Summary:

- Reels is a $3 billion run rate business today, but it is expected to be a $5 billion run rate revenue contributor by the end of 2023.

- Instagram and Facebook have seen surprisingly higher engagement levels and daily time spent as the adoption of Reels grows faster than expected.

- Reels monetization will go through the following stages, first neutrality, then scaled monetization, and finally incorporating overlay ads.

- The different ad load mechanics that overlay ads bring can result in more monetization opportunities while not deteriorating the user experience.

- Lastly, the use of AI can be used not just to improve the relevance of Reels shown, but also the ease at which Reels can be created.

grinvalds

After a more than 100% rally in The Barbell Portfolio’s Meta Platforms (NASDAQ:META) position, I often get asked by members whether they should take profit from their Meta position.

I have just written an article on Meta that highlights why I am maintaining the Meta position in The Barbell Portfolio even after the rally we have seen, because I think that Meta still has legs to run from an earnings perspective.

The rally in the share price was aided by the expansion in its P/E multiple from 6x to 19x, but the near-term upside will come from earnings upside as the company is poised to grow EPS at a CAGR of 25% over the next four years.

While part of the near-term earnings upside will come from the efficiency improvements initiated as part of 2023 being the “year of efficiency” for Meta, I do think that there is a huge and increasing opportunity for Meta’s Reels given the rising adoption and improving monetization opportunities.

Where is Reels today?

I am of the opinion that Reels will be a $5 billion run rate revenue contributor by the end of 2023.

Meta announced that in the third quarter of 2022, Reels was a $3 billion run rate business and that there was about $500 million remaining quarterly headwind from Reels monetization that will be neutralized by the end of 2023 or in early 2024.

What has changed?

I think that when I first initiated a contrarian position in Meta, while I knew that the market was overly pessimistic about Meta’s Facebook and Instagram and ignoring the Reels optionality and the strong focus the management team had on Reels, I did not think that Reels would take off so quickly and aggressively.

In my analysis for the 1Q23 quarter, I had this to say about Reels:

Reels is an important part of the story in terms of driving engagement and it’s clear that as management started to ramp Reels that engagement also went up along with it.

Management commented that on both Instagram and Facebook, Reels continued to grow rapidly.

On top of that, Reels also improved in the social aspect. Users were resharing Reels more than 2 billion times each day, two times that from six months ago.

I do think that Reels has been key to increasing engagement in Meta’s Family of Apps in general. In addition, Reels is also believed to be gaining share in the short form video format as it continues to ramp up.

In the 1Q23 quarter, Reels monetization efficiency increased 30% on Instagram and 40% on Facebook when compared to the prior year.

Reels is expected to gradually become neutral to Meta’s overall revenue by end 2023 or early 2024.

Clearly, Meta’s Reels was accelerating and gaining adoption at a much quicker rate than before.

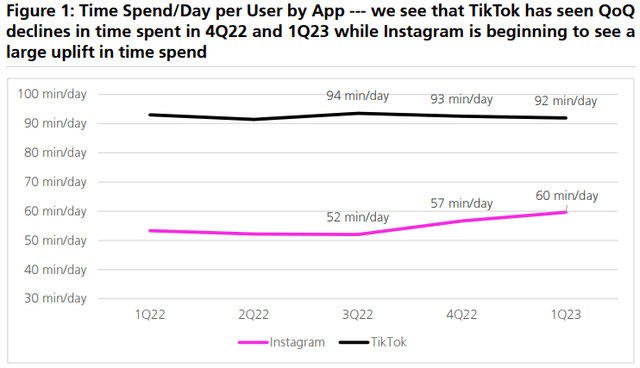

As can be seen below, since Reels adoption kicked off, Instagram has seen a meaningful increase in time spend on the platform while TikTok has seen declines in the time spent on its platform.

