Summary:

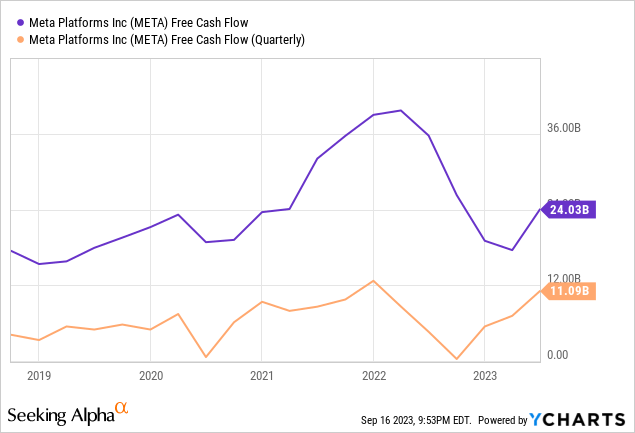

- Meta’s ongoing top-line growth re-acceleration and recent margin expansion have driven a strong recovery in free cash flow generation.

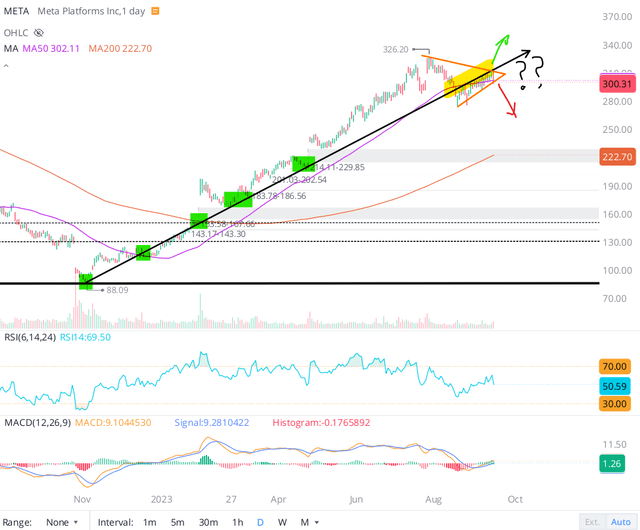

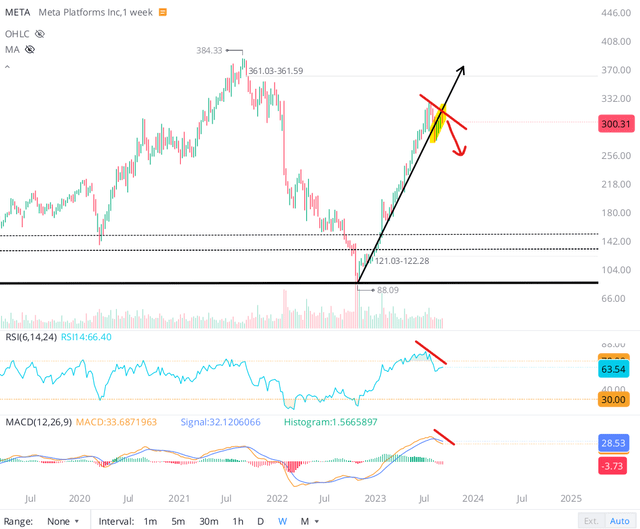

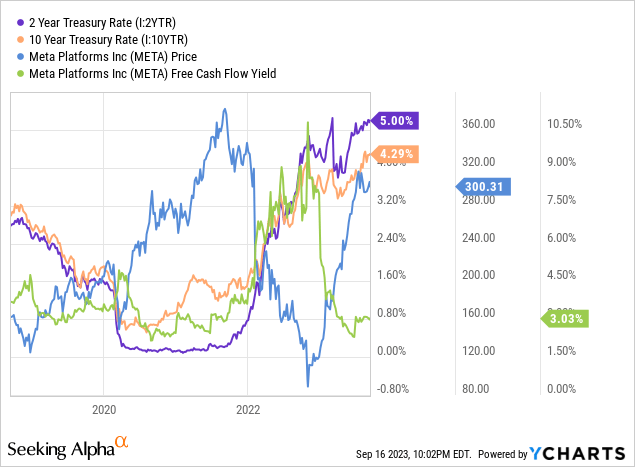

- META stock has been on a strong upward trend, but the recent rise in treasury yields may lead to a corrective pullback in the stock despite Meta’s improving financial performance.

