Summary:

- In recent quarters, Meta Platforms, Inc. has demonstrated strong execution and cost discipline, which have significantly improved profitability and set the company up for sustained growth.

- It has declared its first dividend and increased the share repurchase authorization by ~$50Bn.

- While no longer cheap, we still see a considerable growth runway for Meta Platforms and opportunity to grow into its high multiples.

Delmaine Donson

Summary

In recent quarters, Meta Platforms, Inc. (NASDAQ:META) has clearly demonstrated strong execution and decisive action on cost discipline, all of which have significantly raised its credibility in navigating a challenging economic and political environment and positioned the company for sustainable growth. Roughly a year ago, the market was concerned that Apple Inc.’s (AAPL) IDFA removal would result in permanent signal loss, the shift towards Reels would cannibalize Meta’s most profitable revenue streams (i.e., Feeds and Stories), and Reality Lab’s losses would consume a significant portion of the core businesses’ earnings. Now, it seems that much of the signal loss has been recaptured with its best-in-class ad platform; Reels monetization continues to improve with placements across several surfaces, and Reality Labs investments have largely shifted to AI, which is driving efficiency and creating new products/enhancements that could drive the next leg of growth for Meta. While no longer cheap by almost any metric, we see a reasonable path for Meta to grow into its multiple.

Context/Recent Developments

Meta has recently made significant strides in its operational restructuring and cost optimization, alongside advancing its strategic technological initiatives. Its Q4 results highlighted a sharp increase in profit and revenue, attributed to effective cost-cutting measures and a rebound in advertising performance. A significant component of the improved efficiency was the reduction of its workforce by ~22% compared to the prior year, which has been a key factor in reducing expenses and streamlining operations.

In addition to its operational efficiencies, Meta has also been proactive in its capital management strategies. The company has initiated a quarterly dividend, marking a new phase in its approach to shareholder returns. This move, coupled with the company’s share repurchase activity, underscores Meta’s confidence in its long-term financial health and commitment to returning value to its shareholders as it exits its hyper-growth phase.

Its outlook for the coming year includes significant investments in infrastructure, with capex expected to be in the range of ~$30-37Bn. This reflects the ongoing product development efforts in AR/VR, and its ambition to scale its product ecosystem. These investments are crucial for supporting Meta’s priority areas in 2024, particularly as the company shifts its workforce composition towards more technical roles, which are anticipated to further drive payroll expenses.

These developments come amid a backdrop of heightened regulatory scrutiny and potential legal challenges, especially in the EU and the U.S., which Meta is actively monitoring and contesting.

Recent Performance

Engagement

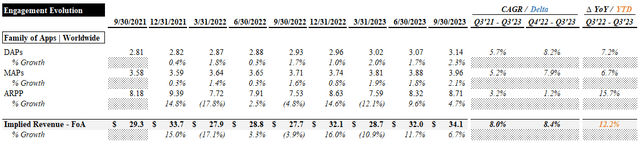

From Q3 ’21 to Q3 ’23 (n.b., detailed engagement data is forthcoming), engagement across the Family of Apps (“FoA”) increased significantly. Daily Active People (“DAP”) grew at a ~6% CAGR over the period, accelerating to ~8% from Q4 ’22 to Q3 ’23. Monthly Active People (“MAP”) grew slightly slower, implying a slight improvement in engagement (i.e., DAP/MAP ratio). Average Revenue per Person (“ARPP”) grew at a modest ~3% CAGR, decelerating from Q4 ’22 onward (n.b., ~1% CAGR).

Engagement Evolution (Family of Apps) (Empyrean; Meta)

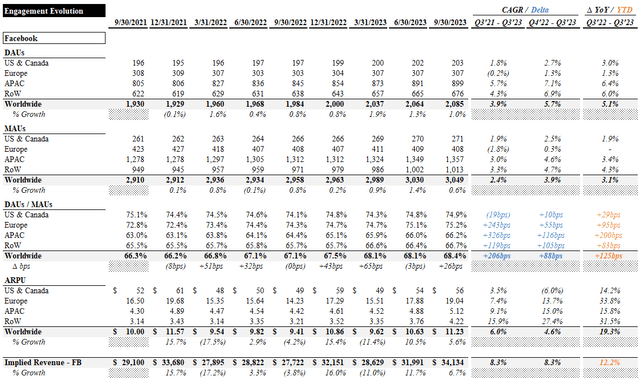

Of its entire product portfolio, Meta only provides details on Facebook. Daily Active Users (“DAUs”) grew at a ~4% CAGR (n.b., ~6% from Q4 ’22), underpinned by strong growth in APAC and Rest of World (“RoW”). Monthly Active Users (“MAUs”) grew slightly slower at a ~2% CAGR (n.b., ~4% from Q4 ’22). Engagement (i.e., DAU/MAU ratio) improved by ~200bps, with Europe and APAC driving most of the improvement. Engagement in the US & Canada remained roughly flat. Average Revenue per User (“ARPU”) grew at a robust ~6% CAGR (n.b., ~5% from Q4 ’22), and is up ~19% YoY. RoW, APAC, and Europe saw the largest growth in ARPU over the period.

Engagement Evolution (Facebook) (Empyrean; Meta)

We see APAC and RoW as the main growth drivers within the core product portfolio, both having significant opportunities to increase market penetration and drive ARPU growth as countries in these markets develop economically.

