Summary:

- Meta Platforms, Inc.’s recent plan to cancel its premium headset and restructuring of Reality Labs are improving sentiment and profitability prospects.

- This could catalyze a stock price breakout in the near term.

- In the longer term, Reality Labs cost cuts should help to expand its profit margins noticeably in the near future (my model points to about 200 basis points expansion).

- But the market has not fully factored in such expansion yet, resulting in a mispricing opportunity.

Andrey Zhuravlev

In my last article on Meta Platforms, Inc. (NASDAQ: NASDAQ:META), I addressed a concern surrounding its AI expenditures. After examining its recent financials by Buffett’s $1 test, I am not alarmed by its AI-related investments, as the company continues to demonstrate robust returns on its investments. Since then, the company has made another strategic move on its capital allocation. The company has announced several changes to its Reality Lab (“RL”) and the details are quoted below.

Aug 23 (Reuters) – Meta Platforms has canceled plans for a premium mixed-reality headset intended to compete with Apple’s Vision Pro, the Information reported on Friday. The company told employees at its Reality Labs division to stop work on the device this week after a product review meeting, the report said citing two Meta employees. The axed device was internally code-named La Jolla and was scheduled for release in 2027, the report said. It was going to contain ultrahigh-resolution screens known as micro-OLEDs — the same display technology used in Vision Pros.

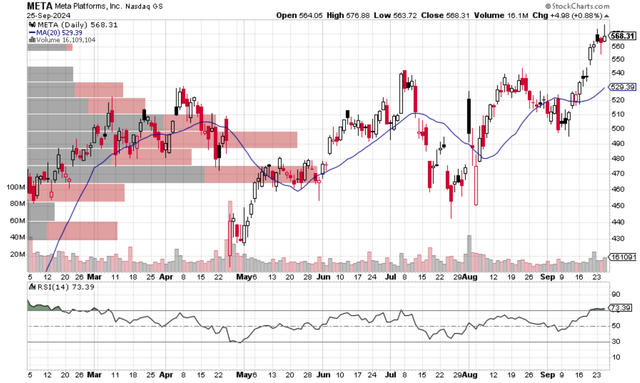

These announcements have been received favorably by the market, judging by the stock price movements afterward, as illustrated by the chart below. The stock prices have overtaken their earlier peaks and now hovers around an all-time high. Given these new developments, it is the goal of this article to argue that A) the stock price now demonstrates strong sentiment and is very likely to break out in the near term, and B) the cost cuts could fundamentally improve its profitability and support higher stock prices in the longer term too.

META stock price could break out

META’s stock price actions after the above announcements suggest a favorable technical outlook. More specifically, the top panel of the chart above describes the price-volume trading information of META with its 20-day moving average. The bottom panel shows its Relative Strength Index (“RSI”).

As seen, META stock prices have attempted the $530~$540 resistant level a few times in the past 6 months. Since the announcements, the price of META has finally overtaken this level and now sits noticeably above it. Moreover, it also consistently traded above its 20-day moving average since these cost cuts were announced. This so-called upward crossover is a typical technical signal that suggests buying pressure outweighs the selling pressure.

Furthermore, note that the RSI also started to increase since these announcements. The RSI used to be below 50 and currently sits at 73.39, squarely in the overbought regime and confirming the large buying pressure mentioned above.

Next, I will argue that its fundamental profitability could support higher stock prices in the longer term, too.

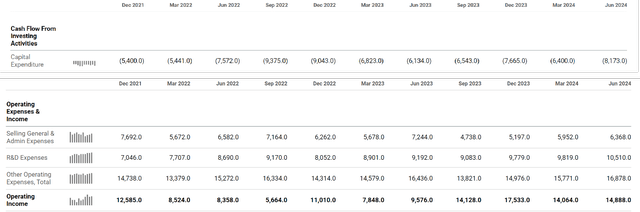

META stock: recent cost surges

Among the many concerns that have caused its price volatility in the past few months, a top one on my list is the concern of its increasing expenses and potential subsequent margin pressure. For example, the screenshot below was taken from its cash flow statement and income statement. As seen, both CAPEX and Research and Development (R&D) expenses have experienced a noticeable uptick recently. As an example, between June 2023 and June 2024, its R&D expenses witnessed a significant increase, climbing from $9,192 million in June 2023 to $10,510 million in June 2024, representing an increase of over 10% in one year. The CAPEX expenses climbed even more, from $6,134 million in June 2023 to $8,173 million in June 2024, an increase of more than 33% in one year.

These rises, while reflecting META’s continued investment in innovation and product development, have also concerned me (and the overall market too) due to the uncertainties in their returns and their implications for its ongoing profitability.

