Summary:

- Meta Platforms, Inc. stock was a great value play in November 2022, but it has since rallied and is now trading at high multiples.

- The company’s competitive position has been challenged by Amazon, Apple, and TikTok, impacting its ad targeting and share of user attention.

- While Meta has a strong position in the VR market with its Quest headsets, the segment is currently not large enough to impact the company’s overall performance.

- In this article I make the case that Meta Platforms, Inc. stock is fully valued at today’s prices.

Justin Sullivan

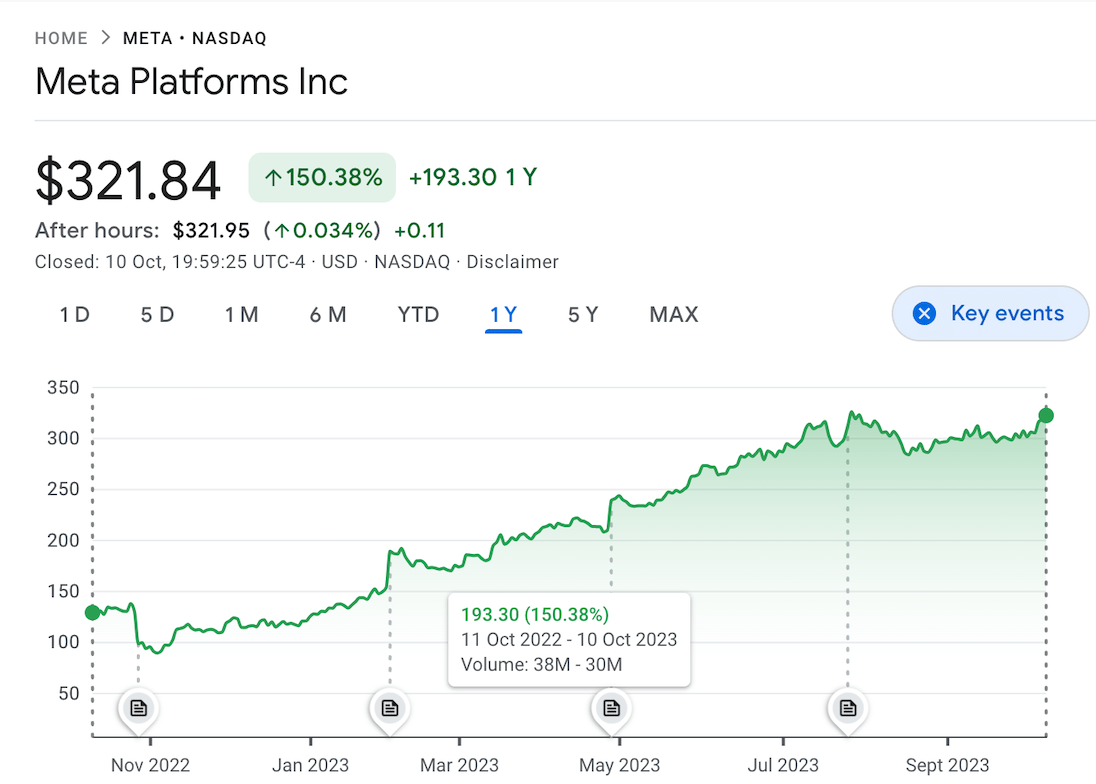

Meta Platforms, Inc. (NASDAQ:META) was one of the best value plays you could have made in November 2022. That month, the stock went all the way down to the $80-$90 range, at which point it was trading at 10-12 times earnings and similar free cash flow multiples. Meta hit its lows after a very disappointing Q3 earnings release which showed its free cash flow (“FCF”) shrinking from $9.5 billion to $179 million. Such a colossal decline in FCF predictably got investors heading for the exits, as it was a full 98% decline. The release attributed the decline in FCF to a one-time increase in capital expenditure (“CAPEX”) related to new data centers. Later earnings releases showed the decline in FCF reversing, as the data center spend was a one-time charge, but not many investors spotted that when the Q3 earnings release came out.

