Summary:

- Meta Platforms has seen significant reductions in operational costs and increased free cash flow since implementing efficiency measures, with the potential for further cost reductions in 2023.

- The company’s portfolio of apps continues to grow, with over a third of the global population utilizing Meta’s products and both daily and monthly active users increasing YoY.

- Despite the recent rally, Meta’s shares may still have room for growth, with the possibility of reaching $325 in winter 2023 if market conditions are favorable and the company continues its positive trends.

Leon Neal

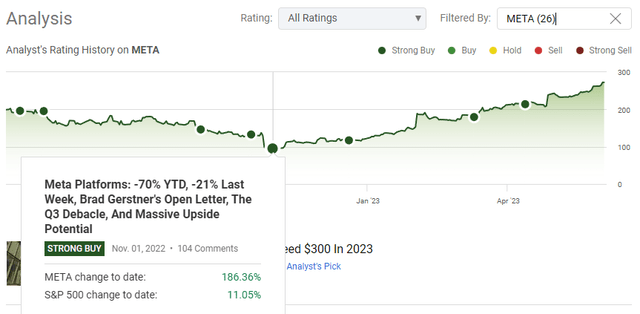

The rally continues for Meta Platforms (NASDAQ:META) from its overextended downturn. I was very bullish on the way down, and I am just as bullish on the way up. Since my article on 11/1/22 (can be read here) where I outlined the case for a massive breakout, shares of META have increased 189% compared to 9.78% for the S&P 500. Prior to Q1 2023 earnings, I released an article (can be read here) when shares of META reached $214.84, discussing how shares could exceed $300 in 2023. Some disagreed, saying that it was time to short META. Everyone is entitled to their own opinion, and while I am not always correct, shares of META keep appreciating. On 6/2, META closed at $272.61 and needs to appreciate by 10.05% to reach $300. Even at $300, META would still need to appreciate by roughly 27.37% to reach their all-time high, which is in the $382 range. I wish I had a crystal ball, as it would make things a lot easier, and while I don’t know what the outcome will be, I still see META getting above $300 in 2023.

The Impacts of META’s efficiency decisions on costs

On the Q1 conference call, Mr. Zuckerberg addressed META’s commitment to efficiency. META will continue to slow its hiring rates, flatten its management structure and increase the percentage of the workforce that is technical. The priority is to prioritize projects that will improve the speed and quality of internal endeavors with a focus on delivering META’s long-term vision. META has gone through multiple waves of restructurings and layoffs, and in May, META will have finished an additional wave throughout its business groups. META is focused on improving its distributed work model by delivering AI tools to boost productivity and remove unnecessary processes across the company.

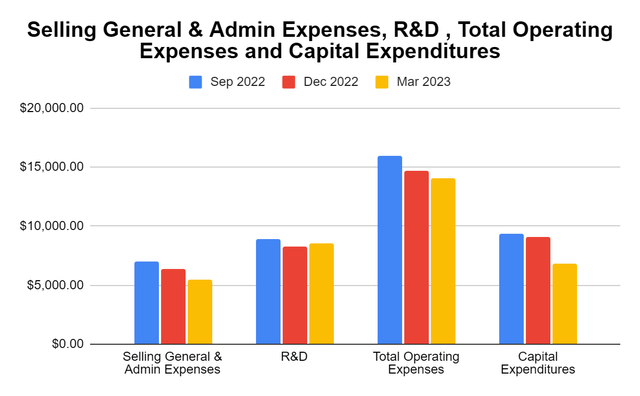

Brad Gerstner penned his open letter to MR. Zuckerberg on 10/24/22, and I wrote my article covering his open letter and outlining the massive upside potential for shares of META on 11/1/22. I want to look at how META’s move to efficiency has translated to actual expenses. The full ramifications of the restructurings and layoffs are yet to be felt, as it will take some time for all the impacts to be recognized in META’s numbers. There are 4 line items I am specifically looking at, which include selling, general, and administrative expenses, research & development (R&D), total operating expenses, and capital expenditures. I am excluding the cost of revenue because as META increases revenue generated, I expect the cost of revenue to increase, therefore, I am excluding this from what I consider the actual operational costs.

META is absolutely delivering on its capital efficiency plans. Since the close of Q3 2022, META has seen significant reductions in selling, general, and administrative expenses, research & development (R&D), total operating expenses, and capital expenditures across Q4 2022 and Q1 2023. Selling, general, and administrative costs declined by -8.6% in Q4 2022, then by another -14.54% in Q1 2023. Over the previous 2 quarters, META has reduced its quarterly selling, general, and administrative costs by -$1.54 billion or -21.9%. R&D saw a -7.34% reduction in Q4 2022, then an uptick in Q1 2023 of 3.55%. Overall, R&D is down -4.05% or -4362 million over the past 2 quarters. META’s total operating expenses came in at $15.95 billion in Q3 2022, which were reduced by -7.9% in Q4 2022, and by another -4.34% in Q1 of 2023. Overall, quarterly total operating expenses have declined by -$1.9 billion or -11.9% in the past 2 quarters.

