Summary:

- Meta Platforms has been doing quite well fundamentally as of late, with revenue, profits, and cash flows rising nicely.

- Robust demand for advertising placements and an increase in users continue to push revenue higher even as advertising rates fall.

- The platform looks fundamentally attractive and is likely to rise further from here, especially with appealing growth initiatives in play.

Saranya Yuenyong

Over a long enough window of time, every investor has both their winners and their losers. One of the best wins that I have achieved in the market in the past two years was when I purchased shares of Facebook parent Meta Platforms (NASDAQ:META) late last year. I ended up nearly doubling my money on the stock in the span of only several months. But as I have written about previously, I clearly ended up selling out too early and missed another double relative to the initial price I paid for shares. Since I last wrote about the company in July of this year, shares have only continued to increase. The market’s realization that there was an overreaction to the downside, combined with robust financial performance and the prospect of AI helping the company moving forward, has all had a massive bullish effect. Even with the stock now up well over three times since I initially bought shares, I would argue that some additional upside still exists. But relative to where the stock has been, that upside will not be terribly significant.

The picture keeps improving

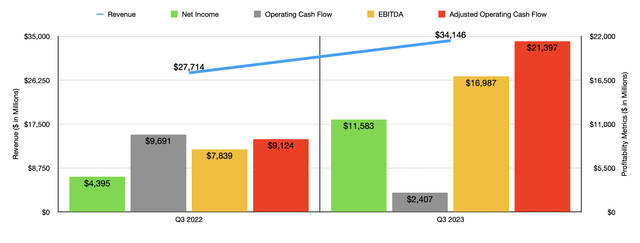

No matter how you stack it, the recent financial performance achieved by Meta Platforms has been impressive. Let’s consider just the most recent quarterly data, which covers the third quarter of the 2023 fiscal year. Revenue came in at $34.15 billion. That’s 23.2% above the $27.71 billion generated the same time last year. This surge, according to management, was driven by a couple of key factors. For starters, since the vast majority of the company’s revenue comes from advertising, it is obvious that most of the upside has come from an improvement in the advertising market.

This is not to say that everything regarding advertising for the company was positive. While the company reported a 31% year over year increase in the number of ads delivered on the platform, with ad impressions growing across all regions in which the company operates, the average price per ad dropped by 6% year over year. While weak advertising revenue looks negative, the picture is far more complicated than that. For starters, management has made clear for several quarters now that Reels is becoming a more significant revenue stream for the company than it was in the past. Annualized revenue for it is well over $10 billion now. And by its very nature, the monetization of ads displayed via Reels is lower than the more traditional advertising that the company has historically done. A lot of the company’s growth has also been in markets that are not as attractive as the US or even Europe. And because of that, monetization on a per ad basis is also lower. It’s the same kind of phenomenon seen by any major companies such as some of the streaming firms out there.

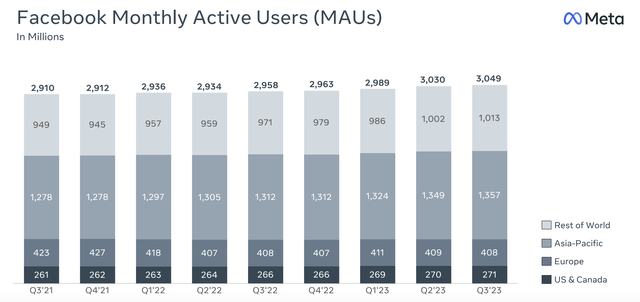

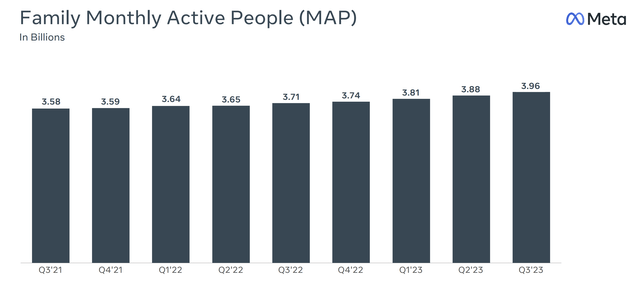

The increase in the number of ads is due in part to higher demand for advertising capabilities. For instance, marketer spending in online commerce, consumer packaged goods, gaming, and other sectors, helped to increase the number of ads purchased. But there’s also the fact that the number of users on the company’s platforms continue to grow as well. The number of monthly active users on Facebook, for instance, increased from 2.958 million in the third quarter of 2022 to an all-time high of 3.049 million in the third quarter of this year. That number is also 19,000 above what the company reported in the second quarter. For the family of apps that the company has, monthly users increased from 3.71 million last year to 3.96 million this year. That’s also up from the 3.88 million reported in the second quarter of this year.

With the increase in revenue for the company has also come higher profits. Net income, for instance, skyrocketed from $4.40 billion to $11.58 billion. The increase in sales for the company certainly helped. But there were also some other improvements. Management has been cutting costs for several months now, including by cutting headcount. Cost of revenue, for instance, managed to decline from 21% of sales to 18%. That may not sound like much, but when applied to the revenue generated in the third quarter alone, it translates to an extra $1.02 billion in pretax profits. An even larger decline from 33% to 27% came about in research and development costs, plus the company reported a plunge in marketing and sales expenses from $3.78 billion to $2.88 billion thanks largely to a 36% decline in employee headcount on a year over year basis. Other profitability metrics for the company also improved. Operating cash flow, for instance, more than doubled from $9.69 billion to $20.46 billion. On an adjusted basis, it grew from $9.12 billion to $21.40 billion. And finally, EBITDA for the company expanded from $7.84 billion to $16.99 billion.