At any rate, the buying in META stock was very good for many months. META went on to become one of the best-performing large cap tech stocks of 2023, when its business performance recovered. As of the company’s most recent earnings release, its free cash flow was growing on a year-over-year basis, not just sequentially from the Q3 2022 disaster release!

So, Meta has admirably recovered from its 2022 lows, and will probably not revisit those lows. It has been a major win for investors who bought at the right time.

However, today is a different story.

After rallying 254% off its 2022 lows, Meta is starting to look expensive, trading at the following multiples according to Seeking Alpha Quant:

-

37 times earnings.

-

6.9 times sales.

-

6 times book value.

-

14.76 times operating cash flow.

Apart from the operating cash flow multiple, these are all very high. Also, if we use the more stringent free cash flow measure in place of operating cash flow, we get $9.18 in FCF per share, which gives us a 35 price/cash flow ratio–not much better than the earnings multiple.

Granted, Meta’s free cash flow is likely to improve dramatically in the upcoming quarter. As I will show in the ensuing paragraphs, the company should deliver at least $5 billion in FCF, as the one-time charges that took a bite out of Q3 2022 earnings will not recur. Additionally, Meta’s post-market October 25 earnings release will bump Q3 2022 out of the trailing 12 month period, likely resulting in a large increase in 12 month FCF. I’m not expecting a return to 2021’s level of FCF (about $28 billion), but it’s possible we’ll see $25 billion or so in the trailing 12 month period. If that’s the case, then the FCF per share would become $9.54 per share rather than the current $9.18 reported on Seeking Alpha Quant. The price/free cash flow multiple would shrink to 33.73, which is lower than before but still fairly high.

The point is that Meta Platforms stock isn’t the value opportunity it once was. Today, you can buy Alphabet (GOOG) stock at 29 times earnings, much cheaper than Meta. GOOG is not cheap in absolute terms, but its earnings multiple goes to show that there are now stocks cheaper than META among that stock’s peers – that wasn’t the case in late 2022. For this reason I consider META stock a “hold” at today’s prices. In the ensuing paragraphs, I’ll explain why I feel that way about the stock, focusing on the stock’s valuation, growth prospects and competitive position.

Meta Platforms stock performance (Google Finance)

Competitive Position

One thing about META today that isn’t as good as in the past is the company’s competitive position. Numerous challenges to Meta’s market share have arisen in recent years, including:

-

Major growth at Amazon’s (AMZN) ad platform.

-

The rise of TikTok.

These developments impeded Meta’s ad targeting, and created competition for user attention.

First, Apple’s ATT policy impacted Meta in an immediate sense by removing the company’s ability to collect user data without permission. Before ATT, Meta could track location and web browsing data on every single IOS user with a Facebook or Instagram app installed on their device. Today, the company has to ask users for their permission before they install such apps. If users say “no,” then Meta is not able to show them targeted ads based on new data collected. This diminished Meta’s competitive position by reducing the value of its ads to customers.

Amazon and TikTok had similar effects, albeit by different means. Amazon ads gave Amazon vendors an easy way to advertise directly on Amazon, eliminating the need to advertise on a third party platform. TikTok created a new format of “video first” content that initially gave Instagram a run for its money. Today Instagram is catching up with TikTok, but the latter company continues to enjoy significant market share in its space.

New Products

Given that Meta is losing market share to its ad-tech rivals, we need to know whether the company can launch new product categories in which it has a strong moat. Meta still has some competitive advantages in ad-tech, but the industry is not the Google-Facebook duopoly it once was. Amazon, TikTok and Microsoft (via LinkedIn) now enjoy significant shares of the ad-tech market, and that could put pressure on Meta’s pricing power. Given that these competitors aren’t going away anytime soon, we need to ask whether there are new products in Meta’s pipeline that face less competition than its core offerings.

It turns out there is:

Virtual Reality (“VR”) headsets!

VR is Meta’s newest market, and its share in the space is over 50%. Its product line in the space is called the Quest (Quest, Quest 2, Quest 3, Quest Pro, etc.). These headsets let customers carry an entire library of apps in their headset. Whereas previous VR headsets usually had to be hooked up to a computer or gaming console, the Quest is a computing platform in itself. Games and apps can be installed on it directly.