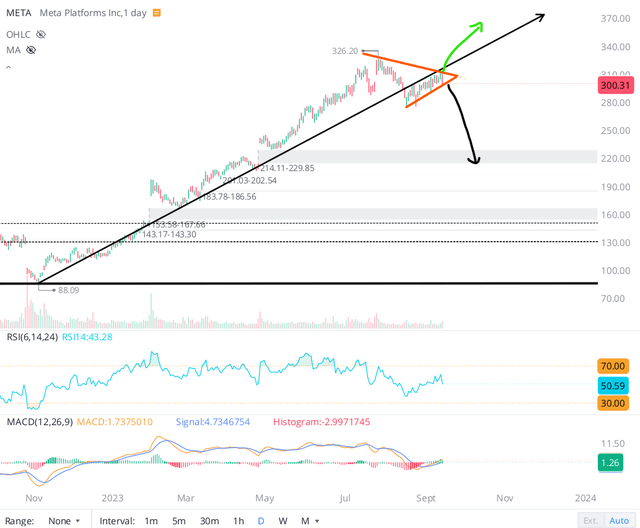

- Technically, META stock looks primed for an imminent breakout or breakdown from a triangle, and investors must brace for volatility.

- With Meta’s stock running ~20% ahead of its fair value at a time when the stock is losing a key trendline, I think a pullback is the likelier outcome here.

- Considering the strong possibility of a breakdown to low $200s, I am downgrading META to a “Hold” rating at $300 per share. This decision wasn’t easy as a long-term META investor, but a 5.5% yielding treasury bill allows for patience.

ryasick

Introduction

Meta Platforms’ (NASDAQ:META) “Year of Efficiency” is turning out to be the “Year of Melt-up” with the social media giant’s stock running up in a straight line throughout this year so far. While market participants have rightly cheered much improved financial performance at Meta in recent quarters, the recent run-up in treasury yields has left META with a negative equity risk premium.

Historically, Meta’s stock and treasury yields have moved in opposite directions. With long-duration yields climbing back up to pre-SVB (March 2023) levels, the likelihood of a pullback in META stock is rising.

From a technical perspective, Meta’s stock looks primed for a big near-to-medium-term move as the price action tightens in a triangle formation right underneath META’s uptrend line from its 2022 bottom. However, triangles can break out in either direction and so, META investors must brace for volatility.

If you have been following my work on SA, you know that I have held a bullish stance on META stock thus far in 2023.

Ahan Vashi’s META coverage on SeekingAlpha

And here’s what I said in my previous article (Where Will Meta Platforms Stock Be In 2025?) in early June 2023:

Meta is a fundamentally-sound business with a deep network effects moat. As we know, Meta’s social media assets are used by ~3B people across the globe, and some of these assets, like Reels, WhatsApp, and Messenger, are deeply under-monetized. As Meta monetizes these assets, revenues are likely to grow at a healthy clip over the coming years. And if Meta succeeds in its long-term ambition of building the next big computing platform with Reality Labs (metaverse), I think we can get double-digit growth from Meta throughout the 2020s. Hence, the long-term outlook for Meta appears rosy.

As shared in today’s note, I see Meta’s share price rising from $263 to $402 (~$1T in market cap) at ~16.5% CAGR by the end of 2025 (using conservative assumptions). From a long-term risk-reward perspective, Meta still looks like a solid investment (despite the current stock price being higher than our fair value estimate). Hence, long-term investors that are fine paying a premium for a fantastic business can buy Meta right here, right now.

For those worried about near-term market gyrations, Meta’s current technical setup is ripe for a sizeable pullback, and with treasuries yielding ~5%, waiting for a better entry point (in the low $200s) is a fine idea.

After weighing near-term and long-term risk-reward, I am keeping a moderately bullish stance on META at current levels with a minimum investment horizon of 1-2 years in mind. Despite maintaining a bullish view on META, I do have a strong preference for staggered accumulation, given the rapid run-up in the stock over the last few months.

Key Takeaway: I rate Meta a modest “Buy” in the $260s, with a strong preference for staggered accumulation.

