Summary:

- Meta Platforms, Inc. recently beat estimates while upping forecast.

- Has META stock gotten carried away? Perhaps.

- However, despite a 24% run up since my last review, forward multiple remains the same.

- Reality labs will continue bleeding this year, if not further.

Justin Sullivan

For those keeping scores, I’ve fared pretty well with my ratings on Meta Platforms, Inc. (NASDAQ:META). Let’s take a look:

- I called the stock’s bottom in November. The layoffs and Mark Zuckerberg finally admitting he was wrong propelled the stock to more than double since then.

- I rated the stock a “Hold” in January, citing its run up since November. And boy, was I wrong. The stock has since then gone up 63%. I am glad I did not recommend selling here, as the holders (like myself) still participated in this move up.

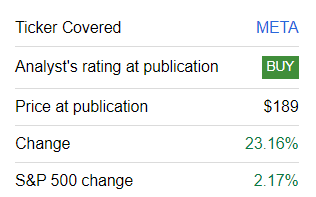

- And finally, boy, am I glad I wrote this “Mea Culpa” upgrade on Meta Platforms, Inc. in March. Since then, Meta stock has outperformed the market by more than 10 folds as shown below. More than half of this 23% gain can be attributed directly to the company’s recent earnings as covered in this Seeking Alpha earnings news. Read my previous coverage on Meta here.

Meta Change (Seekingalpha.com)

2 out of 3 isn’t bad but more importantly, calling the bottom in November was pretty good in hindsight as I realized back then the layoffs were Zuckerberg’s way of admitting to the market that he had gone too far. Obviously, this is cherry picking and I’ve had some bad calls on other stocks. But the bigger point here is Meta stock’s outlook from here. Let us look at the Good, Bad, and Ugly from this earnings report while evaluating the stock’s outlook as well. Let us get into the details.

Good

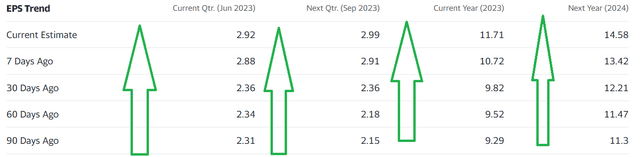

- Not only did Meta beat on EPS and Revenue in Q1, the company upped its revenue estimate so much that the lowest range of the new guidance ($29.50 B) was marginally higher than the consensus of $29.48 Billion. When I downgraded the stock to a “Hold” in January, FY 2023’s EPS estimate was $7.88. When I upgraded in March, the same estimate had gone up to $9.53. Right now, FY 2023’s EPS estimate stands at $11.71. That’s nearly 50% jump since January. No wonder the stock has been on a magical run since. In addition, FY 2024’s estimates currently stand at $14.58, up nearly 27% at the time of the March article. As a result, the stock is still trading a forward multiple of 16 based on 2024’s estimates. Once again, as a comparison, the S&P 500 is currently trading at a multiple of 24. Meta’s upward EPS revision is still uniform across the board as shown below.

Meta Estimates (Yahoo Finance)

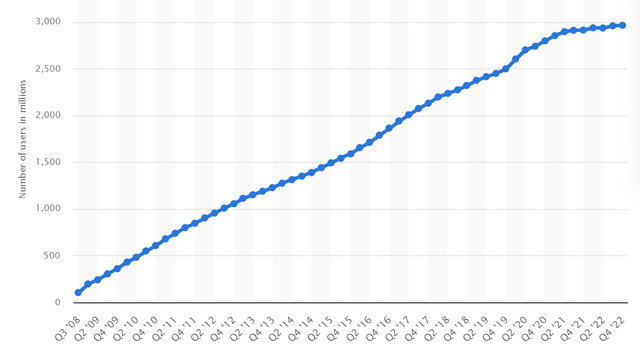

- Besides the obvious strength in advertising, Meta’s Monthly Active People (“MAP”) and Monthly Active Users (“MAU”) both went up YoY. The increase in MAP and MAU, although small, is significant for the company to ensure the jitters from 2022 do not return.

