Summary:

- Meta Platforms reported strong financial results, with increased free cash flow and active users.

- The market’s negative reaction to Meta’s earnings is unwarranted, as the company has strong growth potential and a wide reach.

- Despite losses in Reality Labs, Meta’s overall profitability and cash flow generation justify its investment in future technologies.

Justin Sullivan

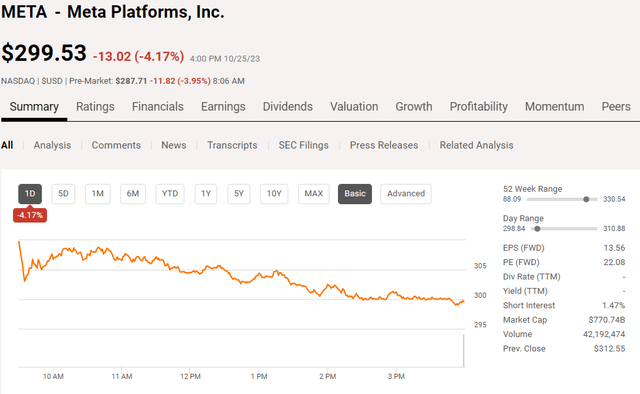

Meta Platforms (NASDAQ:META) reported a blowout quarter as everything increased from free cash flow [FCF] to active people using its products. Shares of META sold off -$13.02 (-4.17%) during trading and are lower by another -$11.82 (-3.95%) in the pre-market. META has given back -13.25% from its recent highs of $330.54, and companies are not being rewarded for top and bottom-line beats. I think the market got Alphabet (GOOGL) wrong as it was focused on Google Cloud slowing rather than the entire company’s performance, and I think the market is getting META wrong also. There is so much anticipation regarding what the Fed will do and if rates stay higher for longer. I am looking for companies that have moats, can operate in a higher for longer environment, have growth on the horizon, and are growing their profitability. META checks off all the boxes, and there isn’t another company from The Coca-Cola Company (KO) to GOOGL that has the reach that META does. With more than 1/3rd of the global population utilizing its products and Mark Zuckerberg’s tri-mandate of efficiency, growth, and profitability, I am sticking with META. I have been a long-term shareholder, and if shares continue to decline as big tech finishes out earnings season, I could be compelled to add to my position.

Following up on my previous article about META from June

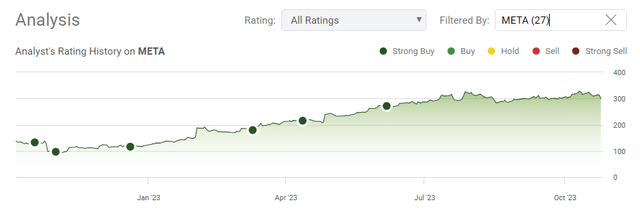

I have been bullish on META for years, and even when things got tough, my stance never changed. I am still looking at META as a long-term core holding, and I am still very bullish on its future. In my previous article from June (can be read here), I discussed the impacts of META’s efficiency decisions on costs, why META looked like it was getting back to growth after a difficult year, and the value proposition for shareholders. META was at $270.14 when the article was published, and even after the recent drop, shares are still up 10.88% compared to the S&P 500, declining -1.98%. I am following up on my previous article, as earnings were just released. I think the selloff is overdone, and after earnings are digested, capital will flow back into META.

Reality Labs, aka The Metaverse, was the only sore spot in Q3, and the negativity is overblown

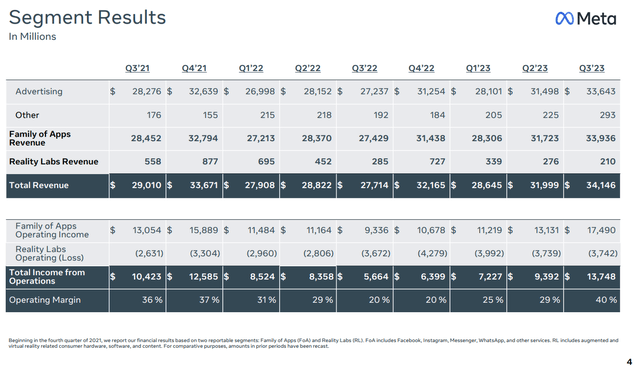

Some people are stuck on Reality Labs and don’t see the vision. Instead, they see a division of META that is losing billions each quarter. Over the past 9 quarters, since Q3 of 2021, Reality Labs has had an operating loss of -$31.13 billion. Most companies will never produce $31.13 billion in profits, and this is how much Reality Labs has lost in less than 3-years. In 2023, Reality Labs has lost -11.47 billion, and at this rate, the final tally could exceed -$15 billion in losses for 2023 when Q4 is reported.

