Summary:

- Meta Platforms’ share price has surged 67% YTD, driven by strong earnings and AI market exuberance, but AI monetization remains uncertain.

- META’s advertising business remains robust with increased ad impressions and pricing power, despite a slowdown in overall marketing budgets.

- The Company’s potential growth engines include AI and AR/VR, but the market has already priced in much of its future potential, suggesting a low margin of safety.

- Investors should adopt a wait-and-see approach to better understand META’s AI monetization strategy before making further investment decisions.

J Studios/DigitalVision via Getty Images

Introduction

Share price of Meta Platforms (NASDAQ:META) has surged by 67% on a year-to-date basis. This rally can be attributable to: (1) the company’s consistently strong earnings in recent quarters and (2) the market exuberance driven by artificial intelligence. Although the company has proved its resilience and ability to capture growth, the ability to monetize artificial intelligence remains a huge uncertainty. In this report, I will demonstrate why the price of META is potentially undervalued. Investors should adopt a wait and see approach, gaining more color into META’s artificial intelligence monetization strategy before making further decisions.

Latest Developments

Meta’s Financial Performance (Earnings Presentation)

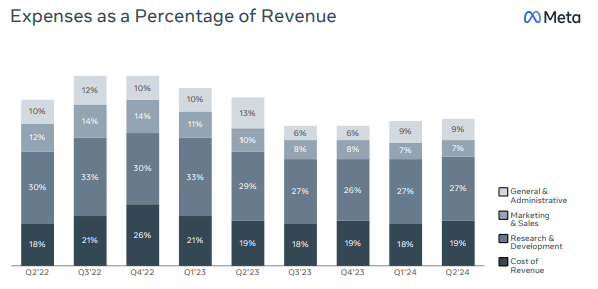

In 2Q24, META posted yet another strong set of earnings. The social media giant generated $39.07 billion in total revenues, representing a 22.10% year-on-year growth. Advertising revenues increased by 21.68% to $38.72 billion. Reality labs revenue surged by 27.89% to $353 million. Overall gross margins remained relatively stable at 81.30%. During this period, net margin improved from 23.44% last year to 34.46% primarily due to reduced spend in R&D and SG&A. Capital expenditures for the firm remained elevated as the company continue to invest heavily into artificial intelligence; on a year-to-date basis, the company has spent $15.18 billion as compared to $13.44 last year.

Advertising Business To Maintain

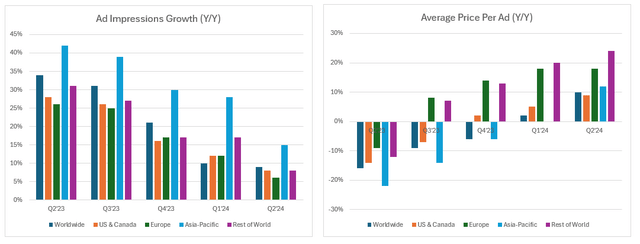

Total advertising impressions have grown by 9% on average across all regions. Although growth is tapering, the advertising segment remains robust as supported by increasing growth in the firm’s average price per advertisement, suggesting that the company not only has command of the market but also strong pricing power. Across all regions, growth of average price per ad surged to 10% year-on-year, as compared to -16% in 2Q23.

Meta’s Ads Performance (Company Filings)

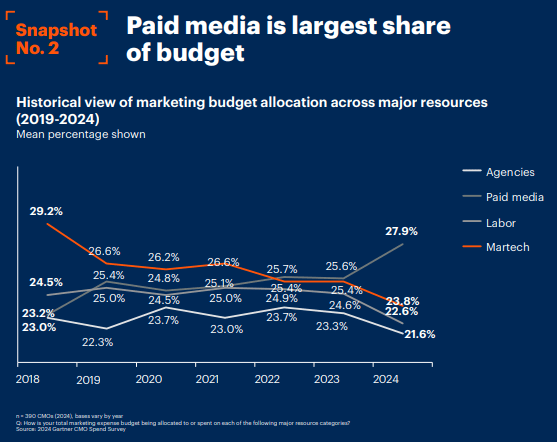

Outlook of the advertising industry remains strong despite a slowdown in marketing budgets. Based on a recent study conducted by Gartner, total marketing budgets fell by 15% as companies leverage on generative artificial intelligence. However, budget allocations to paid media (i.e., advertising) has increased from 25.60% to 27.90%. Allocations to other categories such as labor and marketing technology solutions are expected to deteriorate.

