Summary:

- We continue to be buy-rated on Meta Platforms post-earnings.

- We believe Meta is rebounding from its 2022 lows, and Zuckerberg’s “year of efficiency” is playing out; Meta broke its streak of revenue declines with sales up 3% in 1Q23.

- The stock is up roughly 117% since we published our buy-rating last November, outperforming the S&P 500 (up 7% in comparison).

- We also believe Meta’s massive investment in its Reality Labs unit may actually pay off in the mid-to-long run amid the growing AI hype.

- The stock price remains volatile due to weaker ad spending pressuring revenue, but we recommend investors begin exploring favorable entry points into the stock.

Justin Sullivan

Meta Platforms (NASDAQ:META) is making a comeback in what Zuckerberg coins the “year of efficiency”- we maintain our buy recommendation on the stock. Meta remains our favorite stock in the FANG group, demonstrating resilience to the weak spending environment and providing an attractive valuation. We expect Meta to reverse the losses of 2022 through restructuring costs, layoffs, and capping losses on Reality Labs; the company’s 1Q23 earning results broke the streak of revenue declines over the past three consecutive quarters, reporting revenue growth of 3% Y/Y compared to a 5% Y/Y decline in revenue last quarter. Meta had a rough 2022, alongside the larger tech group, dropping roughly 64% last year. The stock is now showing signs of resilience and recovery, up an impressive 117% since we published our buy-rating back in November, outperforming the S&P 500, which is up 7% during the same period.

The following chart outlines our rating history on Meta.

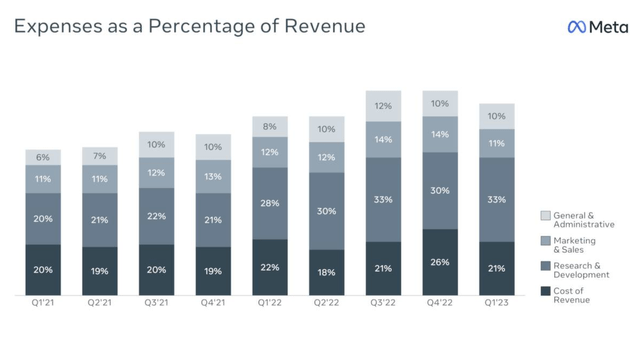

The stock rose more than 12% after reporting 1Q23 results that beat expectations, expanded the forecast for the coming quarter, and lowered the expense outlook. Meta’s 1Q23 earnings results further consolidate our bullish sentiment on the stock; the company is improving top and bottom lines with revenue of $28.65B and EPS of $2.20. We expect cost-cutting is a significant driver behind the hype around Meta; in March, the company announced three rounds of planned layoffs to further reduce the company size by 10,000 employees across Family of Apps (FOA) and Reality Labs (RL) segments. Management is really pushing the “year of efficiency” into action; the company also lowered expenses for this year to be in the $86B to $90B range compared to the previous guide of $96B to $101B in October – the new outlook includes the $3-5B of restructuring costs. The company is effectively shrinking its expenses as a percentage of revenue; the following chart outlines expenses as a percentage of revenue as of 1Q23.

Meta 1Q23 earnings presentation

We’re also seeing management walk the talk regarding the Reality Labs unit; we’re still seeing operating losses for the Metaverse venture, but at least now, said losses are moderating. Operating loss from Reality Labs was $3,992M this quarter compared to $4,279M last quarter. With the AI boom triggered by OpenAI’s ChatGPT, we also believe Meta’s years of investing in the Metaverse may pay off. Meta CEO Mark Zuckerberg highlighted this in the earnings call saying, “Mixed reality is built on a stack of AI technologies for understanding the physical world and blending it with digital objects… Metaverse technologies will also help deliver AI.” Meta is already utilizing AI in several features to do with FoA to drive accuracy in reel recommendations and monetization; according to the call, “AI recommendations have driven a more than 24% increase in time spent on Instagram…” and “Reel monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter.” Still, we don’t expect the stock to skyrocket on its AI or Metaverse businesses toward 1H24, but these are pluses to keep in mind when studying whether to add a position in Meta.

Our bullish sentiment on Meta is driven by the company’s ability to juggle cost cuts and restructuring without threatening growth. We believe Meta is better positioned to outperform the peer group toward the end of the year.