Instagram vs TikTok time spent per day (Sensor tower)

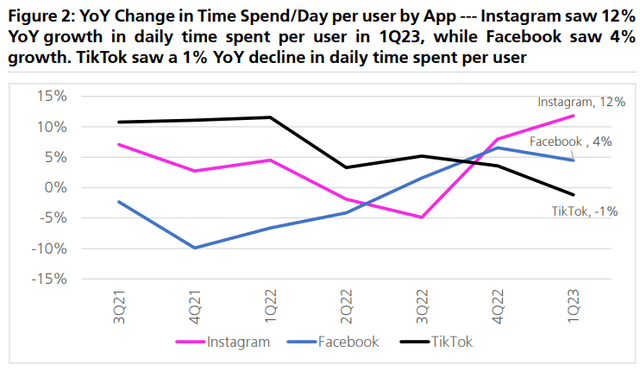

The same picture is painted below when we look at the year-on-year growth for the time spent daily per user as Instagram and Facebook are in an upward trend since 4Q21 for Facebook and 3Q22 for Instagram, while TikTok has seen growth decelerate and even turn negative in 1Q23.

Year on year growth in time spent for Facebook, Instagram and TikTok (Sensor tower)

As a result, this highlights to me that there is an increase in engagement in both Facebook and Instagram for Meta.

With a higher engagement rate and continued traction in its engagement rate, given that both platforms have time spent per day still significantly below TikTok, there is room for a more optimistic assumption that we could see an increase in engagement.

Earlier I assumed that we could see engagement for Facebook and Instagram increase by about 15%, but I think that there is now the opportunity for the increase in engagement to be anywhere between 18% and 30%, and I’ll elaborate more on this next.

Monetization of Reels

Ramping up Reels to a monetization level to that of Newsfeed or Stories will take time.

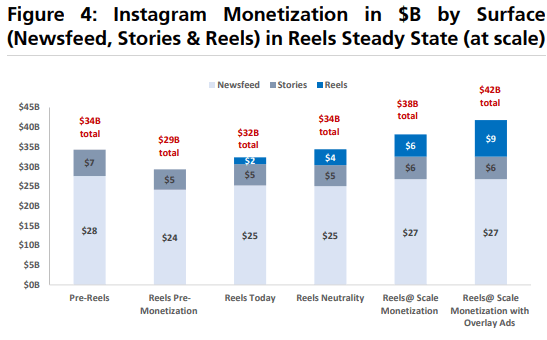

Reels could be about a $5 billion revenue headwind in the near-term, but presents an 18% ad revenue tailwind to Meta in the longer term.

Here’s why:

I found that Reels has the potential to be a much bigger portion of Instagram’s revenue mix than Stories in the longer term. Reels is driving more engagement on the platform than Stories and given its higher watch rate, it is expected to become a pivotal part of Instagram in the long term.

Another reason for the huge ad revenue tailwind in the longer term is because Reels, when it is ramped up and in a steady state, will also drive the overall time spent on the platform, leading to more time spent on Newsfeed and Stories, and in turn, more opportunities for Meta to serve ads.

Lastly, with Reels, we have to consider that there is ultimately a higher ad load potential when incorporating overlay ads. If overlay ads were to be incorporated meaningfully, there could be a 14-percentage point improvement in Instagram revenue just from the overlay ads alone.

As shown below, the first scenario pre-Reels is based on the year 2020, which is used as a benchmark year. In 2020, the total Instagram revenue was just under $35 billion, with $28 billion from Newsfeed and $7 billion from Stories. I expect that when Reels reaches neutrality, it could contribute $4 billion in revenue to Instagram and at scale, will contribute $6 billion in revenue to Instagram. With overlay ads, we could see Reels revenue contribution of $9 billion in total.

When at scale, Instagram could generate $36 billion in revenues, $13 billion from Reels and Stories and $23 billion from Newsfeed, while when we incorporate overlay ads, this adds 18% upside to that number as the total revenue generated at Instagram could go up to $42 billion.

