Summary:

- Meta Platforms, Inc. beat results on improving engagement trends, while guidance came in better than expected.

- Engagement trends reached record levels for a second time due to its AI content discovery engine and Reels adoption.

- The company remains disciplined on capital expenditures and operating expenses as it executes on its year of efficiency.

- Meta still looks attractively priced, as it is currently trading at 16x 2024 P/E.

- My 1-year price target for Meta is $298, implying an upside potential of 28% from current levels.

panida wijitpanya

Meta Platforms, Inc. (NASDAQ:META) has seen a strong rally since October 2022, and I have been telling members of Outperforming the Market about the opportunity I see with Meta as recently as February 2023.

Despite the strong rally we have seen, I think that Meta looks attractive at current levels, although the contrarian opportunity might be gone. The rally in the share price was contributed by the expansion in its P/E multiple from 6x to 16x, but the near-term upside will come from earnings upside as the company is poised to grow EPS at a CAGR of 25% over the next four years.

I have previously written articles on Meta, including an article elaborating why I think Meta is winning the war against TikTok, which can be found here.

Overview of results

Revenue came in at $28.6 billion, up 6% year-on-year excluding the effects of FX, which was 4 percentage points above consensus. This was due to the advertising revenue strength, which was up 7% year-on-year excluding the effects of FX, 5 percentage points above consensus. The strength came from the RoW region and APAC regions, which grew 10% and 4% from the prior year.

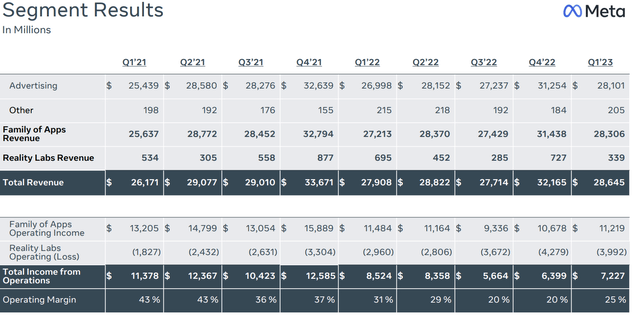

Family of Apps revenue and operating income was solid as revenue grew 4% from the prior year, while operating margin was at 39.6%.

Reality Labs revenue fell 41% year-on-year and lower than consensus, while operating losses for Reality Labs came in at $4 billion.

Meta’s Q1 2023 GAAP EPS of $2.20 was above consensus of $2.02. The company repurchased $9.2 billion of shares in 1Q23 and has $42 billion of stock repurchases available in its authorization.

Q2 2023 guidance was 4 percentage points above consensus at $30.75 billion in the midpoint. Operating expenses guidance was lowered from $89 billion to $95 billion down to $86 billion to $90 billion.

2023 capital expenditure spend is maintained at between $30 billion to $33 billion. Meta is spending on more efficient data center architecture to support its non-AI, core AI, and generative AI workloads.

Cost improvements in Family of Apps business

In the Q1 2023 quarter, the Family of Apps margin increased to 42.9%, excluding the impact of one-time charges. This was an increase of 70 basis points relative to the prior year.

Meta continues to identify roadmaps which it can streamline and wind down projects that are not in its top priority. At the same time, work continues to streamline the business in terms of operational efficiency.

Even as Meta resumes hiring, the areas in which it hires includes priority areas like generative AI, infrastructure, AI, Reality Labs, amongst others.

Meta’s segment results (Meta IR)

At the same time, Meta continues to think of Reality Labs as a long-term project. However, this long-term project has resulted in operating losses of almost $4 billion in 2023, and I expect that the business will result in an operating loss of about $15 billion for the full year 2023.

That said, I am looking to monitor the trend for Reality Labs as Meta looks to launch in the second half of 2023 its Quest 3 product. On a positive note, despite the operating losses, there were more than 1 billion Meta Avatars created to date, and there was a two times increase in the number of titles with more than $25 million in revenue. Lastly, about half of Quest daily active users (“DAU”) are now spending more than one hour on their devices, highlighting increasing engagement signs for Reality Labs.

Ultimately, I see Reality Labs as an expensive optionality into the Metaverse for Meta given the continued capital expenditure spend and operating losses it will potentially bring over the next few years until the metaverse theme shows that it can really kick off.

Improving engagement trends

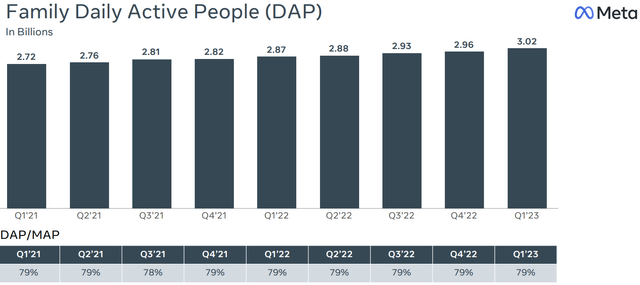

What a difference one year makes. In late 2021, when the Family Daily Active People metrics were reported, there was a concern that growth was slowing and the bearish comments that were made suggested that we would see Meta’s scale fall from then on.

In 1Q23, Meta’s scale continued to grow as it exceeded 3 billion in terms of its Family Daily Active People, which is up 5% year-on-year.

On top of that, the DAP/MAP ratio reached a record high of 79.3% in 1Q23.

This was the second consecutive quarter of higher engagement trends, as DAP/MAP ratio continued to break records.