Steven Fiorillo, Seeking Alpha

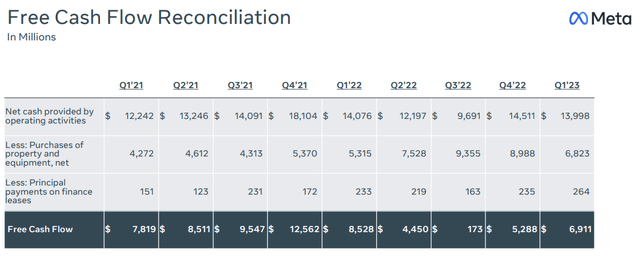

The last component I look at is capital expenditures which can be found on the cash flow statement rather than the income statement like the other line items. CapEx is important because it represents the cash outflows toward purchasing plant, property, and equipment for the company. Free cash flow (FCF), my favorite profitability metric, is measured by subtracting CapEx, which is cash going out from cash from operations, which is cash being generated from the business. META also includes the principal payments on finance leases in their FCF, so I will include it. In Q3 2022, META allocated almost all its cash from operations to capital expenditures and was left with just $173 million of FCF for the quarter. This came as a shock to many based on historical FCF levels.

In Q4 of 2022, META reduced its CapEx by -$367 million (-3.92%) while increasing the cash generated from operations by $4.82 billion. In Q1 of 2023, META reduced its CapEx by another -24.09% as they shed -$2.17 billion. META’s CapEx declined by -27.07% (-$2.53 billion) over the previous 2 quarters. The combination of decreased CapEx and increased cash from operations has helped META’s FCF get back to almost $7 billion in Q1 of 2023.

Overall, the impacts on META’s decisions are positively impacting their expenses. It’s still early, and I would expect to see further reductions in costs throughout 2023. The latest restructuring in May probably won’t be seen in the numbers until at least Q3, maybe even Q4. I think this was important for the market to see because a narrative was built that META was recklessly spending on Reality Labs without a care in the world. META has shown that it can be fiscally responsible and tighten its belt while allocating capital toward future growth projects, including reality labs.

After a year of negative growth in revenue and declining profits, META looks like it’s back to YoY growth

For many companies, META’s 2022 numbers of $116.61 billion in revenue and $23.2 billion in net income would be incredible. For META, on the other hand, 2022 was the first year that revenue declined YoY, and profitability fell off a cliff. In 2021, META generated $117.93 billion in revenue and produced $39.37 billion in net income. Q1 of 2023 set the stage for a return to growth as META delivered $28.65 billion in revenue which was a 3% YoY increase compared to $27.91 billion in Q1 2022. META also guided that Q2 2023 revenue would come in between $29.5 and $32 billion compared to $28.82 billion in Q2 of 2022.

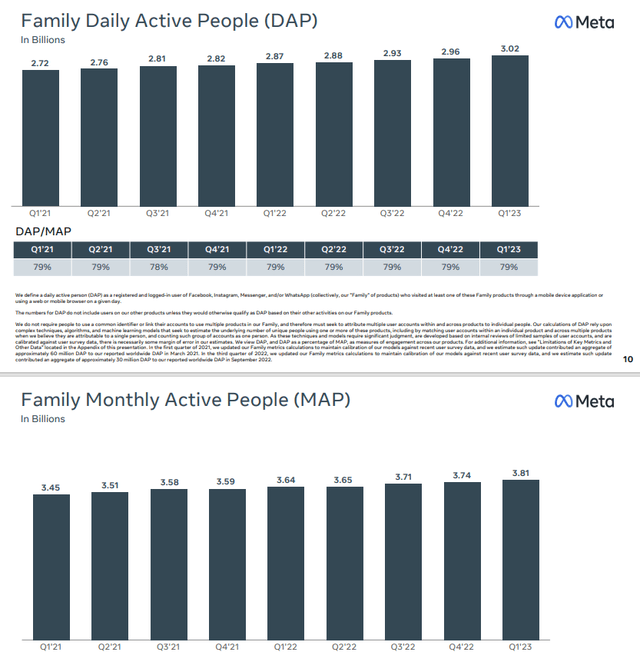

There was always a concern from a segment in the investment community that, at some point, META would stop seeing growth across its platforms and eventually start to lose customers. META continues to prove that theory wrong as Family Daily Active People (DAP) increased 5% YoY to 3.02 billion, while Family Monthly Active People increased 5% as well YoY to 3.81 billion. Its legacy platform Facebook saw Daily Active Users (DAUs) increase 4% YoY to 2.04 billion, and its Monthly Active Users (MAUs) increase 2% YoY to 2.99 billion. These are incredible metrics across the board, and while growth has slowed at periods, it has never retraced into a negative QoQ decline.

