valuation multiple is reasonable. In other words, the company’s strategic investments in AI could pave the way for a higher growth trajectory, which deserves a higher valuation.

Given these factors, despite a remarkable 140% YTD rally this year, I believe the stock is still undervalued. The projected earnings growth and the potential for future expansion in valuation multiples make META an attractive investment for the long term.

Conclusion

In sum, META currently is navigating the competitive advertising industry while making strategic AI investments for long-term growth. Despite facing challenges in advertising revenue and margins contraction last year, the company’s focus on efficiency and cost reduction has resulted in a positive trend of margin expansion and earnings growth in FY2023. With a current P/E fwd of 25x, only 10% above the 5-year average, I believe the stock is still undervalued. This is reinforced by the company’s increasing capex on AI technologies, such as the Metaverse, which has the potential to accelerate long-term growth amidst the current AI revolution. Considering these factors, despite a 140% YTD rally, META’s upside momentum remains intact, making it an appealing long-term investment for those seeking to capitalize on the potential of AI monetization. Therefore, I reiterate my bullish stance on META.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.