Summary:

- Meta Platforms is a uniquely positioned, highly profitable company committed to building long-term value for shareholders, as evidenced by its firm dedication to innovation.

- META’s 21% market share in digital advertising and 50% EBITDA margin highlight its wide moat and strength of the business model.

- The company’s commitment to R&D and AI development ensures sustainable growth and enhanced ad performance, benefiting both users and advertisers.

- Despite potential risks like cybersecurity and antitrust issues, Meta’s current valuation is compelling, with a conservative market pricing suggesting significant upside.

PM Images

My thesis

Meta Platforms (NASDAQ:META) is a no-brainer Strong Buy in my opinion. My analysis suggests that the market values the stock very conservatively, especially considering the company’s immense fundamental strength.

Meta holds a unique positioning in the vast global digital advertising industry by being by far the most popular “Family of Apps” in social networking. The company consistently works on developing experience both for users and digital advertising customers. This results in higher ROI on advertising, which helps Meta in efficiently monetizing its social networks. The management does not just enjoy high profitability from digital advertising but reinvests a lot to build sustainable value for shareholders by unlocking new potential synergies and revenue streams.

META stock analysis

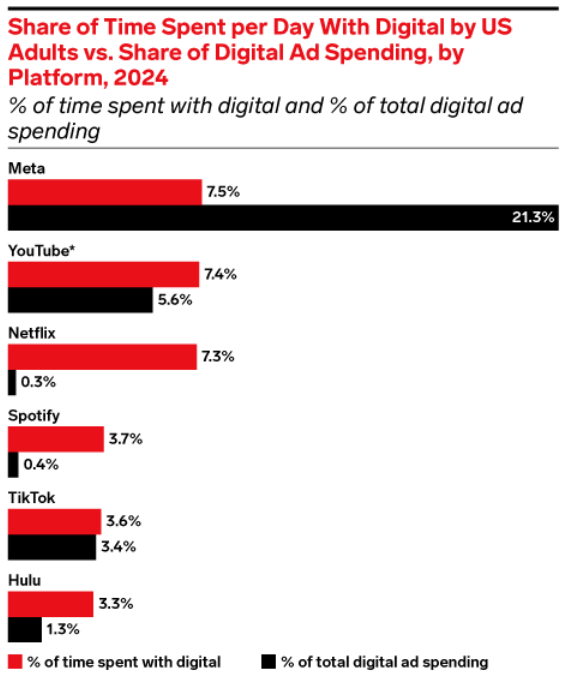

Meta Platforms, Inc., is formerly known as Facebook. The company is by far the world’s the largest social network since its ‘Family of Apps’ includes its legacy product Facebook, Instagram, WhatsApp, and Messenger. Each of this App boasts billions of active users, making Meta an absolutely uniquely positioned company in the global digital advertising space. As the below chart suggests, Meta is extremely efficient in terms of monetizing its digital advertising potential compared to such popular platforms as YouTube or Netflix (NFLX).

eMarketer

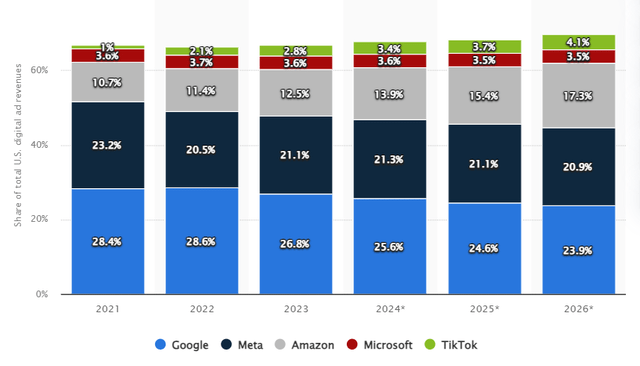

In terms of the overall digital advertising market, Meta commands a massive 21% market share and holds a firm second spot behind Google (GOOGL), which dominates the market due to its almost monopolistic position in search engines.

