Summary:

- Facebook parent Meta Platforms has seen a 398.6% stock increase since October 2022, outperforming the S&P 500.

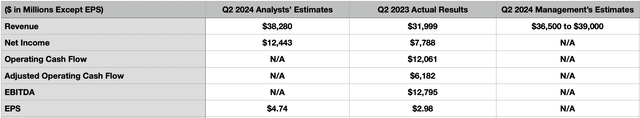

- Analysts anticipate revenue growth of 19.6% and earnings per share of $4.74 for Meta Platforms for the second quarter of 2024.

- Despite heavy investments in Reality Labs, Meta Platforms has improved profit margins and increased share buybacks, which has been fuel for its rising share price.

- While shares aren’t cheap, they are attractive enough to warrant optimism from here.

Derick Hudson

With a market capitalization as of this writing of $1.24 trillion, Facebook parent Meta Platforms (NASDAQ:META) is one of the largest publicly traded companies on the planet. It wasn’t so long ago, however, that the company was considerably smaller than this. Back in October of 2022, I ended up rating the company a ‘strong buy’ after the stock had plummeted materially. There were concerns about the business hemorrhaging cash because of its investments in augmented reality. But I ultimately concluded that the picture for shareholders was very favorable.

From that time through the present day, the stock is up an unbelievable 398.6% at a time when the S&P 500 is up only 43.1%. But as is common amongst value investors, I ended up selling my own shares far too early, coming in just shy of doubling the money I put into the business. It was around that time that I downgraded the stock. But even as of my most recent article, published in early May of this year, I had the company rated a ‘buy’. And during that time even, shares have continued to outperform the broader market, having risen by 11.5% at a time when the S&P 500 is up by 10%.

The fact of the matter is that these are fascinating times for the business. Although management continues to generate billions of dollars annually into Reality Labs with little to show for it, the core business is growing at a nice clip. But of course, investors would be wise to pay attention to new data as it comes out. After all, the picture can always change at a moment’s notice. It just so happens that, after the market closes on July 31st, management is going to be announcing financial results covering the second quarter of the company’s 2024 fiscal year. And the positive thing about this is that there is currently the expectation of continued year-over-year growth. So long as nothing negative comes out of the woodwork, I think that this will justify the ‘buy’ rating that I have kept the stock at as of late. And it will help shares continue to outperform the broader market for the foreseeable future.

Keep an eye on the highlights

The first thing that the market will be paying attention to when management does report results on July 31st will be revenue and earnings. At present, analysts anticipate sales of $38.28 billion. If this comes to fruition, it would represent an increase of 19.6% over the $32 billion the company generated the same time last year. Better monetization of the platform, combined with continued growth in the number of active users on it, will be responsible for any sort of revenue increase. It is worth noting that the estimates provided by analysts are near the higher end of the range that management forecasted. They currently think that sales will come in at between $36.5 billion and $39 billion. At the midpoint, this would be $37.75 billion for a gain of 18% year over year.

In all likelihood, the bottom line for the company will also come in strong. Analysts are forecasting earnings per share of $4.74. This would be well above the $2.98 per share reported the same time last year. Assuming no change in share count, this would mean a rise in net income from $7.79 billion last year to a whopping $12.44 billion this year. Unfortunately, management has not provided any estimates here. But given the company’s track record, I wouldn’t be surprised if earnings come in at or above forecasts.

There are, of course, other profitability metrics that investors should be paying attention to. First and foremost, we have operating cash flow. No estimates have been provided for this or for the other profitability metrics. But for the second quarter of 2023, this metric totaled $12.06 billion. If we adjust for changes in working capital, however, we do get a considerably lower reading of $6.18 billion. Another metric that will matter will be EBITDA. For context, this time last year, the metric came in at $12.80 billion.

Margins, cash, and buybacks, oh my!

Fundamentally speaking, Meta Platforms has been doing really well as of late. In addition to seeing growth in revenue over the past couple of years now, the company has also been able to significantly boost its profit margins. This has been a key driver behind value creation for investors. Over the past year or so, management has been dedicated to cutting certain costs. But this doesn’t mean that we will see a linear progression. In fact, in its second quarter earnings release, the company increased guidance for total expenses for this year to be between $96 billion and $99 billion. The upper end of that range was unchanged from when the company announced results for the end of 2023. But the lower end of the range was up $2 billion from the $94 billion previously anticipated.

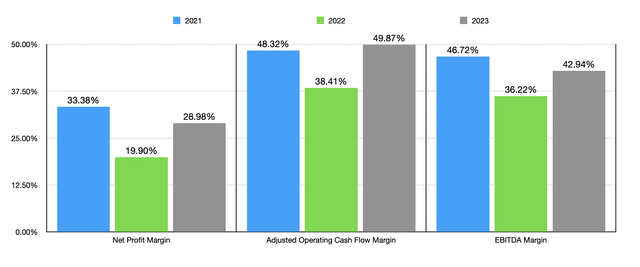

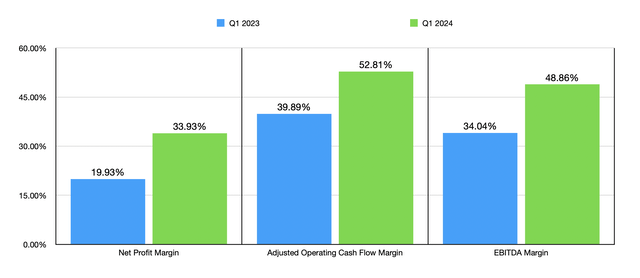

Regardless of what happens for this year as a whole, there is no denying that growth and cost-cutting initiatives have been instrumental in pushing the stock higher. Even though margins are, for the most part, lower than they were in 2021, they are up a lot from what they were in 2022. From 2022 to 2023, the company’s net profit margin shot up from 19.90% to 28.98%. It’s adjusted operating cash flow margin grew from 38.41% to 49.87%. And its EBITDA margin went from 36.22% to 42.94%. All of this can be seen in the chart above. And in the chart below, you can see continued improvement for the first quarter of 2024 compared to the first quarter of last year. If the company is to outperform on the bottom line, margin expansion will be necessary. In fact, if we take analysts estimates for the second quarter of the year, this implies a net profit margin of 32.51%. For the same time of 2023, the net profit margin was only 24.34%.

