Summary:

- After a spectacular run-up in 2023, Meta is starting to look as expensive as its big tech peers.

- In this note, we will review near-term and long-term risk-reward for META to see if it is a good investment at current levels.

- According to my analysis, Meta’s stock has run up ~15-20% above its fair value. And Meta’s technical chart looks ripe for an imminent pullback in the stock.

- However, Meta’s long-term risk-reward remains attractive, with the stock offering ~16.5% CAGR return for the next five years.

- Spoiler Alert: I rate Meta a modest “Buy” in the $260s, with a strong preference for staggered accumulation.

Galeanu Mihai

Introduction

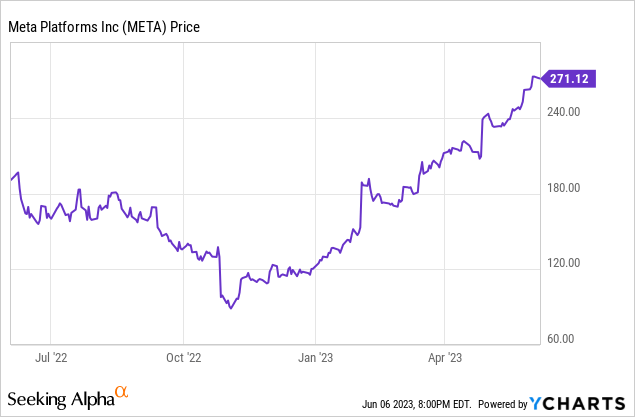

Since hitting a capitulatory bottom in October 2022, Meta Platforms, Inc. (NASDAQ:META) stock has shot up higher in a straight line (~3x’ing in 8 months or so), with the social media giant’s “Year of Efficiency” and the early promise of generative AI luring investors and speculators back into META.

While Meta’s stock experienced insane volatility amid a vicious revenue and earnings contraction in 2022, Meta’s key business fundamentals (i.e., user growth and engagement) remained resilient throughout these market gyrations. However, as a consequence of Meta’s free-spending ways, Mr. Market sold META stock into the abyss, and at one point, META traded at just ~10-12x P/FCF. After recording a series of poor quarterly reports, Zuckerberg & Co. presented an aggressive spending plan for 2023 at the time of releasing Meta’s Q3 2022 earnings report.

Here’s what I said then –

In my view, Meta’s Q3 report was slightly better-than-expected, and Q4 guidance was not apocalyptic. The biggest issue with Meta right now is its management’s lack of willingness to moderate expenses quickly to protect or boost near-term profitability. Amid a challenging macroeconomic environment, Meta’s aggressive spending plan for next year is scary poppins, and we could even see negative earnings in 2023 if the macro worsens from here.

With that said, some of Meta’s investments targeted at Reels, WhatsApp, and Messenger monetization should start yielding results in the next 12-18 months. Hence, we may well get a re-acceleration in revenues by the second half of next year or early 2024. Due to heightened business uncertainty, Meta could remain in the penalty box until it shows significant improvement in business fundamentals. After internalizing Meta’s Q3 report, I continue to like their social media assets, and I think we are getting a great deal at these prices. Meta’s products and services are used by 3B+ people on a daily basis, and none of Facebook, WhatsApp, Messenger, or Instagram are going anywhere. Facebook is not MySpace 2.0.

The latest downdraft in Meta’s stock looks like a capitulatory move. At ~$250-260B in market cap, Meta is ridiculously cheap. Yes, cheap could get cheaper, as we have seen over the last few quarters; however, the risk/reward situation is still heavily tilted in favor of bulls and too compelling to ignore for long-term-oriented investors.

Key Takeaway: I rate Meta a “Strong Buy” in the $90s

Fortunately, Meta’s management found cost religion soon after, and the rest is history. As of writing, META stock is up ~200% since I issued that “Strong Buy” call in late October. And as you may know, I have provided a couple more (less aggressive) positive endorsements for Meta since then –

- Meta Stock: 5 Things Smart Investors Should Know [Feb 2023]

- Meta Platforms Stock: 4 Reasons To Buy [Mar 2023]

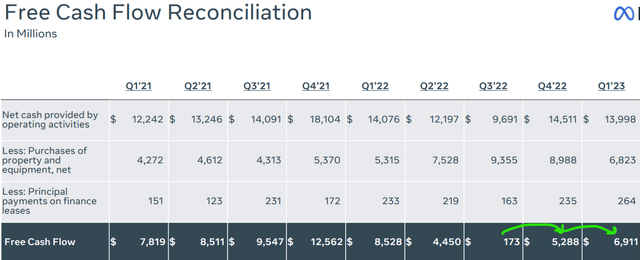

Through Q1 2023, Meta’s user growth and engagement metrics have held up strong, with Meta’s AI investments starting to pay off. More importantly, Meta’s aggressive cost-cutting measures have yielded incredible results in a short space of time, with quarterly free cash flows rebounding sharply in the last couple of quarters.

