Summary:

- Meta Platforms has shown resilience and adaptability in the face of technological shifts, leading to successful recaptures of lost ground.

- We believe the company has the wind at its back and that the stock can climb higher.

- We rate at Hold.

da-kuk

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

To ATH, And Beyond

Meta Platforms, Inc.’s (NASDAQ:META) greatest asset is, in our view, the sheer determination to succeed possessed by its founder-CEO Mr. Zuckerberg. On at least three occasions now the company has been wrong-footed by a shift in the technology environment – or more specifically by its own errors in expectations of future user behavior – only to achieve a turnaround, and quick-smart too.

Right out of the gate at IPO time, the company was geared strongly to browser usage at a time when the US consumer was finally moving to mobile, catching up on Europe’s initial lead in mobile data comm. The stock was hit, questions were asked, the company got with the program, and the stock went up.

Then came instant messaging, photos and videos, none of which was Meta’s bailiwick in the 2010s. The company threw money at the problem, paying $19bn-ish for WhatsApp and $1bn-ish for Instagram. Neither had any meaningful revenue at the time and both looked like silly prices paid (particularly WhatsApp). Not so much now. WhatsApp and Apple’s iMessage worked in harmony to tilt the power balance in cellular away from carriers and towards content and platform providers, in each case by deflating carrier SMS revenues rather brutally. $19bn-ish to scoop a whole lot of equity value out of wireless telephony and into the software platform? Cheap. $1bn for Instagram – sound expensive to you now? Thought not.

Next. Metaverse. A tectonic shift of natural appeal to Mr. Zuckerberg one would think, more in the digital domain and less in the wetware domain was the promise. It has yet to materialize. META spent more on capex for Metaverse developments than it did to acquire WhatsApp and Instagram combined, while simultaneously not putting AI at the top of the to-do pile. This hit META stock hard – too hard in our view, as we noted back in October 2022 with this Seeking Alpha note:

Earlier META Coverage (Seeking Alpha, Cestrian Capital Research.)

Fundamentals may not matter much on a day-to-day basis to stock prices, but at extremes, fundamental analysis can deliver you the confidence to buy or to sell against the trend. 7.5x TTM trailing twelve months’ cash flow for Meta? An easy Buy. Worked out well as you can see.

What about now – with the stock approaching its all-time highs once more, how should one view Meta Platforms’ stock?

Is Meta Platforms Stock A Buy, Sell, or Hold?

We rate META stock at Hold. We believe the name can continue to run up with the market, and we think the market has further up to go in 2024. Let’s first of all look at the company’s financial fundamentals.

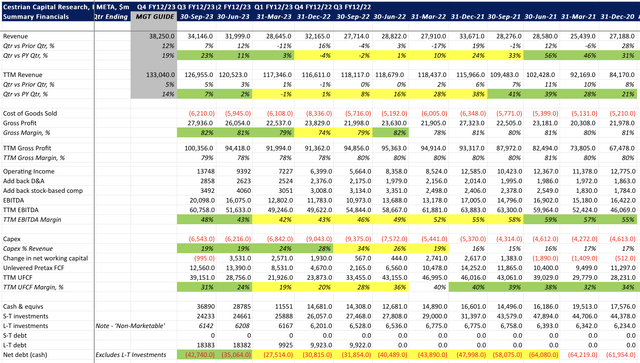

META Fundamentals (Company SEC Filings, Ycharts.com, Cestrian Analysis)

On every level up to and including the Q3 print (that’s the 30 Sep 2023 quarter), the company was firing on all cylinders (translated for youngsters: Each cell was fully charged, and maximum torque delivered at 0rpm). Revenue growth had accelerated from negative 4% in the Dec-22 quarter to +23% in the Sep-23 quarter. EBITDA margins were back up to +48% on a TTM basis, from a recent low of +42% just two quarters back. Unlevered pretax free cash flow margins reached +31% on a TTM basis, from a recent low of +19% two quarters ago. And from the low point of 31 March 2023 (only $28bn in the bank, scary) the company generated over $14bn in net cash in two quarters. Not too shabby.

The valuation is up, of course. No longer 7.5x TTM UFCF. About three times that in fact.

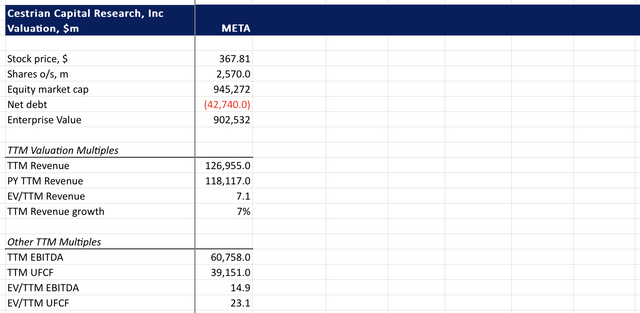

META Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

That’s still not particularly expensive though – on any given Monday you may pay more than that 23x TTM UFCF for an ex-growth defense contractor.

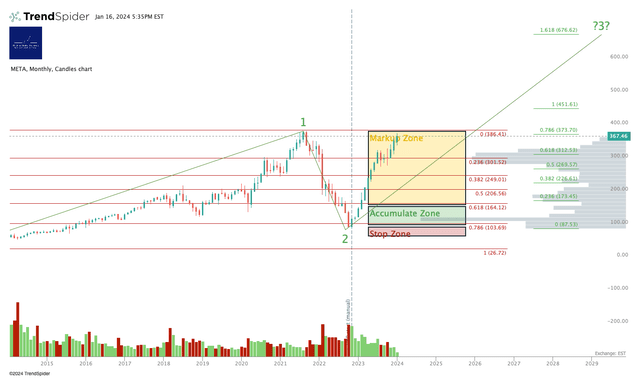

What about from a technical analysis perspective? Well, META has been only up since the October 2022 lows, so you would expect some weakness at some point. Hasn’t happened yet – perhaps Mr. Z’s $500m sale of META stock recently will prove timely. But longer term we believe that the stock could head north of $600, maybe as high as $670.

You can open a full-page version of this chart, here. It’s a monthly chart which starts from the post-IPO lows (just off-screen to the left). The 2022 low was the .786 Fibonacci retracement of the whole move up from the post-IPO lows to the 2021 highs. A righteous low to buy! And if the pattern holds true we may see a move over a number of years up to the 1.618 extension of that prior Wave 1 – that’s how we derive our price target. It’s just a projection, can be right can be wrong, but the number of times this chart method proves worthy is a surprise to us, so, don’t think that such a lofty target is nuts – it’s not. It may prove wrong, but it’s not nuts!

META Stock Chart (TrendSpider, Cestrian Analysis)

Hold rating.

Cestrian Capital Research, Inc – 16 January 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: See disclaimer text at the top of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

GET INSTITUTIONAL GRADE BUYSIDE RESEARCH FROM CESTRIAN CAPITAL RESEARCH

We provide investment research prepared to institutional investor quality, presented in a way anyone can understand. Our work allows you to make sense of company fundamentals and stock technicals without resort to jargon or esoterica. We offer Free, Basic and Full membership tiers in our “Growth Investor Pro” service here on Seeking Alpha. Join us! Click HERE to learn more.