Summary:

- Meta Platforms is the largest social media company in the world with the potential to increase its user base by expanding into new segment of virtual and augmented reality.

- The company’s core digital advertising business has demonstrated stellar financial performance with huge margins, which enabled the company to invest heavily in developing new products and features.

- Despite a massive year-to-date rally, my valuation analysis suggests the stock is still significantly undervalued.

Justin Sullivan/Getty Images News

Investment thesis

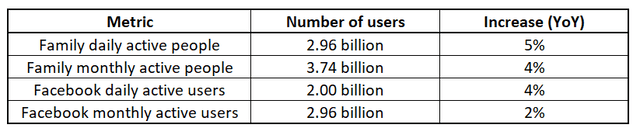

Meta Platforms, Inc (NASDAQ:META) is a company with unique market positioning and an incredible user base that provides strong foundation to sustain stellar growth rate, which the company demonstrated over the last decade. With more than 3 billion monthly active users [MAU] across Family of Apps the company has very robust positioning to expand into new markets. Meta demonstrates impressive financials with wide margins and strong cash flows, which enables the company to invest vast amounts to new technologies. Additionally, my valuation analysis suggests the stock is massively undervalued.

Company information

Meta is a global technology company originally named “Facebook” and founded in 2004. In 2021, the company was renamed “Meta,” reflecting the company’s plans to shift toward building the Metaverse, which will be a shared online space that integrates virtual and augmented realities to create immersive experiences. Meta operates the world’s largest family of social networking sites and applications, including the flagship social network Facebook, Instagram, Facebook Messenger and WhatsApp.

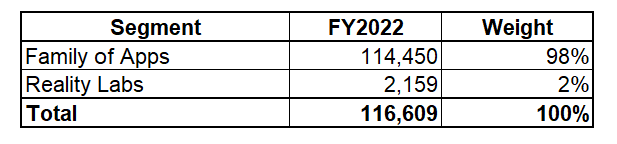

The company reports its financial results in two segments: Family of Apps [FoA] and Reality Labs [RL]. A substantial part of revenue is generated by FoA, which sells advertising placements via its family of apps including Facebook, Instagram, Messenger, and WhatsApp. The RL segment focuses on the development and advancement of virtual and augmented reality solutions: the team works to develop products and experiences that enable people to interact with each other and with digital content in immersive and engaging ways. Work includes developing hardware such as the Oculus virtual reality headsets, as well as software and tools for creating VR and AR content.

In FY 2022 FoA sales comprised 98% of the total company revenue. Meta derives about 55% of its revenue from outside the North America.

Author’s calculations

Financials

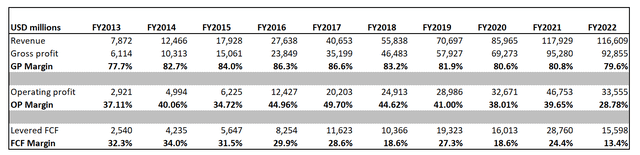

First, let me take a look at Meta’s financial performance over the last decade. Revenue growth has been crazy at a CAGR of almost 35%, with gross margins ranging from 77% to 87%. Currently, Meta’s gross margin is at the low end of its historical range. The company was a money printing machine with a free cash flow margin of around 30%, but this deteriorated in the last three years as the company started to invest heavily in new projects related to virtual and augmented reality.

META invests significant portion of its revenues in research and development [R&D], which enables to introduce users new features of the company’s products. Investments in R&D on average represented 22% of Meta’s sales over the last decade.

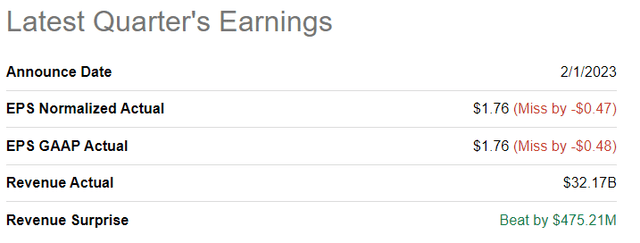

Now let me narrow down to the company’s latest financial quarter results, which were announced on February 1, 2023. Meta topped consensus estimates from the topline perspective and missed in terms of EPS.

The company reported user growth, though revenue per user declined for the second quarter in a row. Quarterly revenue declined both YoY and sequentially at about 4% rate. 4Q2022 revenue was adversely affected by currency headwinds together with softening digital advertising demand given current macroeconomic uncertainties. The average price per ad dropped 22% with impressions metric increase of 22%. Apple’s (AAPL) App Tracking Transparency [ATT], which made it complex to target ad audience, continued to pressure down Meta’s revenues. According to the company’s CFO, Susan Li, the company is working hard on mitigating adverse effects from ATT by developing artificial intelligence and machine learning tools for ads targeting and measurement improvement. While revenue was declining in the last quarter, total expenses rose 22%. It is important to mention here that the 11,000 employees, laid-off in November, were still remaining on payroll as of FY 2022 year-end due to applicable legal requirements. The management expects that laid-off employees will be out of the company’s headcount by the end of Q1 2023.