Since then, META stock has gone up another $40, and I think it is the right time to re-evaluate our bullish position given the rapid run-up in long-duration treasury yields.

Meta Stock Key Metrics

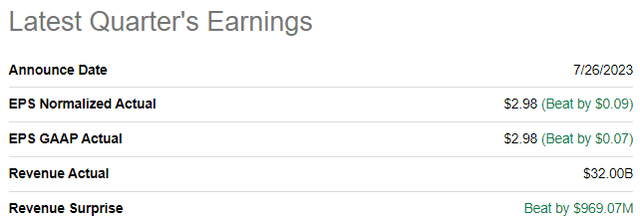

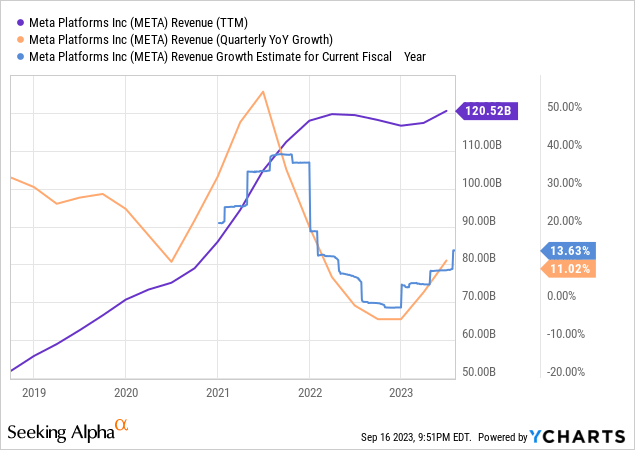

On the back of stronger-than-expected user engagement (primarily due to Reels) and DAU/MAU growth, Meta outperformed street expectations in Q2 2023, with revenues rising 11% y/y to $32B (vs. est. $31.03B) and normalized EPS coming in at $2.98 (vs. est. of $2.89).

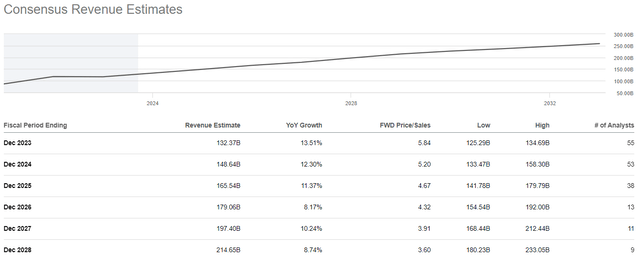

From a fundamental perspective, Meta showcased a re-acceleration in y/y revenue growth in H1 2023, with further re-acceleration to mid-teens expected in H2 2023. Furthermore, Meta is now forecasted to grow sales at ~10%+ CAGR over the next five years as per consensus street estimates.

In my view, deeply under-monetized assets like Reels and WhatsApp will lead this next leg of growth at Meta. And reality labs (metaverse) could extend this growth runway even further. Now, Meta’s rapid growth days are probably in the rearview mirror; however, investors can reasonably expect solid high-single to low-double-digit growth from Meta for several years to come.

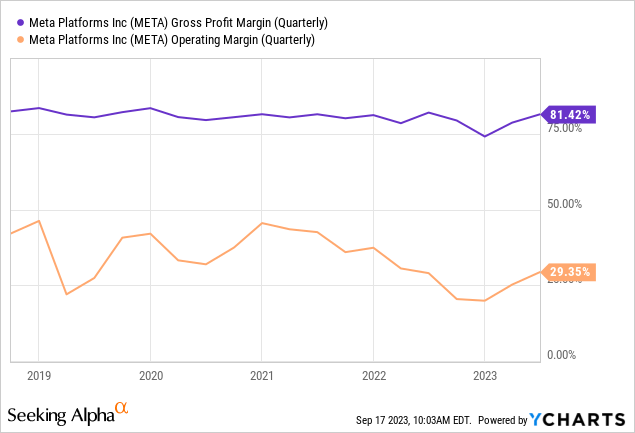

While Meta is still investing aggressively in its ambitious metaverse project (next big computing platform), recent cost-cutting measures across the core digital advertising business have enabled a sharp rebound in Meta’s gross and operating profit margins in H1 2023.