My analysis is focused on Instagram, but I would argue that we will see a similar trend on the core Facebook platform. I chose to focus on Instagram mainly because Reels adoption is at a lag at Facebook compared to Instagram given that it is still more nascent on the Facebook core app.

In the analysis below, I assumed zero MAU growth when in reality, MAU has been growing in recent quarters. At the end of my analysis, I think that the steady state for Reels will definitely take some time, with at least five years to go. The reason for this is that Stories took almost seven years to reach its steady state when it reached monetization parity with Newsfeed. Reels is currently at its three-year mark today and as management has mentioned before, it will take longer to reach monetization parity than Stories. However, I would not be surprised if we saw this process accelerated given Meta’s generative AI and AI discovery engine initiatives.

Instagram Monetization opportunity for Reels (Sensor tower, App Annie, UBS, company reports)

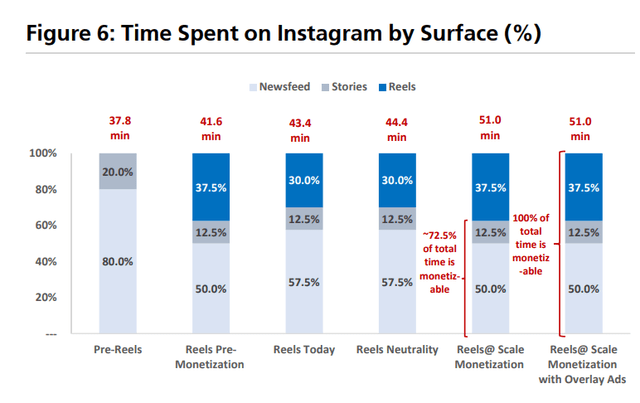

I will now go through some of the assumptions to my model, as shown above.

Before Reels, there was a split between Newsfeed and Stories of about 80% and 20%.

However, Reels changed the dynamic of the time spent on Instagram.

After Reels was launched, Reels took up almost 30% of the time spent, while Newsfeed and Stories went down to 58% and 12% respectively.

Reels was also incremental to time spent on the Instagram app as users were spending about 38 minutes before Reels, and after Reels was launched, users spent 42 minutes on Instagram daily.

I assume that a user will spend 51 minutes each day on Instagram, representing a 35% increase in time spent compared to before Reels was launched.

I also assumed that the mix would shift towards users spending about 38% of their time on Reels, 12.5% of their time on Stories and the remaining 50% of their time on Newsfeed.

In terms of ad load, Newsfeed has an ad load of between 20% to 25% while Stories has an ad load of around 30%. I assume that we are able to reach an ad load of around 30% for Reels, similar to what we see with Stories.

Time spent on Instagram by Surface (Sensor tower, App Annie, UBS, company reports)

What are overlay ads?

Overlay ads are basically ads in the form of either a banner or sticker that are placed on a Reel when it is being played.

In 2022, Meta launched its overlay ads experiment to creators in more than 50 countries.

This new ad format is a transition away from the traditional way that Meta has been showing Ads.

Meta has been traditionally showing ads that are inserted between content or posts. With overlay ads, this brings a different ad load mechanics and can help with monetization.

Meta’s overlay ads for Reels (Meta)

In my view, overlay ads will enable Reels to have a higher ad load while at the same time, being less disruptive to the user experience.

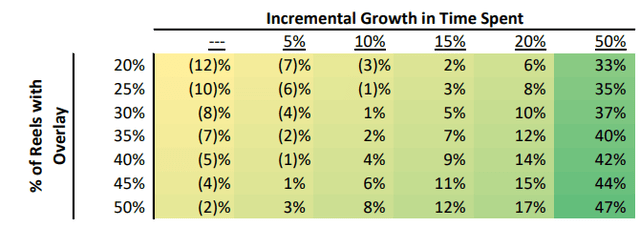

UBS did a sensitivity analysis to show how the different levels of Reels with overlay and how the incremental growth in time spent from Reels will affect Instagram revenues. In short, with 20% incremental growth in time spent and about 30% of Reels with overlay, this brings an increase of 10% to Instagram’s revenues.