Meta Q1 2023 Earnings Presentation

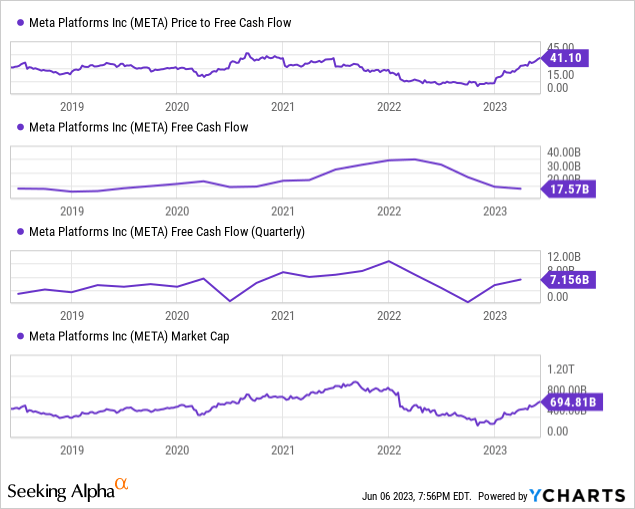

While the reversal in Meta’s quarterly free cash flow generation trends has been impressive, its stock has rebounded even more spectacularly – climbing from a market cap of ~$250B to ~$700B. Yes, Meta is still some way off of its all-time highs of ~$1T; however, its trading multiples have ballooned from ~10-12x P/FCF to ~40-42x P/FCF (levels last seen in late-2020).

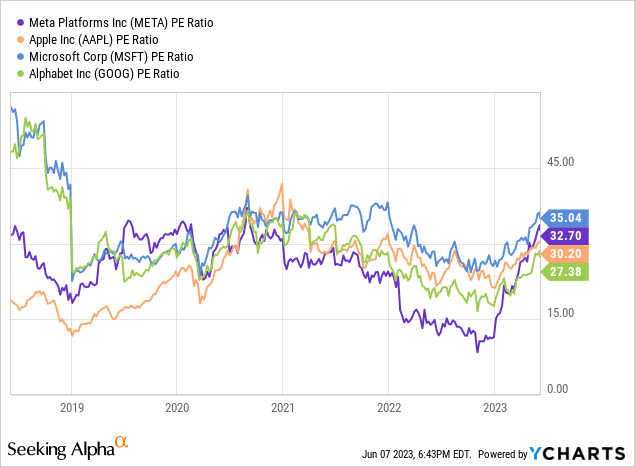

Based on its P/FCF multiple, Meta is more expensive than it was at the height of the liquidity bubble of 2020-21. Even on price-to-earnings, Meta’s stock (trading at ~32x P/E) is looking just as expensive as big tech peers such as Apple (AAPL) and Microsoft (MSFT). And if you have been following my research work on SeekingAlpha, you know that I currently have a “Sell” rating on both Apple and Microsoft.

Is Meta a “Sell” at current levels, or is it still a good long-term investment?

Well, let’s review near-term and long-term risk-reward for META to answer this question. In today’s note, we will look at analyst targets & estimates, technical charts, and quant factor grades to assess META’s near-term risk-reward. Furthermore, we shall analyze Meta’s valuation to assess its long-term risk-reward.

What Is The Short-Term Prediction For META?

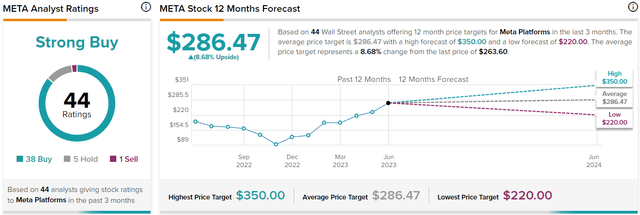

After gaining ~200% in price (or $450B in market capitalization) over the last eight months, Meta has once again become a Wall Street darling. Out of 44 analysts covering the stock, 38 analysts rate it a “Buy”, 5 analysts rate it a “Hold”, and only 1 analyst rates it a “Sell”.