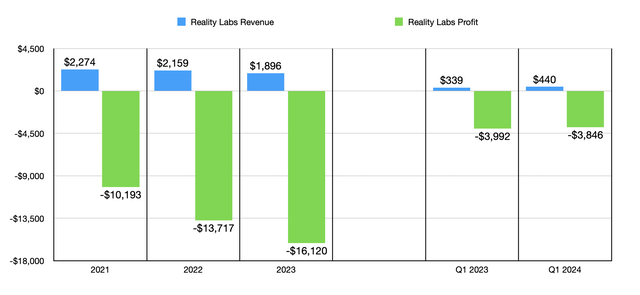

What I find to be really interesting is that these margins have improved even at a time when the company continues to invest heavily in Reality Labs. Even as revenue dropped from $2.27 billion in 2021 to just under $1.90 billion last year, the operating loss of that segment exploded from $10.19 billion to $16.12 billion.

Admittedly, there was a slight improvement in the first quarter of this year, with a loss of $3.85 billion compared to the $3.99 billion reported one year earlier. But this came on the back of a slight improvement in revenue from $339 million to $440 million. Management has not offered much at all in the way of guidance on some of this stuff. But they did caution investors, in the first quarter earnings release of this year, to expect the company to ‘invest aggressively’ in support of its AI research and product development activities. So I wouldn’t be surprised to see continued significant losses on this front.

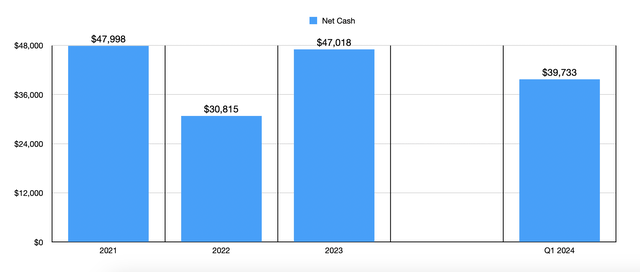

Less certain will be the overall cash position of the business. After seeing net cash plummet from about $48 billion in 2021 to $30.82 billion one year later, we saw a growth to $47.2 billion in 2023. But by the end of the first quarter of this year, net cash had fallen some to $39.74 billion. This seems to be the result of a couple of things. For starters, the company did finally start paying a dividend. And in the first quarter of 2024, it allocated $1.27 billion toward these distributions. But more importantly, management has also ratcheted up share buybacks.

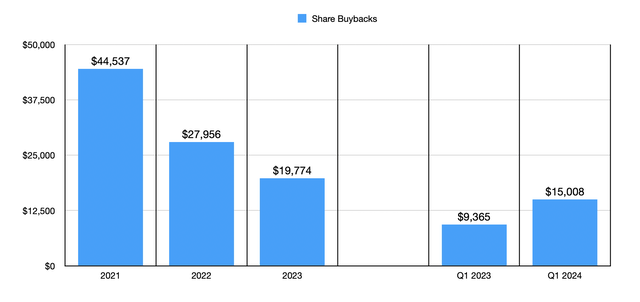

In the first quarter of this year alone, the company allocated $15.01 billion toward the repurchase of common stock. This was up from $9.37 billion one year earlier. This does mark a rather significant turnaround from prior years. From 2021 through 2023, annual share buybacks dropped from $44.54 billion to $19.77 billion. I would have liked for more purchases to occur when the stock was far cheaper. But the picture is what it is.

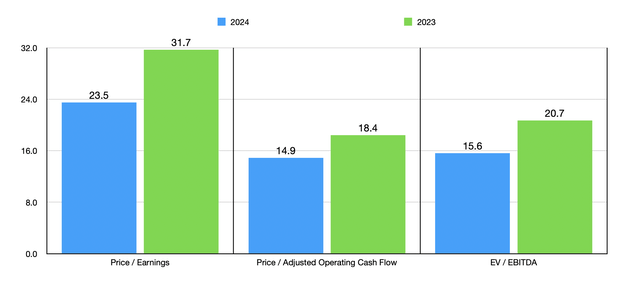

As for valuation, guidance will ultimately determine what the picture looks like. But using the same numbers as in my prior article and updating for the increase in price that shares experienced, you can see in the chart above how shares are valued on a forward basis for 2024 and using historical results for 2023. Considering the high quality operation that we are talking about, and the historical growth the company has exhibited, I wouldn’t say that the stock is overvalued. But it’s not cheap enough to get me to pull the trigger.

Takeaway

As earnings near, investors are probably getting anxious. The stock has risen significantly and, at some point, further market beating upside will be impossible. But I don’t think we are there just yet. Even though the stock has gotten a bit pricey for my liking, I do think that this is a high quality company that’s worthy of a ‘buy’ rating at this point in time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!