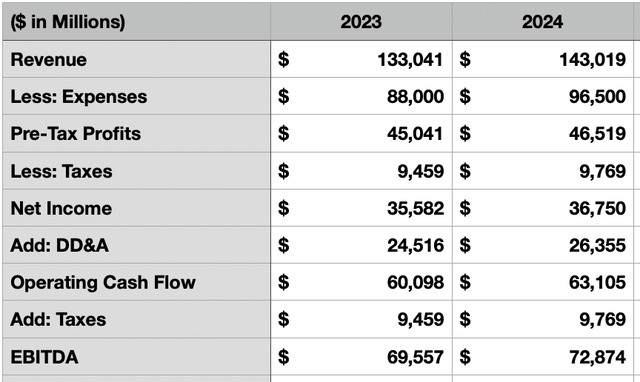

In addition to posting solid results for the third quarter, management has continued to improve when it comes to guidance for the year. Total expenses are now forecasted to be between $87 billion and $89 billion. That’s down from the prior expected range of between $88 billion and $91 billion. This is not to say that the picture will be the same way next year. Management is expecting significant investments being made, particularly in things like AR/VR with Reality Labs, and AI and data center operations, to result in expenses growing to between $94 billion and $99 billion in 2024. Management has not provided any solid estimates when it comes to revenue. But we do know that if we take managements midpoint estimate for the fourth quarter of this year, then revenue this year will be up 14.1% compared to what it was last year.

Given the state of the economy, and the uncertainty of a large company like Meta Platforms at a time when it’s undergoing significant changes, I think a conservative estimate for revenue growth would be around 7.5%. That would put sales at $143.02 billion. After we strip out midpoint guidance for expenses and factor in a 21% tax rate, that should give us around $36.75 billion in profits for the year. When we add back estimated depreciation and amortization, we should get operating cash flow of $63.11 billion. That’s up from the $60.10 billion that I am estimating for the current fiscal year based on current guidance. Given that the company actually has cash in excess of debt, it should not have any interest expense on a net basis. So operating cash flow should also be an appropriate proxy for EBIDA. We could add back in taxes to arrive at EBITDA. But historically speaking, EBITDA has either been around what operating cash flow has been or it has been lower. And that’s because of the large amount of stock-based compensation that the company makes available for its employees. To keep things simple, I decided to use the operating cash flow estimate as a proxy for EBITDA as well.

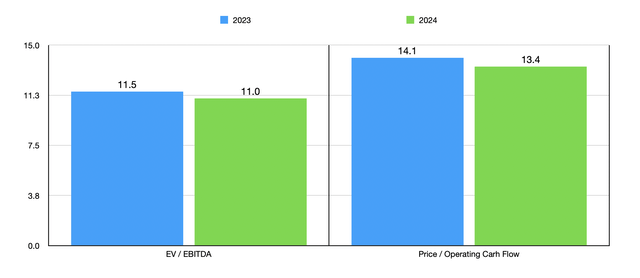

Using these estimates, you can see how shares of the company are priced in the chart below. For a global enterprise that is an industry leader and that continues to grow, not to mention one that has excess cash totaling $42.74 billion, and that is investing significantly into growth initiatives, I see this as fairly attractive. It is possible, of course, that we could see the picture get even better. And that’s because management continues to make interesting moves. Earlier this month, for instance, news broke that Meta Platforms would make available the ability to see product advertisements from Amazon (AMZN) available in a way that allows users to not only see real time prices, but to also purchase those products immediately from their Facebook or Instagram accounts. As the world’s largest online store, Amazon makes the perfect sense to partner up with. Both companies have the potential to benefit significantly, with Meta Platforms becoming more valuable to advertisers while perhaps generating additional advertising revenue, while Amazon has the opportunity to increase sales directly.

Another interesting initiative remains the Threads platform that Meta Platforms launched earlier this year in a bid to bring about the downfall of the severely struggling X platform, formerly known as Twitter. Despite third party estimates suggesting the contrary, management claims that there are nearly 100 million monthly active users on Threads, with some estimates pegging the number of total users at around 141 million. This is something that I have written about previously and that I believe could go on to bring in billions of dollars of additional revenue to the enterprise. Management continues to make investments in AI, AR/VR, and other initiatives. Just recently, the company launched its newest headset, known as the Quest 3, which was released on October 10th. But that particular initiative is likely to pale in comparison to the newest headset launched by Apple (AAPL) known as the Vision Pro. If any of these initiatives or others such as the Ray-Ban Meta smart glasses that the company just launched a second generation of, turn out to be big winners, then the company could look even more appealing on a forward basis.

Takeaway

Based on all the data provided, I would argue that Meta Platforms is doing a fine job at this point in time. Since I last wrote about the company in a bullish article published in July of this year, shares have seen upside of 5.6% while the S&P 500 is down 2.8%. I do believe that further return disparities relative to the market will occur. If any of the company’s other initiatives turn out to be big winners, the disparity could be rather meaningful. But even if that does not come to pass, I do think that a bit of additional upside from here is warranted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!