CMO Ad Spending Survey (Gartner)

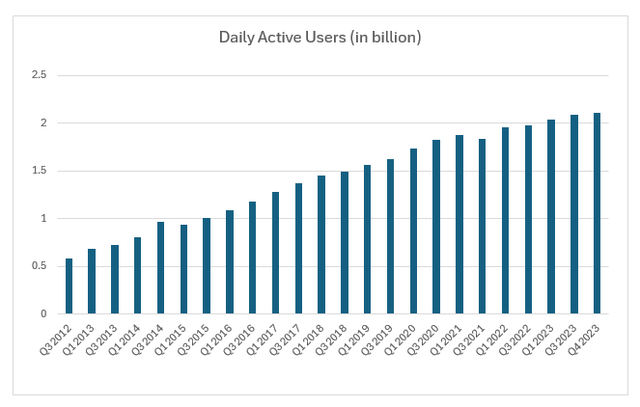

More importantly, META has a history of being agile and adaptable. The company has always taken risks to ensure that they stay on top of the market. Although some of these risks are questionable, most of the company’s bets are paying off. For example, the company’s more recent Threads and new features in Facebook (e.g. Reels) have shown success in maintaining the gen-z cohort.

Facebook’s Daily Active Users (Company Filings)

In addition, we should expect to see META and GOOG to benefit from the exodus of advertisers from X (formerly twitter). According to a recent survey based on 18k consumers and 1k senior markets, Kantar found that 26% of marketers will be planning to reduce advertising on X. Moreover, X is tweaking its business model to focus on creators’ engagements rather than advertising; it is likely that we will continue to see further reduction of ads in one of META’s longtime competitor.

Artificial Intelligence & Reality Lab As Potential New Growth Engines

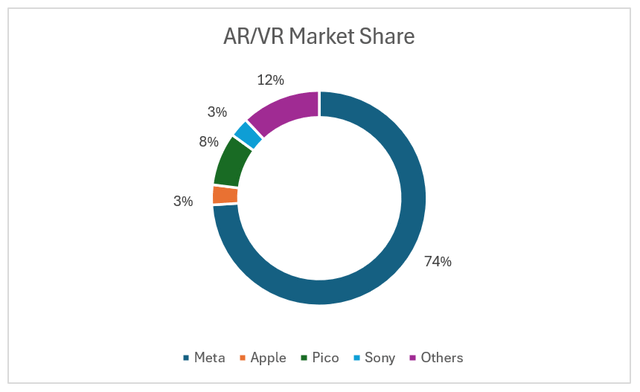

Currently, META has two major growth engines: (1) Artificial Intelligence and (2) AR/VR (i.e., Reality Labs). Although revenue from AR/VR segment has tapered, the industry is still in its nascent stages and META’s is already an industry leader and monetizing it. As of 1Q24, the company holds at least 74% of the AR/VR headset market share.

AR/VR Market Share By Companies (Global XR Model Tracker)

According to Statista Market Insights, the AR/VR market size is likely to reach $51 billion by FY2026, with an average growth rate of 17% per annum. As the industry further matures in the consumer market, META is likely to be one of the major beneficiaries. In fact, as an industry leader, META has continued to make advances. On 25th September, the company introduced Orion, an AR glass that has the look and feel of a regular pair of glasses as compared to the bulkier Quest 3; Orion will be used as a prototype for the company to iterate and build more friendly consumer AR glasses. The industry just needs a “Chat-GPT” moment to introduce AR/VR to the mainstream.