I completely understand why this is an eyesore. The Metaverse may seem like an idea destined to fail to some, while Apple (AAPL) is a direct competitor that already has a stranglehold on the hardware market. I have seen the discussions about how this capital could have been utilized differently, from paying special dividends to shareholders, increasing its buyback program, or simply putting the money to work in treasuries at a high risk-free rate of return. These options would have been more positive for META over the past 3-years from a short-term perspective. I feel that this is only one side of the coin and that the executive team at META has earned a significant amount of leeway.

I am a stickler for profitability, accountability, and valuations based on the bottom line. While META has lost -$15.75 billion over the trailing twelve months (TTM) on Reality Labs, its family of apps generated $52.52 billion in income from operations, placing their net income from operations at $36.77 billion for the TTM. Q4 2022 and Q1 2023 were META’s lowest operating margin quarters since Q3 2021, and with that being said, their total operating margin was 29.32%. This is why I am cutting META a lot of slack. They are investing heavily in what they see the future of their company being, and while some may feel the losses from Reality Labs are excessive, META is a cash flow producing machine that is absorbing the current losses and generating profits hand over fist. In Q3 2023, META generated $13.75 billion in income from operations after losing -$3.74 billion on Reality Labs. As a shareholder, I have to trust that the team at META knows what they are doing as they have taken the company this far, and the current profits justify their investment.

I do think there is a future for Reality Labs that is being overlooked. On the Q3 conference call, Susan Li (META CFO) indicated that while there will be a YoY increase in losses for Reality Labs their CapEx range will decrease. META’s total expenses for 2023 are also expected to come in lower than previously guided, and the new range is $87 billion to $89 billion rather than $88 billion to $91 billion. I continue to believe that there is going to be a large market in the next several years for VR/AR, and getting there will be capital-intensive. I do believe that gaming will move into the VR segment, as well as enjoying content from your home. I don’t believe the future of content is on a physical screen, and I feel that there will be a duopoly controlling the space between META and AAPL. I won’t be surprised if the major sports leagues offer virtual season passes or if you can enjoy a concert from a VR headset in the future. META is funding the R&D through its operational profits, and the potential to control a significant percentage of the next evolution of entertainment is worth the risk in my opinion.

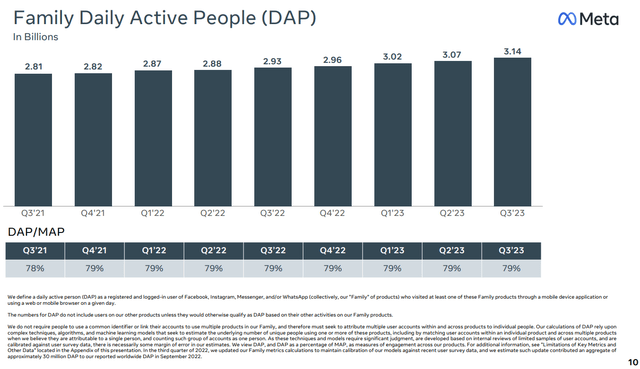

META delivered a blowout, and the days of META not growing are still far away

META continues to remain relevant, and the growth isn’t reversing. In Q3, META saw a 2.28% increase in Family Daily Active People (DAP), and a 2.06% increase in Family Monthly Active People (MAP). META’s legacy platform, Facebook, is still growing as well, with a 1.02% increase in Facebook Daily Active Users (DAUs), and a .06% increase in Facebook Monthly Active Users (MAUs). More than 1/3rd of the global population continues to utilize META’s suite of products, and its relevance continues to grow. There may not be a better way to reach a target audience, and on the conference call, Mr. Zuckerberg discussed how innovation in AI is front and center, and they will be launching new consumer AI experiences throughout all their apps and businesses in the coming years. In Q3, META’s ad impressions delivered across its apps increased by 31% YoY as its revenue jumped 23% YoY. META’s increased user base continues to prove the thesis about where companies are spending, and I see this continuing to grow in the future.