TipRanks

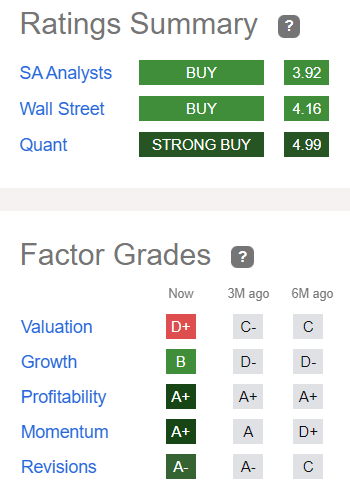

Clearly, Wall Street has turned bullish on META in 2023. And this bullish view is supported by my fellow SA analysts. Furthermore, META is now rated a “Strong Buy” based on its SA Quant rating score of 4.99/5.

SeekingAlpha

The significant improvement in Meta’s quant factor grades over the last six months is a direct result of robust upgrades on “Growth (D- to B)”, “Momentum (D+ to A+)”, and “Revisions (C to A-)” grades [slightly offset by a downgrade in “Valuation (C- to D+)”]. From a quant factor grade perspective, Meta stock remains a “Strong Buy” here.

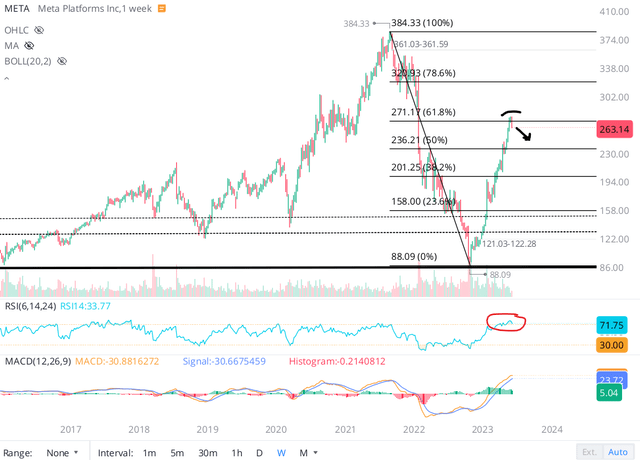

That said, Meta’s stock is currently in overbought territory (RSI > 70) whilst trading right beneath the 61.8% Fibonacci retracement level of the entire downdraft of 2022. From a technical perspective, META looks ripe for some sort of a pullback in the near term.

WeBull Desktop

In yesterday’s session, Meta tumbled from $275 to $263, in what appears to be a clear rejection of the 61.8% Fib retracement level. If we get confirmation of this rejection with further selloff this week, I think Meta’s stock could fill some of the gaps it has left on the wild ride-up in recent months.