Until now, few have been able to match Meta’s library of VR applications, but Apple is stepping up to the bat. Its Vision Pro headset will come with a large lineup of apps, both by Apple and by third party developers. Apple is asking IOS developers to port their apps over to the Vision Pro. This may result in the Vision Pro becoming the first non-Meta VR headset with a truly impressive lineup of apps, but with a $3,499 price point, it seems to be targeting a different segment than that being targeted by the Quest line, which maxes out at $999.

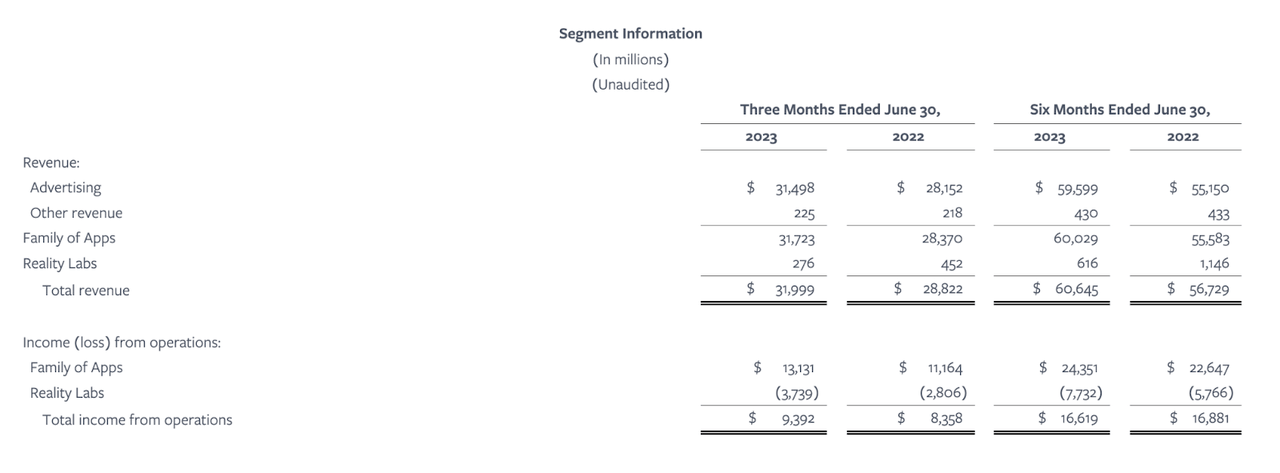

At any rate, the Quest is not really moving the needle for Meta right now in terms of revenue OR profitability. Meta’s VR segment did $272 million in revenue last quarter, out of $31 billion total. The entire segment is negligible as a percentage of Meta’s business–though it is burning through $3.7 billion per quarter. While it’s promising that Meta has a strong competitive position in VR, the entire VR market seems too small for the time being to really change the conversation on the company as a whole.

Meta Platforms segment earnings (Meta Platforms)

The Bottom Line

Looking at Meta’s valuation, recent earnings and competitive position together, we can conclude that the stock is about fairly valued. It has a strong enough competitive position in the growing ad-tech market that we can assume the company will grow in the future. However, the increased competition in that market points to the likelihood of past growth being slower than future growth. Meta’s revenue and earnings declined in two out of the last three quarters. Its second quarter results were helped by a FOREX tailwind. In the third quarter, the U.S. dollar gained on foreign currencies, making Meta’s foreign-source revenue and earnings less valuable. So, the same factor that helped Meta last quarter, will hinder it when the next earnings release comes out.

So we’ve got Meta at 37 times earnings, and moderate but diminished growth prospects. There is enough going on at Meta Platforms, Inc. to make it unwise as a short – the core advertising business is extremely profitable, and a beat on earnings could easily trigger a rally. However, it’s not the most compelling long, either, after already having run up more than 200% from the lows. On the whole, I’d say the best way to approach Meta is to either avoid it or go long at only a very small weighting. When stocks are fully valued but not criminally overvalued, things can go either way.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.