Summary:

- Meta Platforms is poised for a significant earnings beat in Q3, driven by robust ad performance and a cyclical recovery in digital advertising spending.

- Despite increased CapEx on AI, the Company remains highly profitable with strong free cash flow margins, making it a compelling buy.

- META’s AR glasses, developed with Ray-Ban, show solid sales, potentially contributing to a positive earnings surprise.

- With a favorable valuation and strong Q4 revenue guidance expected, Meta Platforms is an attractive pure-play digital advertising investment.

Robert Way

Meta Platforms (NASDAQ:META) is due to report earnings for its third fiscal quarter on October 30, 2024, which could be a make-or-break moment for the social media company’s stock. Shares have soared this year on a strong recovery in the online ad market, as well as growing average revenue per user. Further, Meta Platforms has been able to grow its user count across apps and platforms, resulting in a bigger advertising base, which is likely what continued in Q3 as well. Meta Platforms also invested in AR glasses, which are seeing strong customer up-take. I believe Meta Platforms is headed for a sizable earnings beat at the end of the month, driven by strong ad performance, and will likely submit a robust outlook for Q4 revenues as well. In my opinion, shares are a promising buy ahead of the Q3 earnings release date.

Previous rating

I rated Meta Platforms a buy in my last work on the social media platform in August because the company reported massive free cash flow margins in the region of 28% and the company benefited from solid user growth across its ecosystem: Meta Is Crushing It And The Stock Is A Steal. Although the company saw an uptick in CapEx spending related to AI products lately, Meta Platforms is set to remain very profitable on both a free cash flow and earnings basis in the future. In my opinion, the online ad market remained in very good shape in the third-quarter, which benefits Meta Platforms more than other large tech companies. With earnings estimates also moving in the right direction, I believe investors are set to see a strong earnings sheet at the end of October.

Ad spending growth, Meta’s AR glasses, focus on revenue outlook for Q4’24

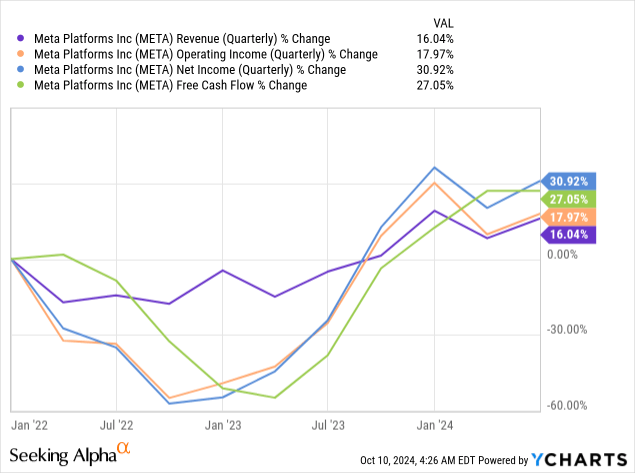

A strong advertising market in the third-quarter would indicate that Meta Platforms has considerable potential to outperform Q3 earnings estimates. The social media platform generated 22% year-over-year revenue growth in the last quarter, and in the quarter before that 27% Y/Y growth. This strong growth is backed by growing demand for online advertising services, and it is a profound recovery in digital advertising spending after the 2022 slump that is driving Meta Platforms’ growth in most key performance metrics, including revenue, free cash flow and operating income.

In the third-quarter, Meta Platforms likely continued to perform very well as there are no indications of an advertising slowdown. In fact, eMarketer projects that FY 2024 will be a record year in terms of digital media ad spend, which would obviously benefit Meta Platforms more than any other company. This is because Meta Platforms is heavily reliant on its digital advertising business model that helps marketers place ads on its various platforms. In Q2’24, Meta Platforms generated 98.1% of all revenues from digital advertising.

eMarketer

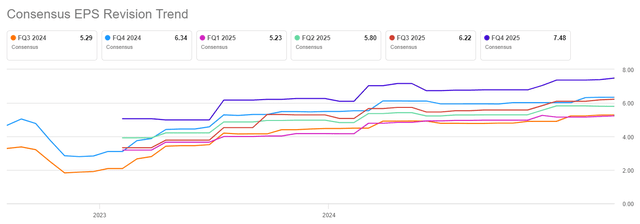

In the last 90 days, earnings estimates for Meta’s Q3 have been revised upward a massive 36 times, compared to just 1 downward revision. Therefore, upside EPS revisions outmatch downward revisions 36:1, indicating that analysts generally expect a positive earnings release for the third-quarter.

Another element for a positive earnings surprise could come from Meta AR glasses. Meta Platforms partnered with Ray-Ban, a leading sun and prescription eyewear brand, and produced Meta’s latest iteration of smart glasses that include Meta AI. The glasses have seen some solid sales success in the third-quarter and the company could definitely surprise here with its outlook.

What could further draw investors to Meta Platforms following the Q3 earnings release is a strong revenue guidance for Q4. Revenues in the fourth-quarter tend to surge due to the inclusion of the holiday period, as well as other shopping events like Black Friday that fall into the reporting period. With social media spending already being on a long-term upswing, I believe Meta Platforms could guide for fourth-quarter revenues somewhere between $44-45B, potentially showing 12-13% year-over-year growth.

Meta’s valuation is too cheap to ignore…

Meta Platforms has had a fantastic run this year, with shares revaluing higher 67%. Shares of the social media company are valued at 24.2X forward earnings which makes META the second-cheapest magnificent 7 stock that investors can own right now: only Alphabet (GOOG) is cheaper than Meta Platforms with a forward P/E ratio, based off of FY 2025 earnings, of 18.8X.

At the end of September, I recommended investors to buy Google’s antitrust issues, as I generally believe that Big Tech is set for a strong earnings report season. Both Meta Platforms and Google represent the deepest value for me in the big tech group here, largely because of their reliance on digital advertising.

In the longer term, Meta Platforms could revalue to a 26X P/E ratio — which equals the average P/E ratio in the industry group. However, as earnings estimates have risen significantly since my last work, I am raising my fair value estimate for META, ahead of the Q3 earnings release, to $631 per-share, based off of a consensus estimate of $24.46. This new fair value estimate implies 7% upside, but I may revise the price target higher based off of Meta Platforms’ digital advertising performance in Q3.

Risks for Meta

The social media company is widely dependent on ad spending, which makes Meta one of the least diversified large-cap tech companies that investors can buy. Although Meta Platforms is trying to diversify its revenue mix, the company generates 98% of its revenues from online advertising. This exposes the social media company to cyclical earnings risks (as we have seen during the ad market slump in 2022). What would change my mind about Meta Platforms is if the company were to see contracting free cash flow margins.

Final thoughts

In my opinion, Meta Platforms is set to crush estimates for the third fiscal quarter as the online ad market likely had a strong quarter yet again. Companies also tend to increase their platform-spend in the fourth-quarter, meaning Meta Platforms could surprise with a strong revenue outlook for Q4 as well. Further, Meta Platforms is seeing some solid momentum with its latest AI-optimized AR glasses, which could help the company showcase the efficiency of Meta AI and lead to new revenue streams down the road. The most attractive features of an investment in Meta Platforms is that the company is a pure-play digital advertising play with a very appealing valuation. META is the second-cheapest big tech company and has considerable long-term earnings upside as its platforms continue to grow and capture a larger share of digital advertising spending.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.