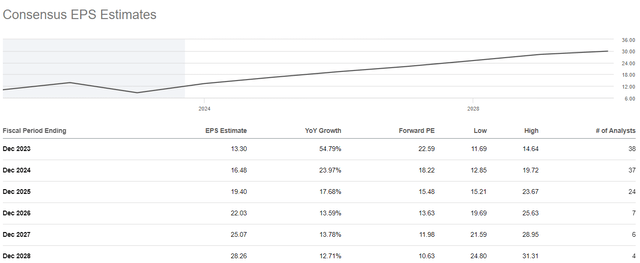

This margin expansion coupled with the ongoing re-acceleration in top-line growth is driving a positive rebound in Meta’s free cash flow generation, which appears set to exceed $40B this year. With its current market capitalization of ~$773B, Meta is still trading at <20x P/FCF [2023E], which, in my view, is a reasonable valuation even with treasury yields at 4-5.5%.

As of now, Meta’s revenue growth and margins appear to be past their troughs. According to consensus street estimates, Meta is set to grow EPS at a double-digit CAGR rate for the next five years.

Barring a deep recession triggering yet another slump in the advertising market, I think Meta will deliver alpha-rich earnings from current levels.

Meta Stock: Relative And Absolute Valuation

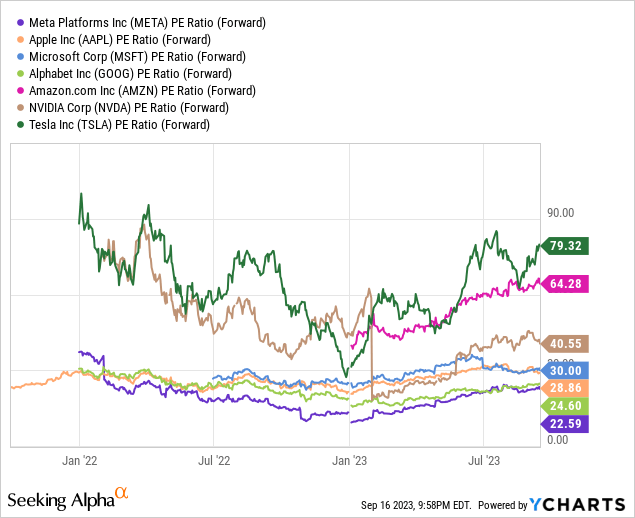

From a relative valuation standpoint, Meta is still the cheapest big-tech stock based on forward earnings. And a forward P/E of ~22.6x is by no means excessive even in a 4-5% interest rate environment.

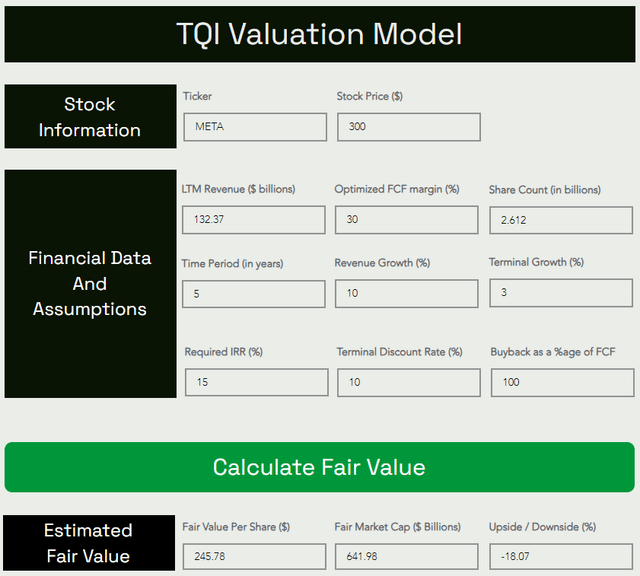

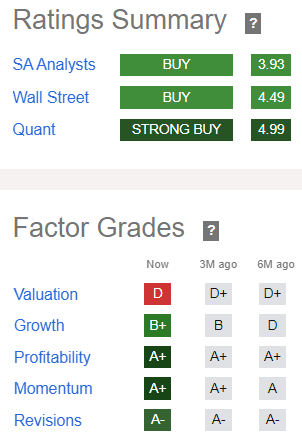

That said, Meta is running ~20% above its fair value according to TQI’s Valuation Model:

TQI Valuation Model (TQIG.org ) TQI Valuation Model (TQIG.org )

While Meta stock looks somewhat overvalued on an absolute basis at this moment in time, the business is growing at a healthy clip whilst expanding margins. Hence, I think intrinsic value can catch up to price over the upcoming quarters. With the 5-year expected CAGR for Meta [~16%] still outpacing my investment hurdle rate of 15%, the long-term risk/reward continues to look favorable for META stock.