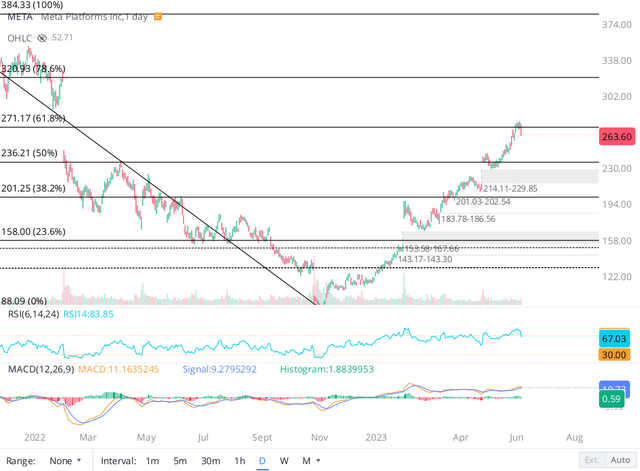

WeBull Desktop

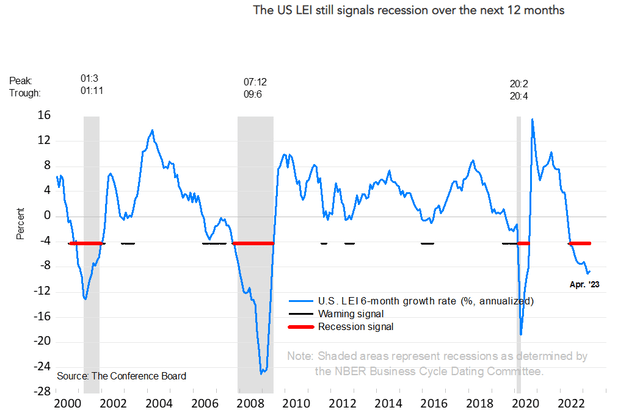

On Meta’s chart, I see two big gaps – one at $215 and the other at ~$155. If technology stocks were to see any sort of a pullback after such a massive year-to-date run-up, Meta looks primed to head back down to the low $200s. While I can’t see Meta going back down to the mid-$100s, we could yet end up in a recession within the next 12-18 months, and markets could get irrational on the downside once again, as they did in late 2022. Hence, I wouldn’t rule out the possibility of a gap fill at ~$155 too.

Conference Board

With a resolution of the debt ceiling issue now in place, US Treasury general account is set to be refilled to the tune of $1T via fresh treasury issuance over the coming weeks and months. This rise in TGA balance will likely drain liquidity out of financial markets, and high-flying tech stocks could get hit in such an environment. Hence, the near-term outlook for Meta looks ominous.

Where Will Meta Platforms Stock Be In 2025?

To answer this question, we will utilize TQI Valuation Model with the following assumptions:

- Modeling period: 5 years

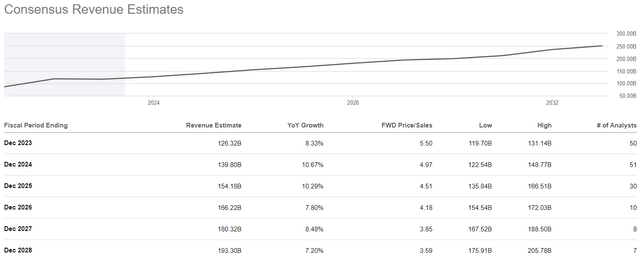

- Modeling period revenue growth: 10% CAGR [Over the next five years, consensus analyst estimates have pegged Meta’s CAGR revenue growth at ~10% per year. While I think Meta could do a lot better in terms of growth (especially if Reality Labs investments pay off), we will use street estimates as it’s a relatively safe assumption that Meta’s core social media assets can hit by themselves].

SeekingAlpha

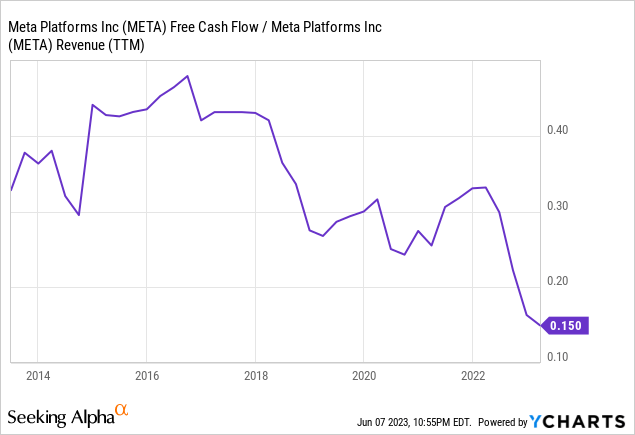

- Optimized FCF margin: 30% [While Meta’s TTM FCF margin is ~15%, the social media giant’s FCF margin has historically hovered in the 25-40% range. In Q1 2023, Meta’s quarterly FCF margin reached 24%, and I think the ride up to 30% should be relatively straightforward. In the long run, I can see Meta’s steady-state FCF margins reaching 40%+; however, for the sake of conservatism, I am going with an optimized FCF margin of 30%]

All other assumptions are relatively straightforward, but if you have any questions, please feel free to share them in the comments section or DM me.

