Summary:

- Meta Platforms delivers strong Q4 2023 results, beating revenue and EPS expectations.

- Despite ongoing controversies, Meta’s ecosystem of products reaches a significant portion of the global population and continues to grow.

- Meta rewards shareholders with a $50 billion buyback authorization and a new dividend program, indicating confidence in future profitability.

Kelly Sullivan

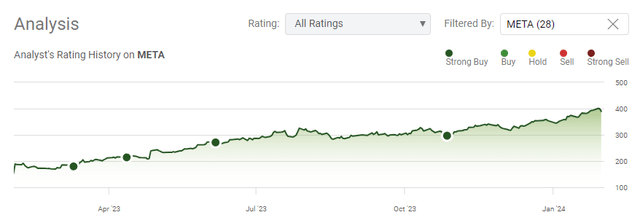

Not too long ago, it seemed like Meta Platforms (NASDAQ:META) couldn’t catch a break as many investors were worried about catching a falling knife. Shares of META fell over 76%, from reaching $380.66 on 8/30/21 to declining to $88.91 on 11/3/22. META was still incredibly profitable throughout the downfall, and today marked another win for long-term shareholders and shareholders brave enough to go against the grain. META delivered an incredible Q4 2023, generating $5.33 in GAAP EPS and $40.11 billion in revenue. META beat on the top and bottom lines, announced a $50 billion buyback authorization, and implemented a dividend program. Everything about today was bullish, and while shares spiked over 10% after hours, I still feel there is value to be unlocked as shares of META can continue higher going forward.

Seeking Alpha

Following up on my previous coverage regarding META

I’m not just getting on the bandwagon, as I have been very bullish on META for years. When shares were declining and hit $94.33, I released an article (can be read here) discussing the massive upside potential. Since then, shares have increased by over 380%, while the S&P 500 has appreciated by 25.77%. Since my last article on META (can be read here) was published on 10/27/23, I discussed why the previous decline was an opportunity. Since then, shares have appreciated by 53%. After going through the earnings report, I am still very bullish on META and am following up on my previous articles to discuss why I believe shares will continue to rise.

Seeking Alpha

Meta Platforms proved once again that it is a profit generating machine

Sometimes, it can be hard, but tuning out the noise and going through the numbers is very important. Everyone has an opinion, and in today’s society, opinions get amplified across social media. Everyone has the right to their opinions, and there are valid points as to why people dislike META. I have always kept in mind that opinions, are just that, opinions. While I can respect everyone’s opinion regardless of whether I agree with it, my opinion or someone else’s doesn’t change META’s operating results. I truly believe that nobody should invest in META or any other company because I am invested or anyone else is invested. I feel that if you’re willing to allocate capital toward investing in a company, then you should be doing a fair amount of due diligence and, at the very least, going through the numbers. For investors who have continued to rely on META’s earnings reports, the writing has been on the wall, and META has been undervalued.

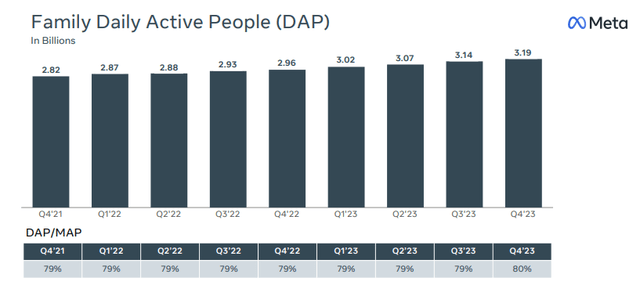

Despite the noise, META has an ecosystem of products that is unmatched. There were 3.19 billion family daily active people using one of their products while 3.98 billion people utilized their products on a monthly basis. There are currently 8.09 billion people globally, which means that roughly 39.43% of the global population utilizes META’s products on a daily basis, and 49.2% use them monthly. What I don’t understand is how people can overlook this. There isn’t another ecosystem of products that I am aware of that touches half of the global population on a continuous basis. The most bullish part is that utilization is continuing to grow. On a YoY basis daily active people increased by 8%, while monthly active people increased by 6%. META continues to be widely popular and continues to expand its monetization across the userbase. In Q4 2023, META increased its revenue per person by $1.47 or 17.03%, while on an annual basis, its revenue per person increased by $2.93 from $31.79 to $34.72 or 9.2%. These metrics were positively impacted by ad impressions increasing by 21% YoY and ad prices increasing by 2% YoY.