Sensitivity analysis showing the percentage of Reels with overlay and the incremental growth in time spent from Reels (UBS)

Reels monetization levers

There are multiple ways for Reels monetization to improve.

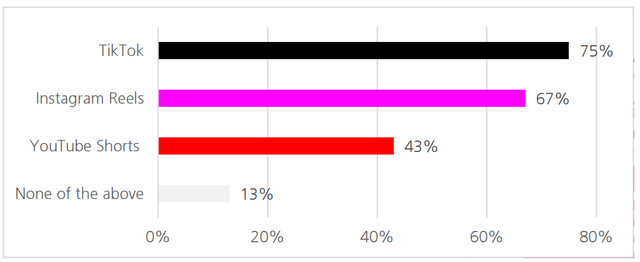

First, Reels monetization can improve as advertiser adoption of Reels increase. Reels, although part of the short-form video format, is a relatively new and unproven format. As more advertisers gain confidence in the returns on investment on advertising on Reels, and along with an improvement in the macroeconomic environment that leads to bigger ad budgets, we could see more advertisers begin to adopt Reels.

Short-Form Video (SFV) Platform that US Ad Buyers say their largest clients are advertising on, Dec 2022 (e-marketer)

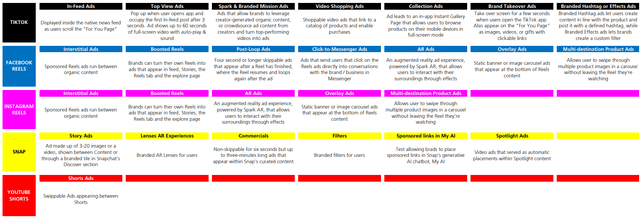

Second, Reels monetization can improve as more ad formats are delivered to advertisers on Reels. As can be seen below, ad formats can vary from platform to platform and Instagram and Facebook can learn from TikTok’s ad formats to improve monetization.

Video ad formats offered by various short-form video platforms (Company disclosures)

Third, by increasing the usage of ad formats like overlays, the monetization of Reels can be improved as ad loads are improved while user experience remains positive.

The importance of AI

I think that the recent talk about AI and generative AI tools will help speed up the monetization of Reels and improve the engagement levels for Reels.

Firstly, its AI discovery engine is able to generate recommendations of relevant Reels that may not be from an account a user has followed. This AI discovery engine has not just enabled improved discovery of a Reel, but also led to higher engagement rates. Meta has stated that since Reels was launched in 2020, AI recommendations have led to more than 24% increase in time spent on Instagram. With improved engagement metrics, this will drive more advertisers to the platform and create a flywheel effect if successful.

Secondly, there are generative AI creative tools that can help with the generation of Reels. There are tools like Image Outcropping that Meta is currently testing where it allows the same creative assets to be easily adjusted and then used for multiple surfaces like Reels and Stories. Other ways where generative AI could help is by streamlining the product design, marketing and data analytics process to improve the efficacy of ads.

Conclusion

I do not think that the market has priced in the full potential of Reels yet.

However, we can see that Reels is not just increasing the time spent on its platforms, but also steadily growing in terms of the proportion of time spent relative to other formats like Newsfeed and Stories.

At the end of the day, while Reels neutrality will soon be achieved, when Reels reaches scaled monetization and when that is coupled with overlay ads, there is a 18% tailwind for Instagram revenues alone.

Overlay ad could be a new ad format that will help with ad load and not deteriorate the user experience along the way, leading to a smoother path to scaled monetization, as well as more room for monetization.

Lastly, I think that the use of AI to not just make it easier for creators to make Reels, but also to drive adoption and engagement of Reels will go a long way to driving monetization for the format.

I do think that we are just at the beginning for Reels, and that it is possible for TikTok and Reels to be the dominant short-form video format in the world.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 51% in the past year through owning high conviction growth, value, and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!