Summary:

- I am bullish on Meta heading into Q1 earnings, as I believe that the market may be too pessimistic about the social media giant’s earnings power.

- Although I understand that the market for digital advertising continues to be under-pressured, I see an upside coming from two major tailwinds.

- As compared to 2022, the ad business has likely stabilized, and OPEX spending has likely been more disciplined, with further upside potential.

- Going into Q1, I suggest investors consider META 105/115%-moneyness call spreads with a May 5th expiration date.

Justin Sullivan

Thesis

On April 26th after market close, Meta Platforms (NASDAQ:META) is set to release its Q1 2023 earnings report. Due to the global decrease in digital ad spending that pressured 2022, market sentiment remains negative, and analysts predict that Meta’s topline for the 2023 January quarter may contract about 1% YoY, despite ongoing inflationary pressures. For Meta’s EPS, analysts are estimating a 28% YoY drop.

Personally, however, I disagree with the negative assessment as I see two major tailwinds working in Meta’s favor: Firstly, global macro conditions have improved YTD, and the ad business seems to be stabilizing or even recovering. Additionally, foreign exchange headwinds caused by a strong dollar have decreased. Finally, it is worth pointing out Meta’s ambition to act more cost-discipline, indicating the possibility of margin expansion.

In my opinion, Meta stock remains undervalued; and I reiterate a ‘Buy’ rating with a $257.93/ share target price.

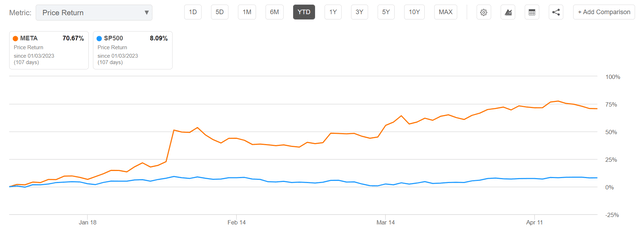

For reference, Meta stock has outperformed strongly since the start of the new year 2023. YTD shares are up about 71%, as compared to a gain of only about 8% for the S&P 500 (SP500).

Low Q1 Expectations Open Room For Upside

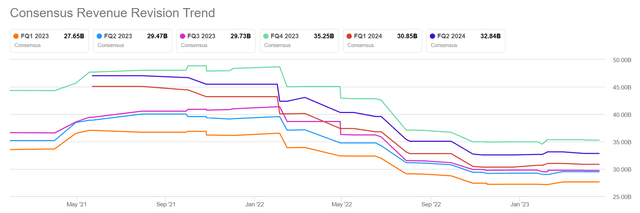

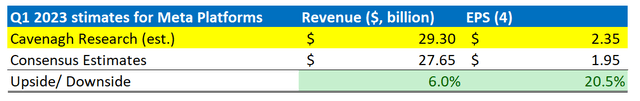

Based on information collected by Seeking Alpha, 38 analysts have submitted their projections for Meta’s Q1 2023 results, as of April 22th. These projections anticipate that the social media giant’s total sales will likely fall between $26.76 billion and $29.28 billion, with the average estimate being $27.65 billion. Using the average analyst consensus estimate as a reference point, it is suggested that Meta’s Q1 sales may contract about 1% YoY as compared to the same period in 2022. Furthermore, analysts estimate that Meta’s Q1 2023 EPS estimates vary from $1.42 to $2.41, with the average being $1.95, which implies an earnings contraction of about 28% according to consensus ad mid-point.

I would like to point out that the consensus revenue projections have consistently declined over the last 12 to 14 months, with current sales expectations falling around 20% below estimates made in December 2021.

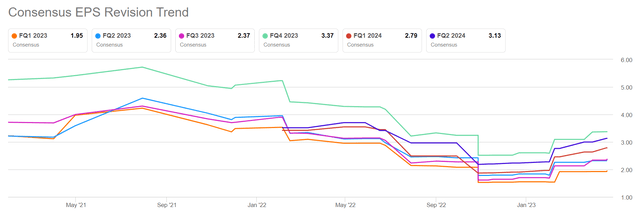

Likewise, the EPS expectations for Meta’s Q1 2023 have plummeted. In early 2022, analysts were projecting an EPS of almost $4, whereas recent estimations are suggesting an earnings-power of only about $2.

The Ad Business May Be Stabilizing/Recovering

Referencing the previous section of this article, it is evident that expectations for Meta’s Q1 results remain low. But the depressed sentiment may be exaggerated, in light of the latest evidence about a stabilizing/ recovering ads business. Specifically, I would like to point out key takeaways from five independent research reports.

First: A survey conducted by William Blair, which consulted with around 30 advertising budget decision-makers, concluded that 72% of respondents expect an increase in their advertising budgets for 2023 compared to the previous year. Only 19% anticipate their budget to stay the same, while a mere 9% predict a decrease in their budget. In terms of budget allocation, survey participants stated their intention to distribute their ad budgets relatively evenly between search, social, and video advertising, which would give Meta Platforms exposure to about two-thirds of the budget. [Source: William Blair: Proprietary Survey Points to Digital Budget Growth in 2023, April 05th].

