Summary:

- Meta Platforms is not just a social media company but a tech giant leading in AI and augmented reality, setting up for long-term dominance.

- Meta’s open-source Llama AI models and AI assistant are driving significant user engagement and revenue growth, with click-through rates up 11% and conversions rising 7.6%.

- Meta’s Reality Labs is pioneering AR hardware, like Orion glasses, which could redefine tech interaction and potentially rival smartphones in ubiquity.

- Despite heavy investments, Meta maintains strong financial health with operating margins above 40% and is expected to generate $95 billion EBIT by 2027.

- In my view, an expected return of 8-17% CAGR through the next 3 years should be reasonable, as Meta is on track to push beyond the $2 trillion valuation mark.

Derick Hudson

Meta Platforms (NASDAQ:META) (NEOE:META:CA) is often seen as the company behind Facebook and Instagram, but over the last few years, they’ve transformed into a powerhouse in the AI and virtual reality world. Surely, when I look at Meta, I don’t just see a social media company—I see a tech giant at the forefront of AI and the future of computing. They’re not afraid to take bold bets on what comes next, whether that’s building open-source AI models or investing heavily in augmented reality hardware. These moves are setting Meta up to dominate the tech landscape for years to come. And accordingly, for anyone with a long-term mindset, I argue that Meta offers a rare combination of visionary innovation and strong financial performance. It’s not just a good bet for the next year or two—it’s the kind of investment that could define the next decade. If you’re looking for a stock that’s positioned to lead in AI, Meta is where I’d place my bet.

Meta’s Game-Changing AI with Llama Models

One of the most exciting things about Meta is their AI development, particularly their Llama models. Now, I know AI models might sound a bit tech-heavy, difficult to understand compared to social networks, but here’s why they matter: Meta is building some of the most open and accessible AI tools out there. Their Llama models, like the new Llama 3.2, are designed to be used by developers everywhere. These models can do everything from understanding text and images to running smoothly on smaller devices. What’s more, Meta has made Llama open-source. That means developers across the world can use and build on it, which is already happening—Llama has been downloaded 400 million times on Hugging Face. This is significant because it means Meta doesn’t just benefit from its own AI breakthroughs, but from a whole community of developers innovating on top of its models. By empowering others to build, Meta is making sure it stays at the heart of AI advancements, while OPEX for Meta as a business are kept minimal. Building on the power of open-source, Meta’s AI assistant is quietly becoming one of the most-used AI tools in the world. Indeed, Mark recently revealed at Meta Connect 2024 that Meta’s AI assistant counts almost 500 million monthly users, as it’s integrated seamlessly across all platforms (e.g., Facebook, Instagram, WhatsApp, Threats, Messenger).

And here’s where it gets really interesting: Meta has already figured out some first ideas of how to make this AI work for their bottom line — contrary to the AI business models of some other Magnificent 7 peers. Thanks to AI, Meta Platforms has seen a jump in ad performance, with click-through rates up 11% and conversions rising 7.6% thanks to AI. So, not only is the AI improving user experience, but it’s also driving real revenue growth. If Meta can keep scaling this across its billions of users, the financial upside may be massive. To further underscore this thesis, I point out that Meta’s ad revenues in the second quarter were up 22% YoY, compared to 11% YoY growth for key competitor Google. This trend may suggest that Meta’s AI tools may help the company to take market share.

The Future of Computing? Meta’s Reality Labs

Now, let’s talk about something that feels like it’s out of a sci-fi movie: augmented reality (AR). Meta’s Reality Labs division is pouring billions into developing AR hardware, and this has often been a thorn in the side of many investors. However, I argue that Meta’s investments are paying off, with recent demo of the Orion glasses clearly indicating a path for commercializing the company’s innovation in AR/VR. While the Orion glasses aren’t available to the public yet, the tech behind them is game-changing. Imagine wearing lightweight glasses that blend the digital and physical world together, powered by Meta’s AI. This could completely redefine how we interact with technology, moving beyond the smartphone. Seeking Alpha analyst Stone Fox capital has described Meta’s Orion demonstration as another “iPhone moment“.