Statista expects the competition in digital advertising to intensify over the next three years, especially from Amazon (AMZN). This is a risk for Meta, but I want to emphasize that the below chart suggests that Amazon is expected to gain market share at Google’s expense. Meta’s market share will suffer much less from competition, according to the below forecast.

Statista

Since Meta makes their social networks freely accessible, its users number in the billions, which is an ideal target for advertisers. It not only maximizes user-acquisition but also offers a rich dataset for customized advertising to improve the effectiveness of ad campaigns. The fact that Meta puts advertising inside the platform and does not detract from the user experience is one of Meta’s biggest strengths and the reason it is such a success and wide moat.

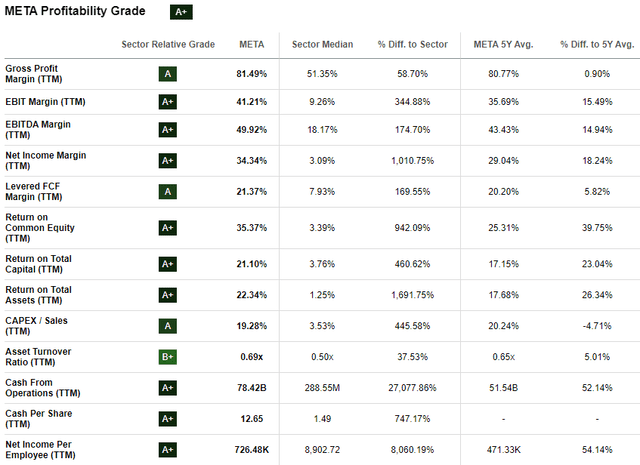

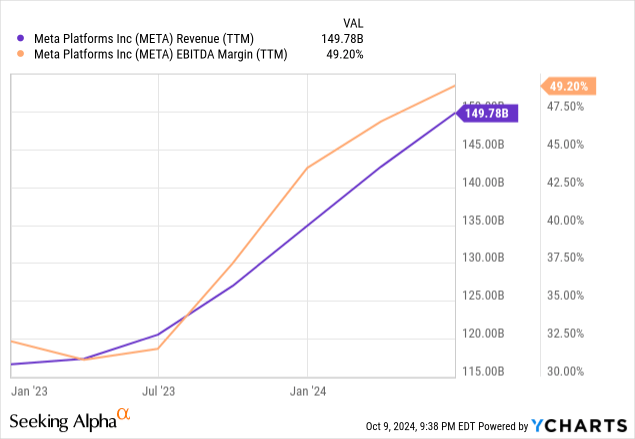

Grand View Research forecasts a 15.5% CAGR by 2030 for the global digital advertising market. This is a strong tailwind for Meta, meaning that its core business has the potential to continue growing by double digits even despite the expected fierce competition in the industry. Meta’s business is highly profitable with an unparalleled 50% EBITDA margin.

Seeking Alpha

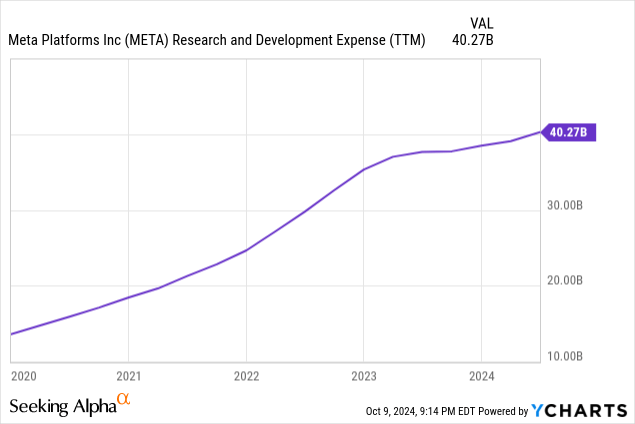

I have to applaud management because they do not just enjoy their dominance in social networking by generating high profits, but care about sustainable value for shareholders. The company spends a staggering $40 billion per year on R&D, which indicates a firm commitment to deliver long-term growth.