Meta Platforms

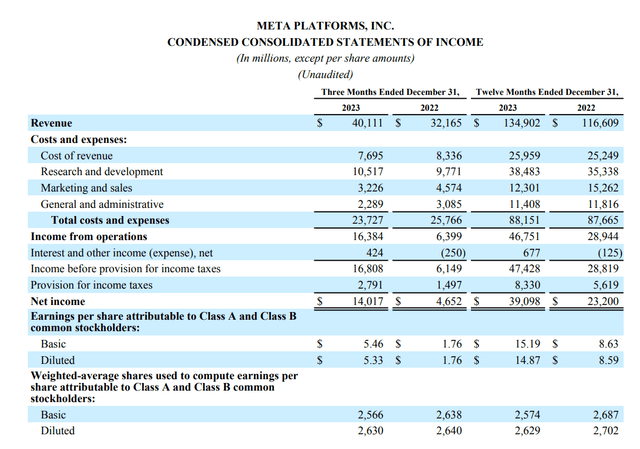

META continues to be a profit center, and despite its ongoing investments into future growth drivers, META is operating its own printing press. In Q4, revenue increased by 25% YoY, while META generated $134.90 billion in revenue for the 2023 fiscal year, which was a 16% YoY increase. META grew its operating income by 61.52% YoY ($17.81 billion) and its net income by 68.53% ($15.9 billion). In 2023 META operated at a 34.66% operating margin, generating $46.75 billion in operating income, and at a 28.98% profit margin, generating $39.1 billion in net income. The bottom line is profitability matters, and META has fantastic margins and is extremely profitable.

Meta Platforms

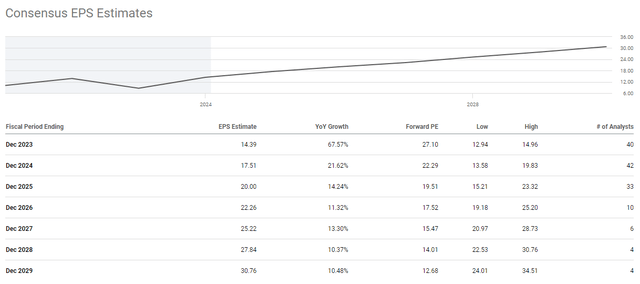

META is setting the tone with the offense and has guided for $34.5-37 billion in Q1 2024 revenue. This is important because this will be the most amount of quarterly revenue generated, excluding Q4 2023, and META is setting the stage for a record-breaking year. They indicated that headcount declined by -22% YoY as they finished with 67,317 employees at the end of 2023. The Street is currently expecting META to generate $17.51 in 2024 EPS and $20 in 2025 EPS, which means that after the recent run-up, shares are trading at 25.7 times 2024 earnings and 22.5 times 2025 earnings. There is a good chance that these estimates will be revised based on META’s 2023 results, and shares may have even more value to be unlocked.

