Summary:

- With TikTok facing a potential ban in the US, Meta’s business is looking even more lucrative, with the stock up over 50% YTD, given the momentum in its FoA segment.

- With a sizable audience overlap and its strategic AI initiatives around improving content recommendations and ad performance, Meta has seen its DAU’s and ARPU grow 6.5% and 14% YoY respectively.

- Although its Reality Labs segment continues to drag down overall profitability by 30%, Meta’s operating margins grew by 900 basis points YoY by streamlining operating expenses.

- While Reality Labs is expected to remain unprofitable in FY24, along with its ambitious AI capex plan that has a hidden problem of depreciation costs, the management is not slowing down.

- Valuing Meta as two separate business entities, I believe that the stock is still priced to deliver significant upside from its current levels, making it a “buy”.

Derick Hudson

By Amrita Roy, Produced by Colorado Wealth Management Fund

Introduction & Investment Thesis

With TikTok and the US facing off in court over a law that could lead to a ban of the platform, Meta (NASDAQ:META) is looking even more lucrative.

Business is great at Meta, with the stock up over 50% YTD, beating the S&P 500 and Nasdaq 100. The company is seeing a growing momentum in its Family of Apps (“FoA”) business segment that houses Facebook, Instagram, WhatsApp, and Threads that saw its revenue grow over 20% YoY to $38.7B in Q2 FY24. The momentum is driven by DAUs (Daily Active Users) and ARPU (Average Revenue per User) growing 6.5% and 14% YoY, respectively, as it is likely that more users are moving away from TikTok onto Meta given the large audience overlap between the two platforms as well as Meta’s AI initiatives around better content recommendations and matching, which is helping boost user engagement and monetization.

However, the social media giant’s Reality Labs division continues to be a drag on overall operating profitability by almost 30%. Yet, Meta Platforms still managed to expand its operating margins by 900 basis points on a year-over-year basis.

Furthermore, the management also has ambitious plans for its capex in order to support their AI research and product development efforts. So far, while their investments in Core AI are translating into revenue growth, there isn’t a clear path to ROI (Return on Investment) for its Gen AI initiatives. However, the management remains confident, despite fears of depreciation costs associated with an expanded infrastructure footprint.

Assessing both the “good” and the “bad,” I believe the stock is priced to deliver significant upside at current levels despite it already climbing 50% YTD. This is largely because of its FoA business segment, which boasts an operating margin of over 47%. While it is possible that its operating margin may face some shrinkage if depreciation costs start to drag down profits faster than revenue growth in the coming years, I believe the stock is still priced at an attractive level. As a result, I will initiate my “buy” rating on the stock, with a price target of $732, which represents an upside of 37% from its current levels.

Overview of what is going on with TikTok

TikTok was facing off with the US government in federal court earlier this week to block a US law that would ban the short video app used by 170M Americans as soon as January 19, arguing that it violates free speech protections. Meanwhile, the US government’s stance remains that the app poses a national security threat because of its access to vast amounts of personal data on America, asserting that China can covertly manipulate information that Americans consume via the popular app. As of now, TikTok, which is owned by ByteDance, has until January 19 to sell or divest TikTok’s US assets, which would reduce its size and strip off the technology that powers it, or else face a ban in the US.

Meta will be a beneficiary regardless of whether TikTok is banned or not.

Whether the ban ultimately takes place or not, I believe that Meta is already benefiting as users and advertisers allocate more of their attention and spending on the platform given the large overlap in audience between these two platforms as well as Meta’s strategic initiative towards driving engagement and monetization of users on its FoA business segment.