Financials

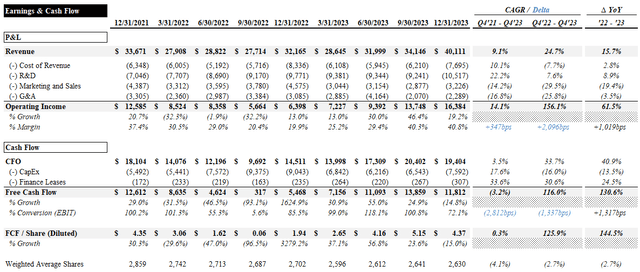

Financially, top line growth has been healthy and improving in recent quarters. The “restructuring” initiative, aimed at stripping out excessive spending on money-losing projects (i.e., Reality Labs), has driven significant improvements in operating margins and cash conversion. Revenue grew at a ~9% CAGR, while ~350bps of operating margin expansion (n.b., ~1,000bps YoY) drove a ~14% operating income CAGR.

While the FCF CAGR over the period is negative, this is largely due to elevated CapEx in Q4; it is up ~130% YoY. Due to a moderate pace of share buybacks (n.b., ~4% reduction in diluted share count p.a.), FCF per share has grown ~145% YoY.

Earnings & Cash Flow Evolution (Empyrean; Meta)

We are happy to see the recent changes beginning to pay off and the sharpened focus on shareholder returns. Despite the increasing levels of expenditure required to grow the business and satisfy regulators, we still have the opportunity for a slight degree of margin expansion and improvement in cash flow conversion. Operating income could grow another ~30% if Meta can create a product out of Reality Labs with strong demand or shutter the business altogether (n.b., RL burned ~$4.6Bn in Q4). While unlikely, having another growth lever under the company’s control is reassuring should the core business slow materially.

Risks

China-Based Advertisers

China-based advertisers accounted for ~10% of advertising revenue in ’23, accounting for ~5% of overall growth. It was well known that China-based advertisers accounted for a large portion of Meta’s revenue, but the extent to which Meta relied on them was surprising. The largest verticals these advertisers were active in were Online Commerce & Gaming. This could increase political pressure on Meta and threaten topline growth if geopolitical tensions rise further.

Higher CapEx Requirements

Meta raised its ’24 capex guide due to its increasing focus on AI. With a goal of building the most popular and advanced AI products and services, it raised the high-end of its ’24 capex guidance by ~$2Bn and now expects to spend between ~$30-37Bn, with which it expects to acquire ~350k of Nvidia’s H100s and ultimately have ~600K equivalent H100s of compute by the end of the year ’24.

Regulatory Headwinds

Regulatory headwinds remain a significant concern, with the FTC seeking to modify an existing consent order that could have an adverse impact on future operations.

In 2019, the FTC accused Meta of misleading parents about privacy controls regarding the Messenger Kids app and other issues. Furthermore, it also imposed a $5 billion fine on the company while banning the monetization of data of minors.

In May 2023, The FTC proposed changes to the privacy order, alleging that Meta had violated the 2019 order. The FTC has now proposed a blanket prohibition order on monetizing youth data.

As per the changes, Meta will not be able to profit from the data of minors it collects, and this would even include interactions with its VR devices. The amended privacy order will also limit how Meta can use biometric recognition and make additional protections mandatory for users under 18. (Spice Works.)

Catalyst – Reality Labs

With RL burning the equivalent of +20% of FoA operating income, it significantly drags profitability. These projects do not need to ultimately work out for Meta to realize the upside through this segment. In time, if the segment cannot stand on its own two feet, shutting it down would give a large boost in profitability.

With the company signaling its intention to be viewed as a mature industry leader with a new focus on shareholder returns, it is increasingly likely that Meta something will happen around this segment (i.e., restructuring, spinoff, JV, etc.).

Valuation

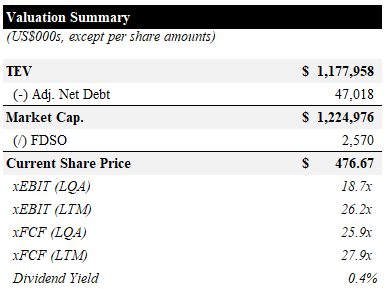

Meta is trading for ~18.7x and ~26.2x LQA and LTM EBIT, respectively, and ~25.9x and ~27.9x LQA and LTM FCF. The newly initiated dividend implies a current yield of ~0.4%.

Valuation Summary (Empyrean)

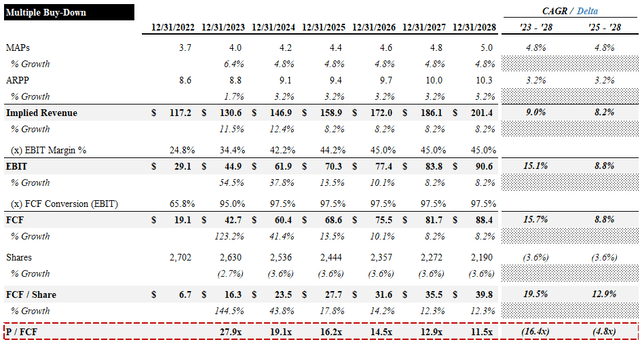

Our preferred valuation approach for Meta is forward multiples. With the assumptions detailed in the table below, we see a reasonable path to ~13% FCF per share growth in the coming 5 years driven by moderate growth in MAPs and ARPP, slight margin improvement, and continued share buybacks. This implies a significant multiple buy-down from ~28x to ~11.5x by the end of ’28.

Multiple Buy-Down (Empyrean; Meta)

We see this as a reasonable case, given the significant growth opportunities in users and ARPP in APAC and RoW, as well as the success or failure of RL, either of which would significantly improve profitability and cash flow.

Conclusion

Despite the ~20% pop after Q4 earnings, we still see a credible case for Meta Platforms, Inc. as a GARP play. While its core product offerings are quite mature in North America and Europe, there remains a significant runway for high-magnitude, long-duration growth in APAC and RoW. The substantial cash flow of the advertising business will support significant returns to shareholders via buybacks and dividends and can subsidize the money-losing RL until something happens to crystallize value in that segment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.