Admittedly, calculating the financial upside of such a venture is challenging due to its uncharted nature and significant upfront costs. However, the theoretical upside is immensely attractive—creating the next must-have hardware that could rival the smartphone in ubiquity and impact. Meta’s bold investments highlight their willingness to take big risks for potentially transformative rewards, positioning them to lead in a future where AR becomes mainstream.

Financial Strength Despite Heavy Investment

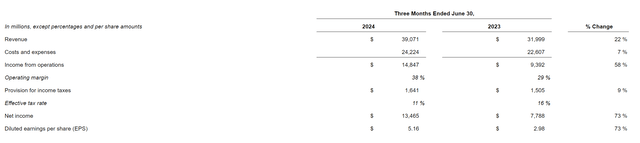

Meta has managed to balance its massive investments in AI and AR while still keeping its core businesses strong. In 2024, their revenue is expected to grow by over 20%, which is impressive considering the scale at which they operate. Moreover, even with billions being funneled into futuristic projects, Meta remains highly profitable, with operating margins (EBIT) sitting above 40%, and Return On Equity above 35%. Thus, Meta is not sacrificing today’s success for tomorrow’s innovation—the company is managing for both. In Q2, Meta’s revenue was up 22% YoY, while income from operations surged 58% YoY, to $14.9 billion ($60 billion annualized).

While Meta’s stock has already seen impressive growth, it’s far from reaching its full potential. Indeed, Meta boasts an enormous user base across all emerging markets. As these markets continue to grow economically, advertising expenditures will naturally increase, and Meta is positioned to automatically capture these rising ad dollars. In other words, businesses aiming to reach the expanding disposable income of the emerging markets will gravitate toward Meta’s platforms—Facebook, Instagram, and WhatsApp—where their target audiences are already highly engaged. At the same time as Meta is capturing this growth, incremental expenses should be kept at a minimum: Its platform model allows it to scale effortlessly, serving additional users at minimal cost, and without the need for significant incremental investments typical of physical businesses.

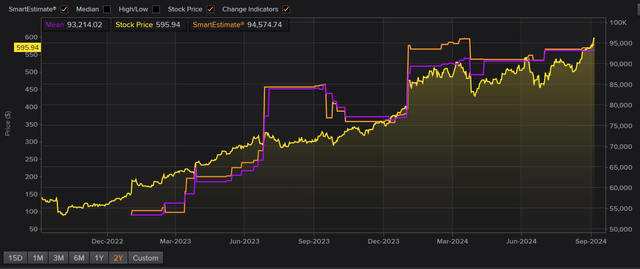

Taking all financial considerations together, analyst consensus currently estimates that Meta will generate approximately $95 billion of EBIT in 2027. If we assume that the stock should trade at a terminal EBIT value of 20-25x, which reflects a terminal earnings yield of about 4.5%, then the estimated valuation range for Meta in 2027 should be $1.9 – $2.4 trillion. Compared to Meta’s trading value of less than $1.5 trillion currently, investors may expect an 8-17% CAGR through the next 3 years — which I feel is a very rich return for taking equity risk on a high-quality stock such as Meta.

Final Thoughts

Meta Platforms is evolving into a powerhouse in artificial intelligence and virtual reality. The company boldly invests in what’s next, from developing open-source AI models to heavily funding augmented reality hardware. These strategic moves are positioning Meta to potentially dominate the tech landscape for years to come. Accordingly, for those with a long-term perspective, Meta offers a rare combination of visionary innovation and strong financial performance.

With $95 billion of EBIT estimated for 2025, I see Meta stock as attractively valued: In my view, an expected return of 8-17% CAGR through the next 3 years should be reasonable, as Meta is on track to push beyond the $2 trillion valuation mark.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.