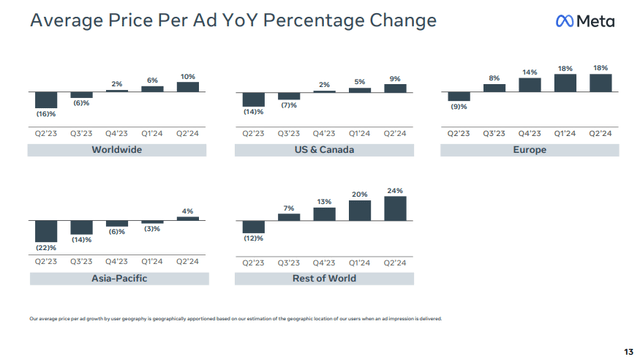

In its latest earnings report, Meta saw its revenues grow 22.1% YoY to $39.07B, exceeding expectations. Out of the $39.07B in revenue, FoA contributed 99% to Total Revenue, growing over 20% YoY, with DAUs growing 6.5% YoY to 3.27B, and ARPU growing over 14% to $11.89, with strength in WhatsApp, Instagram, and Threads, which showcases growing engagement among their most promising cohort of 18-29 year old users. Meanwhile, it also saw its ad impressions grow by 10% YoY, with price per impression also growing 10% YoY as advertisers shifted their ad spending on the platform with growing ad performance. Plus, the management is also confident that there is more opportunity to grow ad load on Reels and other lower-monetizing surfaces as the mix of overall video engagement shifts more towards shorter videos over time, creating more targeted ad insertion opportunities.

Q2 FY24 Earnings Slides: Growth in Price per Ad

Elaborating on Meta’s initiatives with AI, Meta splits its AI into two groups: Core AI and Gen AI, with the former referring to using AI to augment its engagement and advertising in its existing products, while the latter refers to its conversational GenAI assistant and other Meta AI products that are built on top of its large language model Llama 3.1 with use cases in business messaging, ad creative and more. During the earnings call, the management outlined that its unified video recommendation engine, which combines reels, long videos, and live videos into one algorithm to drive better recommendations and matching, is already increasing Facebook engagement, while it simultaneously builds better capabilities and features for advertisers to create highly targeted and optimized campaigns, with its Lattice tool driving a 22% return on ad spend boost for its US advertisers.

Reality Labs continues to be a drag for profitability.

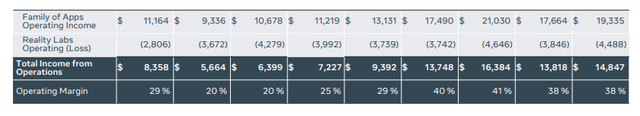

Shifting gears to profitability, the company saw a 23% increase in its cost of revenue, which was driven higher primarily by infrastructure and Reality Labs inventory costs. However, its total costs and expenses grew just 7% YoY as the company streamlined its operating expenses, especially on Marketing & Sales and G&A front, leading to a 58% YoY growth in operating income (on a GAAP basis) to $14.8B with an overall expansion in operating margin of 900 basis points to 38% compared to the previous year. This comes despite an operating loss of $4.5B during the quarter from its Meta Reality Labs, which houses its “metaverse” work with products that include Ray-Ban Meta glasses and Quest 3.

Q2 FY24 Earnings Slides: Reality Labs profitability shows no signs of improvement

However, the management remains firm on their plans to continue with their ongoing investments in their Reality Labs, especially as demand for Ray Ban was outpacing supply during the quarter, along with Quest 3 sales outpacing expectations as people take advantage of it as a general computing platform in addition to gaming.

I would like to point out, however, that there hasn’t been any material improvement in the overall profitability in the segment over the last 2 years. Plus, the management expects the operating losses from their Reality Labs segment to increase meaningfully year-over-year from ongoing product development efforts and investments to scale their ecosystem, thus dragging overall profitability down.

Capex shows no slowdown with lurking depreciation costs

Finally, the company also raised its guidance on the capex front for FY24 with latest projections at $37- $40B, up from $35- $40B, while simultaneously projecting significant growth in capex continuing into next year as they support their AI research and product development efforts.

On one hand, their investments in Core AI capacity are justified given the strong returns they are seeing in the form of higher engagement and advertiser spend. However, when it comes to the lack of clear path for ROI on its Gen AI initiatives, the management has clearly outlined that the returns will come in over a longer period of time as they map these investments against monetization opportunities across ad creative, business messaging, and more.

However, in all this, the lurking problem is that the useful lifetime of AI GPU chips can be shorter than many expect, especially as AI chips go through an accelerating innovation cycle, leading to higher than expected depreciation expenses that ultimately drag down profits and lower return on invested capital. While the management discussed that they will build their infrastructure in a way that provides them with flexibility in how they use it over time, a larger than expected mismatch between Wall Street estimates and the company’s guidance for costs in 2025 and beyond can lead to a potential sell-off in the stock.

META’s valuation as two separate businesses: Family of Apps and Reality Labs

I have evaluated Meta’s price targets by valuing the company as two separate entities given the drag on profitability its Reality Labs division has on the company’s earnings, as I had stated earlier.