Second: Evercore ISI’s analysts, Mark Mahaney and team, have recently published a research note arguing that while the advertising environment could improve, META’s advertising performance has been showing signs of recovery, reaching levels similar to before the implementation of ATT (App Tracking Transparency), as Meta has already started to utilize artificial intelligence and machine learning in its ad targeting, as seen in the deployment of Performance Max and Advantage+. Additionally, Evercore pointed out that as advertisers are pressured to act more cost-conscious, ad budgets are increasingly shifting towards high ROI platforms, which benefits both Meta and Google/ Alphabet

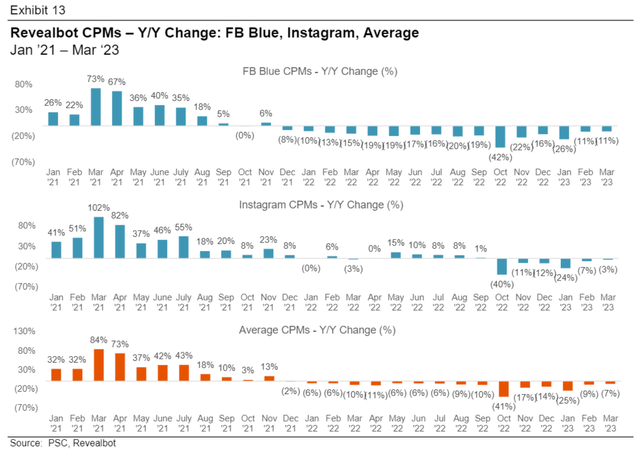

Third: According to research conducted by investment bank Piper Sandler, ad pricing for FB Blue and Instagram is recovering, after strong impression growth in 2022 prompted a sharp drop in CPMs. Piper Sandler now estimates that the CPMs price contraction in March has narrowed significantly versus January, with FB CPMs being down 11% YoY, versus 26% YoY in January, and Instagram CPMs being down only 3% YoY, versus 24% YoY in January. [Piper Sandler, Ad Metrics: META Pricing Declines Continue to Improve, April 10th]

Source: Piper Sandler, Revealbot

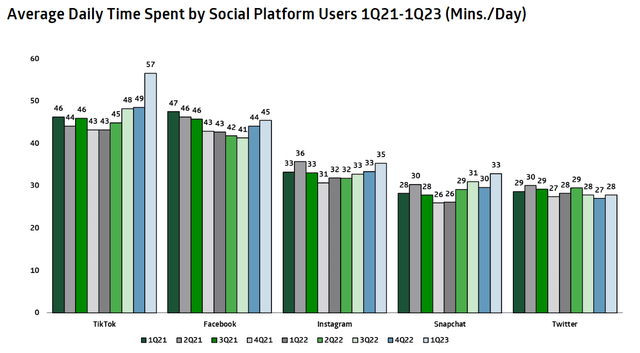

Fourth: TD Cowen has provided insights into a proprietary survey that indicates that time spent on Facebook and Instagram is picking-up nicely, suggesting that the favorable ad pricing trend in Q1 2023 (see Piper Sandler estimates) might have been complemented by a growth in ad impressions. [Source: TD Cowen proprietary Consumer Tracking Survey, n=~2,500, March 2023]

Finally, JPMorgan’s internet analyst Doug Anmuth and team argued that Instagram and Facebook, as well as other social media platforms, might gain wallet share at the expense of TikTok, due to regulatory risk:

[We believe advertisers] are shifting some spend away from TikTok given ongoing regulatory, data security, & measurement concerns. Overall, we believe trends are somewhat better than when GOOGL/ META/PINS/SNAP reported 4Q in late Jan/early Feb, suggesting potential for upside.

[Source: JPMorgan, Online Ads 1Q23 Preview, 18 April]

Margin Upside On OPEX Discipline

Complementing the likelihood of a solid Q1 2023 topline, as argued in the previous section of this article, Meta might also surprise investors with stronger-than-expected OPEX discipline.

Investors are well aware that since Q3 2022 Meta has already announced two rounds of layoffs, reducing the company’s headcount by around 21,000 cumulatively, which is roughly 24% of the social media giants pre-Q3 employee-base. On a FY bases, this headcount reduction will, according to my estimates, likely unlock annual cost savings of close to $3 billion, assuming an average total employee cost of ~140,000/ year.

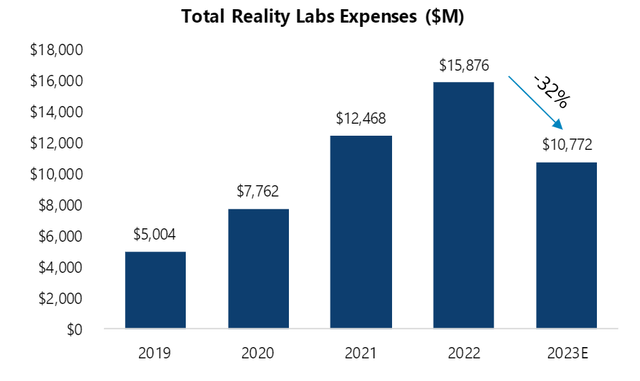

In addition, there is evidence that Meta is also reigning in lavish investments on the ‘metaverse’ bet. According to Jefferies estimates, Meta’s total reality labs expenses in 2023 will likely drop to $10.8 billion, down about 32% versus $15.9 billion of expenses in 2022. [Jefferies, Meta Platforms Deep Dive, April 5th]

Conclusion

Personally, I believe Meta stock will beat Q1 2023 analyst consensus expectations, on a better-than-expected advertising environment complimented by strong OPEX discipline. In detail, I model Q1 2023 topline for Meta at $29.3 billion, versus $27.65 billion estimated by consensus (6% upside). Likewise, I estimate Meta’s EPS at $2.35, as compared to $1.95 consensus (20.5% upside).

Following a likely earnings beat, I believe Meta stock has room to appreciation towards about $257.93/ share, which remains my target price for the social media giant.

As a short-term strategy, I am increasing my exposure to Meta stock Q1 2023 buying time-sensitive call options. Given the speculative nature of options trading/ speculation, I suggest investors consider 105/115%-moneyness call spreads with a May 5th expiration date, as they have the potential for a 4:1 payoff if META stock closes at above $240/share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; this article is a market commentary and a reflection of the author's opinion only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.