Next, I will explain how the cost-cost efforts surrounding the RL have effectively addressed much of my concern.

META stock: RL cost’s potential impact on margins

Besides the cancellation of its premium headset, the cost-cut efforts also include other components, such as the restructuring of the RL. Overall, my estimate is these cost-cut efforts could potentially lower RL hardware expenditures by 20% by 2026 and lead to about $3 B of cost savings. Such cost savings are still not factored fully into its market prices and thus create a mispricing in my view.

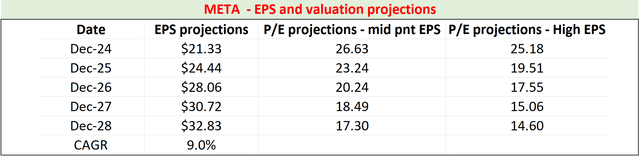

More specifically, next, I will show why I think the market’s projection for its net profit margin (“NPM”) is too conservative. Let me start with the following consensus estimates. As seen, the market consensus anticipates META’s EPS to grow from $21.33 in FY 2024 to $32.83 in FY 2028. This projection translates into a CAGR of 9% for the next five years.

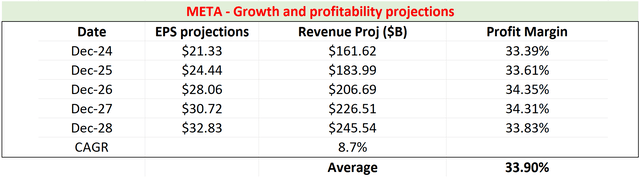

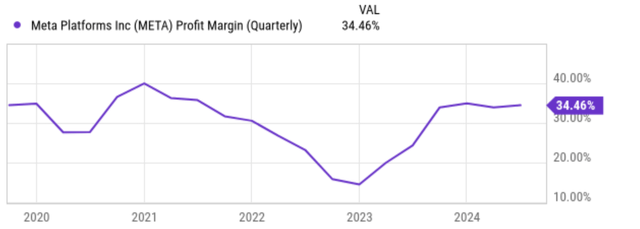

Next, I will combine the above EPS projection with the market’s consensus revenue estimates to back out the implied NPM. To wit, consensus estimates project META’s revenues to increase from $161B in FY 2024 to $245 in FY 2028, implying an annualized rate of 8.7% CAGR. Remember that consensus expects its EPS to grow at a very similar rate (9%). In my mind, this means that the consensus does not expect any meaningful margin expansion. Indeed, as a quick and dirty estimate, the table below computed its NPM implied by the consensus estimates by assuming a fixed share count (of around 2.53 billion shares). My calculations indicate that the implied NPM is on average 33.9% for the next 5 years, very close to its current margin of 33.46% currently (see the next chart below).

I thus think the current market consensus has not fully priced in the impacts of its RL cost cuts yet. As aforementioned, my estimate is that these cost cuts could lead to about $3 B of cost savings by 2026, translating into a margin expansion of around 200 basis points for the next few years.

Other risks and final thoughts

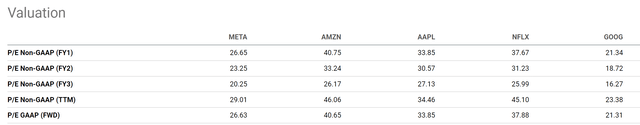

As another reflection of the mispricing, the chart above provides a comparison of META’s P/E ratio to the rest of the FAANG stocks: Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Google (GOOG). As seen, on any of the bases (FWD, TTM, etc.), META’s P/E ratios are the second lowest among this group (with GOOG being the lowest). Trading at an FY1 P/E of 21x only, the stock is too cheap in my view given its growth potential, market-leading position, superb profitability, and the potential for further margin expansion as argued above.

In terms of downside risks, META’s stock prices might be due for a pullback in the near term. If you recall from the first chart, the overbuying has already lasted for a few days by now, judging by the RSI signal. However, given the strong uptrend and strong business fundamentals, my view is that a short-term correction could present a buying opportunity rather than a reversal of the overall trend, as detailed next. In terms of business fundamentals, investors could see higher depreciation expenses in the near term due to the surge in CAPEX expenses recently. This could hurt its near-term profitability metrics, but I only consider them as accounting artifacts and would not rely on such jitters to evaluate its long-term profitability potential.

All told, I consider META’s strategy to cut RL costs as the right step to shore up profitability and also better focus its resources on more promising products. These cost-cut efforts should help to expand its profit margins noticeably in the near future. However, I don’t think the market consensus has fully factored in such expansion potential yet, resulting in a mispricing opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.