Summary:

- Meta Platforms, Inc. is reinventing its business and focusing on AI, with new AI tools and personal AI assistants being introduced at Meta Connect 2023.

- The market opportunity for personal AI assistants was predicted to be over a trillion dollars, with users willing to pay a few hundred dollars for such services.

- Meta Platforms stock remains a bargain at 14x normalized earnings not including AI upside, once the tech giant eliminates Metaverse losses.

Damir Khabirov

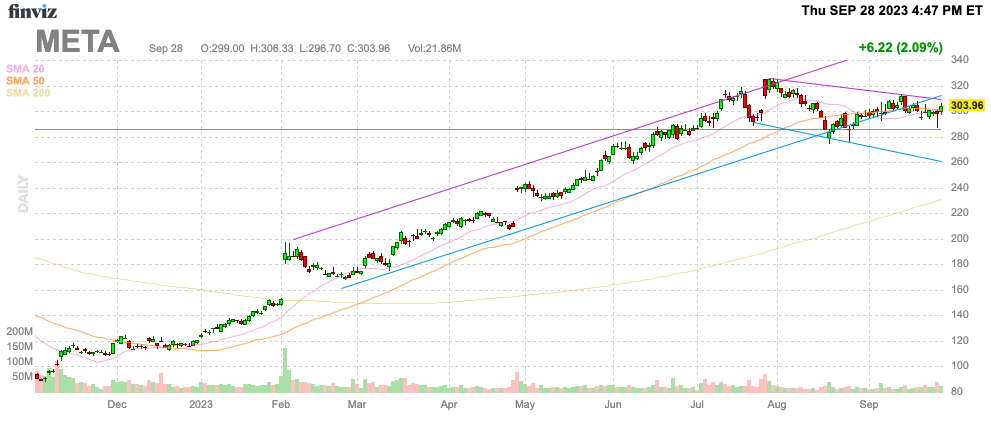

Over the last few years, Meta Platforms, Inc. (NASDAQ:META) has been a controversial stock and a very volatile investment. The social media giant has now reinvented the business and is poised to ride the AI wave higher while still struggling to live up to its new name. My investment thesis remains ultra Bullish on the stock after the 2-month pause above $300 and the unleashing of new innovations in the AI space.

Source: Finviz

Meta Connect 2023

Meta already had a promising future with Reels boosting social media advertising and the potential of the Metaverse. Suddenly, AI has taken over the opportunity sphere, pushing the Meta Quest 3 and Reels into afterthoughts for the business.

The company announced new AI tools at the Meta Connect 2023 event, including personal AI assistants with 28 AI personality characters. While a lot of work is focused on large language models and generative AI tools like ChatGPT from OpenAI, a real big opportunity could exist in these personal AI assistants under Meta AI. Meta plans to implement assistants that can interact with users over all of their platforms: Facebook, Instagram, and WhatsApp.

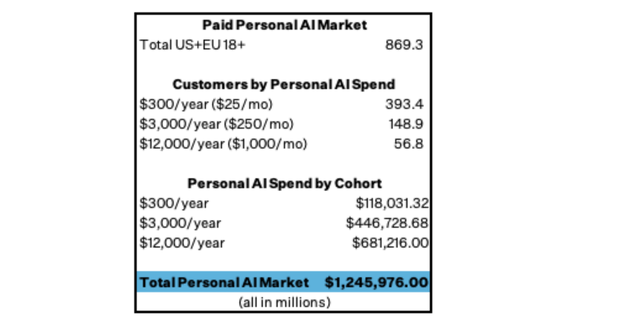

Deepwater Asset Management did a study a few months ago highlighting the huge opportunity in personal AI assistants. The investment managers predicted over a trillion dollar market opportunity in Personal AI.

Based on a survey, users appeared willing to pay on average a few hundred dollars for a personal AI assistant. The amount seems massive, but a lot of people already spend $240/year on ChatGPT Plus.

The math is simple. The U.S. and EU have 869 million people 18 or over. The math comes out to a $1.25 trillion market opportunity for personal AI assistants based on the amounts people were willing to spend according to the survey results.