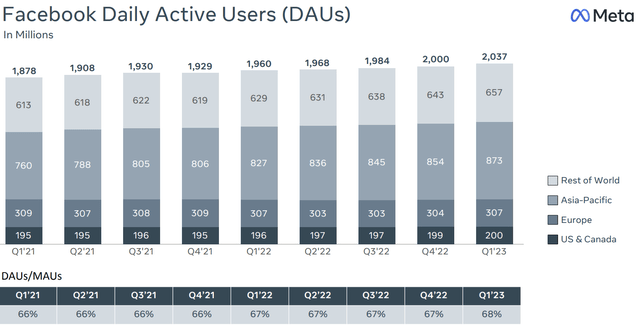

The trend was similar for core Facebook business, as Daily Active Users increased by 4% to a record $2.037 billion Daily Active Users while the engagement trends reached a record 68%

Facebook Daily Active Users (Meta IR)

Why did Meta’s engagement continue to improve and reach records? I think this is due to both the continued investments and progress in both the AI content discovery engine and Reels. I will elaborate more on both of these dynamics in the next section.

AI Content Discovery Engine

The improving engagement trends seen across Meta’s Family of Apps was a result of its AI content discovery engine. Meta has continued to invest in recommendations and ranking systems that has resulted in continued improvements in its discovery engine. In turn, the continued improvements in its discovery engine has led to relevant content being recommended to the right people.

Meta commented in its recent Q1 2023 earnings call that more than 20% of the content users see in their Instagram and Facebook feeds today are recommended from this AI content discovery engine from groups or accounts that users currently do not follow. In fact, the figure is higher on Instagram, as 40% of the content you see are from accounts not followed by users recommended by the discovery engine.

On top of that, after the launch of Reels, Meta’s AI recommendations resulted in an increase in time spent on Instagram by 24%.

As a result of continued improvements and works on AI, it is also helping improve monetization. In the Q1 2023 quarter, Reels monetization efficiency increase 30% on Instagram and 40% on Facebook when compared to the prior year.

All in all, I think the evidence is clear that the investments in the AI discovery engine are showing improvements in users by attracting them into the Family of Apps, retaining them longer as they spend more time on the platform, and increasing monetization efficiency for Meta as a result of these improved user metrics.

Reels improvement

Reels is an important part of the story in terms of driving engagement, and it is clear that as management started to ramp Reels that engagement also went up along with it.

Management commented that on both Instagram and Facebook, Reels continued to grow rapidly.

On top of that, Reels also improved in the social aspect. Users were resharing Reels more than 2 billion times each day, two times that from six months ago.

I do think that Reels has been key to increasing engagement in Meta’s Family of Apps in general. In addition, Reels is also believed to be gaining share in the short form video format as it continues to ramp up.

Meta continue to progress in improving monetization efficiency of Reels compared to its more mature formats like Feed and Stories. Management commented that there are structural supply constraints for Reels as users view a Reel for a longer time than content on Feed or Stories. As a result, there will then be fewer opportunities for Meta to be serving advertisements between Reels. This makes it slightly more challenging to close the monetization efficiency gap between Stories and Reels.

Management remained focused on improving the overall economics of Reels by growing the monetization per time on Reels and driving incremental engagement on Reels.

Reels is expected to gradually become neutral to Meta’s overall revenue by end 2023 or early 2024.

Capital expenditure

Meta maintained its capital expenditures guidance for 2023 to be in the range of $30 billion to $33 billion. This is spent on AI capacity build-out to support ads, Feed and Reels, along with another bucket of investment spent on capacity for its generative AI initiatives.

Meta is a leader in content recommendation AI, but it is focused on investments in generative AI behind LLMs and fundamental AI models across text, image, and video technology.

This could help Meta continue to bring about automated content generation and engagement for users, creators and advertisers.

In addition, I expect that Meta will enable to use of chatbots for businesses to engage directly with customers.

Valuation

Meta currently trades at 16x 2024 P/E. While the stock has rallied 156% from its lows, I think that the company still remains attractively valued as I expect EPS CAGR of 25% over the next four year period.

I will highlight that the 156% return we have seen was purely a result of P/E multiple expansion from the low of 6x P/E to the current 16x P/E.

As a result, I expect that the company will benefit from the 25% EPS CAGR over the next four years and the next leg of upside will come from the earnings upside rather than multiple expansion.

I use a blend of discounted cash flow (“DCF”) and P/E multiple methods to value Meta. The key assumptions include a terminal P/E of 18x and discount rate of 10%.

My 1-year price target for Meta is $298, implying an upside potential of 28% from current levels.

Conclusion

I think the tide has finally turned for Meta Platforms, Inc., as the worst looks to be over for the company. As engagement trends continue to break new records, its user base remains highly engaged as a result of improvements in its AI content discovery engine while Reels is driving incremental engagement across its platforms. Reels monetization progress looks to be on track and remains management’s priority as it looks to narrow the monetization efficiency gap between Reels and other formats. In addition, Meta’s announcement that 2023 will be its year of efficiency continues to materialize with significant improvement in operating efficiency, streamlining of business operations and priorities.

Reality Labs investments and capital expenditures need to be monitored. While it remains a long-term opportunity for Meta Platforms, Inc., it will continue to cause near-term pain in terms of operating losses. I think the sentiment turnaround for Meta in the past 8 months has been phenomenal.

My 1-year price target for Meta Platforms, Inc. is $298, implying an upside potential of 28% from current levels. I would reiterate that the upside to Meta will likely come from earnings upside rather than from multiple expansion. As the stock has rallied about 156% since its lows, I think this is reflected by the multiple expanding from the low of 6x P/E to the 16x P/E we see today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 51% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!