Summary:

- I discuss my take on Zuckerberg’s update. I think there’s more to read into than the headline headcount cuts.

- Headcount cuts unlikely to lead to revised margin surprise.

- Risk of revenue misses is elevated.

- Flatter is faster means more experiments to make Metaverse work.

- It is too early for me to buy or add to Meta at the current valuations.

Kelly Sullivan

Introduction

Everyone seems excited about the operational efficiency improvements happening at Meta (NASDAQ:META) after CEO Mark Zuckerberg’s recent update. However, upon reading between the lines, my takeaway is that Meta is entering a phase of rapid experimentation as they try to focus and make inroads on their Metaverse vision, all whilst their core advertising revenue stream faces secular challenges for multiple years. The range of possible outcomes for Meta has broadened. I am neither a buyer nor a seller at current prices.

Thesis

I have three key takeaways from Zuckerberg’s recent update:

- Headcount cuts unlikely to lead to revised margin surprise

- Risk of revenue misses is elevated

- Flatter is faster means more experiments to make Metaverse work

Headcount cuts unlikely to lead to revised margin surprise

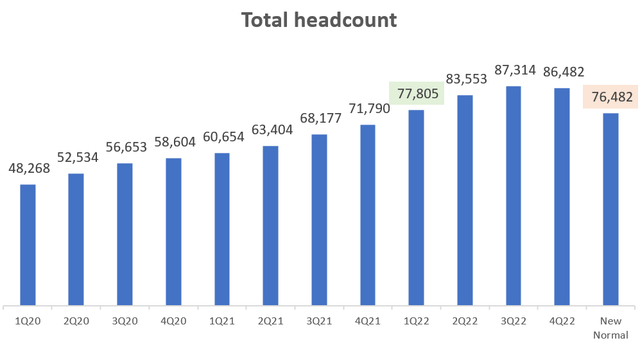

Meta intends to reduce headcount by another 10,000 employees, which corresponds to 13% of its Q4 FY23 total headcount of 86,482. In addition, the company will go into a hiring freeze to buffer up for what I think they are signaling; tough times and intense work ahead.

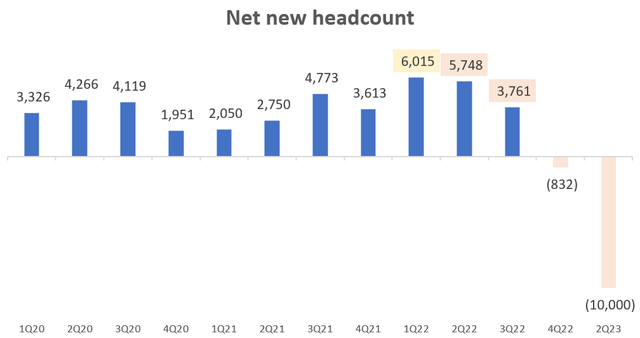

Net new headcount (Company Filings, Author’s Analysis)

The scale of these job cuts means a total Ctrl+Z of most of FY22 net new hiring; the entirety of Q2 FY22 and Q3 FY22, and 8.2% of Q1 FY22 net new headcount additions.

For the new normal, Facebook is resetting its organization back to before FY22:

Total headcount (Company Filings, Author’s Analysis)

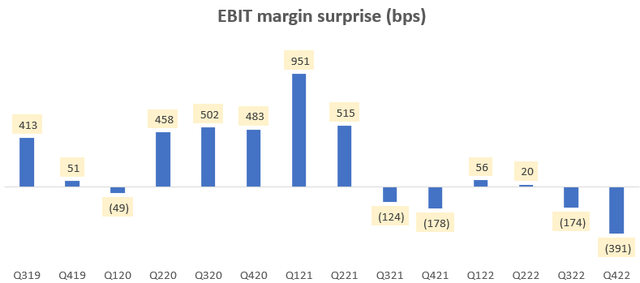

Overall, I believe Zuckerberg’s clear messaging on the cost structure (reduction and hiring freeze) leaves little room for margin surprises. I expect the Street to price in these impacts very quickly. This can be considered as an incremental positive since Meta has been missing EBIT margin estimates by an average of 132 bps over the last 6 quarters:

EBIT Margin Surprise (bps) (Company Filings, Author’s Analysis)

Risk of revenue misses is elevated

Zuckerberg highlighted the importance of preparing for a new economic reality:

“At this point, I think we should prepare ourselves for the possibility that this new economic reality will continue for many years. Higher interest rates lead to the economy running leaner, more geopolitical instability leads to more volatility, and increased regulation leads to slower growth and increased costs of innovation.”