The focus on AI and machine learning for improving ad performance also gives the firm a distinct advantage. Through its ongoing improvement of algorithms and delivery systems, Meta allows advertisers to receive the best return on their investments while strengthening its own value proposition.

Apart from developing AI to strengthen its digital advertising business, the company also works on developing new potential synergies using AI algorithms. AI makes the company capable of working with big amounts of data, in real-time and providing personalized experiences that are engaging and satisfying to users. Then you have the AI-powered content creators, which are available on Instagram and Facebook, so you can easily create a catchy post or story. Meta’s AI projects are not just on the existing platforms, the firm is already exploring new applications and services. Meta, for example, is using AI to build chatbots and virtual assistants to boost interaction and customer support across its applications.

ai.meta.com

Meta’s Llama large-language model (LLM) is gaining traction as well. According to the above screenshot, the LLM development was in partnership with the most technologically advanced software and hardware companies in the world, which underscores its technological edge.

The latest model, Llama 3.2, will likely add more synergies as it enhances opportunities for customers by improved digital advertising precision. Moreover, it enables new product innovations like the augmented reality and personalized content. There are mobile versions as well, which increases potential reach and awareness. The model is also multilingual, which means solid opportunities to expand internationally with localized services.

Intrinsic value calculation

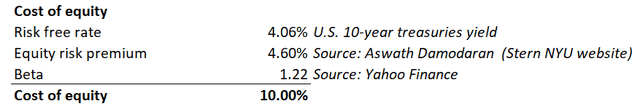

As usual, I’m starting this part of analysis by figuring out the discount rate. Meta pays dividends, but a 0.34% yield looks immaterial enough to run a dividend discount model (DDM). Therefore, my approach to calculate Meta’s intrinsic value per share is the discounted cash flow (DCF) model. The levered free cash flow (FCF) will be used, so the cost of equity is the discount rate in this case. Below, working relies on the capital-asset pricing model (CAPM) approach.

DT Invest

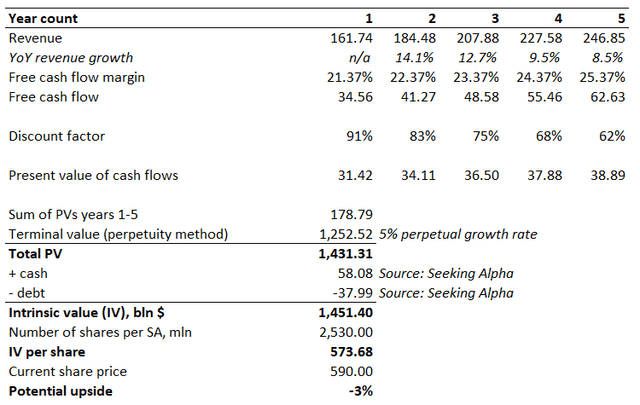

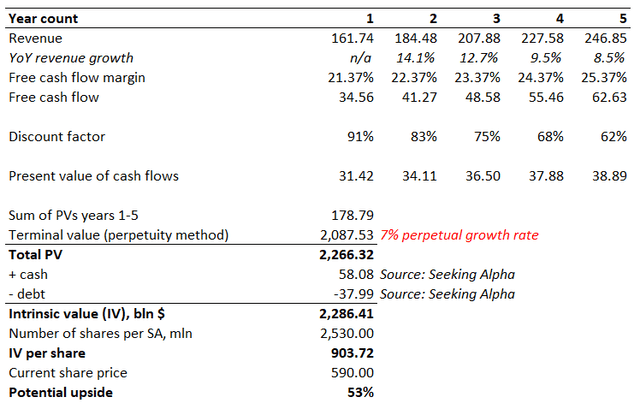

Meta’s cost of equity is 10%, which will be used to discount future cash flows. To project them, I need just two more assumptions: the revenue and levered FCF. Revenue for years 1-5 are provided by consensus of Wall Street Analysts. This projection looks reliable and sound as it expects growth deceleration, which is reasonable given increasing comparatives.