- From a technical perspective, Meta’s stock is still trading well above the all-important 200-Day moving average but more importantly, since the March review, the 200-Day moving average itself has gone up 5%. Another encouraging sign is that despite the recent run up, the stock’s Relative Strength Index (“RSI”) is at a reasonable level at 60. This makes me believe the stock may still have some legs to make new 52 week highs from here.

Bad

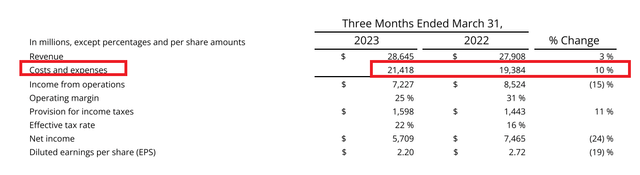

- Despite all the headline grabbing news about layoffs and cost savings, Meta’s Q1 showed a 10% YoY increase in costs and expenses as shown below. Obviously, this means only two things:

- (a) the layoffs and other initiatives only slowed down the pace of increasing expenses. This is confirmed by this statement in Seeking Alpha’s earnings coverage: “As part of its layoffs and cost-cutting efforts, Meta now estimates that its total expenses for 2023 will be between $86B and $90B, while last October it had forecast expenses for the year to be in a range of $96B to $101B.” In other words, lesser expenses than projected earlier but still increasing YoY, at least for now.

- (b) the layoffs were indeed strategic, at least partially, where the company likely continued hiring or at least did not fire personnel in certain areas of business.

Meta Expenses (investors.fb.com)

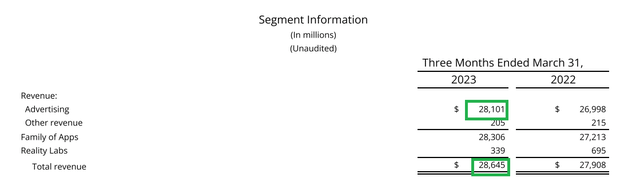

- I know this is like saying “The only problem with Ford Motor Company (F) is that it is reliant on cars” but despite all the recent noise about AI and Metaverse, 98.10% of Meta’s 2023 Q1 revenue came from advertising. In an irony of sorts, this number has actually gone up YoY as in 2022 Q1, ads represented a slightly less 96.73%

Meta Revenue (investor.fb.com)

Ugly

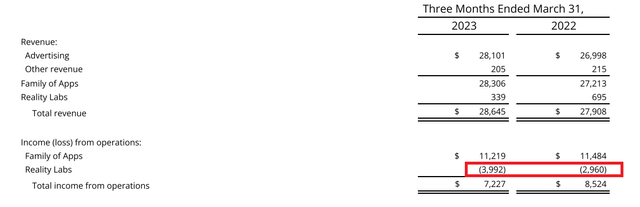

- Reality Labs is bleeding, to put it mildly. Revenue fell more than 50% while a near 35% YoY increase in net loss in this segment sent the quarterly loss up to nearly $4 Billion. To make matters worse, the company does not expect it to slow down any time soon as stated in the Q1 release.

Meta Reality Labs (investor.fb.com)

- This is a bit of a cheat as this news wasn’t part of Q1 announcement but came in later. But, Meta Platforms, Inc. heading to the bond market for $7 Billion gives me a pause. A 40-year security when interest rates are so high, to potentially finance buybacks and capital expenditures makes me wonder (worry) if Zuckerberg will again lose sight of reality after the stock’s surge in the last 6 months.

Conclusion

Despite the company’s struggles in 2022 and over-reliance on advertising revenue, it is hard to slap a sell rating on Meta Platforms, Inc. The company is a behemoth, like it or not, and whether its AI and Metaverse efforts bear fruits or not. However, with everyone tooting the company’s horns, the contrarian in me believes the easy money has been made. I am rating META stock a Hold here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.