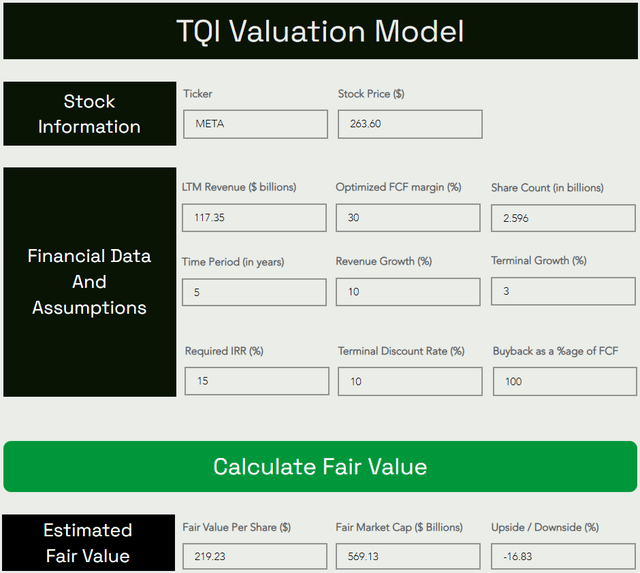

Here’s my valuation for Meta:

TQI Valuation Model (TQIG.org)

Using a 5-yr modeling period and conservative assumptions, we deduced a ~$219 fair value estimate for Meta. At its current price of ~$263, Meta appears to be overvalued by ~17%.

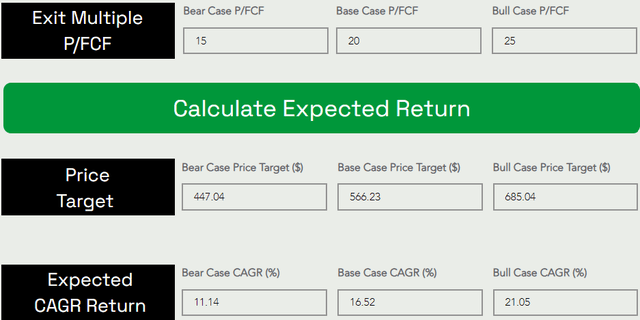

Now, assuming a base case exit multiple of ~20x P/FCF, META could be trading at ~$566 per share five years from now.

TQI Valuation Model (TQIG.org)

At this estimated future price, Meta would generate a 5-yr CAGR return of ~16.5%, which is higher than my investment hurdle rate of 15%. Hence, I think META’s long-term risk/reward is still in favor of bulls despite the stock getting somewhat ahead of its fair value for the time being.

If we were to extrapolate prices based on Meta’s projected 5-yr CAGR return, I see META’s share price reaching ~$400 per share (or ~$1T in market cap) by the end of 2025.

| End of Year | Meta Share Price Target |

| Current Date | $263.60 |

| 2023 | $296.26 |

| 2024 | $345.20 |

| 2025 | $402.22 |

Final Thoughts: Is META Stock A Good Long-Term Investment?

Meta is a fundamentally-sound business with a deep network effects moat. As we know, Meta’s social media assets are used by ~3B people across the globe, and some of these assets, like Reels, WhatsApp, and Messenger, are deeply under-monetized. As Meta monetizes these assets, revenues are likely to grow at a healthy clip over the coming years. And if Meta succeeds in its long-term ambition of building the next big computing platform with Reality Labs (metaverse), I think we can get double-digit growth from Meta throughout the 2020s. Hence, the long-term outlook for Meta appears rosy.

As shared in today’s note, I see Meta’s share price rising from $263 to $402 (~$1T in market cap) at ~16.5% CAGR by the end of 2025 (using conservative assumptions). From a long-term risk-reward perspective, Meta still looks like a solid investment (despite the current stock price being higher than our fair value estimate). Hence, long-term investors that are fine paying a premium for a fantastic business can buy Meta right here, right now.

For those worried about near-term market gyrations, Meta’s current technical setup is ripe for a sizeable pullback, and with treasuries yielding ~5%, waiting for a better entry point (in the low $200s) is a fine idea.

After weighing near-term and long-term risk-reward, I am keeping a moderately bullish stance on META at current levels with a minimum investment horizon of 1-2 years in mind. Despite maintaining a bullish view on META, I do have a strong preference for staggered accumulation, given the rapid run-up in the stock over the last few months.

Key Takeaway: I rate Meta a modest “Buy” in the $260s, with a strong preference for staggered accumulation.

Thanks for reading, and happy investing! Please share your thoughts, questions, and/or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

At my investing group, The Quantamental Investor, we were buying META aggressively in the low to mid $100s throughout late 2022. While it's been a fun ride up, portfolio allocation rules have forced us to trim META in recent weeks. As of now, we own a full position in Meta with an effective cost basis of $129 per share. Given our commitment to portfolio allocation discipline, we will not buy additional shares until Meta drops below its fair value ($219 –> this is a moving target) and portfolio allocation rules allow fresh purchases.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). New users can also avail of a special introductory pricing deal!