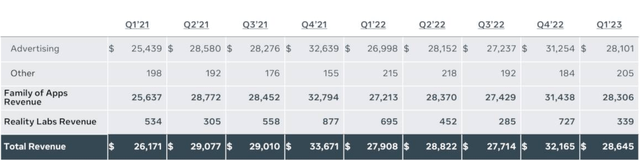

Bread & Butter: Ad revenue

Meta’s ad revenue was also better than expected at $28.1B in 1Q23 compared to $26.998B a year ago, despite the slowdown in advertising spending. Tracking ad spending has been a significant theme in our analysis of Amazon (AMZN), Alphabet (GOOGL) (GOOG), and Meta as advertisers tighten the belt on spending in 2023. We focus so much on ad spending trends because Meta derives the bulk of its revenues through ads, accounting for roughly 98% of revenues in 1Q23. Ad revenue beat estimates this quarter and grew year-over-year but dropped sequentially from $31.254B in 4Q22, likely due to seasonality. The following outlines Meta’s dependency on advertising revenues over the past several quarters.

Meta 1Q23 earnings presentation

We continue to expect ad spending to be slower due to higher interest rates and inflationary pressures weighing on advertisers’ budgets amid market uncertainty. With this in mind, we are more confident about the weaker economy recovering in 2024. We expect Meta will be better positioned than the peer group to reap the benefits once ad spending picks up due to its growing customer base across its FoAs.

Valuation

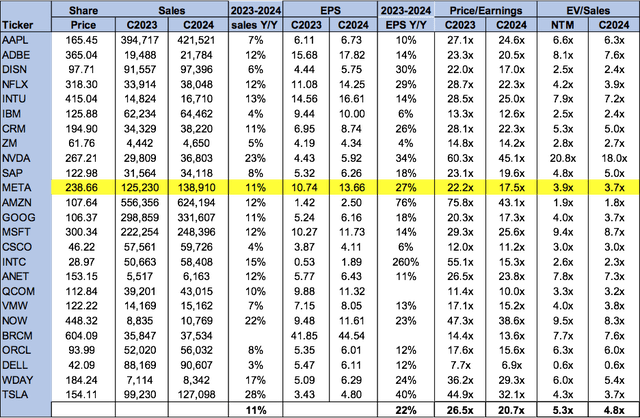

Meta stock is relatively cheap, trading below the peer group average. On a P/E basis, the stock is trading at 17.5x C2024 EPS $13.66 compared to the peer group average of 20.7x. The stock is trading at 3.7x EV/C2024 Sales versus the peer group average of 4.8x. Meta is our favorite mega-tech stock in the FANG group and presents an attractive valuation at current levels compared to Microsoft (MSFT), trading at 8.7x EV/C2024 Sales. We recommend investors begin exploring entry points into the stock toward 2H23.

The following chart outlines Meta’s valuation.

Word on Wall Street

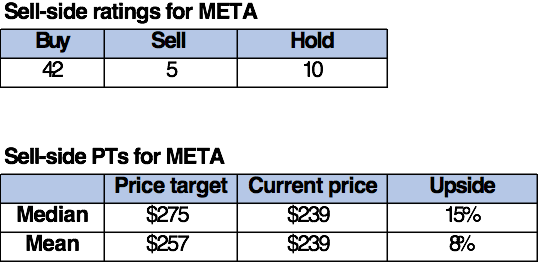

It appears that Wall Street shares our bullish sentiment on the stock. Of the 57 analysts covering the stock, 42 are buy-rated, ten are hold-rated, and the remaining are sell-rated.

The following table outlines META’s sell-side ratings.

TechStockPros

What to do with the stock

We continue to be buy-rated on Meta post-1Q23 earnings. We believe Meta is fueling a big tech rally this week after beating estimates – to make things better, the stock is up over 100% since our buy-rating in November. We expect the stock to be the closest thing to a ‘safe haven’ in the FANG group amid market uncertainty. We’re constructive on management, pushing cost-cutting measures and lowering capital expenses’ outlook. The stock is also undervalued, trading well below the peer group. We see a favorable risk-reward profile for the stock amid the weakening macroeconomy and recommend investors begin exploring entry points into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.