Part of my reasoning for adopting this valuation approach was driven by my discussions with Colorado Wealth Management Fund, who was also interested in valuing Meta as two separate entities. Investors should note that Reality Labs, while generating operating losses, is still a revenue-generating engine for Meta. If we were to value Meta as a whole using a PE-based approach, its Reality Labs segment would dilute the earnings multiple and the implied price target as a result.

So, here’s how I have valued the company as two separate entities, below.

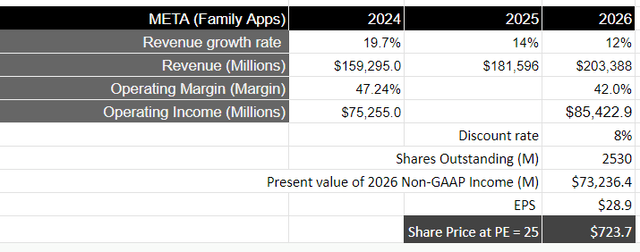

Assuming that revenue from FoA grows in line with overall revenue expectations per consensus estimates at 19.7% in FY24, followed by growth in the low to mid-teens, it should generate close to $203.4B in revenue by FY26. In this case, I believe that Meta will continue to drive engaging experiences across its apps through ongoing enhancements to their recommendation systems while enabling superior monetization through optimizing levels of ad and improving ad performance. Plus, given their ongoing capex towards Gen AI initiatives with Llama 3.1 and Llama 4, it should play a growing role in how businesses market and engage with customers as they start testing the ability for businesses to use AI in their chats with customers to help sell their goods and services.

From a profitability standpoint, assuming it grows in line with revenue in FY24 but then slows down in the coming years due to depreciation costs from AI capex squeezing on margins, I am taking a cautious approach and expecting a decline of roughly 500 basis points from its FoA operating margins from its current levels to 42%. This will translate to an Operating income of $85.4B in FY26, which will be equivalent to a present value of $73.2B when discounted at 8%.

Taking a PE ratio of 25, which is roughly 1.5 times higher than the average multiple of the S&P 500, where its companies grow their earnings on average by 8% over a 10-year period, this translates to a price target of $723 per share for its FoA segment. I want to remind you that this calculation strips away the 30% drag from its Reality Labs segment.

Author’s Valuation Model: Family of Apps

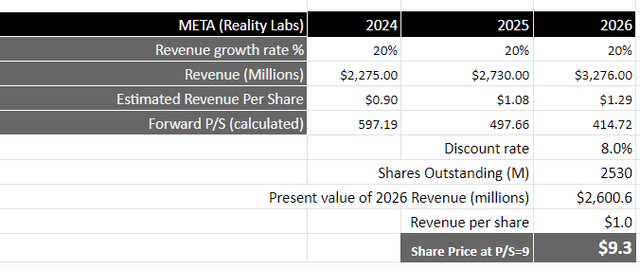

Moving on to its Reality Labs segment, the path to profitability is hard to predict. However, I expect demand to remain strong over the coming years, with annual growth of 20% or higher, especially as adoption for AR/VR products grows in the coming years along with ongoing product innovation in the space. Therefore, basing my valuation of the segment on my revenue growth projections over the next 3 years, and assuming an annual growth rate of 20% over this period of time, it should generate close to $3.3B by FY26, which will translate to a present value of $2.6B when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their revenues at an average rate of 4.8% with a price-to-sales ratio of 2.19, Meta’s Reality Labs should trade at roughly four times the multiple, given the growth rate of its revenue during this period of time. This will translate to a P/S ratio of 9, or a price target of $9.3 per share.

Author’s Valuation Model: Reality Labs

Adding the respective price targets of the two business segments gets me to a net price target of $730, which represents an upside of 36% from its current levels.

My final verdict and conclusions

While Meta is trading at a 9% premium to its 5-year forward price-to-earnings multiple, there is growing sentiment in Wall Street that the company is an artificial intelligence play given its revenue-generating initiatives with Core AI to drive better content recommendations and improve ad performance, as well as investments in Gen AI to empower creators and businesses to better interact with their communities. I personally believe that the momentum in its FoA business segment is likely to continue given the uncertainty surrounding TikToK and the user overlap between the two platforms that make it easy for users to switch over, thus simultaneously shifting ad spend towards Meta.

Although Reality Labs is a drag on overall profitability, while its ambitious capex plans have a hidden risk of depreciation costs from its growing infrastructure footprint, I believe there is a net upside to Meta’s growth story. As a result, I will assign a “buy” rating on the stock at its current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.