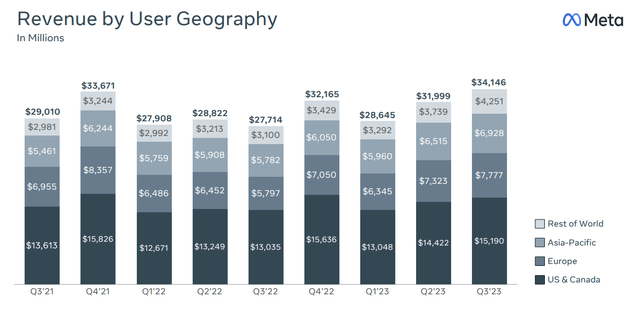

This was a blowout quarter and a sign of what is yet to come. META generated $34.15 billion in revenue, which was a $700 million beat on the consensus estimates while producing $4.39 in EPS, which beat estimates by $0.76. It’s shocking that META is being sold off, considering this was a record quarter in revenue and profitability. META generated $11.58 billion in net income and $13.64 billion in FCF over the past 3-months. META rewarded shareholders by repurchasing $3.70 billion of its Class A common stock while having $37.22 billion remaining on its repurchase authorization. META’s cash and marketable securities on hand amounted to $61.12 billion while only having $18.38 billion in long-term debt.

META is guiding for their Q4 revenue to come in at $36.5 to $40 billion, which would mark a 2nd consecutive record-breaking quarter on the top-line. As META’s expenses as a percentage of revenue dropped to a multi-year low in Q3, there is a strong possibility that META will deliver at least an additional $1 billion in net income and FCF in Q4. In Q3, META had a 33.92% net income margin ($11.58 billion / $34.15 billion) and a 39.94% FCF margin ($13.34 billion / $34.15 Billion). If META maintains these margins and comes in around the halfway point with $38 billion of revenue, then META should see their FCF and net income increase by 11.29% to $15.39 billion of FCF and $12.89 billion of net income in Q4 2023. META is getting penalized for no reason as they increased guidance and are in a position to deliver a blowout Q4. Let’s not forget the first month of Q4 is almost over, and META has been down this road before, they are not going to provide a range they don’t believe is attainable.

Why I still want to be in META and why I would buy more on the pullback

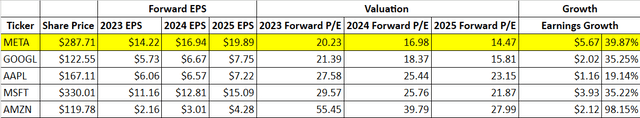

While AAPL and Amazon (AMZN) still have to report, META looks the cheapest from a valuation perspective from big tech. After updating the numbers for AAPL, META, AMZN, Microsoft (MSFT), and Alphabet (GOOGL), META is still where I want to be. I am a shareholder of META, GOOGL, AMZN, and AAPL, and if I were going to add anywhere, it would currently be META, then GOOGL.

Based on the 2023 EPS projections, META is trading at 20.23x earnings. When I look out to 2025, META is trading at 14.47x 2025 earnings. META has 39.87% EPS growth on the horizon from the end of 2023 through 2025. Paying 20.23x 2023 earnings and 14.47x 2025 earnings for one of the most profitable companies in the world that haven’t been impacted by the Fed’s restrictive policies looks inexpensive.

Steven Fiorillo, Seeking Alpha

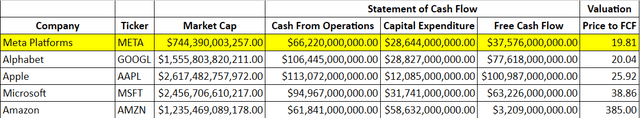

When I look at META on a price to FCF methodology, they also look inexpensive. META has generated $37.58 billion in FCF over the TTM and trades at 19.81x their FCF. Paying under 20x FCF for a company that continues to grow is inexpensive, in my opinion, and I feel that META should be trading at a premium to where AAPL is due to the fact that they have double the amount of earnings growth on the horizon. META is starting to see the impacts of their efficiencies and these numbers could actually improve over the next several quarters if META hits its revenue projections and improves its margins. META may be more undervalued than I believe.

Steven Fiorillo, Seeking Alpha

Conclusion

I think that the selloff in META is way overblown, and investors should go back and read through the earnings report and conference call again. META had a record quarter across many different metrics, from engagement to operational performance. META is trading at the cheapest valuations in big tech and has significant growth on the horizon, with tens of billions authorized for buybacks. When the dust settles, I think investors are going to realize that this selloff is overdone as META raised guidance and not only delivered record results but forecasted for another record quarter in Q4. When the market turns, META should continue higher, and I don’t think a price target of $375-$400 in 2024 is out of the question.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL, AMZN, GOOGL, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.