The TTM levered FCF margin is 21.37%, which is easily available thanks to Seeking Alpha’s “Profitability” tab. We can see above that there is a strong correlation between revenue growth and EBITDA margin. Therefore, I have to incorporate future expansion of the levered FCF margin. At the same time, I have to be conservative and a one percentage point expansion per year looks modest.

DT Invest

It looks like the market currently prices a 5% perpetual growth rate because intrinsic value per share is very close to the last close. I think that this suggests that Meta’s valuation is highly attractive. Perpetual growth rate is always a highly controversial assumption.

Some analysts say that incorporating a perpetual growth rate higher than inflation or GDP growth levels is not reasonable because a company cannot outpace growth of the broader economy. This point of view might seem very sound and reasonable, but I see a few drawbacks.

First, this point of view does not take into account the potential to grow via acquisitions and synergetic potential from them. It is apparent that Meta’s business would have grown much slower over the past decade if the company did not acquire Instagram or WhatsApp and relied only on monetizing its legacy Facebook platform.

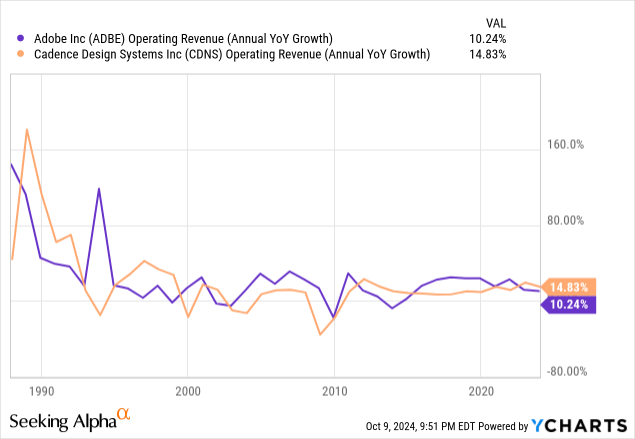

Second, there are several examples of companies that maintained double-digit revenue growth over several decades. It is not only icons like Apple (AAPL) or Microsoft (MSFT) that maintained a double-digit revenue CAGR since 1980s, but notably less popular companies like Adobe (ADBE) or Cadence Design Systems (CDNS). Adding more names to the above chart will make it not readable, but readers can easily find on the web that there are several other companies with long-term revenue CAGR far beyond the GDP growth. This means that maintaining a multi-decade revenue growth rate far above GDP growth is not something unreal.

We have to be careful when we play with the perpetual growth rate, since the DCF is extremely sensitive to changes in this assumption. For example, implementing a 7% rate makes META a $2.2 trillion company.

DT Invest

I obviously do not have a crystal ball, and I do not know whether Meta will be able to deliver a 7% or 10% revenue CAGR over the next several decades. But what I know for sure is that the market incorporating a 5% perpetual growth rate is unfairly low for such a company, in my opinion. Therefore, I find META’s current share price compelling at $590.

What can go wrong with my thesis?

The stock saw a massive bull run compared to Autumn 2022 lows. The stock price grew by more than six times since then, by far outperforming the broader market. After such a rally, there are always risks of investors taking profits as some might think that the optimism has peaked. Such a sentiment might be true, especially in light of increasing probability of the U.S. economy falling into recession in 2025.

Seeking Alpha

Owning several social network platforms with billions of users sharing their sensitive data means there are several significant risks for the company and its investors. The company might suffer from cyberattacks and data breaches, which will significantly undermine its image as a trusted social networking provider.

Apart from cybersecurity risks, there are significant antitrust concerns. Meta appears to hold a monopolistic position in the space, and all monopolists face intense scrutiny, which increases the risk of fines and penalties if regulators identify patterns of misconduct.

Summary

Meta is a uniquely positioned, highly profitable company committed to building long-term value for shareholders, as evidenced by its firm dedication to innovation. The market values the stock very conservatively, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.