META’s portfolio of apps continues to grow. This is the first time that META surpassed 3 billion people using at least one of its Family of Apps daily, while approximately 3.8 billion people use at least one on a monthly basis. Facebook, which is its legacy platform, continues to grow globally, with DAU and MAU growth sequentially across all regions. More than a third of the global population utilizes META’s products, and despite speculation, they have yet to be dethroned in the social media space.

While META’s recent run has made shares more reasonably priced, looking at forward metrics could indicate more appreciation is in its future

The last time I looked at META’s valuation, META’s market cap was $560.27 billion with a TTM FCF of $19.04 billion, placing its price to FCF at 29.42x. Today, META has a market cap of $698.63 billion, and its TTM FCF is $16.82 billion, placing its price to FCF at 41.53x. The price to FCF valuation has increased significantly, but it’s not just because the market cap has increased. The TTM FCF has declined because the $8.53 billion of FCF generated in Q1 2022 has rolled off, and the anomaly of Q3 2022, when FCF came in at just $173 million, is still in the TTM. If META generates the same amount of FCF in Q2-Q4, they will generate $27.64 billion in FCF for 2023, and if I use that number, it will place their price to FCF at 25.27x. If shares of META stay stagnant, and their FCF comes in at $27.64 billion for 2023, shares would actually be cheaper on a price-to-FCF basis compared to when the market cap was $138 billion less.

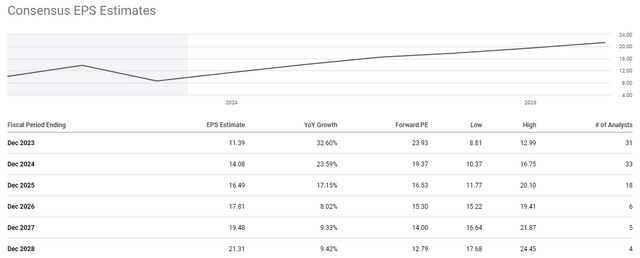

The analyst community sees large amounts of future growth in META’s EPS. In 2022, META generated $8.63 in EPS. There are 31 analysts who have META’s EPS pegged at $11.39 for 2023, which is a YoY growth rate of 32.60%. For 2024, 33 analysts have META’s EPS pegged at $14.08, which would be a new record for META and be a YoY growth rate of 23.59% from 2023. META is also expected to see double-digit YoY growth in 2025, as 18 analysts have their EPS coming in at 16.49x. This puts META at a forward P/E for 2023 of 23.93, then 19.37 in 2024, and 16.53 in 2025. Based on the analyst community, shares of META still look cheap.

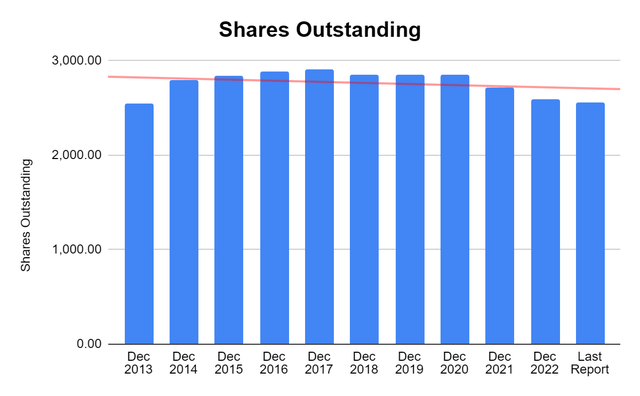

Since 2017, META has actively been repurchasing shares, and in Q1 2023, META repurchased $9.22 billion of its class A common shares. They had $41.73 billion remaining on their approved repurchase authorization plan. In just over 5 years, META has repurchased 11.78% of its shares as its shares outstanding declined by -342.3 million. While META doesn’t pay a dividend, its rewards shareholders by allocating capital toward its buyback program. Despite recent hiccups, META is a cash-rich company with $37.44 billion of cash and short-term investments sitting on its balance sheet, with only $9.92 billion in long-term debt and tens of billions being generated annually in pure profit.

Steven Fiorillo, Seeking Alpha

Conclusion

META’s massive run may still have steam left in the tank. Regardless, if you dislike META as a company, the facts are that costs are coming down, more than 1/3rd of the global population uses its products, and there have been 2 consecutive quarters of EPS, net income, and FCF growth. I am excited about Q2 and Q3 because I don’t believe the full impacts of META’s efficiency measures are reflected in the costs yet, and margins could improve a bit. Previously I said META would hit $300 in 2023, and after Q1, I think it can go higher. I wouldn’t be surprised to see META at $325 in the winter if the markets rally in the 2nd half of 2023. Based on the forward EPS estimates, META looks cheap, and if Reality Labs is successful, it could be a huge catalyst that isn’t priced in. If META extrapolates on these trends over the next several quarters, I think all-time highs will be reached in 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.