– Author’s bolded emphasis

He cited many big-picture top-down factors in play. Factors that everybody knows about already. What he did not mention, but what I think is still in play, is a weaker digital ad spend environment, which is expected to see further declines in 2023. According to media-buying firm GroupM, global ad spend growth is expected to slow down in 2023 with a 5.9% YoY growth; lower than the 6.4% YoY growth in the prior year.

My read is that Zuckerberg is expecting the ad spending weakness to potentially continue “for many years”. I think the market is not appreciating this factor as much as the cost-cutting and margins improvement commentary takes center-stage. Given that 97% of Meta’s top-line is still indexed to advertising spends, I believe the risks of revenue misses in upcoming quarters are elevated.

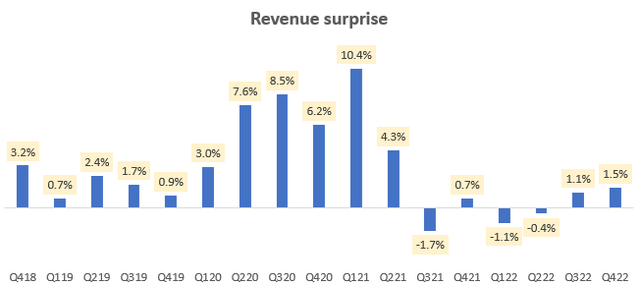

Notice how Meta has already broken an 11-quarter spell of consistent revenue beats between Q4 FY18 and Q2 FY21:

Revenue margins surprise (Company Filings, Author’s Analysis)

I suspect it will be a long while till we see such streaks on top-line beats.

‘Flatter is faster’ means more experiments to make Metaverse work

Startups have flat organizations that operate at high velocity as they need to experiment a lot to hit upon a winning and scalable business model. I believe the “Flatter is faster’ observation combined with the following comment indicates that Meta is investing heavily in R&D to make Metaverse work:

So we put together a financial plan that enables us to invest heavily in the future… This work is incredibly important and the stakes are high.

Zuckerberg is concentrating his bets and “canceling lower priority projects” such as NFTs to realize his vision of the Metaverse.

What does this mean for the stock?

I believe there is a neutral to downside risk to operational performance of Meta’s currently core ad-monetization streams. The fruits of their R&D will take multiple quarters if not years to materialize. As such, I believe the stock is likely to enter a time-correction phase. With a current LTM P/E of 22.6x, Meta trades at a most 14.5% premium to the Nasdaq’s P/E of 19.7x, indicating the market’s belief in Meta. Probably this is justified, however as I don’t have the VC-like knack of identifying potential long before it starts to show signs of traction, I prefer to wait for incremental developments on their Metaverse bet before initiating new buys.

Conclusion

A major driver of market moves is news and earnings surprises. With Zuckerberg’s recent update on operational strategy, I believe the chances of margin surprise are reduced as Wall St revises their estimates to reflect the new reality. However, I think what was not directly said, but is still a key driver for Meta, is the possibility of an extended slowdown in the digital ad spending environment into 2023 and beyond. Due to this, I believe there is an elevated risk of revenue misses.

At the margin, Meta’s metaverse investments will decide the fate of the stock. As the company is still in focused and experimental R&D stage here, I suspect it will take multiple quarters, and likely years, until meaningful signs of traction materialize here for investors to form a view; is Meta winning the metaverse or not?

For me, it is too early to buy or add to META stock at the current valuations. Hence, I maintain a ‘hold’ stance.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.