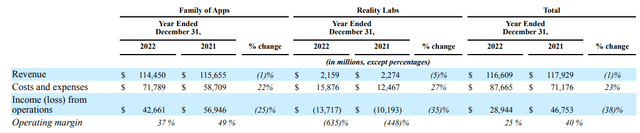

From the full-year perspective, revenue decreased about 1% from $117.93 billion to $116.61 billion with GAAP EPS dropping 38%. Both segments demonstrated decline in revenue and increase in costs, thus significantly narrowing operating margin.

The company’s revenue in 2022 was impacted by a reduction in advertising demand compared to 2021, which was primarily driven by reduced marketing budgets as a result of challenging macroeconomic environment as well as ATT from Apple. The company demonstrated modest growth from the FoA perspective.

Compiled by author based on Meta’s 10-K

During the latest earnings call, the CEO, Mark Zuckerberg, announced that management’s theme for 2023 is the “Year of Efficiency” which means more layoffs and decreased CAPEX roadmap, if said shortly. The company continues to restructure its organizational structure and recently announced that another 10,000 employees to be laid-off.

Company’s balance sheet is very strong with current and leverage ratios being very conservative. Meta’s net cash and cash equivalents position as of 2022 year end was $30.8 billion. With this large amount of cash the company is well positioned to continue investing aggressively either in R&D or strategic acquisitions, or even both. History demonstrates us that in the last decade Meta’s investments in R&D were very successful and enabled to grow revenue at a breathtaking pace. Though, last year market punished Meta stock severely due to vast investments in Reality Labs, which does not generate profits yet. Here I believe that it is very early to arrive at any conclusions regarding the metaverse project. For instance, when in April 2012 the company acquired Instagram, Derek Thompson from The Atlantic was very surprised with the purchase price of $1 billion:

This morning, Facebook bought Instagram, the photo-sharing phone app, for a fat $1 billion. Instagram has more than 30 million signed-up users, but it doesn’t make any money. It employs only 13 people, at last count. To plug it into one of our favorite formulas, if you divided its new valuation by employees, you would get $77 million per worker.

Acquisition of WhatsApp for $19 billion in 2014 also was a shocker for business world, but nowadays both Instagram and WhatsApp are very large diamonds in Meta’s mobile crown. Thus, based on Meta’s management team strong track-record of very successful strategic acquisitions, I have high conviction that recent acquisition of Kustomer will also turn out to be a good investment.

Meta does not pay dividend, but in recent years the company has been repurchasing shares aggressively returning to shareholders a total of $113 billion during last 5 years via buybacks. As of 2022 year-end the company was authorized to repurchase additional $51 billion worth of stock.

In summary, the last few quarters have been challenging for the company in the face of several major headwinds, but the company has weathered them all. I am optimistic about management’s initiatives to optimize costs without compromising growth prospects. I strongly believe that management’s efforts will put the company back on the path of expanding margins and FCF with continued revenue growth.

Valuation indicates massive undervaluation

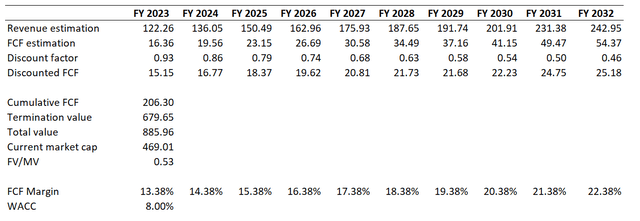

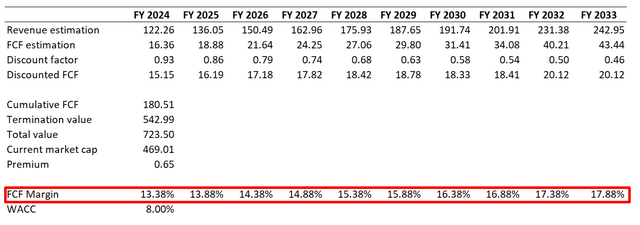

Meta is an obvious growth company that does not pay dividends, so for valuation, I use Discounted Cash Flow [DCF] approach. I have revenue consensus estimates and historical free cash flow margin to project future cash flows. What I need also is a discount rate, which would be a WACC estimation from Gurufocus rounded up to 8%. Incorporating all of the assumptions together I arrived to a conclusion that the stock is massively undervalued relative to future cash flows discounted at WACC.

According to the above model, revenue is expected to grow at CAGR of about 8% which is very conservative compared to digital advertising market growth prospects and FCF margin expanding 100 basis points each year from the 13.38% level of FY2022, which was not the best year for the company. So, I believe that assumptions are rather conservative, but I would also like to challenge the DCF with two more scenarios simulations.