Seeking Alpha

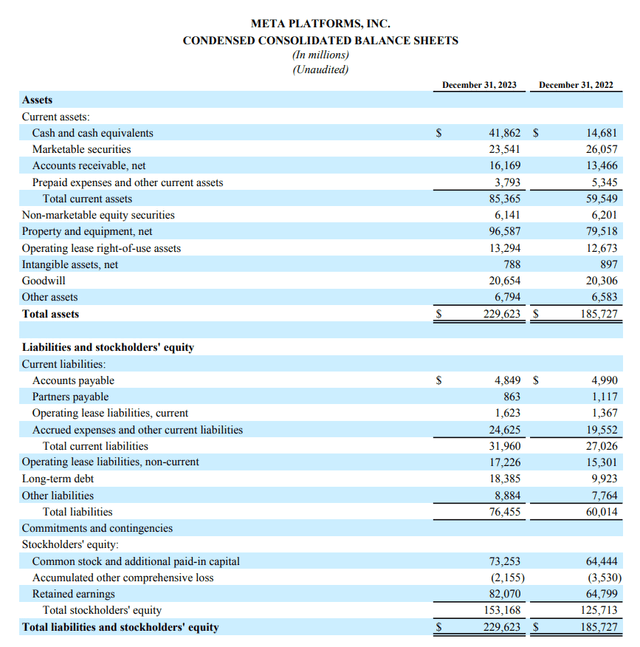

META is rewarding shareholders with more buybacks and a dividend program

In Q4, META repurchased $6.32 billion of shares, bringing the amount of capital allocated toward buybacks in 2023 to $20.03 billion. META still has $30.93 billion available under its current repurchase program and just authorized an additional $50 billion of capital to be allocated toward buybacks. META finished the year with $65.54 billion in on-hand liquidity between cash and marketable securities. In addition, META is produced $43.01 billion in free cash flow (FCF) in 2023. META has tens of billions on hand that they can allocate toward buybacks while continuously generating additional profitability to replenish their war chest. Buybacks are beneficial to shareholders because they are the most tax efficient way to return capital to shareholders. Buybacks reduce the number of shares outstanding and helps increase EPS because all of the net income is distributed across fewer shares. This also increases every shareholder’s ownership in META as their shares represent a larger piece of the company.

Meta Platforms

META has also started a dividend program where they will pay a quarterly dividend of $0.50 per share or $2 on an annual basis. The street is looking for $17 in 2024 earnings, so the dividend will eat up roughly 11.76% of their earnings. This is an added benefit for shareholders as the dividend won’t impact buybacks or future investment’s. I think META is entering a new stage and will replicate Microsoft (MSFT) and Apple (AAPL) by becoming dividend growth machines while rewarding shareholders through buybacks and increased profitability. The dividend is also bullish because it opens up additional ETFs that can purchase META while making META more attractive to dividend investors.

Risks to investing in META

There are always risks to investing, and while META had an outstanding year, there are still risks to consider. Mark Zuckerberg was just hauled in front of Congress again, and it seems like this is an ongoing occurrence. There are uncontrollable risks from a regulatory perspective regarding the future of social media laws. META could come under enhanced regulations, which could impact their user base. There are also risks of lawsuits that could have META paying out billions in damages due to cyberbullying and to the families that have lost loved ones to suicide where social media played a role. The future is unpredictable, and regulatory hurdles or potential lawsuits should be factored into the investment thesis as they could put downward pressure on shares.

Conclusion and why I am still bullish

I am still very bullish on shares of META after the sharp increase to the upside from a long-term perspective. There are 44 global elections in 2024, including the United States Presidential election in November. I think that META is going to ride the tailwinds of the global election cycle, as almost half of the global population uses its products monthly. META is already guiding for their 2nd largest revenue quarter in Q1 2024, and I think this could be just the beginning. As META buys back shares, it should help them beat EPS estimates. The dividend program will also be bullish as it opens up a new category of investors and ETFs to add META to their portfolios. Ultimately, I think META is setting up for a record-breaking year, and I wouldn’t be surprised if META follows Amazon (AMZN), and Alphabet (GOOGL) in splitting their shares sometime in 2024. While some may think this is insignificant, it’s not, as it will make shares of META more attainable to a larger range of shareholders and increase the daily average volume.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.