On the artificial intelligence front, how will META monetize its capabilities remains a big question. Monetization will most likely come from either inference from API points or a consumer app similar to ChatGPT. However, at this stage, there is simply no color on how the company can monetize it. In fact, there are already arguments that the ROI from AI will not be able to cover the costs and investments made today.

Nevertheless, META remains one of the leading players in artificial intelligence. Although OpenAI’s GPT-4 still outperforms META’s Llama, the company’s large language models is still one of the main models in the market as it is open-source for developers.

Current Share Price Implied Much Of META’s Future Potential Has Been Priced In

On a year-to-date basis, the company has surged by 67%. Part of the reason is because the company has performed exceptionally well over the past four quarters. Revenues grew at an average rate of 24% year-on-year, while net income has surged at an average rate of 139% year-on-year. Net income growth was primarily due to a drastic reduction in SG&A; SG&A margin declined to an average 14.86% for the past four quarters from 21.42% in the preceding four quarters. However, on a forward-looking basis, how much growth is being priced in?

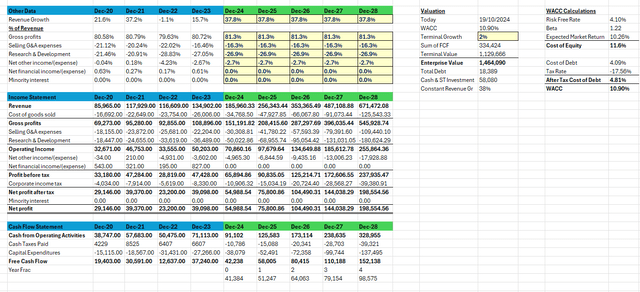

Valuation Analysis (Author’s Projections)

Based on my valuation model, if we assume: (1) margins stay constant as per the latest quarter, (2) current share price of $576.16, (3) terminal growth of 2%, and (4) WACC of 10.90%, markets are pricing in a 37.80% growth per annum for the next five years. For reference, META’s revenue growth rates for the past ten quarters and four quarters are only 11% and 24% respectively; an annualized growth of close to 40% per year is extremely optimistic. One may argue that META’s AI may potentially contribute to the company’s revenue significantly; however, as noted above, it is better to wait until we have further color on how the company can monetize this segment.

This suggests that there is a low margin of safety for investors who are interested in taking new positions at the current price. Firstly, if META fails to meet expectations, it is likely we will see a huge correction. More importantly, META will have to exceed current expectations for new investors to benefit.

Key Elements To Watch In 3Q24

META is scheduled to report its 3Q24 earnings on 30th October 2024. We should closely monitor the company’s capital expenditures. Previously, the company warned that costs are expected to rise further as the company invested heavily on servers and data centers. Although Amazon and Microsoft are also spending heavily on infrastructure, these companies have a dedicated business model around them (e.g. Microsoft Azure).

Additionally, we should continuously track the company’s developments around artificial intelligence. Any new information on how the company is able to monetize its artificial intelligence capabilities will drastically change its growth outlook.

Finally, the company has beaten consensus EPS estimates consistently over the past four quarters. Currently, the consensus estimate for EPS is 5.28, representing a growth of 20.39% year-on-year. If META disappoints, it could signal that the company is facing operational challenges or headwinds which may be enduring in the short-run.

Closing Remarks

Overall, META continues to be a strong company that has an innovative spirit, strong fundamentals, a healthy balance sheet, and is able to generate sustainable cashflows. Apart from its strength in its advertising segment, the company has two potential growth engines that may be able to further expand its revenue significantly in the coming years.

Unfortunately, at the current share price, much has already been priced in by market participants; there is a low margin of safety for investors. While some may argue that the price is justifiable because of its potential in artificial intelligence, I believe it will be wise for investors to wait and see how META can potentially monetize its artificial intelligence capabilities instead of jumping onto the AI hype train.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.