Source: Deepwater Asset Management

Meta is incorporating personal AI into their social media sites, so the actual money might end up being made via advertising. Though, a lot of social media sites are making progress at charging subscriptions, such as Snapchat+, from Snap (SNAP), with 5+ million subscribers now that originally included AI chat functions into the subscription service.

Meta currently has a revenue base of $130 billion and Alphabet/ Google (GOOG, GOOGL) equally has a revenue base of $300 billion. Both of these large tech companies are attacking the AI market, and a trillion dollar opportunity is massive for even these tech giants.

Overcoming Bad Habits

The biggest frustration with the Q2 earnings report from Meta was a continued push into spending on the Metaverse. The company launched the Quest 3, but Meta forecasts spending even more on the money burning segment that is already losing at a $15 billion annual run rate.

Baird analyst Colin Sebastian forecasts the Quest 3 doing $3 to $4 billion worth of revenues in the next 12 months. The major problem here is that the AR/VR device costs $500 and might not have a positive gross margin.

The Reality Labs division only produced $0.6 billion in revenues in the 1H’23 and $2.2 billion during 2022. The new AR/VR device is definitely expected to boost category revenues, but the profit picture isn’t likely to improve due to the potential for these devices to be sold at a loss.

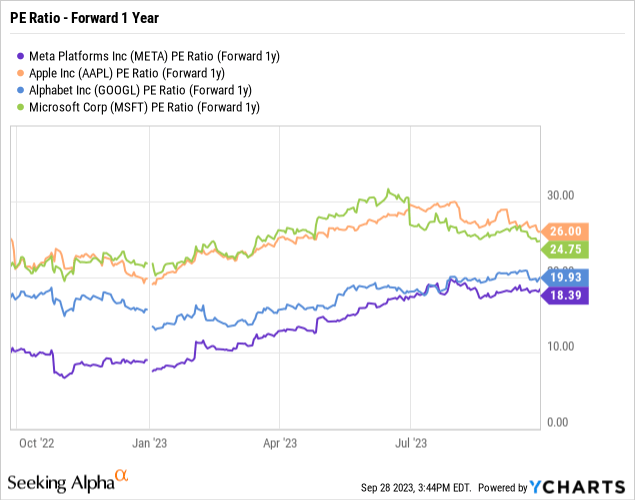

Even with the Reality Labs division holding back earnings by an estimated $5 per share, Meta is still the cheapest tech giant, trading at a forward P/E multiple far below Apple (AAPL) and Microsoft (MSFT).

Meta appears poised to benefit from the AI wave far better than Apple with no real plans and compete with Google and Microsoft in this area.

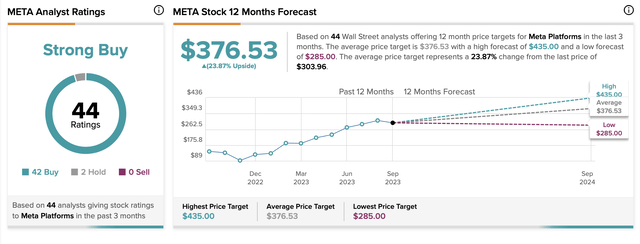

The stock trades at 18x 2024 EPS targets of $16.44, and the elimination of the Reality Labs losses would boost EPS up to $21 per share. Meta only trades at 14x normalized EPS targets.

The stock has bounced substantially off the lows from late 2022. Meta still hasn’t hit a new all-time high from the levels above $380 back in 2021, and this push into AI and some upside from the Metaverse division would boost the stock.

Takeaway

The key investor takeaway is that Meta Platforms, Inc. remains exceptionally cheap, with AI becoming another driver of growth. The company is entering the personal AI assistant category where the market opportunity could be large whether the company monetizes the usage via advertising or eventually introduces a subscription fee.

The stock has been stuck around $300 for a couple of months now. After the market selloff, Meta appears poised to make the next run. Several analysts hiked price targets and the average analyst estimate now up at the old all-time high appears the next path for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.