First, I would like to look at the scenario where the company continues to invest heavily in RL segment and struggling to widen FCF margin significantly with only 25 basis points increase each year. The DCF model still indicates significant undervaluation of more than 25% even with this conservative FCF assumptions.

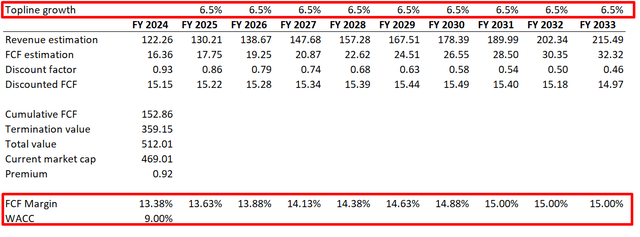

For the second scenario, to understand the margin of safety, I would like to be even more conservative with WACC growing 100 basis points to 9% and revenue growth rate decelerating to a CAGR of 6.5% with maximum FCF margin of 15%. The simulation suggests that the stock is still 8% undervalued.

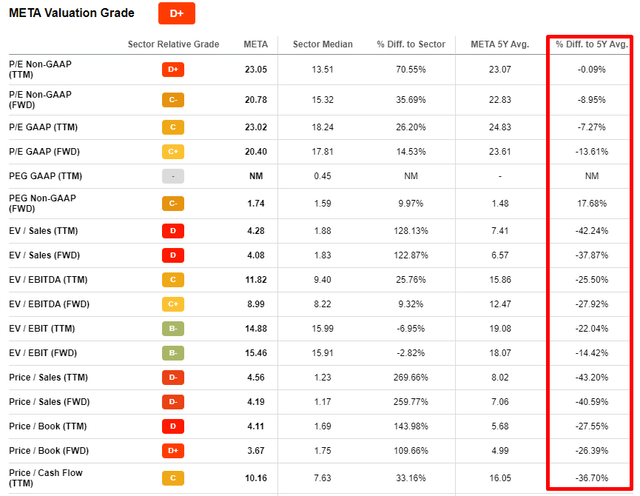

To challenge my calculations, I would also like to refer to the company’s valuation metrics, provided by Seeking Alpha Quant. Meta’s stellar profitability and multibillion audience means the stock is unique and it is no surprise that it trades by far more expensive from multiples point of view versus sector median suggests. So here we should compare Meta versus Meta – current valuation ratios with 5-year averages. And this comparison suggests that the stock is undervalued. Given the management’s determination to return profitability to historical levels via cost-cutting initiatives and valuation multiples being compressed, I have high conviction that upside potential is huge here.

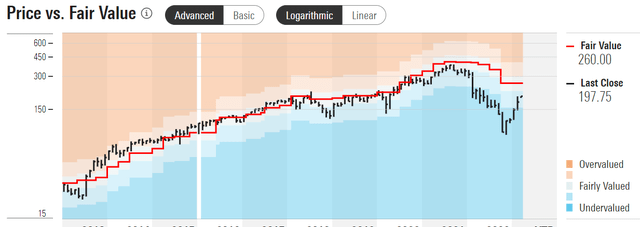

To conclude valuation and support my valuation simulation outcomes, I would also like to share with you Morningstar’s opinion regarding the fair value of the Meta stock. Morningstar suggests that the stock is currently traded at a 24% discount with fair stock price at $260 per share.

Risks to consider

While there are very attractive potential benefits of investing in META, there are also risks that investors should be aware of before making an investment decision.

First, as one of the largest global players in digital advertising, the company is subject to a number of regulations and controls in many countries. There is much controversy over social media privacy and antitrust concerns. Unfavorable regulatory changes could adversely affect the company’s financial results.

Second, because the company’s primary source of revenue is digital advertising, revenue is significantly dependent on changes in the general economic environment. Economic downturns, soft or hard, will impact the company’s overall financial performance.

Third, user engagement is the critical success factor given the nature of META’s business. A loss of trust in the company, either linked to ethical concerns or cybersecurity problems, will lead to a decline in user activity and engagement. This will undermine financial performance as well.

Fourth, the competition is intense. META faces competition in digital advertising from both other social media platforms like Twitter or Snapchat (SNAP) and from giants like Alphabet (GOOGL) or Amazon (AMZN).

Thus, before acquiring META shares, investors should do their due diligence and carefully consider the potential risks and rewards before making an investment decision.

Bottom line

Overall, based on my analysis, I believe the stock is a strong buy at current levels, although there may be some short-term volatility due to general market sentiment and temporary struggles in the overall economy. With its unique market positioning and significant growth prospects, Meta is a compelling investment opportunity for those who want to participate in the future of technology and online interaction. In spite of the massive rally from last autumn’s lows, valuation analysis suggests the stock is still significantly undervalued.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.