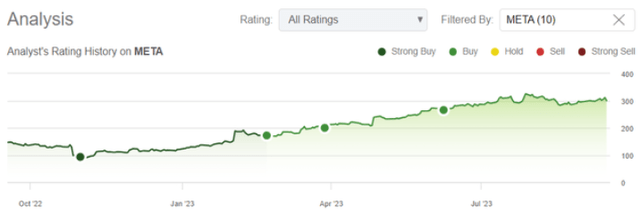

META’s Quant Factor Grades And Technicals

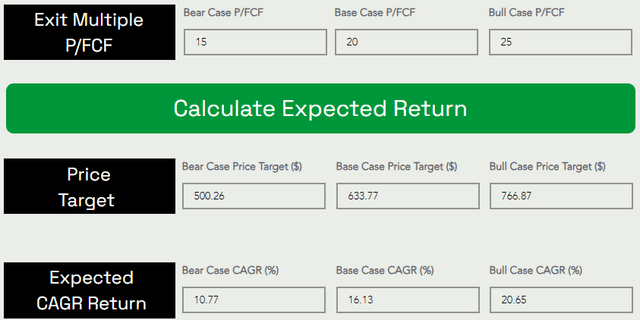

And this bullish view is supported by Wall Street and Seeking Alpha analysts. Furthermore, META continues to be rated a “Strong Buy” by SA’s Quant Rating system with a score of 4.99/5. Based on its strong financial performance and healthy business outlook, Meta’s quant factor grades for “Growth” [B+], “Profitability” [A+], and “Revisions” [A-] are fully justified. And “Valuation” rating of “D” is also reasonable given Meta’s stock is currently running ~20% above its fair value.

SeekingAlpha

Meta’s (technical) “Momentum” grade of “A+” is reflective of the straight-line melt-up we have seen in recent months; however, this grade may deteriorate in upcoming weeks if Meta fails to hold its 50-DMA level and break back above the trendline. Given the rollover in RSI and MACD indicators on the weekly chart, I think Meta’s stock is ripe for a pullback.

Considering Meta’s strong fundamental performance and relatively reasonable valuation, I think any pullback is likely to be corrective in nature. As you can see in the chart below, Meta’s stock has formed a triangle pattern, which can break in either direction. The price action has gotten tighter in recent weeks, and a breakout or breakdown is looking imminent.

If Meta can break back above the uptrend line and re-claim recent highs of $325, I can see the stock marching higher to all-time highs in the next 6-12 months. On the flip side, a breakdown of this triangle can lead META down to low-to-mid $200s for a gap fill. Also, Meta’s chart has another massive gap at ~$155 and that’s where we could be headed in the near-to-medium term if a deep recession (and advertising slump) were to materialize in 2024.

From a technical perspective, the risk/reward is finely balanced right now, with an imminent breakout or breakdown on the horizon. With long-duration treasury yields climbing back above pre-SVB levels [and a flurry of treasury issuance yet to come], a downward resolution looks like the more likely outcome for Meta (and the tech-heavy (QQQ) ETF) in this environment.

Concluding Thoughts: Is Meta Stock A Buy, Sell, Or Hold?

Despite Meta’s improving fundamentals and reasonable relative valuation, I am downgrading META stock to a “Hold” rating (from my previous modest “Buy” rating) due to its price currently running ahead of fair value and a potential loss of momentum (inability to reclaim top line and a break of 50-DMA last week) amid rising treasury yields. The long-term risk/reward for META is still looking favorable; however, I think waiting for a resolution of the triangle pattern formed on Meta’s chart is the prudent decision here for long-term investors [especially with treasury bills giving 5.5% per year].

Key Takeaway: I rate Meta a “Hold” at $300 per share.

Thanks for reading, and happy investing! Please share your thoughts, questions, and/or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.